For the past twenty years, Mark Skousen has used a single strategy to average annualized gains of nearly 60%!

Now, he's applied this same strategy to find a new group of 5 Low-Priced Stocks, all trading for $10 or less, with more than 100% upside.

The Teaser

Mark Skousen's longtime publisher, Roger Michalski, starts the teaser by saying he's “seen Mark recommend nearly 300 triple-digit winners using this powerful strategy.”

If investment newsletter writing were a sport, Mark Skousen would be the grizzled old veteran who refuses to hang it up. He's been at it for 45 years with no sign of letting up.

The Green Bull has reviewed and revealed more than a few of Mark's previous teasers, including his “New Oil” Energy Company and “EV Revolt” Stocks.

At the heart of Mark's strategy is “a rare stock market phenomenon that has only occurred a handful of times in the last 50 years.”

When it happens, small, low-priced stocks led the way every time. Meanwhile, the market’s largest companies tend to go sideways or down.

So, what is this market phenomenon or event?

Underwhelmingly, it's when the Federal Reserve cuts interest rates.

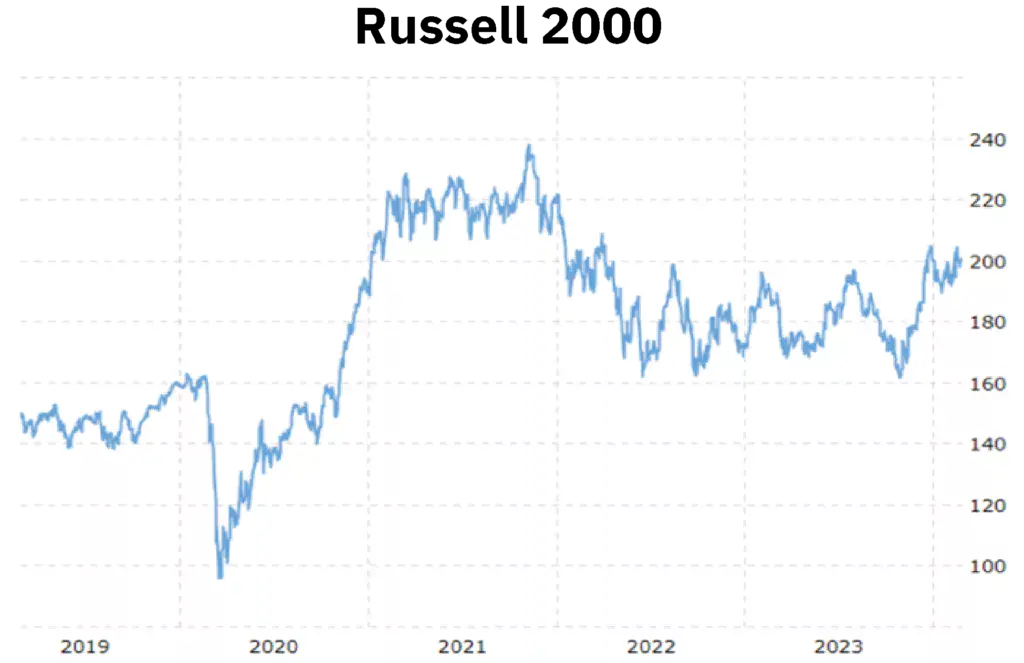

The Russell 2000 Small-Cap Index is used as an example to show how, historically, small, low-priced stocks have skyrocketed in price following a rate cut.

There is some truth to this.

After the Fed cut rates in 2020 and 2021, the Russell did its thing, outperforming the S&P 500 index from April 2000 to April 2023:

As you can see, it was another story after this.

However, this trend goes back to the late 1970s, when the economy was racked by double-digit inflation. When the Fed finally pivoted and cut rates, the Russell 2000 outperformed the S&P 500 by 80%.

Now, Mark believes a perfect storm is brewing…

Small-cap stocks are among the cheapest they have been in decades, the S&P 500 is the most concentrated in half a century, and the U.S. Treasury will have to issue billions in new bonds to cover the interest on the National debt.

Wall Street also believes that the Fed could cut rates sometime this year, and if it does, five stocks will move higher.

The Pitch

Mark has put together a new special report called 5 Low-Priced Stocks With Huge Upside.

It contains the names of all the picks, most of which are worth $1 billion or less, and we can get it as part of a subscription to Mark's Low-Priced Stock Trader research advisory.

A one-year membership normally costs $1,995, but Mark has an introductory offer of six months for $399, with a 30-day money-back guarantee.

Mark's Investment Criteria

The Fed cutting interest rates is only half of the equation.

The other part is finding the best small-caps to buy.

Mark doesn’t recommend investing in the Russell 2000 directly and says 40% of the companies in the index don't make the cut.

Instead, he screens for companies that meet the following criteria:

Continuous profit growth. Being profitable isn't enough; at the very least, it needs to have earnings momentum.

Strong cash reserves and a modest level of debt.

A low absolute PE ratio.

At least a moderate level of liquidity, as some small-caps can be tough to buy and sell, even in small quantities.

There also needs to be insider buying.

Insider activity is one of the best indicators because historically, stocks with insider buying tend to outperform the stock market by 26-to-1 a month after insiders increase their stakes.

Mark says that more than anything else, the stock must also have strong momentum. When it comes to low-priced stocks, he likes to buy stocks that are already going up.

Last, but not least, Mark screens for stocks that trade for a low absolute price. This is because a low-priced stock can double much faster than a large one, so Mark prefers stocks trading for $15 or less.

So, what small-cap stocks meet this criteria?

Revealing Mark Skousen's 5 Low-Priced Stocks

A few clues about each of Mark's were dropped towards the end of the presentation. Here is what we know:

#1 Low-Priced Stock

- The company specializes in speeding up the drug discovery process using artificial intelligence.

- It recently signed a $250 million deal with a large biotech firm to use its AI technology to identify potential cancer treatments.

- It’s a small firm worth less than $500 million, trading for just $5 per share.

I'm pretty sure this is Absci Corp. (Nasdaq: ABSI).

- At the end of 2023, Absci signed a $250 million deal with AstraZeneca to develop an AI-powered cancer antibody drug.

- Absci is currently valued at $328 million, and its stock trades for around $2.60, down more than half over the past year.

#2 Low-Priced Stock

- Another biotech company. This one is “revolutionizing the science of gene sequencing.”

- It believes it can cut the price of genome sequencing by 90%.

Can't be sure, but Pacific Biosciences of California Inc. (Nasdaq: PACB) is one possibility.

- PACB is a developer and manufacturer of systems for gene sequencing, and it recently unveiled new sequencing chemistry to cut costs.

- It is a small-cap with a market cap under $500 million and a stock price below $5.

#3 Low-Priced Stock

- This is a small, $10-ish stock that runs one of the largest commercial brands in the world and is considered the global leader in luxury menswear.

- The stock was only recently listed on the NYSE.

Mark's pick here is Ermenegildo Zegna N.V. (NYSE: ZGN).

- Zegna is a luxury Italian fashion house founded in 1910, renowned for its menswear.

- The company was listed on the NYSE at the end of 2021 following a reverse merger.

#4 Low-Priced Stock

- This is “one of the largest and most robust ecommerce firms of its kind,” with over $2 billion in annual revenue.

- The stock is trading for about one-third of its sales for a price of just $10 per share.

A tough one, but Beyond Inc. (NYSE: BYON) loosely matches Mark's description.

- Beyond's annual revenue has been on the decline for the past few years and stood at $1.4 billion in 2024.

- The stock trades for just $237 million with a stock price under $5 per share, down from $9.50 earlier this year.

#5 Low-Priced Stock

- A beverage company that makes energy drinks, organic teas, and soft drinks that are sugar-free and have zero calories.

- It went public a few years ago and is trading for less than $2 per share, with a market cap just north of $100 million.

This is Zevia Pbc (NYSE: ZVIA).

- Zevia is a maker of energy drinks, organic tea, and mixers sweetened with stevia.

- It went public in the summer of 2021, and currently trades just above $2, with a $168 million market cap.

Double Your Money in 6-12 months?

Putting aside Mark's macro indicator, selection criteria, and picks for just a moment. He is right about one thing…

Micro-caps and small-caps are the only corners of the market where individual investors have an advantage over the big boys on Wall Street due to institutional constraints.

However, are Mark's small-cap stocks most likely to give us above-average returns?

Absci: A high-risk, high-reward biotech play with no existing products on the market. There are better places to invest your money.

Pacific Biosciences: A better biotech play than Absci, but still not great, with net profit margins of only 6%.

Ermenegildo Zegna: The stock is down 41% since its listing. Has it hit bottom? At a market cap of $1.7 billion with $77 million in annual net income, it still has further to fall.

Beyond: An inverse momentum stock that is unprofitable and heading in the wrong direction.

Zevia: Mark compared it to Monster Beverage (the best performing stock of the past several decades), but Zevia is a niche lifestyle brand that lacks the broad appeal of Monster. It is also unprofitable.

Overall, not the best picks to potentially double our money over the short term or the long term for that matter.

Quick Recap & Conclusion

- Renaissance man Mark Skousen is teasing a strategy that has netted him average annualized gains of nearly 60% over the past 20 years.

- At the heart of Mark's strategy is buying small-cap stocks immediately after the Federal Reserve cuts interest rates. He believes a cut is coming this year, and he's found a group of 5 Low-Priced Stocks, all trading for $10 or less, with more than 100% upside.

- The names of each are revealed in a special report called 5 Low-Priced Stocks With Huge Upside. It can be ours with a subscription to Mark's Low-Priced Stock Trader research advisory, which has an introductory price of $399 for the first six months.

- Mark dropped several clues towards the end of his presentation, and we were able to reveal most, if not all, of his picks, for free. They are Absci Corp. (Nasdaq: ABSI), Pacific Biosciences of California Inc. (Nasdaq: PACB), Ermenegildo Zegna N.V. (NYSE: ZGN), Beyond Inc. (NYSE: BYON), and Zevia Pbc (NYSE: ZVIA).

- Besides being small-caps with more upside in theory, there is little to like about Mark's picks. PACB and Zegna are the best of the bunch, but the valuations could be better.

Are you a small-cap fan or a blue chip buyer? Let us know in the comments.