Billion dollar money manager Louis Navellier is calling for the last financial mania of his lifetime.

Just like the second generation of tech stocks that came after the dot-com boom surpassed the first-generation, so too will the “Next Generation AI” Stocks run laps around the first.

The Teaser

“Nothing can make us richer than spotting a financial mania before it begins.”

These are the words Louis Navellier kicks off his 1 hour and 52 minute-long teaser with. Thankfully, it had a playback feature, otherwise we would have had to jump out of a window.

Having most recently reviewed his “QaaS” Stocks and “Trump/AI Convergence” Stocks presentations, we have a good idea about what to expect.

Short of being related to Nancy Pelosi or having a crystal ball, timing the market is about as effective a strategy as letting Jim Cramer pick your stocks. It's not very effective.

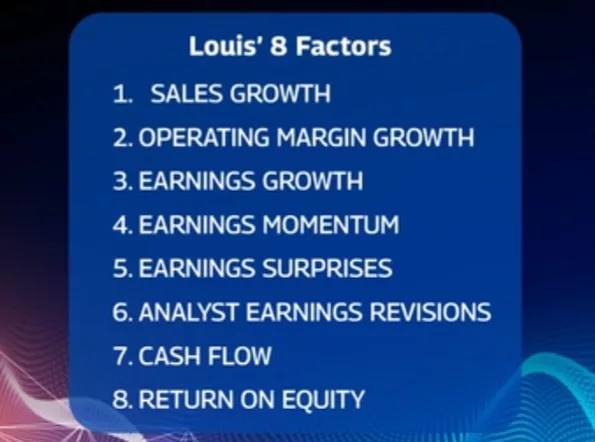

This is where Louis' Stock Grader system comes in.

The Safest Place in the Market

As a modified Harry Markowitz modern portfolio theory, quant-based system that seeks to find stocks with high alpha, or expected returns higher than the associated risks, there's a lot of variables that factor into it.

Eight to be exact:

However, before it ever looks at stocks on a micro level , it identifies where the majority of money is flowing in the market at a macro level.

That's the safest place in the market.

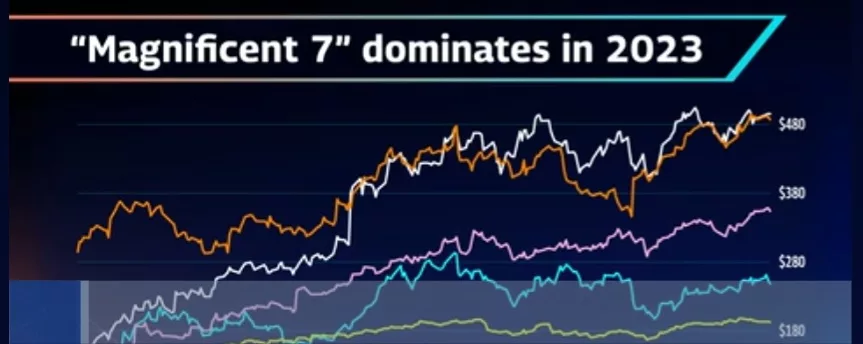

It's how Louis was able to foretell the run-up of the Magnificent Seven prior to 2023.

The biotech boom of the early 2000s, picking up names like Humana, Gilead Sciences, and others, early.

As well as “almost every mania of the past 40 years.”

Louis says

There's always a new mania taking shape somewhere

Today, the new mania is in the “Next Generation AI” Stocks.

He's not talking about chipmakers and chatbots, that's first generation AI, and he's got half a dozen picks to win big from what's coming.

The Pitch

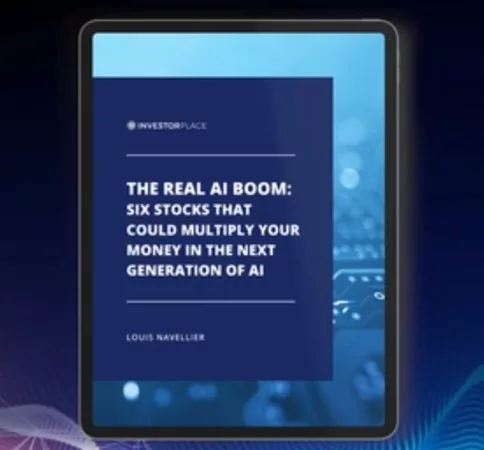

All the picks are revealed exclusively inside a report called The Real AI Boom: Six Stocks That Could Multiply Your Money in The Next Generation of AI.

What we need to get our hands on it is a subscription to Louis' small and mid-cap research service Breakthrough Stocks.

At $4,000 annually, this is one of the more pricey subscriptions we have seen, although a new member discount takes it down to $1,799, for the first year.

Taking AI to the Next Level

According to Louis, nearly everyone is getting the AI story wrong.

The money guru believes that the biggest gains from the artificial intelligence boom will come from businesses reshaping and automating existing jobs and tasks.

As an example, Louis cites Axon Enterprise (Nasdaq: AXON), which combines AI with law enforcement. Eliminating hours of tedious paperwork that officers formerly had to file by hand.

It's even hitting the auto repair industry, which hasn't changed much over the past century.

Many new car makes have AI software installed that alerts the driver about potential problems before a vehicle ever needs to go in for repairs, saving a routine checkup trip to the mechanic.

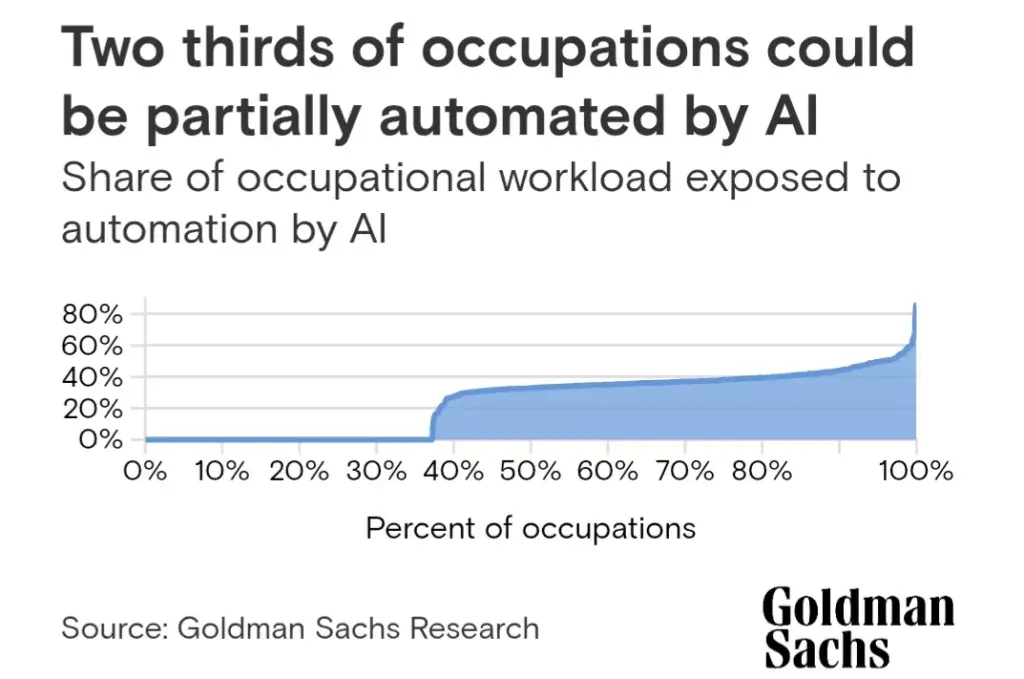

A research paper by Goldman Sachs estimates that as much as two-thirds of current workloads could be automated.

The automation trend is shaping up to be so big, that it will usher in a new date system, like in Biblical times, with a Before AI period, and an After AI era.

It starts now and Louis has a few companies that are the tip of the spear of this massive change.

Revealing Louis Navellier's Next Generation AI Stocks

The good stuff starts about an hour into the teaser, that's when the first clues begin arriving like a past due bill in the mail.

#1 Next Generation AI Stock

Louis' first pick was supposed to be given away for free as a goodwill gesture to get us to pony up to his newsletter for the remainder of his picks.

However, the video skips about 30 seconds or so at the very end when the big reveal happens, kind of like another famous video making the rounds on social media right now. Moving on…

#2 Next Generation AI Stock

One of Louis' other favorite companies combines AI with biotech to make the drug discovery process faster, cheaper, and more efficient.

With nothing more to go on, I will venture to say this could be Exelixis Inc. (Nasdaq: EXEL).

Exelixis is an AI-based drug discovery platform focused on cancer treatments.

It fits Louis' small/mid-cap range and it is also currently owned by his asset management firm, Navellier & Associates.

#3 Next Generation AI Stock

Another is essentially a platform for AI apps that enables Large Language Models (LLMs) to communicate with each other.

Like an Internet of Things (IoT) for AI.

This sounds like Samsara Inc. (NYSE: IOT), which brands itself as “The pioneer of the Connected Operation.”

The company's AI-powered platform enables businesses across various industries to harness and analyze IoT data.

#4 Next Generation AI Stock

Finally, the last generic clue we get is on an online dating company utilizing AI to improve match recommendations by analyzing who you previously swiped right on.

There are only four publicly-traded online dating stocks which makes this easier, and according to what has been written elsewhere, Match Group (Nasdaq: MTCH) is the one making the biggest strategic push into AI-driven features.

No clues, nuggets, or hints were provided on his last couple of picks. But as a kind of bonus, Louis does name a few stocks his proprietary stock-grading system is telling him to avoid.

They are Pfizer, Intel, Warner Bros Discovery, UPS, and regional banks as an asset class.

The reasoning?

They all score low on most of the eight factors highlighted earlier and they are falling behind on integrating AI into their operations in a material way.

Generate Super Alpha or Average Returns?

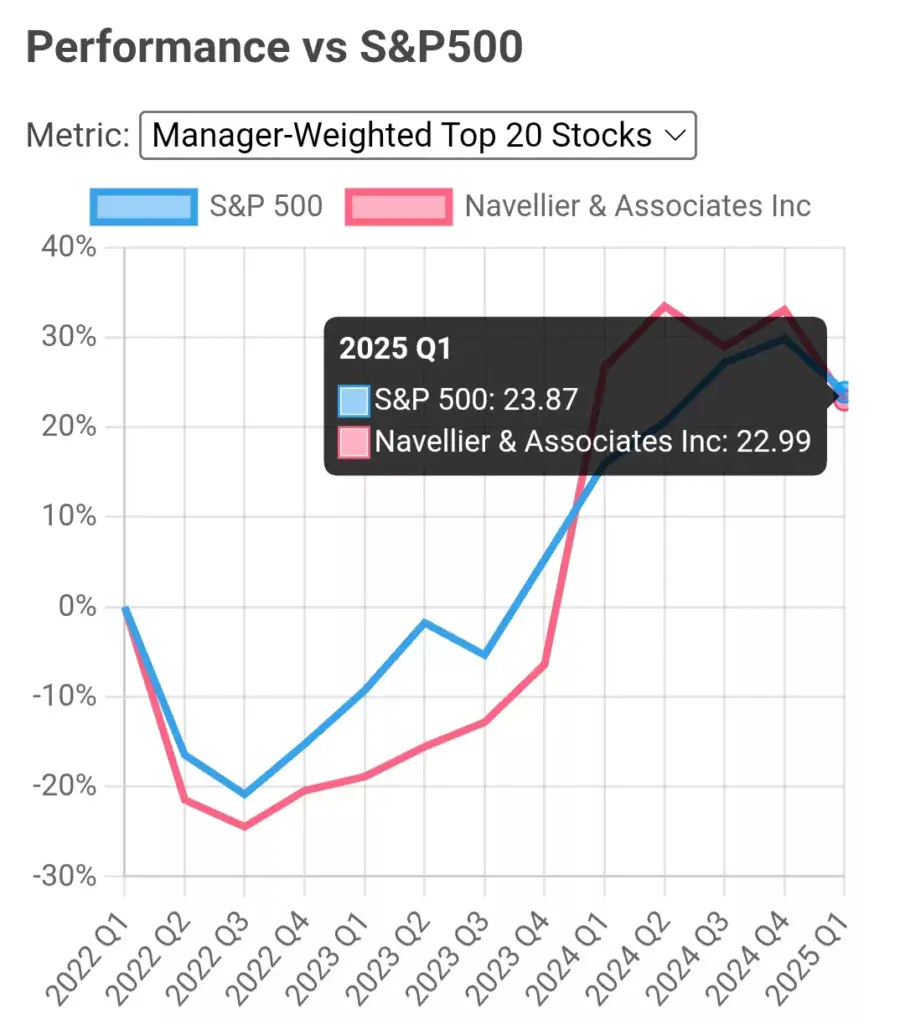

Over the past three years, Louis' Navellier & Associates, which uses the stock-grading system touted in this teaser, has just about equaled the return of the S&P:

So the alpha is not super or average, but rather a tad below average.

As for the individual picks, there's no way to confirm whether or not they are indeed Louis' next generation AI picks.

However, Exelisis is the most interesting of the suggestions.

Samsara is not cashflow positive and Match's revenue is growing largely due to acquisitions, as paid subscriber figures for some of it's biggest apps, like Tinder and okCupid, have been falling for the past four years. Not sustainable.

Despite being in the notoriously volatile biotech space, Exelisis has more than $1 billion in cash on it's books, only $187 million in debt, and it is cashflow positive with a profit margin of 28%.

This is due to a series of successful drug approvals over the past decade, but fortunes can quickly reverse in this space.

Without some specialized expertise or insight, i would hesitate to take a position.

Quick Recap & Conclusion

- Billion dollar money manager Louis Navellier is calling for the last financial mania of his lifetime and some “Next Generation AI” Stocks will be at the center of it.

- Louis believes that the biggest gains from the AI boom will come not from chipmakers or chatbots, but from businesses reshaping and automating existing jobs and tasks.

- The investing guru has got half a dozen such picks and they are only revealed in a report called The Real AI Boom: Six Stocks That Could Multiply Your Money in The Next Generation of AI. To get our hands on it we need a subscription to Louis' small and mid-cap research service called Breakthrough Stocks, which will set us back $1,799 for the first year.

- Louis' teaser was disappointing in that it skipped over a promised free recommendation and only provided generic clues on three of his six “Next Generation AI” Stocks. He did however provide four picks to avoid – Pfizer, Intel, Warner Bros Discovery, UPS, and regional banks as an asset class.

- Overall, I agree with Louis' assessment of the next generation of AI being where the biggest gains will come from, but his recommendations should be taken taken with a grain of salt, as his own performance has been no better than the S&P 500.

Will the next generation of AI stocks be bigger than the first generation? Leave your thoughts in the comments.