Semi-retired trader Karim Rahemtulla is declaring a “Nuclear Miracle.”

He says a new energy technology could send the stock of the company behind it from $3 to $25, and even $50 in the next few years.

The Teaser

Nuclear fusion, while exciting, is decades away from producing commercial energy, if it ever will. However, there's recently been a breakthrough, or a miracle, if you will.

Karim Rahemtulla is a former Wall Street CFO turned day trader, turned newsletter guru. A natural career progression if there ever was one.

We previously revealed his #1 U.S. Stock to Soar from 2-Nanometer Chips and we have also reviewed other nuclear teasers here at Green Bull in the past, like Whitney Tilson's “Project E-92” Nuclear Power Stocks.

To put nuclear fusion into perspective, up until now, it took about 300 megajoules of energy to produce just 3 megajoules of output.

Not exactly efficient.

This is where the breakthrough technology comes in. We're told it can power 1 million homes while being one-tenth the size of a traditional power plant and to boot, it's far cheaper too.

The Mini-Nuclear Power Plant

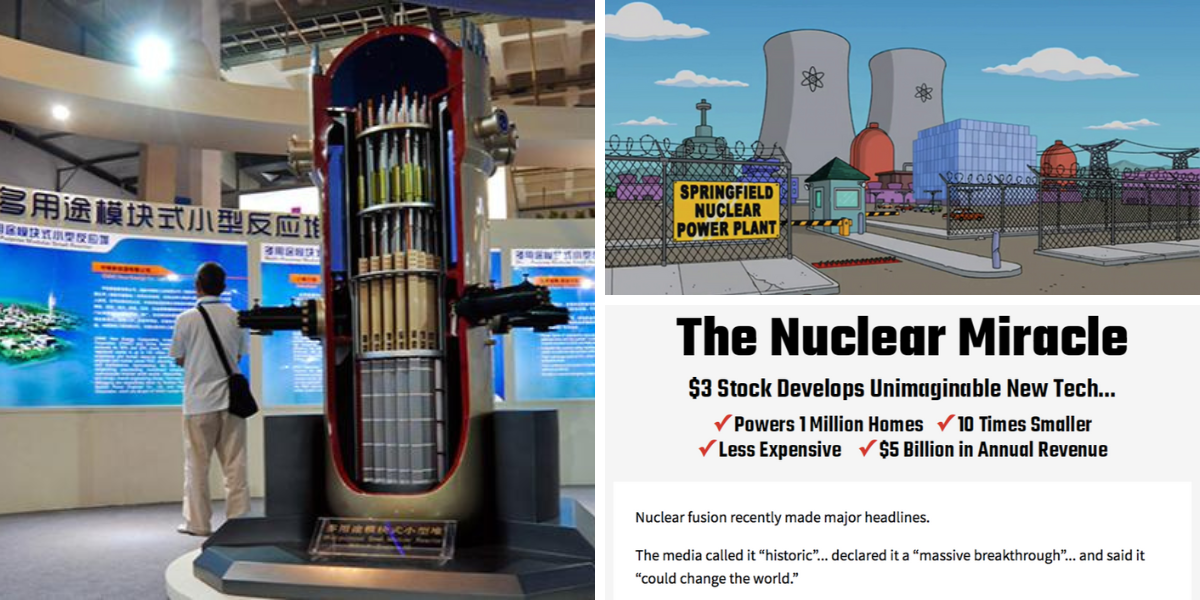

Small-scale nuclear reactors (SMR) started to be developed around the world in 2019.

They have been hailed as the next generation of nuclear power plants and look something like this:

Besides the promise of producing affordable carbon-free energy around the clock, mini nuclear power plants also have another thing going for them – huge government subsidies.

The U.S. Department of Energy has committed more than $1.4 billion to subsidize small nuclear reactor (SMR) projects and the Inflation Reduction Act of 2022 provides zero-emission nuclear power production credits up to $15 per megawatt-hour for electricity produced.

It is hoped that such incentives will pave the way for the nuclear energy sector to help ensure energy security and cut U.S. emissions by 40% before the end of the decade.

Whether or not mini nuclear power plants become the most dominant form of power generation on Earth remains to be seen. But the trifecta of new technology coupled with major public/private investment from the likes of the DoE, Rolls-Royce, and Westinghouse, among others, means the stock being teased could have some upside.

Best of all, this company is already a proven powerhouse in another industry and is expected to see earnings rise dramatically in the years ahead.

The Pitch

Karim urges us to get in now rather than wait and see what happens after earnings are reported, as we may end up paying a much higher price for his nuclear pick.

This is why he wants to rush us a special report that he just put together called “The Last Great Value Stock.”

Inside the report are all the details on the $3 stock Karim predicts is set to dominate the year ahead and the only way to get it is with a subscription to a new advisory service called Trade of the Day Plus.

A one-year subscription to Trade of the Day Plus costs $49 for a limited time and comes with a one-year money-back guarantee. Also included are 52 weeks of trade recommendations, a few bonus reports, such as Karim's Favorite Small-Cap Play and $3 Gold Play, as well as access to a model portfolio, which seems to be the add-in of choice among newsletter purveyors nowadays.

The Key to Why This Stock Will Rise Next

Karim taps into his trading background and states that the key to identifying stocks that will rise next is to look for companies that complete what he calls a “reversal.”

This occurs when a company swings back from a loss to positive net income in a very short time.

When we find such situations, we can make boatloads of money and Karim has a few examples to back up this claim.

Through the first three quarters of 2014, Nintendo lost about $750 million and the stock had collapsed nearly 85% from $80 to just $13.

But in December 2014, a reversal happened.

Nintendo went from a $750 million loss back to positive net income of more than $1 billion over the next three quarters.

As a result, its stock went from $13 back up to $80 at its peak.

That's a 515% gain over the next six years if we held onto the stock.

This is what's happening now with the $3 stock Karim is promoting.

Its operating income just swung from a $2.7 billion net loss back to a profit of more than $700 million.

A 25x Increase

There are a few reasons it was down in the dumps to begin with.

As an engineering and manufacturing firm, this company is literally the engine that runs the economy.

So when the pandemic hit and the economy stopped moving, the company was badly impacted. It took a huge $2.7 billion loss in terms of operating income in 2020.

Just like Nintendo when it saw losses, the stock nosedived.

However, this has all changed.

The company’s sales are soaring, operating income is now firmly in the black once again, and billions of dollars in new sales are coming in.

A large backlog of $61 billion in sales is due to come in over the next few years, which makes Karim believe this $3 stock has a real chance to go to $25 in the years ahead – a 25X increase on its current value.

He even calls it “the single greatest value play we can buy right now.” Let's find out the name and ticker of this stock.

Revealing Karim Rahemtulla’s Nuclear Miracle Company

Karim isn't shy and provides plenty of info on his pick:

- The business is described as “an engineering powerhouse” that builds, supplies, and services world-class engines and power systems. They provide the engines for 60% of A330s worldwide.

- The $3 stock Karim is telling us about charges an hourly fee for service on its engines, creating a Netflix-like recurring revenue stream.

- It is currently working on a nearly $5 billion-per-year project to build nuclear reactors for the United Kingdom.

It was the last clue that gave it away, Karim's pick is Rolls-Royce Holdings plc (OTC: RYCEY).

- RR has won more than 60% of new orders over the last three years for A330 engine deliveries.

- For a flat hourly rate per engine, Rolls Royce handles installations, check-ups, maintenance, and decommissioning.

- As per the New York Times, Rolls-Royce hopes to build 16 small modular reactors in the UK, which could power around one million homes.

10-Bagger Potential?

Rolls-Royce has had a solid run over the past year, with its stock going from $1.36 to $3.90.

Can its momentum continue and perhaps even accelerate?

There are a few reasons to believe it can.

First, Rolls-Royce stock is an absolute and relative bargain at 15x trailing earnings. The average P/E of its peer group is more than double this, at 32x.

Second, it is a well-established and diversified going concern. With profitable businesses across civil aerospace, defense, and power systems.

Lastly, Rolls-Royce has one of the broadest capabilities when it comes to nuclear power. The multinational is vertically integrated in this respect, from engineering, manufacturing, and installation to operation and maintenance of small nuclear reactors (SMR).

Rolls-Royce is already a $33 billion-dollar business, so it will take some time to move the needle and grow, but the potential is there.

Quick Recap & Conclusion

- Semi-retired trader Karim Rahemtulla says a “Nuclear Miracle” is incoming and it could take the stock of the company behind it from $3 to $25, and perhaps even $50 over the next few years.

- The “Nuclear Miracle” is small nuclear reactors (SMR), that promise to produce affordable carbon-free energy around the clock at an affordable price.

- One company is the vertically integrated leader in this emerging industry and its name and ticker symbol are revealed only in a special report called “The Last Great Value Stock.” The report is ours if we subscribe to Karim's Trade of the Day Plus advisory service, which costs $49 for the first year.

- Fortunately, you can skip this step altogether, as we were able to reveal Karim's pick for free as Rolls-Royce Holdings plc (OTC: RYCEY).

- Rolls-Royce is an established business with above-average growth prospects in some of its businesses, like power systems, and a low absolute valuation.

Are mini-nuclear power plants a viable energy alternative? Let us know your thoughts in the comments below.