Eric Fry is literally standing on top of a mountain because what he's about to show us could spread throughout the entire country and be America's next mega-boom.

He calls it an EV “Supercluster” and there's a way to get in on the megatrend.

The Teaser

This so big, it transcends politics, has the potential to transform the American economy, and even rewrite the course of American history, just like we’ve seen happen at least seven times before.

Eric Fry has spent more than a decade as a professional portfolio manager and years heading up a research organization with Wall Street legend Jim Grant, among other things. We have previously reviewed his “Project Omega” teaser and revealed more than a few of his past stock picks here at Green Bull.

So, what exactly is it that Eric is referring to?

He says the “Cluster Effect” is a term economists use to describe not just why booms happen.

But where they’ll happen.

It’s called a “cluster” event because, more often than not, booms happen when a handful of related businesses “cluster” in one location.

What local mega-booms has this “cluster effect” sparked in the past?

The “Cluster Effect” Booms

For starters, what happened in Detroit during the early 1900s when Ford Model T's were rolling off the assembly line is one example.

The automobile caught on, money started pouring in, and so did other car companies.

General MoMots, Chrysler, Packard.

At one point, more than 125 auto companies called Detroit home. Not only did it become America’s richest city, but it was also the car capital of the entire world.

The automotive boom remapped America’s highways and it paved the way for countless gas stations, diners, shopping malls, and even entire suburbs.

In fact, the way cars changed our country practically defines how we live today.

Yet, how many saw it coming?

Just a few.

Another perfect example of a great American “supercluster” boom is Fort Pitt or Pittsburgh as it is known today, which was the world's steelmaker.

For nearly 100 years, Pittsburgh would make the steel that gave the U.S. railroads, skyscrapers, and the weapons that helped it win both world wars.

At its peak, Pittsburgh had more millionaires than New York City.

Yet again, it was hard for most people, even the families who lived there to see it coming.

Houston, Silicon Valley, Hollywood, Wall Street, and Boston for Biotech, are all examples of the “Cluster Effect”.

The bottom line is, when these clusters appear, they can make early investors extremely rich, and a brand-new “supercluster” is taking shape right now.

See, up until very recently, America’s richest zip codes, our largest “clusters” of wealth, have emerged almost entirely on either the East or West Coasts.

But this is what Eric is predicting is about to change.

The Pitch

Besides Eric's #1 stock, he's identified a few other recommendations that could profit from this next “supercluster” boom.

All six recommendations are included in a report called The New 1,000% Portfolio.

This report is ‘free' if we accept Eric's invitation to try his top-rated financial research letter called Fry’s Investment Report.

The key selling point here isn't any additional special reports or features, although it has these too, but that since inception, Fry’s Investment Report has had an average annual return of 42.6% overall.

That's more than quadruple the average return on the S&P. Not too shabby for a service that costs only $29 for the first year.

The Next “Supercluster”

This time around, a supercluster is happening in a place that will take a lot of folks by complete surprise.

It's happening below the Lookout Mountain which Eric is standing on and where in the 1700s, Native Americans waged the “Last Battle of the Cherokees” during the Civil War.

I'm talking about the seven U.S. states you can see from this mountain…

- Tennessee

- Kentucky

- Virginia

- Georgia

- Alabama

- And both Carolinas

In each of these states – especially in Kentucky and Tennessee, there’s a new economic “supercluster” of innovation and investment taking shape.

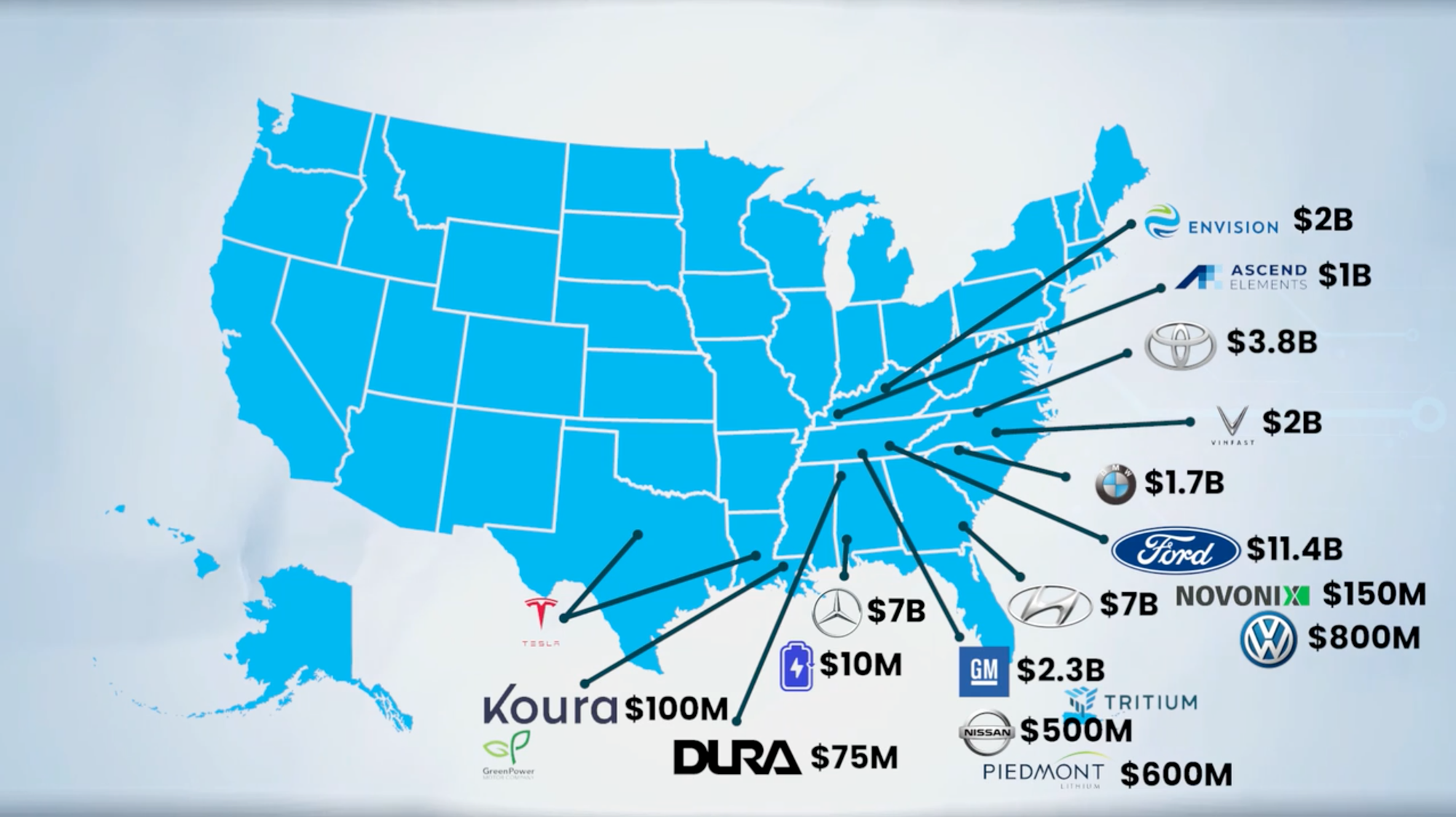

In fact, in the 300 square miles surrounding this mountain, you will find no fewer than 28 different companies, each dedicated to building out the future for electric vehicles and the batteries that power them.

Why the EV Boom IS Happening

Doubts still abound about electric vehicles, including from yours truly.

But Eric hits us with some cold hard figures that have no feelings.

Like the fact that Ford Motor Co. recently inked a deal to spend $11.4 billion to build four EV sites in Kentucky and Tennessee, including a site called Blue Oval City, which is Ford’s first all-new production plant since 1969.

General Motors has also linked up with LG Energy Solutions to build a massive new EV battery plant in Spring Hill, Tennessee.

Meanwhile, Nissan, Toyota, BMW, and Hyundai are all building new EV production facilities and battery plants in the next “supercluster” region – America’s Heartland.

This means billions of dollars in new investment, tens of thousands or even hundreds of thousands of new jobs, and a flood of talent and innovation into the region.

As Sam Cooke once sang, “a change is gonna come” and there's actions we can take right now not to miss out on it.

Revealing Eric Fry's EV “Supercluster” Companies

Eric tells us we can start cashing in on the next supercluster with just one stock.

The name of this stock is Freeport-McMoRan (NYSE: FCX).

Why is this his #1 pick?

It's simple, EVs need batteries and batteries need raw minerals.

In fact, your average EV contains up to ten times as much copper as a gas-powered car.

Power grids, solar, EV charging stations, and even wind energy won’t work without copper.

Freeport-McMoRan is America's biggest copper supplier and one of the biggest copper producers in the world, with five of the six biggest U.S. copper mines, which crank out more than half of the nation’s total supply.

Besides his #1 pick, Eric says five other companies could multiply our money ten times over.

Stock Pick #2

This company uses AI to run “smart” EV-charging grids.

Eric's adds that it's the first pure smart-energy-network play to go public in the US and we can still get shares for under $10.

All signs point to Stem, Inc. (NYSE: STEM) being the pick.

Stem bills itself as “the first publicly-traded smart energy storage company“ and it's stock currently sells for just over $3 per share.

Stock Pick #3

The next company Eric wants to show us makes synthetic graphite.

You can’t make lithium batteries without graphite and this company cuts battery costs by making that graphite synthetically instead of mining it.

It's just won a huge $150 million grant from the U.S. government to build a brand-new plant in Chattanooga.

In this instance, Eric is talking about NOVONIX Limited (Nasdaq: NVX).

NOVONIX received a $150 million dollar grant from the U.S. Department of Energy to expand its production of synthetic graphite anode materials in October 2022.

Stock Pick #4

This company compresses and coats graphite so it can be packed into the anode post of EV batteries.

It's new plant in Louisiana is the first of it's kind outside of China and the only one in the U.S.

The pick here is Syrah Resources Limited (OTC: SYAAF).

Syrah's graphite processing plant in Vidalia is the first such facility in Louisiana and indeed in the U.S.

Stock Pick #5

Right now, 80% of the lithium worldwide comes from China.

However, this fifth company is building a world-class lithium facility that could change all that and it's building that factory 55 miles from Chattanooga.

Not much to go on here, but Piedmont Lithium Inc. (Nasdaq: PLL) looks like the pick to me.

Piedmont is planning to build a lithium processing plant in Etowah, TN, which is about 55 miles northeast of Chattanooga.

The company selected the site for its Tennessee Lithium project in 2022 and it now holds all material permits required to begin construction, which has been slated for this year.

Stock Pick #6

This last company specializes in microsensors and it also makes 5G network solutions that in turn, help make autonomous driving possible.

It is already an industry leader and has an impressive list of partners, including the likes of NASA, ConocoPhilips, and Lockheed-Martin.

Even less to go on here, but the list of microsensor stocks is small and it could be any one of Ametek Inc. (NYSE: AME), ShotSpotter Inc. (Nasdaq: SSTI), or Luna Innovations Inc. (Nasdaq: LUNA).

Make 10x Our Money?

There is a lot to go over, so I will do it Jim Cramer Mad Money style…hopefully with better results.

Freeport-McMoRan: The most solid business of the bunch and it's available at a moderate 27x trailing earnings.

Stem Inc.: A dog of a stock, down 60% over the past 12 months and the business is hemorrhaging money.

NOVONIX Limited: A long term play on the U.S. developing a domestic supply of graphite. Not a bad pick if your time horizon is five, ten years or more.

Syrah Resources Limited: The company expects production at its Vidalia plant to commence by the end of January 2024.

If this happens, the stock should get a nice bump, if there's a delay…you know the rest.

Piedmont Lithium: Defying all expectations, the domestic lithium producer posted it's inaugural revenue and earnings in Q3 2023.

It's stated goal is to become one of the largest lithium hydroxide producers in North America over the long-term, which is within the realm of possibility.

Bottom line, is there a chance we can 10x our money with any of these businesses?

I would say yes, but only over the very long-term, as the alternative energy adoption curve will take much longer than current forecasts anticipate.

Think years and decades instead of weeks and months.

Quick Recap & Conclusion

- Eric Fry is on top of a mountain teasing an EV “Supercluster” that is about to hit America.

- We learn that “Supercluster” is an economic term for a local mega-boom, like the EV and Battery boom taking shape right now in America's Heartland.

- Eric has a #1 stock we should buy to profit from this next “supercluster” boom. It, along with five other recommendations are included in a report called The New 1,000% Portfolio.

- We were able to reveal five of Eric's six picks for free, they are Freeport-McMoRan (NYSE: FCX), Stem, Inc. (NYSE: STEM), NOVONIX Limited (Nasdaq: NVX), Syrah Resources Limited (OTC: SYAAF), and Piedmont Lithium Inc. (Nasdaq: PLL).

- FCX is the only blue chip of the bunch, the rest are all long-term bets on America's alternative energy future, which may or may not pan out.

Is the Heartland the site of America's next mega-boom? Let us know what you think in the comment section below.