Paradigm Press' Doug Hill and James Altucher held a “Superstock Summit.”

It starts with a tempting question, “what would you do if you made 10x your money over the next year?” James wants to make it a reality with some “Microcap Superstocks” that can make 5,000% per year.

We reveal them for free and cover everything you need to know from the more than hour-long presentation in less than 10 minutes.

The Teaser

Microcaps are a virtually untapped island chock-full of the best opportunities in the market.

By now, James Altucher needs no introduction. We have reviewed both of his teasers so far this year, Elon Musk's X-9840 Stock, Second 1,000% Apple Call, and many others.

Conversely, microcap stocks can also be rife with pump-and-dump schemes, short-and-distort scams, and dormant shell companies.

This is where James' teaser comes in useful, as he's narrowed down this universe to five “Microcap Superstocks” that give us the best chance at 1,000% to 5,000% gains over the next year.

Just As Big As AI And Crypto?

Artificial Intelligence and crypto/blockchain are revolutionary technologies driving hypergrowth.

However, many publicly-listed AI businesses are already large caps valued at $10 billion or more and trading for sky-high multiples.

In contrast, microcaps are valued at $500 million or less and oftentimes trade for low multiples.

Such companies make up only 2% of the market, but they have tended to outperform the overall market during economic downturns, including in 2008 and the two years immediately following.

But over the last three years, microcaps, as represented by the Russell Microcap Index have fallen on hard times. Underperforming the S&P 500 by about 9%.

James says this could be about to change.

He says the biggest stock market opportunity by far, will be in these “Microcap Superstocks” and “one reliable profit trigger is signaling that they are are about to take off.”

The Pitch

James has found five “Microcap Superstocks” and he shares their names and ticker symbols only in a series of three reports called “Superstock Setup: Microcaps' Biggest Moment In Decades“ “The Second Wave: 3 Superstocks Leading the AI 2.0 Revolution” and “Bitcoin’s #1 Superstock: The Top Crypto Microcap for Explosive Gains.“

The reports are ours if we sign up to James' newest research service, Microcap Millionaire for $2,500.

This offer includes one to two new microcap stock recommendations per month, focusing on deep value picks, a microcap model portfolio, flash alerts on model portfolio companies, and three additional bonus reports.

What In The World Is A Microcap Superstock?

A microcap is a publicly traded company with a market cap under $500 million.

A “Microcap Superstock” is a company with a market cap under $500 million “possessing all the necessary ingredients to gain 1,000% or more over the next year.”

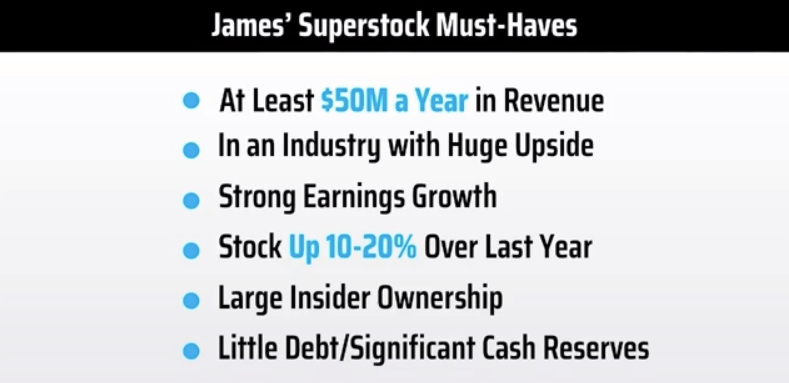

These ingredients consist of seven “must-haves”

The seventh point is a low valuation, which James is adamant could net us a “next magnificent seven stock” only much cheaper.

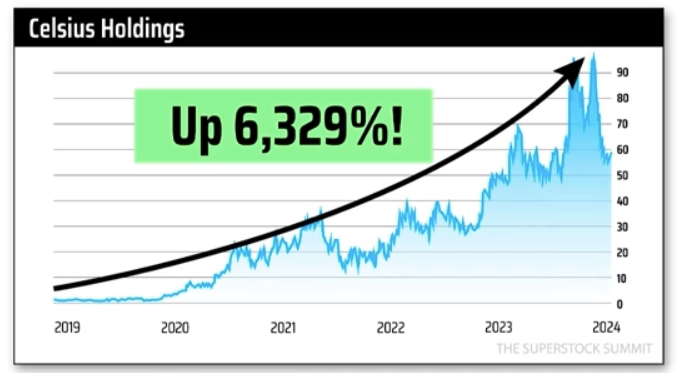

Although not quite “next magnificent seven” level, following these criteria has produced some notable winners for James in the past, including:

And

But that's not all.

There is also a so-called “profit trigger” that will send these “Microcap Superstocks” into the stratosphere.

This catalyst is the much anticipated Fed rate cut in September.

Since a Fed rate cut is already anticipated, I'm not so sure this will have the effect James anticipates, and it may even be partially priced in.

However, as of the end of July, the median price/earnings of the Russell Microcap Index was only 15x. Well below the average 25x P/E of the market. This means that James' picks likely all have a long growth runway.

So what are James' five favorite “Microcap Superstocks“?

Revealing James Altucher's Microcap Superstocks

James drops some very specific clues about each, starting with his favorite “Superstock”

James' Favorite Superstock

- It is emerging as a “dominant player in a new mode of manufacturing“

- Revenue is up 2,000% over the last four years

- Trading at or below the cash on its balance sheet

What is the best chance of earning 1,000% over the next year? Its Nano Dimension Ltd. (Nasdaq: NNDM).

- The Israeli-based business manufactures 3D printers and their components.

- Nano Dimension's revenue has gone from $3.3 million in 2020 to $56 million in fiscal year 2023. A gain of 1,600%.

- Total cash currently sits at $793 million, while its market cap is only $458 million. A rare Ben Graham net-net!

AI 2.0 Software Stock #1

- This company is focused exclusively on data and it is a leader in its field.

- It helps customers use data to create white-label generative AI projects.

- The business has already signed deals with five of the world’s seven largest technology firms.

Much tougher to pinpoint, but searching around the web, some are saying James' pick here is Innodata Inc. (Nasdaq: INOD).

- The company describes itself as a “global data engineering firm” that helps companies solve their toughest AI challenges.

- It is hush-hush about its customer list, but as this press release confirms, it counts several “Magnificent Seven” tech companies as customers.

AI 2.0 Software Stock #2

- This next business is founded by a serial entrepreneur who has previously established more than 20 companies and is now applying AI to the field of medicine, “developing next-gen medical imaging systems at much lower cost.”

- Among its investors is Steve Cohen's firm Point72, which bought over $3 million worth of the stock a few months ago, as well as Ken Griffin and Cathy Wood.

Based on this description, the pick is Nano-X Imaging Ltd. (Nasdaq: NNOX).

- Nano-X's founder, Ran Poliakine, was “a serial entrepreneur who throughout his 35-year career founded more than 20 companies which gave rise to over 70 patents.”

- SEC filings confirm that Steve Cohen's Point72 Asset Management, Ken Griffin's Citadel, and Cathy Wood's ARK Invest all own stakes in NNOX.

AI 2.0 Software Stock #3

- This is a security company specializing in identity verification, biometrics, and fraud prevention.

- It helped Virgin Money “completely digitize its customer journey, speed up its application process, and win new customers.“

James is talking about Mitek Systems Inc. (Nasdaq: MITK).

- The company “specializes in digital identity verification and mobile image processing using artificial intelligence.”

- Mitek is Virgin Money's trusted ID verification partner.

Bitcoin's #1 Superstock

- James says this firm “mines Bitcoin but is a tiny fraction of the size of some of the other miners like Marathon Digital Holdings.”

- Currently has a market cap of only around $300 million.

Given the unique nature of the business, this one was pretty easy to locate. It's Bit Digital Inc. (Nasdaq: BTBT).

- Bit Digital is a Bitcoin and Ethereum miner, in addition to providing AI infrastructure services to institutional customers.

- The company's market cap is currently hovering around $350 million.

Make 5,000% Over The Next Year?

Here are my summary thoughts on each of James' picks:

Nano Dimension: An unprofitable, capital-intensive manufacturer, but its valuation reflects this, selling for below cash. It may be worth taking a flier on at a below-liquidation price.

Innodata: Currently trades at a whopping 150x earnings, may want to skip this one, at this price.

Nano-X Imaging: Unprofitable business in a sector (healthcare) I know little about, easy pass.

Mitek Systems: Another unprofitable business, but I see the potential here, as digital fraud prevention is a market that will continue to grow.

Bit Digital: Bitcoin miners will go the way of the horse buggy at some point as the supply of BTC dries up, but Bit Digital is already pivoting its business and has some upside at only 10x earnings.

Overall, there are better-quality microcap stocks out there than this bunch. However, I do like Nano Dimension, Bit Digital, and to a lesser extent Mitek, as we'd be getting decent value for the price paid.

Quick Recap & Conclusion

- Renaissance man James Altucher is back and he's teasing five “Microcap Superstocks” that can make 1,000%-5,000% per year.

- James believes the anticipated Fed rate cut in September is set to give microcap stocks a big boost and he has some plays that could benefit disproportionately.

- The names and ticker symbols of all five picks can only be found in a series of three reports called “Superstock Setup: Microcaps' Biggest Moment In Decades” “The Second Wave: 3 Superstocks Leading the AI 2.0 Revolution” and “Bitcoin’s #1 Superstock: The Top Crypto Microcap for Explosive Gains.” The reports are ours, but only if we sign up to James' newest research service, Microcap Millionaire for a cool $2,500.

- Fortunately, all five picks have been revealed for free and they are Nano Dimension Ltd. (Nasdaq: NNDM), Innodata Inc. (Nasdaq: INOD), Nano-X Imaging Ltd. (Nasdaq: NNOX), Mitek Systems Inc. (Nasdaq: MITK), and Bit Digital Inc. (Nasdaq: BTBT).

- Of the five, Nano Dimension, Mitek, and Bit Digital are the three that provide the most value, for the price being asked.

Are there better AI and blockchain-based microcap stocks out there? Let us know in the comments.