President Trump hasn't been his normal, happy-go-lucky self lately, and it's because one of the United State's biggest trading partners made a big mistake.

It messed with one massively profitable “Ultimate Stock Unicorn” that we're going to reveal for free in this teaser review.

The Teaser

Of the 23,000 companies that are publicly traded stocks, Karim says only one meets his criteria to be called a “Unicorn” right now.

Karim Rahemtulla is a 1980s Wall Street guy, and trading stocks is what he does.

He's gotten pretty good at it, too, because today, he says he lives off of his daily trading, in addition to being the co-founder of the Monument Traders Alliance.

We have previously reviewed Karim's “Nuclear Miracle” and “#1 U.S. Stock to Soar From 2-Nanometer Chips.” Both produced decent enough picks that we haven't seen shared by anyone else.

Karim's definition of a unicorn is simple:

A company that finds itself so wildly profitable, yet so insanely undervalued, that the share price has almost nowhere to go but up

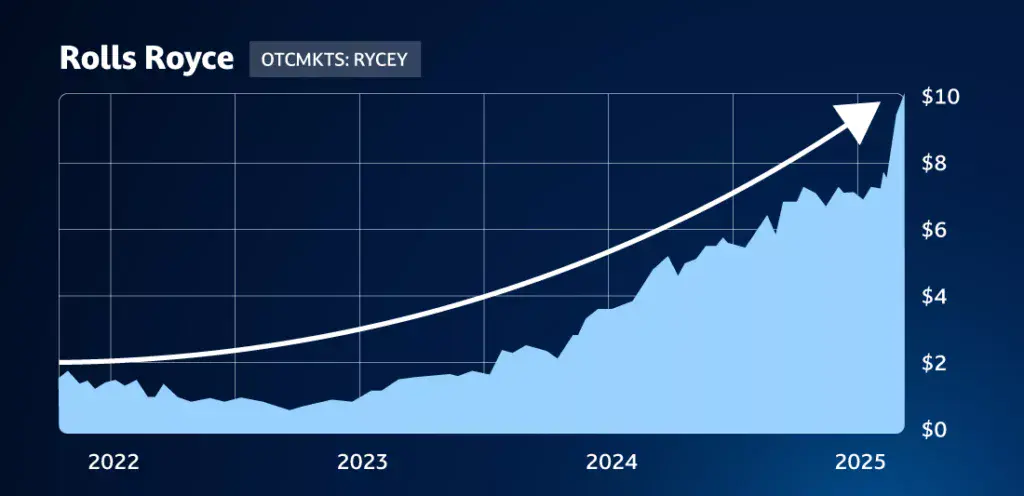

The last time Karim came across something matching this description, it was 2022, and the company was Rolls-Royce (OTC: RYCEY).

It was profitable on a cashflow basis, and the stock was absurdly cheap due primarily to the shutdown of air travel in the preceding two years.

Karim went public with his pick, sending an email to his readers, calling Rolls-Royce “the single best value play in the history of the markets.”

As air travel began to open back up, shares of the aircraft engine-maker and nuclear power system provider soared.

Currently, the stock trades north of $13.

Now, Karim says he has found the next unicorn stock.

It follows the same tried and true blueprint as his previous “Unicorn” Stock, a great company, selling for a cheap price.

The only major difference, apparently, is that not even Rolls Royce was this profitable and cheaply priced when he recommended it.

This makes it the “Ultimate Unicorn,” and it sits at the epicenter of two of the most important industries over the next few years, Energy and Artificial Intelligence (AI).

The Pitch

It's name and ticker symbol can be found in a report called The Ultimate Stock Unicorn: The Most Wildly Profitable and Insanely Cheap Stock in the Market.

However, there's just one small catch…

We need to subscribe to Karim's Catalyst Cashouts Live research service to get it.

A one-year membership costs $49 for a limited time (normally $497), and it comes with a 365-day money-back guarantee.

Britain's Big Mistake

Since Brexit happened in 2016, Brits have had a rough go of it.

Whether by design or decline, economic growth has been stagnant since 2021, and the old Union Jack is in the midst of one of the largest outflows of capital in its history.

Out of sheer desperation, in an attempt to combat such capital flight, it's legislature has passed things like a “windfall tax” on domestic and foreign oil and gas producers, that extends to American companies.

Since Karim's Unicorn produces some 18 million cubic feet of natural gas daily off the British coast in the North Sea, the windfall tax applies to it too.

Trump was having none of it.

He publicly told the UK that they were, uh, “making a big mistake” when it came to their energy tax policy.

Now, cooler heads seemed to have prevailed, as a new UK-US trade deal recently took effect, which slashes US export tariffs but keeps the windfall tax in place, for now.

However, Karim says the beauty of this situation is that the “Ultimate Stock Unicorn” is already wildly profitable, even without the tax break, which only affects a small percentage of its production.

Just how profitable are we talking?

- It had $3.2 billion in operating income in the last fiscal year.

- It is profitable on both a net income and cash flow basis.

- Pays a consistent, growing dividend.

All attributes of a stellar business.

The only thing keeping it cheap, for the time being, is that few people know it exists.

But that could be changing soon, thanks to a potential catalyst Karim has identified.

I always wanted to see a unicorn, so let's find out what it is.

Revealing Karim Rahemtulla's Ultimate Stock Unicorn

Here is everything we know about our potential unicorn ride to the moon:

- The company operates the largest continuous oil and gas deposit ever discovered in the United States.

- It owns 3.7 million acres with nearly 5,000 wells producing 143,299 barrels of oil per day.

- It’s the first company to use natural gas to power hydraulic fracturing.

- It recently signed a multi-year, multi-million-dollar deal to work together with Palantir.

Karim is talking about APA Corp. (Nasdaq: APA). The clues align like the technology inside a hydraulic drill.

- The enormous deposit is the Midland Basin Wolfcamp shale area in Texas's Permian Basin, where APA owns a number of producing fields.

- Following some recent strategic divestitures, the latest figures from APA show it owning nearly 4,300 producing wells, covering 2.7 million acres.

- It lays claim to being the first to use natural gas to power the energy-intensive hydraulic fracturing process in 2013.

- APA and Palantir are collaborating to put AI to use in the oil and gas production process.

The Perfect Profit Formula?

So, we already know APA is firmly profitable, but how cheap is it, and what about growth and that catalyst Karim mentioned?

Counterintuitive to most modern finance guys, I like to start with the balance sheet. Just as the eyes are the window to the soul, the balance sheet is a view at the heart of a business.

APA's is in decent, although not great, shape.

The international oil and gas concern has a current ratio below one, meaning that its debt load exceeds its assets. All of those property acquisitions and drilling programs were not cheap.

Now, APA won't be going bust anytime soon. It has sufficient credit facilities to maintain short-term liquidity, and the vast majority of its debt doesn't come due until 2035 or later.

However, more than anything else, I would say this is the primary reason shares are only trading for 7x current earnings.

It is also why there is a focus on cost-cutting and efficiency, as per it's first quarter earnings supplement.

In this light, Karim's potential catalyst, the ramping up of energy production by way of it's partnership with Palantir, makes perfect sense. Why not let AI have a shot at systematizing operations?

If it works, you're better off, and if it doesn't, you're in the same position you are now.

At the current low price, buying a stake in APA is tempting, but any potential growth will be constrained by its need to service debt.

It's a watchlist add for me, to see how things develop.

Quick Recap & Conclusion

- Full-time trader and newsletter publisher Karim Rahemtulla is teasing an “Ultimate Stock Unicorn” that benefits from Trump's America-first policy and artificial intelligence.

- Karim calls his pick the “Ultimate Stock Unicorn” because it is wildly profitable, yet intensely undervalued.

- It's name and ticker symbol are only revealed in a report called The Ultimate Stock Unicorn: The Most Wildly Profitable and Insanely Cheap Stock in the Market. The catch is, we need to subscribe to Karim's Catalyst Cashouts Live research service to get it, which costs $49 upfront for the first year (normally $497).

- However, Green Bull readers don't have to pay anything, because we revealed Karim's pick as APA Corp. (Nasdaq: APA) for free.

- APA is profitable and cheap at only 7x current earnings, but its massive $6 billion debt load will be a drag on growth going forward. It's a watchlist addition for now and nothing more.

Will AI make APA more efficient and productive? Let us know your thoughts in the comments.