Millionaire tech analyst Luke Lango is issuing an urgent warning for 2024 – “The Great AI Melt-Up” is now upon us.

No matter what happens in the market, this will be the best time to invest in AI and one stock in particular, which could be the next Microsoft.

The Teaser

According to Luke, in 100 years, we will look back and say 2024 was the year Artificial Intelligence went mainstream.

I look forward to being around in 2124 to hold Luke's feet to the fire on this prediction, just as I was to review his “Prometheus Project” Stocks and “Area 52” Quantum Microchip Company.

Luke is confident in his claim because each new consumer technology that debuts is adopted much faster than the previous one.

This has been true for the past 100 years and it is what is happening now with AI.

The gains have already started on a small scale with stocks like BigBear.ai (Nasdaq: BBAI), Symbotic Inc. (Nasdaq: SYM), and Upstart Holdings (Nasdaq: UPST) up 582%, 470%, and 392%, respectively, over the past 18 months.

However, this is nothing compared to what's coming.

We're Back in 1994

Velvet and animal print fashion, Forrest Gump in theaters, and the emergence of the World Wide Web.

Luke matter-of-factly says AI will dwarf what we saw during the early days of the PC and Internet.

Unlike other recent investing trends like the Metaverse and EVs, AI makes us more productive and efficient.

This is the difference between a paradigm shift and a fad.

If it saves us money or time, we humans are going to adopt it. Perhaps the truest words Luke has ever spoken.

AI does this and there are stats to back this up.

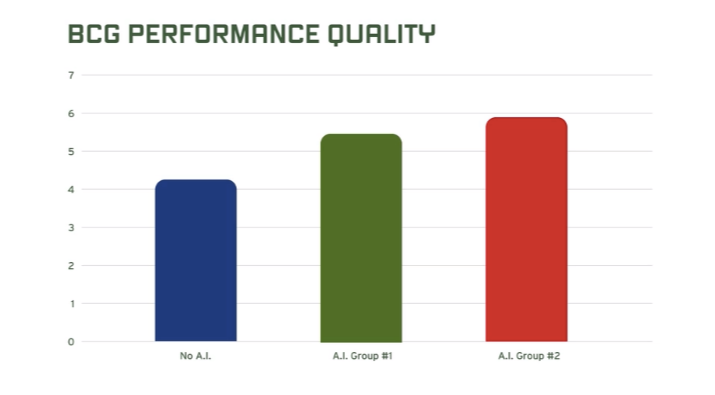

Boston Consulting Group did an experiment splitting up workgroups into one that didn't use AI, one that did, and still another that used AI most effectively.

The result is the chart below.

The workgroups that implemented AI got more done, produced slightly better quality work overall, and did it in less time than their non-AI counterparts.

AI is a productivity game-changer and something Luke calls a Transformational Technology Platform (TTP).

Ultimately, there are two ways we can play this:

- A low-upside strategy

- A high-upside one

The low-upside way entails investing in the FAANG stocks – Facebook, Apple, Amazon, Netflix, and Google.

The high upside means investing in one thing – AI software stocks. No other investment comes close to delivering more gains in less time and Luke has five AI software stocks that could each net us 1,000% gains.

The Pitch

Luke and his team have put together a comprehensive special report revealing the names of all of these stocks and it's called 5 AI Software Companies for 1,000% Gains.

We also get buy-below prices and buy-up-to prices for all five and the only way to get a copy of the report is by taking Luke's research service – Innovation Investor for a spin.

The discounted cost of the service is $49 for the first year and includes a 365-day money-back guarantee, Luke's daily market notes, two bonus reports, and a model portfolio, which is loaded with tech sector stocks.

What in the World is a Transformational Technology Platform?

A few inventions throughout history have changed the world.

I'm not talking about things that helped us organize our calendars more efficiently or made same-day shipping possible.

While nice additions, they pale in comparison to others that fundamentally transformed society.

The Printing Press

Without this mechanical contraption that looks like a medieval torture device, it's doubtful that any of us know how to read today.

It started the era of mass communication, challenged the societal status quo, and made literacy possible for people from all walks of life.

From the time of its conception in the 15th century to the 18th century, the number of books in print rose from less than 5 million to 1 billion.

The Lightbulb

Take away light and we're back in the dark ages.

Yet despite its transformational effect, it was initially met with resistance and calls of witchcraft.

Household and commercial lighting made possible subsequent world-changing innovations like the refrigerator and batteries, which all of us use every day.

It also paved the way for the personal computer, which gave rise to a network of networks that connected the world.

The Internet

Much like its predecessors, the Internet was both heralded and dismissed at the same time.

One of my favorite quotes about the web comes from Paul Krugman:

Had we ignored this advice and invested a few thousand bucks in Internet stocks instead, we would be millionaires today smoking a Cuban cigar while sitting by a pool.

The same is true today about AI – the ultimate Transformational Technology Platform.

It will change the way we live and work, from self-driving cars to automating research, and there are a few companies at the forefront of this change.

Revealing Luke Lango's AI Software Firms

I watched Luke's entire 60-minute+ presentation and he provided more clues about the stocks in his two bonus reports than he did about the five AI software companies he teases throughout.

However, he does give us his top AI software pick for 2024.

Its Palantir Technologies Inc. (NYSE: PLTR).

The reason given for this pick is that Palantir is currently working on a new AI platform called AIP, which integrates AI with enterprise data, logic, and action.

Luke believes it is going to be as commonplace on our desktops as Microsoft Office and it just launched last year.

An Easy 10-Bagger?

At first glance, Palantir at 17x sales and a dizzying 235x trailing earnings is overvalued by every traditional metric.

But can it grow into this generous valuation?

Palantir has grown its annual free cash flow by 73% since 2019 or just over 18% per year.

If we assume this is going to grow with the launch of AIP, to say 40% per year (double what it is now) for at least the next five years and discount this back to the present using a rate of 10%, then the stock would still be overvalued.

The problem is, that Palantir's business and AI as a whole, are not inherently predictable. Add to this the company's relatively low operating margins of 7% due to the custom software solutions it builds for its enterprise clients and we have a business that we should not overpay for.

Quick Recap & Conclusion

- Futurist and tech analyst Luke Lango says “The Great AI Melt-Up” is now upon us and one stock in particular could be the next Microsoft.

- Luke calls AI a Transformational Technology Platform and believes the best way to play it, with the highest upside, is AI software stocks, which could net us 1,000% gains over the next few years.

- A special report called 5 AI Software Companies for 1,000% Gains, reveals the names of all of Luke's picks and there's only one way to get it – a subscription to his Innovation Investor research service. This would cost us $49 for the first year, with a 365-day money-back guarantee.

- Luke holds out on providing any clues about his picks, except for his top pick, which he tells us is Palantir Technologies Inc. (NYSE: PLTR).

- Palantir's growth has ramped up over the past three years and it is expected to get a further boost with the launch of its enterprise AI platform, AIP. Still, the company will have a tough time growing into its sky-high valuation, and buying in now likely means a long wait ahead.

Are you all in on AI software or sticking with the FAANG – Facebook, Apple, Amazon, Netflix, and Google? Tell us in the comments section below.