Eagle Financial's Mark Skousen is teasing a “perfect storm” for profits unfolding in the auto industry. But its not what you may think.

The world is suddenly shifting into reverse on EVs, which signals big profit potential for some “EV Proof” and “EV Revolt” Stocks.

The Teaser

Last year, domestic EV sales topped one million units for the first time, with EVs now commanding 7.6% of the new vehicle market.

But all is not well in EV land.

Eagle Financial's publisher Roger Michalski introduces us to Mark's long list of credentials including being a direct descendant of Benjamin Franklin and an economic analyst for the U.S. Central Intelligence Agency.

We have previously reviewed his “New Oil” Energy Company and “Operation Hoodwink” Semiconductor Stock teasers, which were no-nonsense, straight-to-the-point presentations, unlike the majority of the ones we see.

Looking just at facts and figures, the long-term outlook for electric vehicles is far from what the mainstream media and some partisan politicians have made it out to be.

Here are some inconvenient truths, which Mark neatly lays out:

- It takes three times as much energy to produce lithium-ion EV batteries as it does to make a conventional car battery.

- Worldwide, 80% of electricity still comes from CO2-intensive fossil fuels, and mass EV adoption would increase demand for grid power by as much as 50%.

- 90% of American EV buyers are affluent and own at least two vehicles.

Looking at these, it quickly becomes clear that without some new miracle energy source, mass EV adoption won't be possible, and it's a moot point regardless because EVs don't appeal to everyone.

What does this do to pledges, like the Biden administration's to make 50% of new cars sold in the U.S. electric by 2030?

It renders it all but obsolete and ties in nicely with Mark's prediction of a “sustained consumer-driven revolt against EVs in America and other developed nations.”

The Pitch

This plan and several stock picks are revealed in an EV Revolt Profit Dossier which consists of three separate reports:

- The Two Best “EV Proof” Vehicle Stocks on the Planet

- Three Urgent “EV Revolt” Stocks to Buy NOW

- Five Stocks to Avoid Like a Hot Wire in Today’s Vehicle Market

The only way to get the full dossier is by agreeing to a trial subscription to the long-standing, 40-year-old Forecasts & Strategies newsletter, which costs a discounted $77 for the first year.

It also includes a 30-day money-back guarantee, three more special reports, regular monthly stock picks, and more.

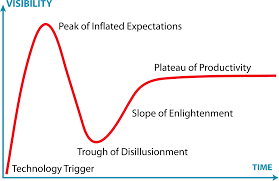

The Gartner Hype Cycle

Developed by well-known American tech research and consulting firm Gartner.

The “hype cycle” charts the general trajectory of interest and investment in a broad array of technologies.

This is the path most new technologies follow.

However, not all technologies make it out of the Trough of Disillusionment phase.

Mark cites 3D TV, which is dead in the water, and Virtual Reality/Augmented Reality, which has been in the starting blocks for years, as prime examples of this.

He goes on to say that electric vehicles are now in this Trough of Disillusionment, and they may not get out for a long, long time.

I believe Mark is right and the underlying economics prove it.

When considering EVs cost 60% more than gas cars, on average, and are also more expensive to maintain and repair, it's no surprise that four in ten Americans now say they wouldn’t buy an EV.

There is also a “revolt” happening at the manufacturer level, with Apple reportedly canceling its self-driving EV project earlier this year, after nearly a decade in the works and $10 billion in expenditures, and legacy carmakers such as Ford cutting EV spending.

On the investing side, EV stock indexes have also lagged behind the general market this year.

This makes the business, consumer, and financial trends all lining up against EVs. Three strikes and you're out!

So how do we play the “EV Revolt” from a moneymaking standpoint?

Revealing Eagle Financial's EV Stocks

Mark first teases two “EV-proof” stocks to buy immediately. Here is the info we were given about each:

EV Revolt Stock #1

- It is a major player in the last vehicles ever to likely go fully electric – long-haul, Class 8 trucks.

- The company is headquartered in the midwestern U.S. and specializes in largely invisible powertrain components for commercial highway vehicles, including Class 8 trucks.

- This firm is also a pioneer in extreme-duty hybrid and electric propulsion systems.

All the roads and highways point toward this being Allison Transmission Holdings Inc. (NYSE: ALSN).

- Allison is based in Indianapolis, Indiana, right in the heart of the Midwest, and it specializes in designing and manufacturing propulsion solutions for commercial and defense vehicles.

- The company began pioneering hybrid technology in 1989 and, since 2003, has delivered more than 5,000 hybrid-propulsion systems.

EV Revolt Stock #2

- A major player in multiple industries, including manufacturing engines for large Ag tractors and harvesters, plus other heavy off-road equipment like rock crushers, trenchers, wood chippers, and industrial pumps.

- It also makes gas engines, gas turbines, peak-load power plants, and large-scale emergency generators too.

- The stock has seen 2,073% max gains over the last 15 years.

I'll be honest, I'm not sure about this one. It's not a perfect fit, but one possibility is Cummins Inc. (NYSE: CMI).

- Cummins is a multinational corporation that designs, manufactures, and distributes engines, filtration, and power generation products. It's diversified, to say the least.

- The stock is up some 1,000% over the past 15 years.

Apart from these two “EV Revolt” stocks, we only get tangible clues about one other…

Mark's Only Pure Vehicle Play

- This particular carmaker is the global pioneer in an ingenious, efficient propulsion technology known as “HSD.”

- It holds over 20,000 key patents for the breakthrough technology.

This sounds like Toyota Motor Corp. (NYSE: TM).

- The Japanese automaker has been working on a Hybrid Synergy Drive (HSD) system for the better part of two decades.

- Toyota owns nearly 24,000 patents related to its hybrid car technology.

Big Profits from EV Pain?

I respect Mark's teaser for a few reasons…

First, it's on the money about electric vehicles remaining a niche market (albeit a growing one), until EV costs come down and the electric grid can handle them.

Second, no reckless claims of any sort are made about out-sized returns over the short term. Just “relevant opportunities to profit from” which is refreshing to see.

Finally, when it comes to the individual stock picks…

Allison Transmission Holdings: An underrated pick with solid underlying economics and steady growth, available for a good price of 12x current earnings.

Cummins Inc.: A boring manufacturer with lots of upside. The best kind! Just wish it was a bit cheaper.

Toyota Motor Corp.: a $256 billion auto industry blue chip. Expect growth that mirrors the general stock market of 7-10% per year or hopefully, slightly more if management executes on its tech initiatives, like its hydrogen business.

Quick Recap & Conclusion

- Eagle Financial's Roger Michalski and Mark Skousen believe the world is suddenly shifting into reverse on electric vehicles, which signals big profit potential for some “EV Proof” and “EV Revolt” Stocks.

- We learn that EVs are currently in the Trough of Disillusionment phase of the technology hype cycle and Mark has a plan in place to profit from their temporary misery.

- This plan and several picks are revealed only in an EV Revolt Profit Dossier which can be ours if we agree to a trial subscription to the long-standing, 40-year-old Forecasts & Strategies newsletter, for a discounted price of $77 for the first year.

- Mark first teases two “EV-proof” stocks to buy immediately, which are Allison Transmission Holdings Inc. (NYSE: ALSN) and (maybe) Cummins Inc. (NYSE: CMI). The only other stock we get any clues on is a “pure vehicle play” which is Toyota Motor Corp. (NYSE: TM).

- Overall, EVs will remain a niche market (albeit a growing one) until EV costs come down and the electric grid can handle them. Mark's counter-picks are all established businesses that provide steady growth at decent prices – nothing earth-shattering, but no disasters either.

Do you agree with the assessment that EVs will remain a niche market until 2030 and potentially beyond? Let us know in the comments below, which could get heated like some leather car seats.