Renowned tech investor Colin Tedards says we've been lied to.

Despite the mainstream media hyping up AI, an unprecedented amount of capital is leaving the artificial intelligence market and going into something called “AI 2.0” and there are three “AI Aftershock” stocks that we need to buy.

The Teaser

Our presentation boldly begins with a warning that “AI won’t make us a dime in 2024, unless we do this.”

Colin Tedards describes himself as an entrepreneur, tech investor, and the lead editor at Brownstone Research, replacing former head honcho Jeff Brown last summer. Colin made his name by buying Apple at $25 per share, before it skyrocketed 667%.

We are familiar with his game and have previously revealed his “#1 AI Stock“ and “Next Nvidia” pick.

So, what exactly is it that we should and shouldn't be doing in regards to investing in AI?

Colin says that today we'll discover the truth about one “horrific” stock to avoid and three potentially lucrative stocks.

The $200 Trillion Dollar Shift

But before we get to that, we learn that this is all underpinned by a $200 Trillion financial shift, set to unfold by January 30th.

Famed Silicon Valley venture capital firm Andreessen Horowitz, backs this statement up by saying the next wave of AI is set to trigger “the most dramatic and sustained economic boom of all time.”

Colin compares what is taking place now or AI 2.0 to the worst earthquake in U.S. history. A record 8.3 on the Richter scale, which took place on April 18, 1906, at 5:12 AM in San Francisco.

The day after the disaster, while Californians thought the big event was behind them, they had no clue that it had only just begun.

Not the best analogy, but Colin says this is exactly what people are getting wrong about Artificial Intelligence.

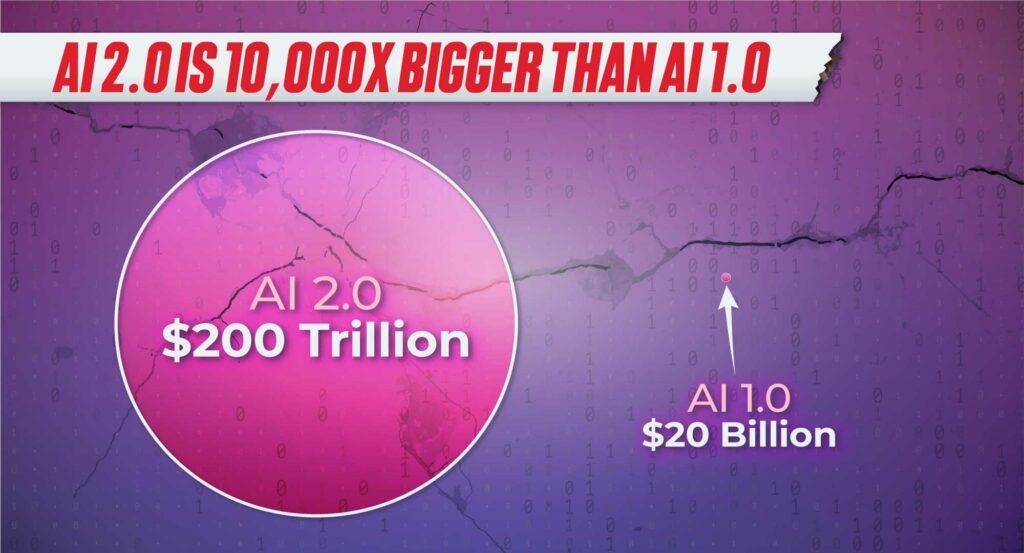

See, tools like ChatGPT (the earthquake) are AI 1.0 and at ‘only' $20 billion, represent an opportunity 10,000 times smaller than what he's calling “AI 2.0” (the aftershock).

To put this into perspective,

Bitcoin was worth $1 Trillion at its peak.

That was enough to create 100,000 new “Bitcoin Millionaires.”

But at $200 Trillion, AI 2.0 could be worth 200 times more than Bitcoin, which means we could soon see the creation of 20 million new AI millionaires.

All this begs the question…what exactly is the “AI Aftershock” causing AI 2.0?

The Pitch

Everything we need to know, including the names of 3 publicly-traded companies are in a new report called: The AI Aftershock Blueprint: 3 Stocks That Could 10X By 2025.

All we need to do to get our hands on a copy is consider Colin's monthly research service, The Near Future Report, at a cost of just $49, with a 60-day money-back guarantee.

Included in the offer are 12 month's of Colin's best investment ideas, two bonus reports, and access to a complete model portfolio where we can see all his current open positions.

The Three Computing Aftershocks

While most Americans are still trying to figure out how ChatGPT works, a repeating 23-year tech pattern has shrewd capitalists betting BIG right now.

Colin says it's all very simple: first, a platform arrives, the economic version of an earthquake.

Next, the aftershock: when groundbreaking services emerge from the platform.

This pattern can be traced back to 1954 and enterprise computers.

The Enterprise Computing Aftershock

Back in 1954, computers were giant room-sized contraptions and the sole domain of the U.S. Department of Defense.

This was the platform.

But the real money wasn’t in the platform. It wasn’t in computers.

Instead, the most profitable winners of the original computing aftershock were the firms who knew how to take this military tech and integrate it into the private sector.

Names like IBM, Electronic Data Systems, and Control Data Corporation made millions by focusing on service and shareholders were rewarded accordingly.

In 1954, the cost of a share of IBM was precisely $8.19.

By 1977, those eight-dollar shares would skyrocket to a split-adjusted $286 apiece.

That is the year another computing aftershock would take place.

The PC Aftershock

1977 marked the start of the PC industry.

Everybody wanted to get rich from PC's and like today, many simply bought the first thing they saw in the news.

At the time, that would have been PC Makers such as IBM and Commodore.

But a shift was already underway.

Software services would expand PCs out of enterprise settings and into nearly every home in America.

The smart money was targeting companies who made this transition possible.

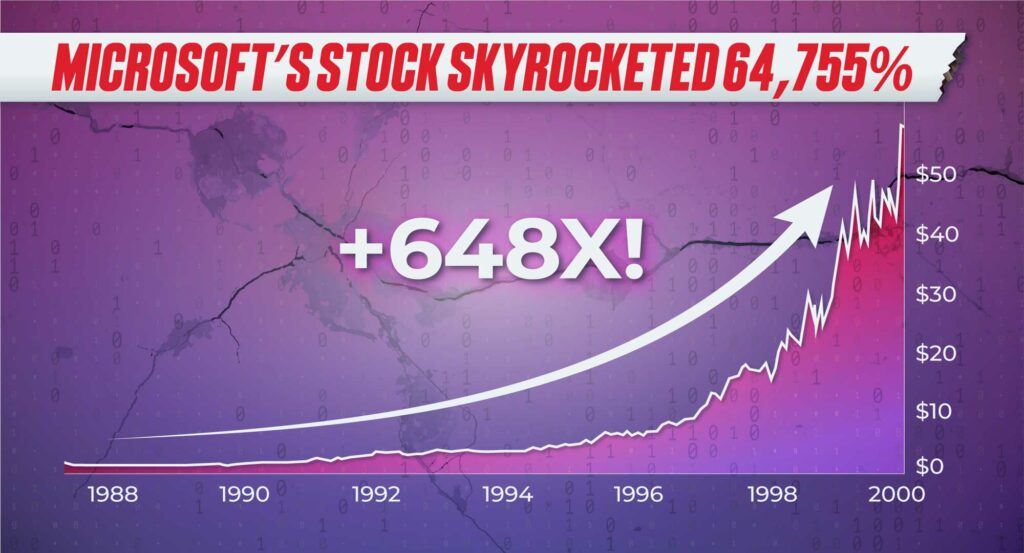

They bet big on so-called 2.0 software players like Apple, Microsoft, and Oracle, and again were amply rewarded.

For example, Microsoft stock was up a huge 64,755% by the late 90s.

The same thing happened in the next aftershock, that is, groundbreaking services emerged from a platform.

The Internet Aftershock

It's the year 2000 and every investor wants to get rich “investing in the internet.”

People were falling over each other to buy browser stocks like AOL, Netscape, and Yahoo.

What a time to be alive.

While these had their brief moment in the sun, many that bought the hype missed out on buying the stocks that would become the real moneymakers of the internet era.

Notably, firms that monetized specific services out of those browsers.

For example, Google monetized the search function, and its stock jumped 5,900%. Similarly, Amazon monetized shopping and exploded an insane 62,000%!

Now the AI Aftershock is set unleash trillions into the economy and AI 2.0 service apps will be what makes investors money starting in the weeks ahead.

This is why Colin is recommending 3 companies that he believes will be among the first to cash in on the latest aftershock.

Revealing Colin Tedard's AI Aftershock Stocks

Let's get straight down to business and look at the clues we get about Colin's #1 pick.

AI Aftershock Pick #1: The Customer Service AI

- This company is partnering with companies like Adidas, Walmart, Amazon, General Electric, Johnson & Johnson, and Microsoft to transform their service department with AI.

- Forbes reports: “As the AI monetization wave gains momentum, this company is poised to be a major beneficiary.”

I was able to track down the Forbes article Colin quotes and the pick is ServiceNow Inc. (NYSE: NOW).

AI Aftershock Pick #2: The Limitless Doctor

- According to the National Cancer Institute, pancreatic cancer claimed the lives of over 50,000 Americans last year.

- A new AI service can “see” tiny cancerous spots invisible to x-rays and the human eye 438 days before a human doctor, on average.

Colin's pick here sounds like it could be GE Healthcare Technologies (Nasdaq: GEHC).

- The General Electric spin-off describes itself as a leading diagnostic imaging producer, utilizing AI for enhanced healthcare outcomes.

- From it's own press release: GE Healthcare’s suite of technologies, from detection to remote monitoring and data sharing, are designed to help improve detection.

AI Aftershock Pick #3: The Automatic Accountant

- This “CPA replacement tool” can fill in every line of your tax return with 100% accuracy.

- The company behind has been growing revenue and cash flow by 17 to 20% a year since 2020.

SAP SE (NYSE: SAP) may be Colin's last pick.

- The business software firm introduced its Joule AI service last year, which automates business processes across SAP applications.

- SAP revenue and profits have been on an upward trend since 2020.

Bonus: Stock to Avoid

Colin says AI software is replacing many of the categories that an online freelancer marketplace which connects businesses with contractors like designers, customer service reps, and legal assistants, caters to.

That marketplace is Upwork (Nasdaq: UPWK).

The AI 2.0 Stocks Minting New Millionaires?

Let me start by saying, I agree with Colin's basic premise that the next wave of AI businesses, will be far more lucrative than what we are seeing today.

As far as his picks go, my thoughts are as follows:

ServiceNow: Like many AI businesses, it is growing rapidly. However, with a Return On Equity (ROE) of only 3.4% and a price/earnings of nearly 100x, the workplace solutions company may not provide above-average returns to shareholders over the short-term.

GE Healthcare Technologies: A decent pick at a decent valuation of 22x trailing earnings. I like the business as a stand-alone roll up play of other medical technology businesses.

SAP: At a market cap of $195 billion, even moderate growth will be incredibly difficult to come by going forward.

Upwork: I'm not buying into Upwork, but for different reasons than Colin states, namely because the marketplace is turning off its core customer base with an aggressive new pricing model.

Quick Recap & Conclusion

- Seasoned tech investor Colin Tedards says the real money is in AI 2.0 and he has three “AI Aftershock” stocks that we need to buy.

- The “AI Aftershock” is just the latest in a series of technology aftershocks, which happens when a new platform arrives (AI) and groundbreaking services then emerge from that platform.

- Everything we need to know, including the names of the three “AI Aftershock” stocks are in a new report called: The AI Aftershock Blueprint: 3 Stocks That Could 10X By 2025.

- We were able to reveal Colin's first pick as ServiceNow Inc. (NYSE: NOW) and we took a crack at the other two, which could be GE Healthcare Technologies (Nasdaq: GEHC) and SAP SE (NYSE: SAP).

- None of these picks are likely to make you a millionaire anytime soon, but other AI 2.0 businesses that emerge over the next few years may.

What AI 2.0 innovation or service are you most looking forward to? Tell us in the comments.