Elon Musk's SpaceX is setting up to be the biggest IPO in history.

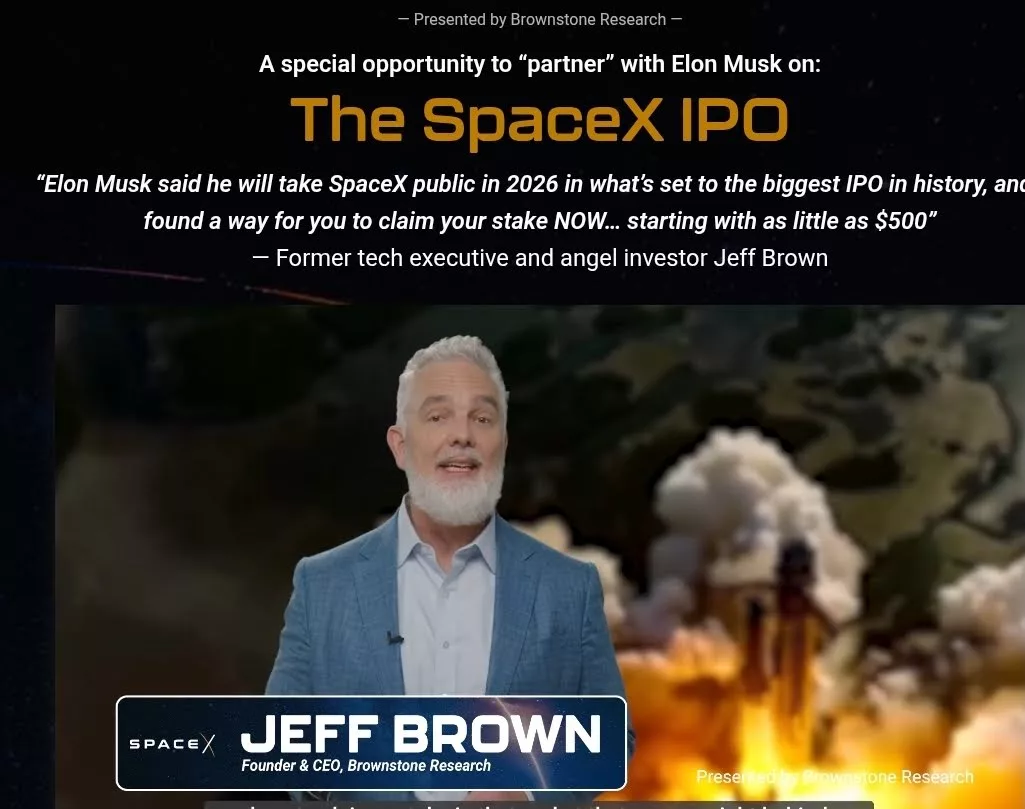

Former tech executive and angel investor Jeff Brown claims that he's found a way to invest in it right now and cash out with the biggest payout of our lives.

The Teaser

That's a pretty big story, but there's an even bigger one hiding in plain sight.

Jeff Brown made his name as a tech guy, but lately he's been branching out.

Two of the recent teasers we've reviewed from Jeff have been about The Medical Holy Grail and a Texas Royalty Plan.

In this one, he's going to space.

In 2002 Elon Musk made a bold face bet that many thought would bankrupt him.

He decided to start a “rocket company” in a bid to help bring down the cost of space exploration.

At the time, each rocket launched into space was single-use, costing tens or even hundreds of millions of dollars.

Some on the fringe, like the Mars Society and Elon Musk thought there had to be a better way.

As it turns out, there was, and the old adage about only those who are crazy enough to think they can change the world, are the ones who do, has come to pass yet again.

Elon didn't invent reusable rockets, but he, along with SpaceX engineers, did build the first operational rocket capable of reflight in 2010.

Following numerous test flights, literal blow ups, and more than $100 million invested, the first operational rocket capable of reflight successfully landed in December 2015.

This innovation has reduced the cost of space exploration by more than 90%, which is where the opportunity comes in.

Now that the technology is proven and the cost is manageable, SpaceX has gone beyond ‘just' space exploration.

It, along with it's Starlink operating subsidiary, have started sending satellites into orbit, by the thousands.

Rapid reusable rockets, capable of being relaunched within hours of touching back down will lower the cost even further.

According to Jeff, this positions SpaceX to become one of the biggest companies ever and we now have a chance to get into it early.

The Pitch

A SpaceX IPO could be filed at any moment now and the way to front-run it is revealed in a special report called How to Claim Your Stake in SpaceX.

To get our hands on it, we'll need a subscription to Jeff's Near Future Report newsletter.

The cost is $179 upfront (normally $499) and it comes with a full 60-day money-back guarantee.

The World's First Global Communications Carrier

Not only is Starlink SpaceX's largest source of revenue, but as of the end of last year, the satellite internet service topped 9 million users across 155 countries and territories, and is adding more than 20k users per day!

Officially, Starlink is now Elon Musk's fastest-growing venture.

A far cry from it's not-so distant days as a service mainly used by the military and rural customers without cellular network coverage.

If we compare it to other internet service providers (ISPs), we are indeed early and the upside is exponentially greater.

The three largest ISPs, Comcast, Charter, and AT&T, each have more than 30 million subscribers, respectively.

Of course, they are all national and not international providers, with the potential to be the first global communications carrier.

Starlink could also serve as a catalyst for SpaceX's ambitions of interplanetary travel, so it deserves a little premium just for that.

Ultimately, it will come down to valuation, but in a time when internet connection is as vital to many as water and electricity, a global provider that isn't reliant on outdated local infrastructure is worth a hefty sum.

Elon knows this.

He tweeted about the right timing for a potential SpaceX IPO being when revenue growth is “smooth.”

That time has now arrived, but what we still don't know is how to indirectly invest in SpaceX shares?

How to Claim A Stake in SpaceX

Jeff promises getting a piece of SpaceX is:

- As easy as buying any stock

- We can get started for as little as $500

This isn't much to go on, but based on the $500 price point, Jeff could be teasing Alphabet Inc. (Nasdaq: GOOGL).

Alphabet directly owns a substantial minority stake in SpaceX that is estimated to be around 7%.

It is the only publicly-traded stock owning a direct stake in SpaceX that is even close to the price point Jeff mentioned.

The only other possibilities are Bank of America and publicly-traded funds, like the ARKX Space & Defense Innovation ETF, which also own minority equity stakes, but don't come close in price.

The Next Trillion-Dollar Company?

Apart from OpenAI, SpaceX is the major IPO that the market is waiting on.

But beyond the hype and headlines, what would be a fair price to pay for a stake in what could be the next trillion-dollar company?

According to insiders, SpaceX generated nearly $8 billion in profit on $15 billion to $16 billion of revenue in fiscal 2024.

That's in the neighborhood of 50% gross margins, which is a welcome sight for a company coming to market.

Growth is just as impressive, on the order of more than 60% year-over-year, which will slow the bigger the company gets, but it's still relatively early days.

Importantly, as pointed out earlier, Starlink makes up more than 50% of total revenue and profits, with no signs of letting up.

If we extrapolate some of these figures out, we get a business that is already the largest satellite operator in the world, generating around $24 billion annually, with 50% gross margins, and a growth rate in the 40-60% range.

There are also growth catalysts in place, such as a potential merger with Musk's other private venture, xAI, and Starshield, the military/defense version of Starlink.

Given it's profitability and growth, you knew the buy-in price wouldn't be cheap. But the current speculation is a $50 billion raise at a $1.5 trillion valuation!

This implies a price of more than 50x sales, never mind earnings/cashflow.

Personally, I don't mind letting my hair down and paying 30x trailing earnings for an innovative, profitable business with good growth prospects every once in a while, but even the best business isn't a good buy at any price.

SpaceX could be the next trillion-dollar company, but apparently, it already is!?

Fortunately, we can still pick up Alphabet shares at 33x earnings to get an indirect SpaceX stake, with plenty of upside from AI, semiconductors, and driverless cars.

Quick Recap & Conclusion

- Elon Musk's SpaceX is gearing up to be the biggest IPO in history and Jeff Brown claims to have found an indirect way to invest in it now.

- The way to front-run SpaceX is only revealed in a special report called How to Claim Your Stake in SpaceX.

- To get our hands on the report, we'll need a subscription to Jeff's Near Future Report newsletter. This would set us back $179 upfront (normally $499).

- No tangible clues are left for us to run with, but given the limited info we did get, one distinct possibility is Alphabet Inc. (Nasdaq: GOOGL), which owns a substantial minority equity stake in SpaceX and is trading in the price range of Jeff's pick.

- SpaceX at a rumored $1.5 trillion valuation is a hard pass, but Alphabet at $4 trillion with solid growth catalysts and a SpaceX stake is something to think about.

Would you buy into a SpaceX IPO? Let us know below in the comments.

ANYTHING ELON MUSK IS INVOLVED IN, I WOULD LIKE TO BE IN ALSO (IF I CAN AFFORD IT)

When can I expect an answer for SpaceX IPO

When can I expect an answer for SpaceX IPO

When will SpaceX announce it Pre Ipo so that I can buy shares.

Baron Partners Fund (BPTIX) is 28% invested in SpaceX.