Financial expert Charles Mizrahi promises to reveal a special class of stocks that have the power to turn $1,000 into $10,000, in as little as one year.

This special class of stocks Charles calls “Omega Stock Superstars” accounts for 90% of all stocks that have gone up more than 1,000% over the past decade. Let's find out what they are.

The Teaser

We're promised no options, crypto, or other kinds of speculative assets are involved here, just some good old-fashioned equities we can buy directly from our brokerage accounts.

Charles Mizrahi went from growing up on a blue-collar street in Brooklyn, New York to the the floor of the New York Futures Exchange by the time he was 20. Given his background, he empathizes with the everyday investor and wants to show us how to get the right stocks, at the right price, without risking our hard-earned money.

I have previously reviewed Charles' “Next Microsoft” pick and his $5 Microcap Oil and Gas Company to 5x Your Money in 5 Years, which were decent picks.

Immediately, one thing sticks out in the video presentation, which starts with a list of stocks that are up more than 1,000% over the last decade.

Many, although not all of the stocks are biotech names.

Charles continues, saying “These Omega stocks aren't listed on the S&P 500, they are rarely talked about in the media, and very few analysts cover them.”

He also adds, “Omega stocks are one investment Main Street investors can get into before Wall Street.”

So, is he teasing microcap biotech stocks?

The answer is yes and no.

It's a mixed bag of suppliers, manufacturers, and a “unique kind” of pharma company. Meaning the Omega factors aren't industry-specific.

What Omega stocks all have in common are five key traits, with each letter in the word O-M-E-G-A representing one of these traits. Charles has done the legwork and narrowed down the best Omega stocks to three, which could appreciate the fastest, over the shortest amount of time.

The Pitch

All the info we need to get started, including the names and ticker symbols of each of these three stocks, is in a special report called Omega Stock Superstars: Everything You Need to Get in on the Top 3 Omega Stocks of 2024.

It's included in a subscription to Microcap Fortunes, Charles' newsletter where, as the name implies, he identifies microcap stocks that have the potential for massive returns.

One year of Microcap Fortunes normally retails for a cool $10,000, but the offer here is a full one-year membership for $1,995. The price includes a new monthly stock recommendation, an active portfolio of 18 of Charles' best Omega stocks, weekly updates, and more.

The Five Omega Stock Traits

If a company has three out of five traits, we're onto a winner.

When a business has all five, that's when we get the 1,000% returns.

It all starts with O…

Operating in a Niche Industry

For a business to have 1,000% potential, it needs to be carving out its own path.

This becomes much easier to identify if we start looking at stocks the old Ben Graham and Warren Buffett way, as pieces of businesses, which is what shares are.

Managed by the Founder

There have been empirical studies done that show founder-led companies outperform over the long term.

It goes back to an old saying – “if you want to appreciate the value of money, earn your own.”

Extreme Growth Potential

For a stock to have extreme growth potential, it needs to be small.

All Omega stocks started out as microcaps (market cap between $50 million – $1 billion), including Charles' three current Omega stock picks.

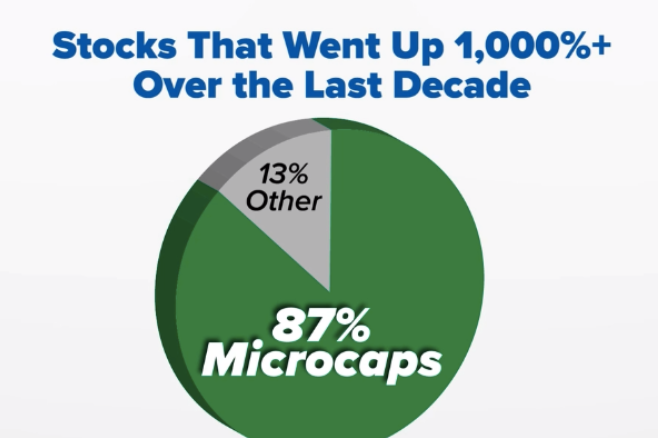

This makes sense, as a whopping 87% of stocks that went up 1,000% or more over the past decade were microcaps.

If stocks have just the E component in Omega, we can beat Wall Street to the punch.

This is because most institutional asset managers are too big to invest in microcaps, and even if they did buy a stake in one, they would likely have to file a Schedule 13D statement with the SEC, declaring more than 5% ownership, which makes them company insiders and opens them up to liability.

Great Financials

This goes beyond just simply growing revenue and cash flow.

We're talking about a clean balance sheet, low debt-to-asset ratios, and a high return on invested capital (ROIC), which is a measure of some form of a competitive advantage.

Accumulating its Own Stock

Of all the stocks that have gone up by 1,000% or more over the last decade, 70% of them had high levels of insider ownership.

Like Peter Lynch once said, “There's no better tip-off to the probable success of a stock than that people in the company are putting their own money into it.”

If we put all five of these traits together, we get Omega:

The best odds to beat Wall Street and the market.

Revealing Charles Mizrahi's Omega Stock Superstars

These three Omega stocks tick every box on the checklist we just went over.

Here is what Charles tells us about each:

First Omega Stock

- An innovative pharma company disrupting the eyecare industry.

- It sells its products online, cutting out the middleman, and passing on the savings to its customers.

- The company's products are already used in more than 8 million surgeries per year.

This sounds like Harrow Inc. (Nasdaq: HROW).

- Harrow is an eyecare pharmaceutical company exclusively focused on the discovery, development, and commercialization of innovative ophthalmic therapies.

- It makes pharmaceutical products for over 8 million annual ophthalmic surgeries in the U.S.

Second Omega Stock

- A special materials supplier to the aerospace industry.

- It has sole supplier status with Airbus and has worked with Boeing and Nasa to make its engines.

- Has paid double its $300 million market cap in dividends since 2005.

The stock being teased here is Park Aerospace Corp. (NYSE: PKE).

- Park is the sole supplier of composite material and lightning strike protection materials on all Airbus A320neo Family Aircraft.

- The company has a current share price of just over $16 with a market cap of $325 million and has paid out $25 per share in dividends or more than $550 million since 2005.

Third Omega Stock

- A manufacturer of specialized electronic components for some of the world's largest companies, including Tesla, Apple, and Nvidia.

- The company is managed by the founder's son, who has been the CEO since 2001.

This one was a little trickier to weed out, but Charles could be talking about Methode Electronics Inc. (NYSE: MEI) here.

- Methode designs and manufactures custom Industrial Wireless Radio Remote Control (RRC) system solutions. Its client roster includes Tesla.

- Company CEO, Donald Duda, who is retiring, has worked in the business since 2000.

Omega Microcaps – Superstars or Regular Joe's?

Admittedly, I am a little biased here.

Buying into undervalued microcaps with solid financials run by management with a long-term focus is my preferred way to invest in the market.

Charles is right when he says that individual investors have an edge in this corner of the market and the numbers speak for themselves in terms of the potential for outperformance.

As for the three Omega picks, I see one or two traits missing from each.

I don't see Park Aerospace or Methode Electronics as having the E in Omega – Extreme Growth Potential. There's nothing wrong with this, especially in the case of Park, which more than makes up for it by regularly returning capital to shareholders. But expectations should be kept in check.

When it comes to Harrow Inc. The business has growth potential, but not-so-great financials.

So likely no 1,000% breakout superstar stock over the short term. However, Charles' reasoning here is sound and microcaps meeting most or all of his criteria are more than average Joe's, which should produce above-average returns over the long term.

Omega Stock Superstars is a rarity – a useful presentation.

Quick Recap & Conclusion

- Financial expert Charles Mizrahi promises to reveal a special class of stocks that have the power to turn $1,000 into $10,000, in as little as one year.

- We learn that Charles is teasing microcap stocks. But only ones that possess five key traits: Operate in a niche industry, are managed by the founder, have extreme growth potential, great financials, and are accumulating their own shares.

- Charles has done the legwork and narrowed down the best Omega stocks to three, which are revealed only in a special report called Omega Stock Superstars: Everything You Need to Get in on the Top 3 Omega Stocks of 2024. It takes a subscription to Microcap Fortunes, Charles' newsletter to get your hands on it, which costs $1,995 for the first year.

- But never fear, because Greenbull is here. We were able to reveal Charles' three picks for free as Harrow Inc. (Nasdaq: HROW), Park Aerospace Corp. (NYSE: PKE), and Methode Electronics Inc. (NYSE: MEI), with the last one being the one we're less than 100% sure about, as it offered the least clues.

- Charles' three picks may not tick off all of his own criteria, but this was an honest and helpful presentation based on sound reasoning, which is more than we can say for others we have reviewed here.

Are microcap stocks a part of your investment portfolio or will they be going forward? Let us know in the comments.