Change is afoot all over the country.

However, the biggest change is happening in Texas, and something Eric Wade calls “New Texas Currency” could have the biggest impact on our bank account and portfolio in over a century.

The Teaser

Many teasers start with the bold statement “This is unlike anything you have ever seen before” which is often easily disproven. But this may be the one time it's true.

Eric “Wall Street” Wade is an internet entrepreneur, cryptocurrency miner, and writer for several of Stansberry Research's investment newsletters.

We have previously reviewed his Blackwell Chip Stocks and Stansberry's 2024 “Obama Surprise” teasers, so we expect this one to be no less sensational.

The reason we have never seen a pitch quite like this one is that it's the first to tease a new currency.

The State of Texas recently passed a landmark bill, HB 4474, effectively recognizing Bitcoin and other blockchain-based cryptocurrencies in the Business and Commerce Code.

What exactly does this mean?

Averting a Disaster

Think egg prices are high?

Well, so does Texas.

That is why it is making crypto legal tender.

It's a bold move, but Texas has a long history of going where no one else dares to venture.

When Mexico abolished its Constitution in 1824, an independence movement started, and in 1836 Texas formally separated from Mexico.

The State also sent its own troops to secure the Southern border in early 2024, clashing with Biden admin Feds.

Now, the world's 8th largest economy is making its most audacious move ever, and one that is likely to get plenty of pushback.

I say this because what Texas just did is not without precedent.

El Salvador was the first country to accept Bitcoin as legal tender in 2021. However, they recently bent the knee to the IMF and agreed to scale back this policy.

Additionally, supranational organizations such as the World Bank have stated that crypto falls short of meeting the basic requirements to be classified as a reserve asset.

These sound like prime catalysts to adopt crypto to me, but there are also other more practical reasons for the timing of Texas' move, like averting a possible dollar disaster.

The Pitch

Eric's #1 move to profit from Texas' financial system shakeup is buying into crypto's growing ecosystem.

More specifically, the stocks of crypto industry infrastructure providers which are only revealed in a special report called “How to Profit from Texas' New Currency.”

It is ours with a subscription to the technology investing newsletter Stansberry Innovation Report, which costs $129.

The offer includes a 30-day money-back guarantee, new crypto and tech picks every month, three bonus reports, and a model portfolio made up of more than 30 open positions.

$40 Trillion by 2026

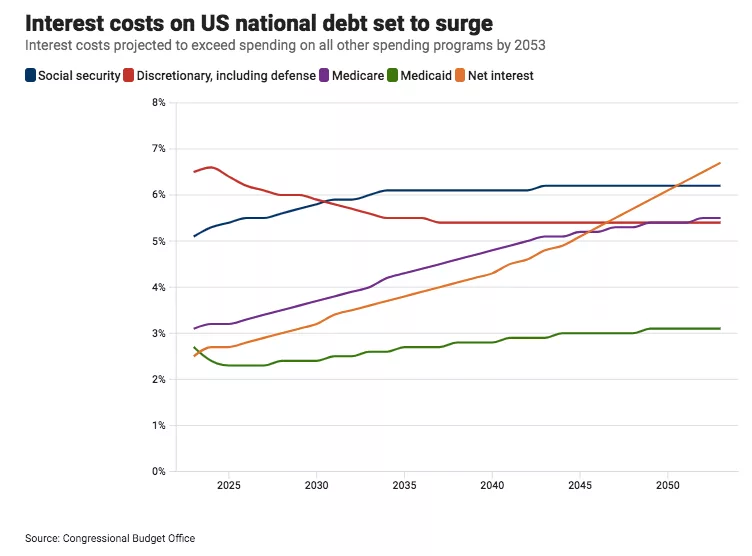

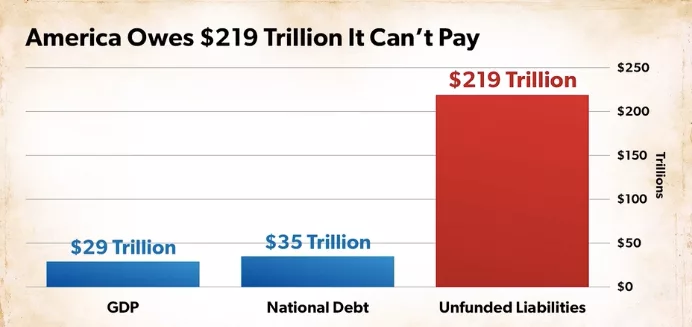

This is what the size of the National debt is expected to be at the end of the year.

According to the Congressional Budget Office (CBO), interest payments on this rising debt pile will total nearly $1 Trillion during the same period.

Interest on the National debt is already the fourth-largest Federal budget item and it's on track to be the single biggest item within the next two decades the way things are going.

But wait, somehow, it gets worse…

Throw in unfunded liabilities like Medicare and Social Security, and the National debt increases by 6x.

You don't need to be a numbers guy or girl to know this isn't good.

All of this means that unless something drastic is done, the debt will soon need to be monetized, in other words, money printing.

Historically, when this starts happening on a large enough scale and is sustained, the result is Zimbabwe circa 2008.

Doing Something Drastic

Texas isn't waiting on the Federal government to change course and is taking matters into its own hands.

Eric calls it a “Plan B” to hedge against the dollar.

The “B” stands for Bitcoin and Texas wants to “become an oasis“ for it.

It is well on its way, with half of all Bitcoin mining in the US taking place in Texas, and it could also become one of the first states in the nation to establish a Bitcoin reserve.

Now that the cryptocurrency infrastructure is in place, owning a piece of it can be extremely lucrative, and that is what Eric is proposing.

Eric Wade's #1 Way to Profit from the New Texas Currency

The video pitch for Eric's stock picks was well over an hour long.

There is no way to tell exactly how long because there is no playback feature. In all that time, all we got was the following:

A few general words were said about each, but nothing substantial that led anywhere.

Our sweep of the dark recesses of the web didn't produce anything either, so a few semi-educated guesses are in order.

The Hardware Play

A public company that supplies the hardware needed to mine cryptocurrency.

This could be either Block Inc. (NYSE: XYZ), which has developed a specialized semiconductor chip for crypto mining machines, or Bitdeer Technologies Group (Nasdaq: BTDR), which makes high-powered, Bitcoin mining machines.

Wall Street's Favorite Crypto Play

Literally speaking, besides spot Bitcoin ETFs, the crypto-related stock with the highest institutional ownership is MicroStrategy Inc. (Nasdaq: MSTR), with over 80% of its shares owned by institutional investors.

The Energy Play

There are many different approaches, but if we're talking crypto energy infrastructure, then Iren Limited (Nasdaq: IREN) could be the pick.

The renewable energy company builds, owns, and operates data centers and electrical infrastructure specifically for crypto mining.

Admittedly, Eric's last “backdoor winner” is too general and left me completely in the dark, kudos sir.

So, how likely are crypto infrastructure plays to deliver outsized returns?

Make 10x Your Money?

As the old saying goes, “During a gold rush, sell shovels.”

This is what many did in the lead-up to the shipping, railroad, dot-com, and housing booms, and got rich!

Doing this during the current crypto and Artificial Intelligence (AI) booms, which are closely intertwined, by buying natural resources, energy, real estate, and other infrastructure technology suppliers could easily net a 10x return over the long term.

Remember, we are only at the first phase of this boom, with the largest gains, likely eclipsing even those experienced by dot-com winners, still to come in the next phase.

No one knows what those phase two stocks will be, they are probably not even listed yet, but they won't be possible without the build-out happening right now in phase one.

So yes, buying proverbial shovels is a sound investment thesis, and look out for wheelbarrows too (stocks that help others implement blockchain technology in their own businesses).

Quick Recap & Conclusion

- Something BIG is happening in Texas that Eric Wade says is leading to a “New Texas Currency” and it could have the biggest impact on our bank account and portfolio in over a century.

- The BIG thing is Texas passing HB 4474 into law, effectively making crypto legal tender in the State. This has kicked off a cryptocurrency infrastructure boom, and owning a piece of it could be extremely lucrative.

- Eric is teasing several crypto industry infrastructure stocks which are only revealed in a special report called “How to Profit from Texas' New Currency.” It can be ours with a subscription to the technology investing newsletter Stansberry Innovation Report, which costs $129.

- No clues are provided about any of Eric's four picks, but we did venture a few semi-educated guesses about each.

- Crypto and AI infrastructure are intertwined. Investing in a diversified portfolio of such plays at this early stage is likely to yield an above-average return over the long term.

What is your favorite crypto/blockchain stock? Drop it in the comments.