Brad Thomas teases a secret plot by the Biden Administration to transfer $30 Trillion of wealth to a select group of individuals.

This will make Wall Street richer at Main Street’s expense, but one corner of the market and “Biden's Secret Stock” stand to disproportionately benefit and so can we.

The Teaser

Regardless of politics or who you vote for, Brad says if we do not prepare in the coming months, we’ll be on the losing side of what will be known as the greatest wealth transfer of all time.

Brad Thomas is a former real estate developer turned stock investor. He's a value guy, which I like to see, and focuses primarily on income plays. I have previously reviewed a few of his past teasers, including “Amazon's Secret Royalty Program” and his “Fast 500” Stock Pick.

What is this $30 trillion dollars Brad speaks of and more importantly, where does it come from?

Apparently, it's all about mis-using a Trump-era policy to direct gobs of money into one sector of the market.

The Federal Government is about to Unleash Limitless Spending

Months of research have uncovered Biden’s use of policy 2022-11.

This officially falls under the jurisdiction of an executive privilege known as The Defense Production Act or DPA for short.

The Defense Production Act was a massive boon to healthcare stocks under Trump and now Biden's using it to lift up an entirely new class of stocks.

Like drunken sailors during an afternoon binge, the federal government threw $369 billion into The Inflation Reduction Act, and allocated another $3.5 trillion towards infrastructure projects.

All told, thanks to the tens of trillions of additional dollars pouring in from the private sector, Goldman Sachs estimates upwards of $30 trillion is being dedicated to this one sector all at once.

The final tally could end up being even higher, as Biden has added specific language to the DPA authorizing potentially unlimited spending.

By following the money, Brad has caught many of Biden's biggest donors, like Goldman, Renaissance Technologies, and hedge fund manager Ken Griffin (not related to Family Guy Peter Griffin), all piling into one stock.

They're betting big and are in for over $500 million on this single stock.

The Pitch

This under-the-radar stock has a single digit Price-to-earnings ratio and Brad has put all of his analysis on it in a report called How To Buy Biden's Secret Stock for 340% Gains.

It is ours if we subscribe to Brad's monthly newsletter, Intelligent Income Investor. The cost to do so is typically $199 per year, but for a limited time, it is available for $49 for the first 12 months. A 60-day money-back guarantee is included, as are two additional special reports, 12 monthly issues of the newsletter, including back issues, and exclusive members-only updates.

The One Sector Trillions Are Flowing Into

It’s no big secret that Biden and the Democrats are all in on green energy.

Based on previous reviews, I am about to get a lot of pushback on this, but here goes nothing.

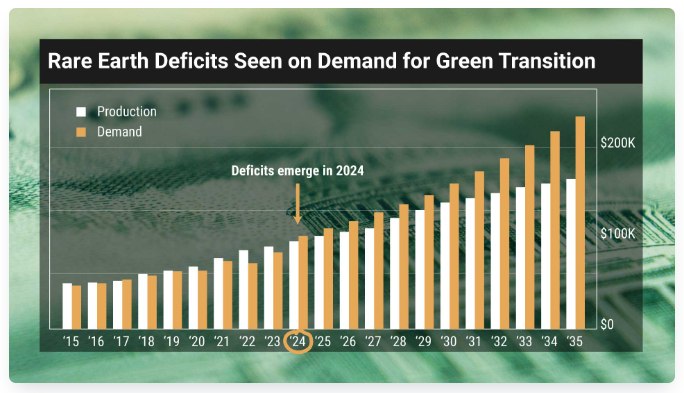

The big problem with renewable energy is we simply don’t have all of the materials, particularly rare earth elements, to build all the cars, infrastructure, and grid to power it all.

Sure it is cleaner than coal and fossil fuels, but where are the resources going to come from?

Even MIT researchers have concluded the current supply is nowhere near enough to match the future demand.

Reuters predicts in 2024, we're finally going to witness this deficit emerge:

Add the fact that about 80% of these critical “green energy” materials come from China and the situation becomes even more untenable.

Politicians know they have overpromised, which is why Biden has expanded the number of critical minerals production projects that may receive funding under the Defense Production Act, among other things.

A Massive Opportunity to Get Rich

Regardless of how you or I feel about green energy, one thing is for certain.

Large blank-check federal government initiatives worth billions and even trillions of dollars make stocks go up!

It happened before in 2020-2021 with healthcare stocks, in 2022 with solar stocks, and it is about to happen now with one stock in particular that is providing the materials needed for the green energy transition.

The company controls a super-rich area of deposit with enough to supply almost all the lithium in the entire world, let's find out what it is.

Revealing Biden's Secret Stock

Brad drops some useful tidbits about this “secret stock.”

- It recently received a nearly $150 million grant from the Department of Energy, as part of a first set of projects, to help create a domestic supply chain for electric vehicle batteries.

- Ford selected this company to supply them with the materials to build 3 million batteries for their vehicles.

- It’s already outperforming the market by over 4,700%.

In this case, all that was needed was the first clue, which was a dead giveaway and confirms the “secret stock” is Albemarle Corp. (NYSE: ALB).

- Albemarle was awarded a nearly $150 million grant from the U.S. Department of Energy, as part of the first set of projects funded by Biden's Infrastructure Law to expand domestic manufacturing of batteries for electric vehicles (EVs).

- The company has a strategic agreement in place with Ford Motor Co. to deliver battery-grade lithium hydroxide for approximately 3 million future Ford EV batteries.

- Albemarle stock has outperformed the S&P 500 by varying degrees ever since 2004.

Make 340% over the Short Term?

Brad's analysis of Abermarle concluded the company is about to undergo the most aggressive growth in its entire history, with the stock increasing up to 340% in value.

Is he right?

The growth thesis is predicated on both the U.S. government's implicit support and the projected supply/demand imbalance of rare earth elements, but this isn't what makes ALB a good pick.

For a specialty chemicals manufacturer, Albemarle's underlying economics are in a word – fantastic.

A 13% return on assets, when the median for manufacturing concerns is well below 5%, and a 34% operating margin, while the S&P 500 average is only 14.5%, make Abermarle a good business.

Combine this with a low absolute valuation of less than 2x book value and ALB stock also provides good value for your money.

There is a risk that it could become too reliant on government funding for an ever larger portion of its earnings, but this is a short/mid-term play for above-average growth.

Quick Recap & Conclusion

- Brad Thomas rightly points out that a massive amount of wealth is being transferred to one particular sector and “Biden's Secret Stock” is one of the biggest beneficiaries.

- The sector is green energy and as much as $30 trillion is being dedicated to it all at once. This is lifting all boats, but one stock is getting a bigger push than others.

- Brad reveals this under-the-radar stock in a report called How To Buy Biden's Secret Stock for 340% Gains. It is ours when we subscribe to his Intelligent Income Investor newsletter at a cost of $49 for the first 12 months.

- Fortunately, we were able to save you a bit of time and money by revealing Biden's Secret Stock as Albemarle Corp. (NYSE: ALB).

- Albemarle is a solid business and it is trading at a relatively cheap price. Given this and the fact that it has the federal government as a backer, it is well-positioned to outperform over the next couple of years.

Will America succeed in raising its stockpile of critical rare-earth elements? We would like to know what you think in the comments below.