Over the past five years, shares of Tesla are up more than 15x, creating a wave of new “Teslanaires.”

However, Dylan Jovine believes that Elon Musk's private AI startup, xAI, will create 10 times more millionaires than Tesla has, and he's teasing a backdoor way to invest in it with “Elon’s #1 AI Stock.”

The Teaser

Artificial intelligence is already disrupting entire industries such as manufacturing, transportation, and displacing hundreds of thousands of workers. This is just the beginning.

Entrepreneur, investor, and boss man of investment research shop Behind the Markets, Dylan Jovine, is a regular here at Green Bull. We have previously revealed his Last Retirement Stock and “UFO Weapon” Company.

What does Dylan know about Elon's AI that we don't?

He claims to use AI every day for Behind the Markets, saying, “It’s helped him make millions of dollars over the years.”

He's even “bought a house and supported his family with that AI cash.”

Thus, he knows how to distinguish AI hype from truth.

Real World AI

Dylan believes online-only chatbots such as ChatGPT work just fine.

But Elon’s AI already works in the real world, which makes it infinitely more valuable.

He's referring to Tesla's custom-built Dojo supercomputer, which built its current full self-driving system (FSD), and it is also behind the Optimus autonomous robots.

Now, there is even talk that Dojo could soon be augmented with xAI's Colossus supercomputer, creating the Frankenstein of AI.

This is Elon's advantage over other AI companies.

Google, Amazon, Facebook, and Microsoft are all limited by the Internet. Elon’s real-world AI isn't.

Just like Elon's AI powers self-driving cars and robots, Dylan's #1 AI stock powers the AI that powers these innovations, and it could deliver big gains in the months and years ahead.

The Pitch

Dylan drops its name in a special report called How You Could Profit From

‘ELON’S #1 AI STOCK'

The report is ours with a Behind the Markets membership, which costs $199 for a lifetime subscription (limited-time offer), and promises “at least one fully researched cutting-edge stock recommendation each month.”

A Market Multiplying more than 8X

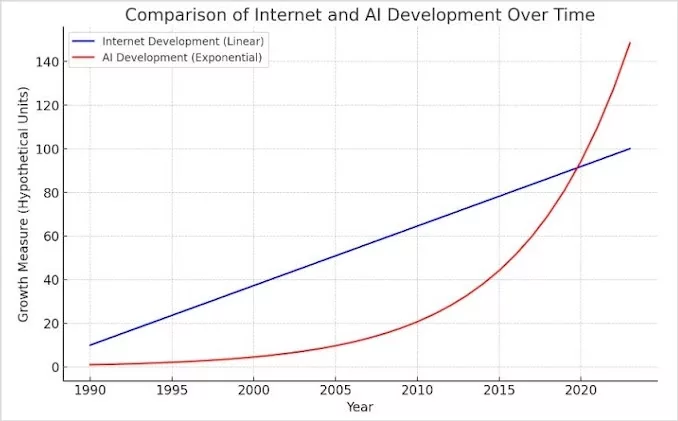

This is a chart of AI's growth curve:

Looking at the big picture, there are three things that artificial intelligence needs not just to keep growing, but to operate:

- Energy

- Hardware

- Data

These make up AI's backbone, which makes everything like chatbots, self-driving cars, and robots possible.

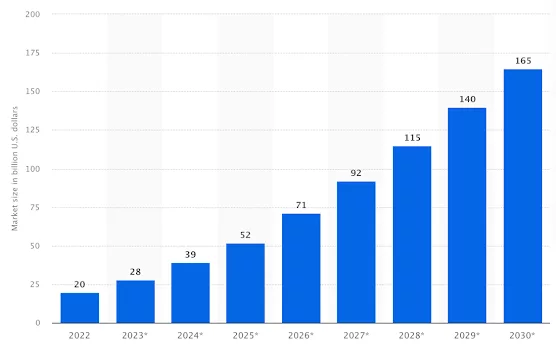

The middle tier, i.e., hardware, such as semiconductor chips, is at the center.

Now, these aren't your parents' computer chips, but a specific kind of ultra-powerful chip called a Graphics Processing Unit (GPU).

In simple terms, these chips are capable of performing a large number of calculations simultaneously, making them ideal for running complex operations like machine learning. GPUs also power Bitcoin, and, by extension, the entire $3.5 trillion crypto universe.

Nvidia (Nasdaq: NVDA) currently dominates this market like a Gilded Age robber baron, with around an 80% market share.

However, the demand for GPUs is growing at such a breakneck pace that even Nvidia cannot keep up.

8x growth over the next five years may be understating it.

The retail price of GPUs reflects this, with the most powerful model going for no less than $3,100…for a single unit.

Naturally, companies and developers are searching high and low for alternatives.

This is where “Elon’s #1 AI stock” comes in, as it also makes highly sought-after GPU chips.

Dylan calls it “the best solution to the GPU shortage problem.” Let's find out what it is.

Revealing Elon's #1 AI Stock

We're fortunate, as Dylan provided ample info to figure this one out.

- Some news outlets have reported that this company offers the highest competition to Nvidia’s high-tech chips.

- Its new chip is almost two and a half times more powerful than Nvidia’s chips.

- This company counts Apple, Microsoft, Google, Facebook, IBM, and Cisco as clients.

- It’s 15 times smaller than Nvidia, so there’s plenty of room for growth.

The answer is Advanced Micro Devices (Nasdaq: AMD).

- It has been known for a while now that Nvidia is the Batman of the GPU market, and AMD is its Robin.

- AMD's latest chip, the M1325x, has outperformed competitor GPUs on certain tasks, such as AI workloads.

- The likes of Microsoft, Google, and Meta (Facebook) are all confirmed AMD clients.

- At a current market cap of $188 billion, AMD is roughly 18 times smaller than Nvidia.

Make 13x Your Money?

There are a few claims to sift through in this teaser.

Starting with how AMD ties back to Elon's private AI startup, xAI.

Not only is xAI an AMD (and Nvidia) client, but both were also investors in xAI's last funding round in December. So, in this sense, an AMD investment comes with a small stake in xAI.

The next claim is that “essential multiplier” stocks can “pay out up to 13X more than the big-name tech stocks they supply.”

Stocks such as Cisco and Broadcom have indeed, in the past, outperformed the end customers they were supplying, over certain periods.

The same could happen today, as AMD notching a 6x gain to achieve a $1 trillion market cap is more likely than Google (Alphabet) going up by the same figure to become a $12 trillion company.

AMD has a fortress-like balance sheet, with $7.3 billion in cash as of the latest quarter against only $4.3 billion in total debt, so it runs a tight ship.

There is a lot to be desired from its underlying economics, though. The high-performance computer hardware company has a net profit margin below 10%, and its return on equity (ROE) is under 5%.

This is what going up against Nvidia will do.

AMD is needed, as Nvidia cannot possibly supply the entire market with GPUs, and its positioning as a low-cost provider, like a Costco to Nvidia's Whole Foods, is strategically sound.

The only thing I don't like is the valuation.

At a current forward price/earnings (P/E) of 29x, AMD is trading only slightly lower than Nvidia, at a forward P/E of 33x.

The growth potential is higher with AMD, so that could explain it, but I wouldn't go all in on AMD at the current price. Dollar-cost averaging in and hopefully catching occasional dips is a safer bet.

Quick Recap & Conclusion

- Dylan Jovine believes that Elon Musk's private AI startup will create 10 times more millionaires than Tesla has, and he's teasing a backdoor way to invest in it with “Elon’s #1 AI Stock.”

- This belief is based on Elon’s AI already working in the real world, via self-driving Teslas and Optimus Robots, which makes it more valuable than Microsoft, Google, and Meta's online-only AI.

- Dylan's #1 AI stock powers the AI that powers these innovations, and it is only revealed in a special report called How You Could Profit From ‘ELON’S #1 AI STOCK.' The report can be ours with a Behind the Markets membership, which costs $199 for a lifetime subscription (limited-time offer).

- Info was divulged, clues were dropped, and we went ahead and revealed the pick for free. It's Advanced Micro Devices (Nasdaq: AMD).

- AMD is a solid business with a sound, low-cost provider strategy. The growth potential is there, just be sure not to overpay for shares.

Are you Team Nvidia or Team AMD? Tell us in the comments.