Former Goldman Sachs Exec and public company CEO Dr. David Eifrig is letting us in on a wild rumor that has gone viral in hedge-fund circles.

It involves President Trump, a “Mar-a-Lago Accord“, and one Gold Stock.

The Teaser

To cut straight to the chase, a carefully orchestrated monetary reset is unfolding as we speak.

David Eifrig is kind of a big deal, he's the head honcho of MarketWise, the publicly-traded parent company of Stansberry Research.

We have previously covered Dr. Eifrig's Gold Bank Recommendation and Stansberry Research at length.

In this teaser, the good doctor says “the last time we saw a monetary reset like this was back in 1985, when those who stood still lost 40% of their wealth.”

Comforting words.

Eifrig is talking about 1985's Plaza Accord agreement to reduce the U.S. trade deficit, which had reached an unheard of 3.5%, by deliberately weakening the dollar.

The market intervention worked insofar as the U.S. dollar lost around 40% of its value in the months that followed.

However, as is often the case in government market interventions, there were plenty of unintended consequences…

For one, if your savings were in cash, you lost almost half your wealth in just two years.

Inflation rose too, so the cost of living jumped and if this wasn't bad enough, banks didn't increase interest rates fast enough to offset the loss in purchasing power.

Now, its a matter of ‘here we go again' with another agreement, the “Mar-a-Lago Accord.”

The Catalyst to A Great Fortune

There are four important components to this story:

- President Trump

- A man named Dr. Stephen Miran, who is the brains behind the Mar-a-Lago Accord

- Treasury Secretary Scott Bessent

- Gold

It all ties together because the Mar-a-Lago Accord is a proposed economic and trade initiative by the Trump administration that would devalue the U.S. dollar in order to boost exports and reduce trade deficits.

If you're on a fixed income or are holding loads of cash, this is not good news.

However, there is another aspect to the Mar-a-Lago Accord.

It's the part about the U.S. monetizing the asset side of it's balance sheet and as this happens, Eifrig expects one asset in particular (gold), to skyrocket.

The Pitch

One gold stock in particular will be the prime beneficiary of all this and the details on it are in a new report called “The No. 1 ‘Mar-a-Lago Accord' Gold Stock.”

We need a subscription to MarketWise's flagship investment research service, Retirement Millionaire, to access it.

This would normally set us back $499 per year, but for a limited time we can get it for $79, with a 30-day money-back guarantee.

The Upcoming Gold Revaluation

A gold revaluation would not be without precedent.

It has already happened four times in the past, including in April 1933 when the federal government confiscated gold from the general public at $20.67 per ounce.

Only to turn around and revalue it with a stroke of the presidential pen to $35 an ounce.

This financial maneuver that would make Enron's accountants blush instantly added $2.8 billion to the government's coffers.

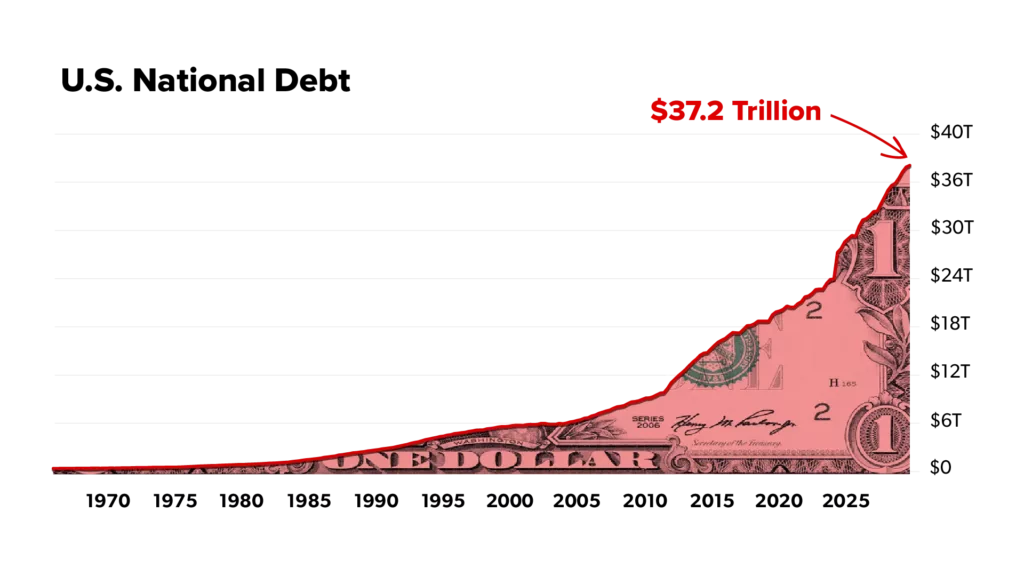

Now, with the national debt at $37 trillion and counting, something just as extreme needs to happen.

Dr. Eifrig can't think of a simpler, more immediate way to monetize a major government-owned asset than to revalue it.

He has a point.

Right now, gold is valued on the government books at just $42.22 per ounce. The government's official price for gold in…1973.

If this were to happen and gold was to be recognized at fair value of around $4k per ounce. It would add more than $900 billion to the Treasury's general account.

This idea has been making the rounds, with a handful of countries revaluing their gold reserves over the past 30 years.

The results were mainly positive, with many retiring existing debts, covering losses, and using it to buy assets that generate additional income on a sustained basis.

The Fed has even acknowledged this very real possibility in their Financial Accounting Manual for Banks, saying:

Whenever the official price of gold is changed, Treasury adjusts the account and, simultaneously, the deposit account

For Eifrig's No. 1 gold stock, it could mean a five to 10-fold gain over the next few years.

Revealing Dr. David Eifrig's “Mar-a-Lago Accord” Gold Stock

When it comes to the pick, we don't get much, but we did manage some honest clues.

- It's not a mining stock or a gold ETF either.

- This company owns massive, gold-rich land, but it doesn't operate any mines.

- Stansberry Research previously recommended this stock and it went up by nearly 1,000%.

The last clue gave it away, Steve Sjuggerud was the analyst and his gold stock pick that went up by 995% is Seabridge Gold Inc. (NYSE: SA).

- Seabridge Gold owns one of the largest undeveloped gold projects in the world in British Columbia, Canada, the Kerr-Sulphurets-Mitchell project.

- Per SA's website, the strategy is to acquire North American deposits; expand them through exploration; move them to reserves through engineering; and sell or joint venture them to established producers for mine construction and operation.

Downside Protection with 1,000% Upside?

There are essentially three gold revaluation scenarios that could play out.

The first is that Trump and Treasury Secretary Scott Bessent decide against revaluing gold reserves for fear of stoking inflation.

Under this scenario, gold continues it's upward ascent over the long-term, albeit with some temporary drops, and stocks like SA outperform.

Another possibility is that a gold revaluation does happen and it is marked to market on the gov's balance sheet. Since inflation expectations would then rise, the price of gold and gold stocks would also appreciate, expeditiously.

In other words, it could go parabolic.

Under the final scenario, a different kind of monetary reset takes places.

One where the the growing demand for stablecoins strengthen the USD and it becomes a largely digital dollar.

The Central Bank Digital Currency (CBDC) scenario is the worst case for humanity, but perhaps the most bullish one for gold.

So, under every circumstance, gold, and hard assets, like SA, go up.

The only question is by how much and when.

I may be a bit bias in the matter, seeing as I own shares of SA, but Seabridge's proven and probable reserves provide some serious downside protection.

They are equivalent to nearly half an ounce of gold per share or almost $2k, against a current share price hovering around $23.

Quick Recap & Conclusion

- Former Goldman Sachs Exec and public company CEO Dr. David Eifrig is letting us in on a wild rumor that involves President Trump, a “Mar-a-Lago Accord“, and one Gold Stock.

- The Mar-a-Lago Accord is a proposed economic and trade initiative that could see the U.S. monetize the asset side of it's balance sheet, and as this happens, Eifrig expects gold to skyrocket immediately.

- One gold stock in particular would be the prime beneficiary and all the details on it are in a new report called “The No. 1 ‘Mar-a-Lago Accord' Gold Stock.” We can get it with a subscription to MarketWise's flagship investment research service, Retirement Millionaire, for $79 for the first year ($499 regularly).

- However, if you read this review you didn't have to pay anything, as we revealed Eifrig's No. 1 Gold Stock for free as Seabridge Gold Inc. (NYSE: SA).

- Under nearly any scenario, gold and hard assets, like the huge reserves SA is sitting on, appreciate over the long-term. A quality pick with downside protection.

Will the U.S. revalue it's gold reserves? Drop a yes or a no in the comments.

*Full Disclosure: The author owns shares of Seabridge Gold stock.

Can you guys expose this following from Whitney Tilson:

Dear Reader,

Over the past 25 years, I’ve made it my mission to speak up when something feels off in the markets.

A month before the dot-com bubble burst, I published a warning essentially saying: “This can’t last.”

In 2008, I rang the alarm on housing calling the fall of Bear Stearns and Lehman Brothers.

I’ve exposed shady CEOs, market frauds, and financial bubbles before most investors saw the cracks.

Eventually, CNBC gave me a nickname I didn’t ask for: “The Prophet.”

But what I see happening right now… it’s much bigger.

Some are even calling it, “The bubble to burst them all.”

And that’s why I’ve stepped forward in a way I never have before… to show you exactly what’s coming… and how to stay on the right side of it.

Because if I’m right again – and I’ve put together all my proof for you – this may be your final chance to prepare.

Click here to see the full details while there’s still time.

https://orders.stansberryresearch.com/?cid=MKT847072&eid=MKT849735&tid=a7b26b4089c647d8ac937ae7d44a677a&affid=4RQSJ&assetId=AST377836&page=3

Cost $149

Regards,

Whitney Tilson

Editor, Stansberry’s Investment Advisory

Thanks for the tip Kevin, do you have the presentation link?

The one posted takes me to the order page.

Depends on current account balance whether its improving through the tarrifs limiting imports.