Hedge fund manager turned opportunistic trader, Larry Benedict, is sharing a trading strategy that he says is so simple and powerful, that it feels illegal.

It's called “Skim Codes” and anyone with a regular brokerage account can use it to make as much as 17x other strategies.

The Teaser

A code that can make money whether the market goes up or down, host Kim Moening echoes our sentiment when she says that “it sounds crazy.”

Larry Benedict is an options pioneer, has more than 30 years of market experience, and is a Boca Raton, Florida resident, which explains the tan.

We have previously reviewed his “One-Ticker Retirement Plan” and Trump Trigger Stocks, teasers.

In this one, we're looking at a trading strategy that is both old and new at the same time.

When confronted with the crazy claim, Larry explains that he didn't recently invent the trading strategy.

In fact, he used it at his former hedge fund, Banyan Equity Management, which he ran for 18 years from January 2000 to 2018.

The only difference is that all of the risk modeling, number crunching, and timing of the strategy, has now been baked into each “Skim Code.”

All we have to do is:

Input the code into our brokerage account and we get the exact same setup as the pros

Sounds sweet, but what exactly are “Skim Codes?”

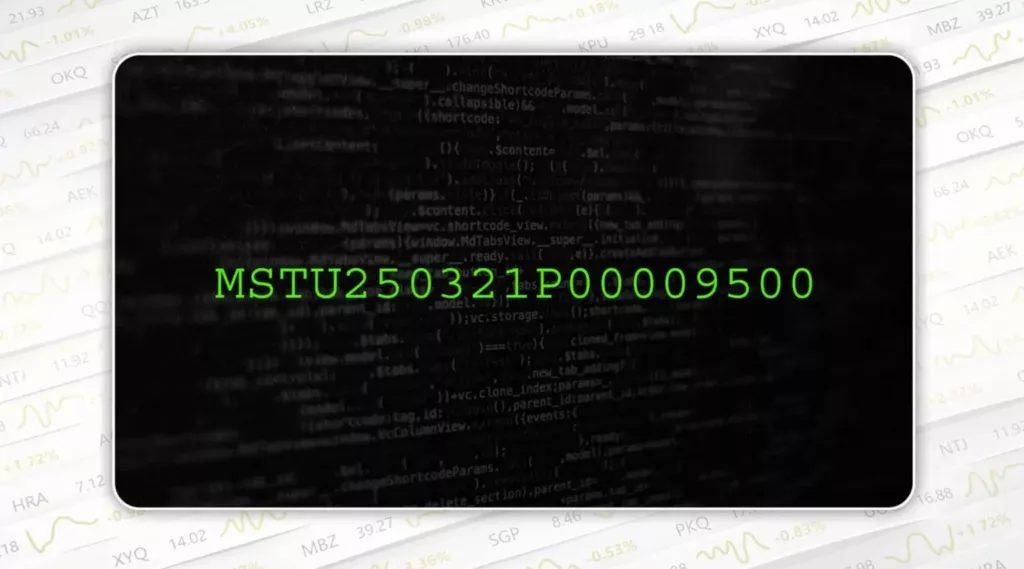

At the onset of the presentation they are described as alien-looking, 18-digit codes:

But halfway through the presentation we learn the truth, Larry says that “Skim Codes” are really short-term options.

However, as with any trading strategy knowing what to trade and more importantly, when, is just as vital.

The Pitch

Larry promises a step-by-step guide in The Skim Trade Blueprint special report, and trade alerts directly to our inbox and cell phones.

But only if we sign up to his One Ticker Trader advisory service.

This costs $79 upfront for the first year (normally $499) and it comes with a 30-day money-back guarantee.

What, When, and Where to Trade

Unlike most trading strategy teasers which hide behind ‘proprietary info' to disclose little of significance.

Larry, to his credit, walks us through a few trade examples.

This is one setup that we know of:

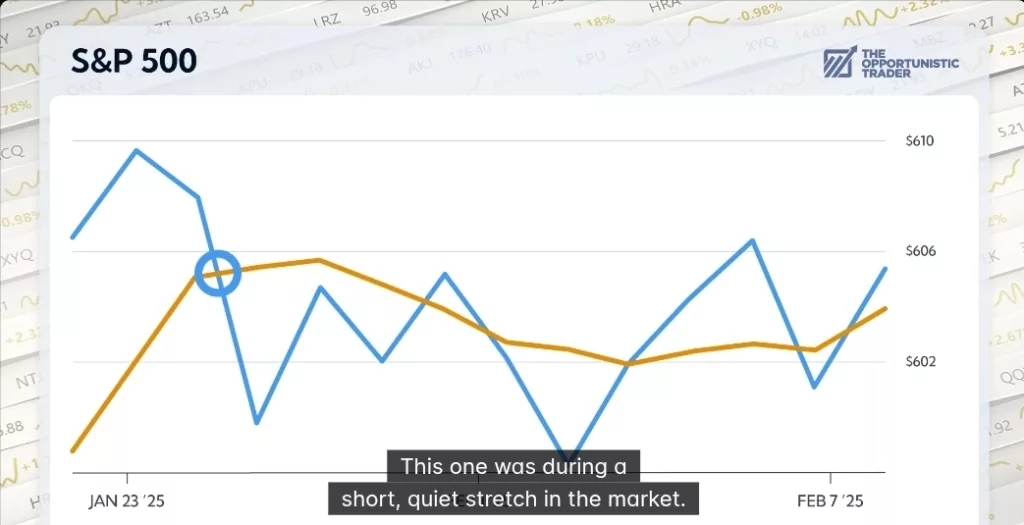

The blue line tracks the market's current price, while the organe line is the trend.

When the two cross, as in the image above, that's confirmation to put on a trade.

This is done by buying an option on an ETF at the confirmation point and cashing out right after.

So, it's more about consistent payouts, “skimming“, than long-shot gambles.

Another example highlights the same setup, except in a down market:

It even works in choppier markets:

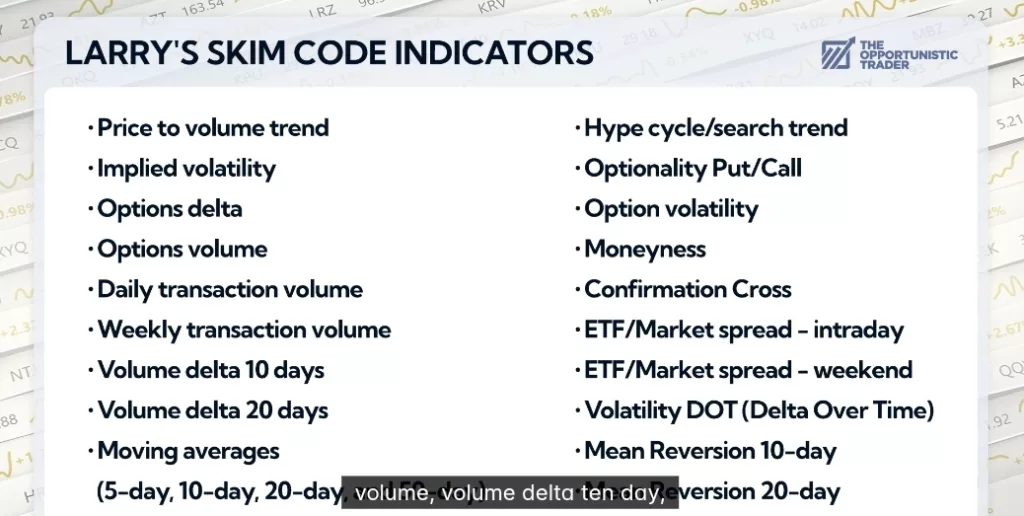

Besides a simple confirmation cross, Larry's system also relies on a litany of secondary and thirtiary indicators:

Fortunately, we don't have to check all these off before executing a trade because there are essentially only three-steps to “skimming“:

- Confirming the trend (comfirmation cross)

- Buy a call (if the market is going up) or a put option (if the market is going down) on an ETF like the S&P 500

- Sell the option and take profits on the same day

Versatility, consistency, and median payouts of 30%-100%, it all sounds tempting.

However, no short-term trading system comes without potential pitfalls and there are several when it comes to Larry's “Skim Codes.”

An 84% Win-Rate?

Larry lays out a sophisticated strategy as simply as possible.

But the reality is that trading options intraday is anything but.

Skimming or scalping, which is high-volume, rapid-fire trading, is even tougher for a few reasons.

First, to trade options with most online brokers, you first need to apply for options trading permissions through the client portal.

If this is accepted, then comes the next hurdle…availability.

In order to quickly enter and exit trades at the drop of a dime, you need to be available and have your phone or laptop out during market hours.

If you're working or on the move, “Skim Codes” aren't an option, no pun intended.

Even if you are available and want to trade, some basic online research returns mixed results from paying subscribers.

One such subscribers wrote on Trustpilot that “many trades were winners, but the losers were significant.”

Given that one typically receives 2-3 trade setup recommendations per month, you can't afford to be wrong more than right.

Going through other reviews, it appears that the ones who have had the most success with the system are, unsurprisingly, those who are seasoned investors/traders.

The big claim, which is not verifiable, is an 84% trade success rate.

Curiously, the disclosures and details page makes no further mention of this and it's also the exact opposite experience of most day traders, with more than 88% losing money in any given year.

However, perhaps the biggest indictment against intraday trading comes from a notable study that pointed out:

The average individual investor underperforms a market index by 1.5% per year. Active traders meanwhile, underperform by 6.5% annually

The only conclusion we can arrive at from the info that has been made available is that “Skim Codes” can be profitable for traders with some experience over the short-term, not so much for others, and unprofitable for all over the long-term.

Lastly, who came up with the name “Skim Codes” anyway? It sounds like a checkout coupon for Kim Kardashian's shapewear brand.

Quick Recap & Conclusion

- Hedge fund manager turned opportunistic trader, Larry Benedict, is sharing a trading strategy called “Skim Codes” that he says is so simple and powerful, that it feels illegal.

- Larry reveals that “Skim Codes” are really short-term call and put options, but we still don't know when and what to trade.

- This is only revealed in The Skim Trade Blueprint, special report, which we can only access with a subscription to Larry's One Ticker Trader advisory service. The cost is $79 upfront for the first year (normally $499).

- The “Skim Codes” system can be boiled down to confirming the trend (comfirmation cross), buying a call (if the market is going up) or a put option (if the market is going down) on an ETF like the S&P 500, and selling the option and taking profits on the same day.

- Based on all publicly available info, “Skim Codes” can be profitable for traders with some experience over the short-term, not so much for others, and unprofitable for all over the long-term.

Have you tried Larry's “Skim Codes” options trading system? Tell us about your experience in the comments.