90% of the time, mining companies end up “mining” shareholders and getting rich off them, rather than the other way around.

However, Garrett Goggins says there exists a “Golden Anomaly” which is a time when you simply can’t afford not to own gold miners. This may be such a time.

The Teaser

A reset of some kind is coming.

Garrett Goggins – CFA, CMT, and Stansberry Research alumnus. He's ventured out on his own now, and this is our first time reviewing one of his teasers.

However, it's not the first time we have exposed gold and other mining-related teasers. Nick Giambruno’s #1 Gold Stock and Marc Lichtenfeld’s “Uranium Profit Package” are two recent examples.

The biggest change to the monetary system in more than 50 years could be coming down the pipe.

If we go beyond the clickbait headline, there may be something to this…

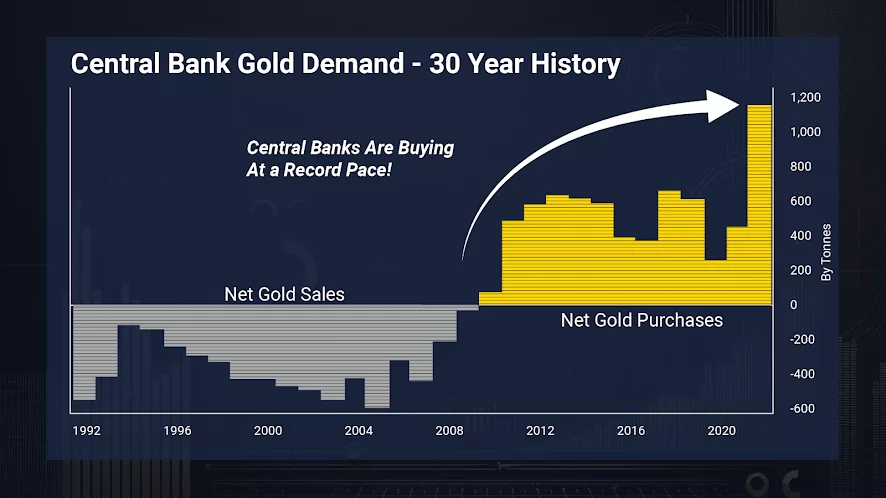

Central Banks worldwide have been buying gold at the fastest rate on record, dumping US Treasuries, and demanding delivery of their physical gold.

No one has been doing this more than the U.S.

Sine this past November, the United States has taken delivery of roughly 30 million ounces of gold.

The Central Bank of Central Banks – The Bank for International Settlements (BIS) has also quietly restored gold to Tier 1 status – the safest assets in the financial universe.

These are the primary reasons why the price of gold has risen more than 36% over the past year.

This is telling Garrett that at some point over the next four years, the dollar’s value compared to other paper currencies will be “renegotiated” with gold at the center of the new monetary system.

But before you kick your front door open and run out of the house to buy gold bullion at $3,000/oz – or higher, Garrett believes there's a way to potentially profit far more than we can with gold bullion.

He's not talking about any kind of physical bullion or gold ETFs, but the stock of four gold miners that could rise “10X, or even 100X from here.”

The Pitch

We can get the names and tickers of Garrett's Top Four picks inside the Golden Portfolio IV (GPIV).

The cost to join the GPIV newsletter is $189 and membership comes with a bonus stock pick, access to a live model portfolio, and even a “live fundamentals” feature showing real-time data on open portfolio positions.

How To Find The Miners Making All The Profits

If 90% of mining companies go nowhere and 10% make all the profits, what makes these different from the rest?

Garrett fundamentally looks for three things…

Superior Ore Grade

Grade is everything.

Simply put, in an inflationary world, only the miners with high enough grades stand to make any real profits.

Stage of Production

Here, Garrett looks for what he calls the “sweet spot.”

It's the point when financing and permitting are done, and the only thing left to do is ramp up production.

The “Anomaly Profit” Variable

This is the most important metric of all and it is FCF – Free Cash Flow.

The value of any gold mining stock is the total profits for the life of the mine, and unlike earnings, you cannot fake FCF.

The FCF the mine produces over its life span is called Net Asset Value or NAV.

The gold line in the chart below shows the Net Asset Value for the life of the mine compared to the current value of outstanding shares or market cap.

The grey line is the current market cap. Those two lines should be close together.

The gap between those two lines is the “Anomaly Profit” Variable and when the gap closes, that's when we can “turn $1,000 into $830,000.”

Revealing Garrett Goggins' Gold Miner Picks

Here is what we know about Garrett's top four picks and how they stack up against his criteria.

Pick #1

- This gold miner has ore grades as high as 74 g/t (grams per tonne). That’s one of the highest in history.

- It has a market cap of around $300 million with a net asset value (NAV) of $1 billion.

Garrett's first pick sounds like it could be i-80 Gold Corp. (NYSE: IAUX).

- i-80's ore grades aren't quite as high as the ones Garrett mentions, but its market cap is just under $300 million with an NAV of between $500 million to $1 billion when all reserves are included.

Stock Pick #2

- The miner has grades up to 13.2 g/t – 13X better than average.

- It also has one million ounces in an open pit mine of ore that’s 2.1 g/t and 90% recoverable.

Again, no way to be certain, but Dakota Gold Corp. (NYSE: DC) sounds like Garrett's pick.

- Earlier in 2025, Dakota Gold reported drill results from its Richmond Hill project, including intersections of 2.22 g/t gold over 50 meters.

Stock Pick #3

- This gold miner is in the top 25% of productivity and the bottom 25% of costs, and has a market cap of only $50 million.

- Its CEO was the managing director at a “too-big-to-fail,” systemically important bank.

This is Revival Gold Inc. (OTC: RVLGF).

- Revival's “all-in sustaining cost” of $1,235 per ounce is one of the lowest in the industry, with a market cap that sits just a hair above $50 million.

- It's President and CEO, Hugh Agro is a former senior executive with Deutsche Bank’s Global Metals and Mining Group.

Stock Pick #4

- This gold explorer has an asset with nearly 4 million ounces at grades as high as 13 g/t – high enough to put it among the top 10 richest in history.

Solaris Resources Inc. (TSX: SLS) appears to be the pick here.

- Solaris' Cariboo project has a resource of over 4 million ounces.

Bonus Pick

- This gold royalty stock owns the richest gold mine in the world today.

Pretty sure this is Franco-Nevada Corp. (NYSE: FNV).

- Barrick Gold is thought to own the “richest” gold mine in U.S. history, but FNV is the leading gold royalty company.

Turn $10,000 into $1,000,000 or more?

How rare is a 100-bagger stock that turns every $1 invested into $100?

Only 19 stocks in the Russell 1,000 have been 100-baggers since 2000.

The odds are long, especially when considering that no resource stocks have accomplished this feat over the past two decades plus.

As it currently stands, none of Garrett's four original picks are profitable going concerns or even at the producer stage, with the sole exception of i-80 Gold in the latter case.

Additionally, Garrett's net asset value calculations are based on all reserves – inferred, indicated, and measured. Not just probable and proven, which would make a lot more sense.

I like resource plays, especially at this point, but owning production stage junior miners, royalty trusts like Franco-Nevada, and physical gold and silver are much better bets for safety of principal and a satisfactory return.

Quick Recap & Conclusion

- Garrett Goggins says there exists a “Golden Anomaly” which is a point in time when you simply can’t afford not to own gold miners. This may be such a time.

- This is because at some point over the next four years, the dollar’s value compared to other paper currencies will be “renegotiated” with gold at the center of a new monetary system.

- Garrett isn't talking about buying physical bullion or gold ETFs, but the stock of four gold miners that could rise “10X, or even 100X from here.” The names are only in Garrett's Golden Portfolio IV (GPIV) newsletter, which costs $189 to join.

- Based on the info we have, Garrett's picks could be i-80 Gold Corp. (NYSE: IAUX), Dakota Gold Corp. (NYSE: DC), Revival Gold Inc. (OTC: RVLGF), Solaris Resources Inc. (TSX: SLS), and Franco-Nevada Corp. (NYSE: FNV).

- The only one of Garrett's picks that is even at the producer stage is i-80 Gold and the only one that is profitable is Franco-Nevada.

What are some quality gold producer stocks to own? Drop them in the comments

Hi

All Aussi stocks EMR, AAR, KAL, NMG – all explorers going into production all have significant gold resources.

All good for 300% increase over time

Thanks for sharing Peter!

Inferred, indicated, and measured are categories for a Mineral Resource, not an Ore Reserve. Measuered and indicated may be converted to an Ore Reserve, but not inferred. Very risky to include inferred in any valuation!

Glad to see a second vote for IAUX, which was just recommended to me yesterday.

You score 0 out of 5

You should buy the product. I did. Only wish I’d bought it sooner

You win some, you lose some, appreciate the feedback Billy Bob

O-fer on all his guesses ?? Which product ? TY