Luke Lango is on location in Silicon Valley to reveal his #1 AI Stock, that could 10x our money.

It's none of the usual suspects like Microsoft, Google, or Nvidia, and, likely, we have never heard of it before…until now.

The Teaser

According to Luke, just this single investment alone is all we need to compound our capital over the next few years.

Luke Lango is your prototypical growth investor. If a stock doesn't have at least 10x growth potential, it's not worth slicking his hair back like Gordon Gekko and making a pitch about it.

I have personally reviewed several of his growth stock teasers in the past, including the “Project Dojo” Stocks and AI Software Firms pitch.

The reason we need just this one investment is because technology companies, like the kind Luke is teasing here, are taking over more and more of the American economy.

Uber and Lyft took over cabs, Netflix and other streaming services are more popular than cable TV, and Google has monopolized a decent chunk of the data market.

All this makes it sound like starting a tech company is the number one way to get rich in America today.

If it is, then the second best way is to financially back the people that do.

AI For The Win And Untold Wealth

Thanks to artificial intelligence, there's no better time to invest in early-stage businesses than right now.

Luke says an investment of a few hundred dollars today “can blossom into $5,000, $10,000, and even $50,000 or more.”

The key is to find a business while it is still small and off the radar of most investors.

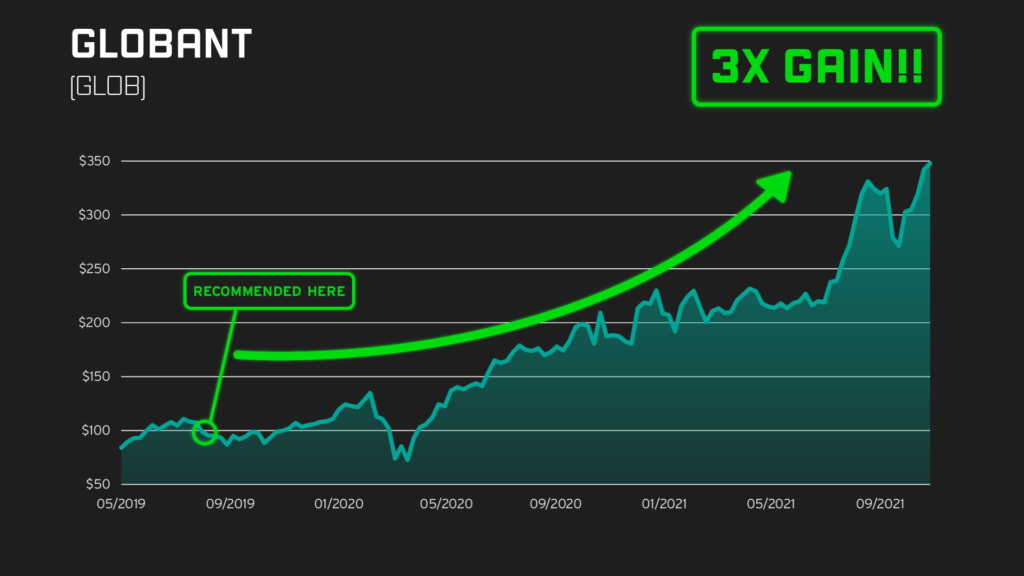

One such company that Luke was early on is Globant S.A. (NYSE: GLOB).

The company helps large corporations implement AI technology and knowing how slow some of these businesses can be to adopt new technology, Globant was on to something.

Luke recommended it back in September 2019 before the AI craze began and the stock went up 3x over the next two years.

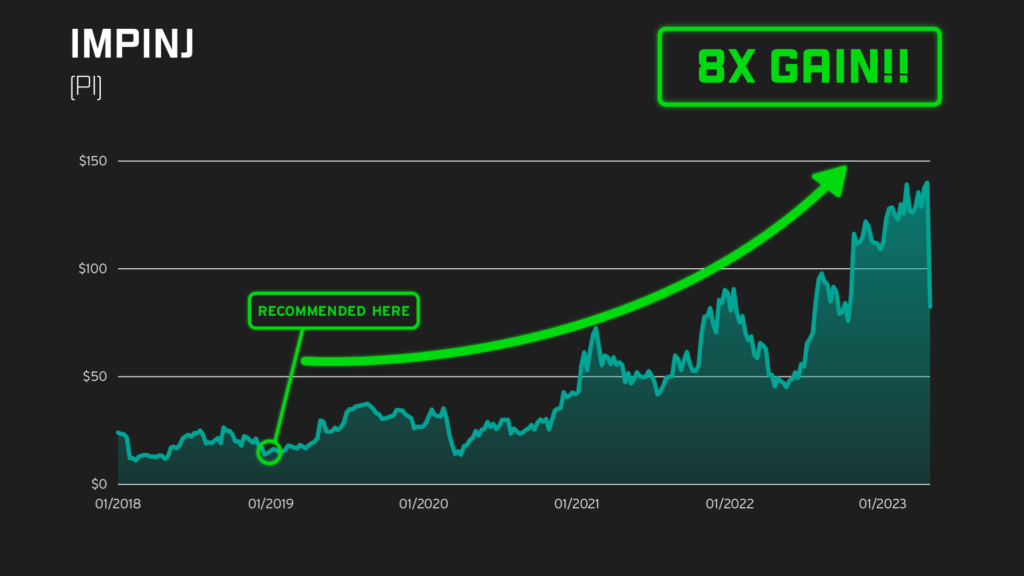

Impinj Inc. (Nasdaq: PI) is another example.

Its patented radio frequency technology gives it an advantage in its niche and as soon as Luke got wind of this, he recommended the stock when it was trading around $16.

Shares currently sit at $100, for a 6x gain.

Today, more than 1,700 new millionaires are created in America every day and AI is accelerating this rate. One well-timed move is all it takes and Luke thinks he's found one that will pay off big over the next few years.

The Pitch

Every last detail about this company and a slew of others is shared with subscribers of Luke's “VC-style” research service – Innovation Investor.

The cost to join is $49 for the first year and it comes with a one-year money-back guarantee if not completely satisfied.

Also included is an early-stage investing guide called the VC Insider's Millionaire Playbook, and two additional special reports called 7 Hyperscale AI Stocks to Buy Now and The Secret Startup Taking Driverless Cars Mainstream.

The Rules of the New AI Economy

As of 2023, the average person is now spending four hours and 25 minutes each day on their phone, up 30% from 2022.

Per Ferris Bueller's famous line ‘Life moves pretty fast. If you don't stop and look around once in a while, you could miss it' Luke is advising us to look up and smell the tech.

By taking heed of our own everyday experiences, we can notice the new AI economy taking shape.

For example, in most major economies, like the UK and Australia, the percentage of payments made using debit cards is well over 50% and climbing.

Digital payments company Square (now Block Inc.) caters to this trend by supplying merchants with point-of-sale hardware and it also owns the popular mobile payment service Cash App. Since going public in 2015, its stock has been up as much as 15x at its peak.

Another example is nuclear power, which has been growing as a percentage of all electricity generation.

Public nuclear energy companies such as Public Service Enterprise Group Incorporated (NYSE: PEG) and Cameco Corp. (NYSE: CCJ), the world's largest publicly traded uranium company, are up big over the long term.

These aren't exactly hard and fast rules, more like observations. But one thing is a prerequisite for the new AI economy.

The Secret

If we look at the biggest stock market winners of the past 20 years, almost all of them have one key attribute in common – they don't make any physical products.

Google, Facebook, Amazon, Microsoft (except for the Xbox), the list goes on.

Luke calls these “hyper-scale opportunities” because they can go from tiny startups to $10 billion in the blink of an eye by leveraging existing infrastructure and startups developing new applications for artificial intelligence are the ultimate hyper-scale businesses.

One such business is pioneering a breakthrough e-commerce platform across the entire U.S. real estate market. Let's find out what it is.

Revealing Luke Lango's #1 AI Stock And More

The company Luke calls the “Amazon of Houses” is leveraging AI and machine learning to accelerate the home-selling process, cut costs, and reduce hassle in the process.

Its name is given to us in the presentation, it's Opendoor Technologies Inc. (Nasdaq: OPEN) and it is Luke's #1 AI Stock. But wait there's more…

It appears as though Luke took the fast food value meal approach with this teaser, combining several items (stock picks) in one.

He also promotes 7 Hyperscale Stocks to Buy Now, which is an older teaser that we previously reviewed here at Greenbull and in which we revealed all seven picks. They are:

- Sunpower (SPWR)

- Pubmatic (PUBM)

- Stitch Fix (SFIX)

- Workhorse (WKHS)

- Shift 4 Payments (FOUR)

- Grow Generation (GRWG)

- Wayfair (W)

Hold on though, because we're not finished yet.

The Secret Startup Taking Driverless Cars Mainstream.

Lastly, Luke provides a bevy of clues about an early-stage driverless car company that and I quote, could be like “uncovering Intel in the 1980s when they were debuting the silicon microchip that would make personal computers commonplace in homes across the country.”

Here are the clues we get about this hotshot upstart:

- It is led by a 27-year-old boy genius who attended Cal Irvine's Beckman Laser Institute instead of going to a regular old high school.

- A rare exception to the physical product rule, the company's sensor is the only one in the market that broadly meets all auto manufacturer system requirements for perception tech.

- The small company has already partnered with seven of the top 10 passenger vehicle manufacturers, including Volvo, Mercedes-Benz, and Nissan, among others.

This one was pretty easy given the details we were provided. Luke's pick here is Luminar Technologies, Inc. (Nasdaq: LAZR). It's a perfect match like pepperoni on pizza:

- The “boy genius” in question is Austin Russell, Luminar's CEO, who rather than go to high school, spent his teen years at the University of California, Irvine's Beckman Laser Institute.

- Luminar touts its lidar technology as “meeting the demanding performance, safety, and cost requirements to enable Level 3 through Level 5 autonomous vehicles in production.”

- Volvo, Mercedes-Benz, and Nissan partnerships are prominently displayed on Luminar's homepage, in the “Major Customer Wins” section just a short scroll from the top.

Is Opendoor Still A Buy?

That was a lot to get through, but as per the purpose of this article, we'll focus just on Luke's #1 AI Stock in this section.

Home reseller Opendoor still sports a valuation of close to $2 billion, but its stock has had a rough time since 2020, down nearly 75%.

From a fundamental standpoint, just about every one of Opendoor's key metrics is awful. Return on equity, negative, current ratio, through the roof.

There may be just one saving grace – book value.

Think of book value almost like the approximate liquidation value of a business. The figure you would get if you were to strip down the business and sell off all of its assets.

Opendoor's book value is currently about $1.43 per share. Now, this is where things get interesting, as the company's current share price is $2.91 per share. Not all that much above its “going out of business price.”

If the stock continues to nosedive, Opendoor may become a value play, rather than a hyper-scale darling.

Quick Recap & Conclusion

- Luke Lango is teasing his #1 AI Stock, which could 10x our money.

- We learn that the company plays by the rules of the new AI economy, which means it doesn't make any physical products, and profiteers off of the existing infrastructure.

- Its name is only revealed to subscribers of Luke's “VC-style” research service – Innovation Investor, which costs $49 for the first year.

- The #1 AI Stock is revealed to us in the presentation as Opendoor Technologies Inc. (Nasdaq: OPEN). An AI-driven e-commerce platform that buys and flips residential properties.

- Opendoor doesn't look good by any metric, but its stock is quickly becoming cheap enough to be considered a value opportunity.

Would you buy Opendoor stock? Let us know why or why not in the comments.