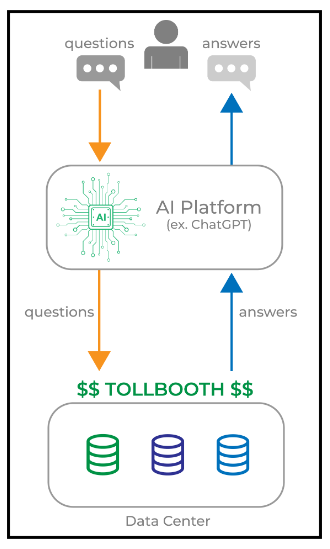

Whenever you ask ChatGPT or another chatbot a question, the query must pass through a special facility before generating a response.

Jason Williams says this AI “Tollbooth” collects a staggering $427.5 million in fees every single month and we're going to reveal what it is.

The Teaser

Every contender in the AI race, whether it's ChatGPT, DALL-E, Bing, or any other newfangled AI platform, all depend on one crucial resource.

Jason Williams is a reformed Wall Street guy who has realized the error of his ways and now wants to help us out using the same strategies he once used to help the ultra-wealthy get even richer. In some previous teasers, we have reviewed here, Jason has promoted such things as “Stimulus Stipends” and “Plug-In Payouts.”

The crucial resource all AI apps depend on is housed in this massive industrial compound:

I have a gut feeling about what Jason may be talking about here.

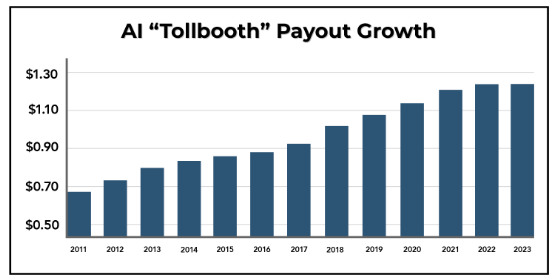

He also says AI “Tollbooth” payouts have surged 116% over the past decade!

However, the AI “Tollbooth” isn’t allowed to keep all of the profits for itself.

Jason reveals it is legally required to share a whopping 90% of its profits with individuals like you and me.

This definitively tells us the man is teasing a Real Estate Investment Trust (REIT), but which one?

A Little-Known Investment Secret Used to Generate Millions in Profit

Jason has used this strategy time and time again to reap significant gains.

It involves pinpointing the firm that provides the one thing every other company in its industry relies on, and that’s exactly what he's doing here.

If we think about what AI is fundamentally dependent on, we will arrive at the same conclusion – data servers.

Unlike algorithms and large language models (LLM), which AI is trained on and represents variable development costs. Servers are hard fixed costs, that there is no getting around.

One little-known tech powerhouse stores the data that powers the AI apps many have already come to rely on.

The Pitch

Jason has put together a special report outlining everything we need to know to start receiving consistent payouts from the AI “Tollbooth” every 90 days. It's unoriginally called “The AI ‘Tollbooth’ That Could Pay for Your Retirement”

If we agree to take Jason's flagship newsletter, The Wealth Advisory, for a no-strings-attached trial, a copy of “The AI ‘Tollbooth’ That Could Pay for Your Retirement,” special report is on the house.

The cost of a subscription to The Wealth Advisory is $99 for the first year and it includes 12 monthly issues, with each providing an in-depth look at a promising new investment opportunity, two additional bonus reports, and a model portfolio and archive access to the newsletter's entire 15-year history. Not too shabby.

The World's Most Valuable Resource

All AI applications require both training data and a model to operate.

Models parse through huge datasets to learn and hopefully, produce the desired outputs. Who knew producing razor-sharp responses for users in mere milliseconds isn't such an easy task.

So, just how huge are the datasets?

It depends on several factors:

Complexity of the Model

To put it simply, the more complex the model, the more data will be required.

General models about everything under the sun, like ChatGPT require infinitely more data than a narrow model about one single topic, like health or fitness.

Input Variety

Ever entered a precise input into an AI chatbot and received a wildly off-base reply?

This may be because its dataset wasn't big enough. The more inputs a model can observe, the more data it requires.

Error Rate

The smaller the error rate, the more data the model will need to parse.

A model with an accuracy rate of 90%, which is average by AI standards, requires billions of datasets.

That’s why all AI businesses have no choice but to rely heavily on data centers. Specifically, ones equipped with state-of-the-art servers, sophisticated cooling systems, and lightning-fast network connections.

Even the Wall Street Journal has admitted that “data centers are being buoyed by rising demand from enterprise AI tools.”

In short, the AI “Tollbooth” is THE one thing that the AI industry relies on.

The REIT Jason is teasing here has invested billions of dollars into developing over 310 data centers worldwide, including the massive industrial compound shown at the beginning of the presentation.

Let's see what other clues we get about this industrial property REIT.

Revealing Jason Williams’ AI “Tollbooth” Company

Here is everything we know about the so-called AI “tollbooth”

- Jason says it is one of the largest owners of data centers in America.

- The REIT collects $427.5 million in fees every single month.

- Amazon, Microsoft, and Google are all customers.

A reverse Google image search for our massive industrial compound returned the answer I was searching for, its Digital Realty Trust Inc. (NYSE: DLR), and the facility pictured is its 1.7 million sq. foot Ashburn, Virginia data campus. The other clues neatly line up as well:

- Digital Realty is the second largest data center REIT by market cap, behind only Equinix Inc. (Nasdaq: EQIX).

- The REIT's revenue over the last twelve months is $5.3 billion, which averages out to just over $427 million per month.

- Amazon AWS, Microsoft Azure, and Google Cloud are all mentioned on Digital Realty's partners page, so I guess that counts.

Real Shot at Collecting Up to $48,800 Annually?

Some REITs and listed trusts have above-average dividend yields.

This is not the case when it comes to data center REITs.

Equinix, the largest of the bunch, carries an annual yield of only 2.1%. Jason's pick, Digital Realty, has a yield that is only marginally better at 3.6%.

If we do some quick math, this means not even a cool $1 million investment in Digital Realty would yield $48k per year. It would return $36k based on today's payout.

A lot of other investors see the writing on the wall and are piling into data centers for the inevitable capital appreciation, driving yields down.

For a comparable 2.2% annual yield and a much lower valuation, not to mention absolute price, a better alternative is the Global X Data Center REITs & Digital Infrastructure ETF (Nasdaq: VPN). It sells for the same price as its NAV and also spreads our risk out, by giving us stakes in multiple data center REITs, as opposed to just one name.

Quick Recap & Conclusion

- Jason Williams says all Artificial Intelligence applications rely on an AI “Tollbooth” that collects a staggering $427.5 million in fees every single month.

- This AI “Tollbooth” is legally required to pay out a whopping 90% of its profits to investors, which tells us Jason is teasing a Data Center Real Estate Investment Trust (REIT).

- The name of this REIT is only revealed in an unoriginally titled special report called “The AI ‘Tollbooth’ That Could Pay for Your Retirement.” It is ours if we subscribe to Jason's The Wealth Advisory newsletter, which would cost us $99 for the first year.

- Fortunately, Green Bull is here, so you get Jason's pick for free. It's Digital Realty Trust Inc. (NYSE: DLR).

- DLR carries a 3.6% annual dividend yield, which isn't much by REIT standards. A better approach may be buying into multiple data center REITs or a sector ETF to diversify our risk and perhaps also raise our yield.

Are data center REITs on your 2024 buy list? Tell us in the comments below.