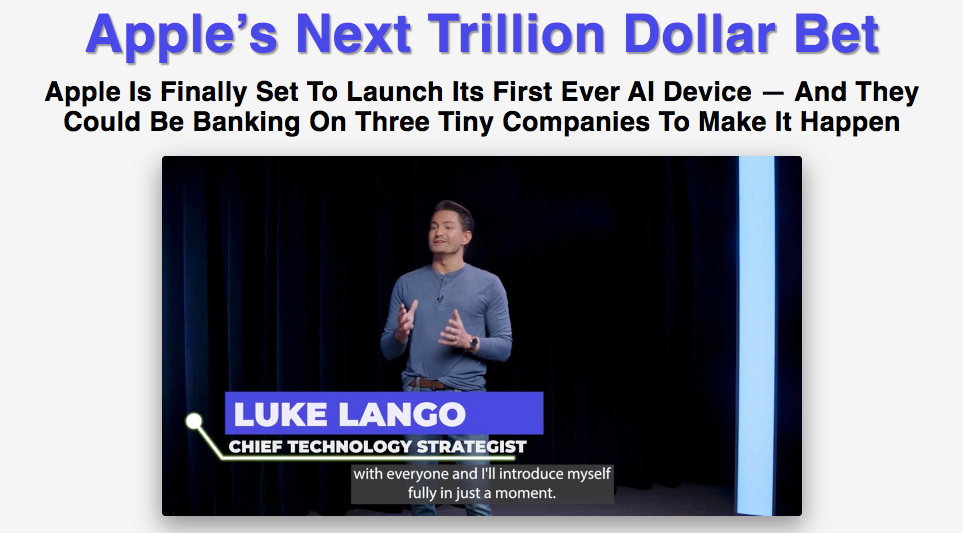

Luke Lango is bringing attention to “Apple's Next Trillion Dollar Bet.”

However, he's not recommending Apple stock, as the real opportunity is in the smaller companies helping Apple make its move.

The Teaser

Over the past few years, a major shift has been underway in Silicon Valley.

Luke Lango loves Apple. This may be an understatement, after releasing such teasers as his “100X AI” Apple Announcement and The AI Melt-Up Playbook, he may get slapped with a restraining order by the tech giant for stalking.

The Valley's biggest companies have shifted their focus to the next shiny object – Artificial Intelligence (AI).

Collectively, the likes of Google (Alphabet), Microsoft, Amazon, and Meta have invested more than $100 billion into AI over the past year alone and they are not done yet.

But you may have noticed that one name is missing from the ones mentioned…Apple.

The company has largely sat out the AI frenzy, apart from its Apple Intelligence announcement regarding Siri.

Tim Cook hyped up the unveiling, saying:

Apple recently made a splash hire to improve the underlying infrastructure of Siri and its in-house AI models.

These moves mean that we could be on the brink of seeing Apple’s AI technology fully roll out later this year and Luke expects it to send shockwaves across the tech industry.

Whether it makes as big of an impact as DeepSeek remains to be seen, but Apple is NOT the play here.

At a current market cap of nearly $3.5 Trillion, it will likely grind higher, but not soar.

Instead, what could soar thanks to Apple’s upcoming AI launch are the smaller stocks that Luke calls “Apple’s silent suppliers.” Our guy has found three companies that he thinks could be working behind the scenes to bring Apple Intelligence to the mass market.

The Pitch

The names of these companies are in a special report called The Silent Suppliers: 3 Companies Set to Support Apple’s AiPhone

It is ours with a subscription to the Innovation Investor research service which costs $99 for the first year.

The service claims an average return on closed positions of 100% in 2023, comes with a 30-day money-back guarantee, and three bonus reports, including 3 AI Losers to Avoid.

The Apple Effect

If it isn't broken, why stop doing it?

This is how Luke's strategy can be summed up.

The “Apple Effect” is real and we don't have to look any further than the supply chain of its biggest cash cow, the iPhone.

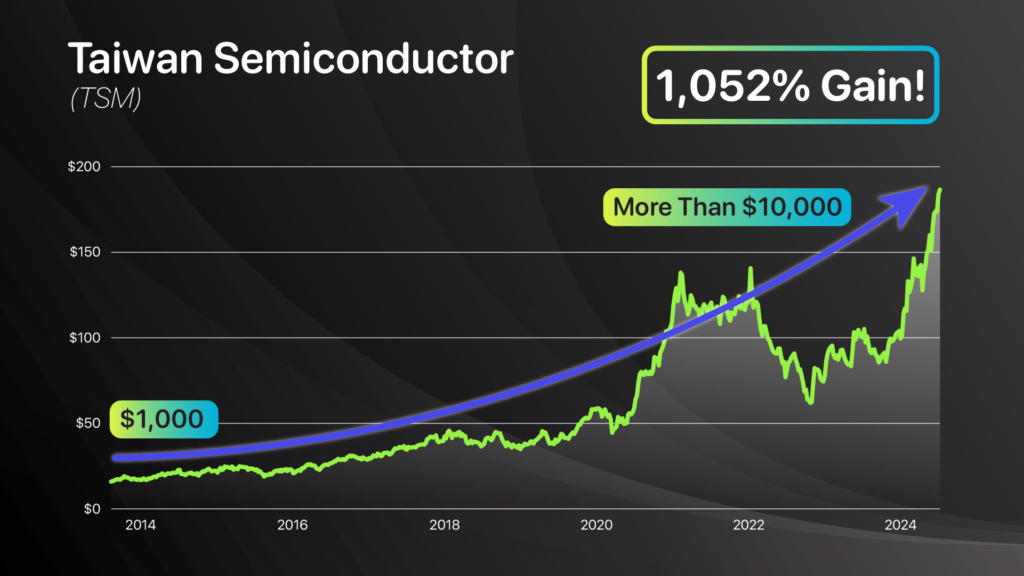

For example, the iPhone’s processor chips are made by Taiwan Semiconductor. Since partnering with Apple, its stock is up 1,052%.

Broadcom is another perfect example.

Since Broadcom started producing Apple’s network chips in 2007, its stock has risen by 10,265%. A rare 10-bagger!

Luke expects the silent suppliers behind Apple's first AI product to take off in a similar fashion. Is he right?

Apple Intelligence is Apple's proprietary AI model and it has one big advantage.

According to CNBC, the average American household owns more than two Apple products. By some accounts, there are more than 2 billion active Apple devices around the world.

This gives it unprecedented access to data that other models like ChatGPT do not come close to matching. Tim Cook knows this better than anyone:

It has the biggest user base across the most used consumer tech products in the world.

Presumably, it will use such access to help make our lives easier. Something that has already started happening.

Apple Intelligence's “personal intelligence system” is already available in beta starting with iOS 18.1 and iPhone 15 Pro models.

Early reviews are mixed, with most saying that it's a good first step.

However, this is creating an investment opportunity in Apple’s AI suppliers, which have yet to be formally announced. Let's try to find out what they are.

Revealing Luke Lango's Apple Silent Supplier Stocks

There are three stock picks in all and Luke gives us a few clues about each, here goes.

First Silent Supplier Stock

- A small firm that produces advanced lithium-ion batteries that Apple needs to power its new AI-enabled devices.

- The company has developed its own proprietary battery technology that allows for a higher energy density and longer cycle life than conventional smartphone batteries.

- It has already hinted at a partnership with Apple in a press release saying they've struck a deal to become a supplier for an “unnamed California-based technology company.”

This sounds like Enovix Corp. (Nasdaq: ENVX).

- Enovix designs, develops, and manufactures lithium-ion batteries for smartphones, tablets, and laptops.

- It has been described as having developed a proprietary battery architecture that has higher energy density, a longer life cycle, and superior safety.

Second Silent Supplier Stock

- This company is behind an innovative AI-powered internet browser. Unlike Apple’s Safari, this browser comes with its own AI system, a free VPN, a built-in ad blocker, and integrated crypto wallets.

Opera Ltd. (Nasdaq: OPRA) is Luke's pick here.

- Opera is the first browser to incorporate its own AI and it comes equipped with a crypto wallet.

Third Silent Supplier Stock

- The third company operates its own generative AI model, similar to ChatGPT.

- Its AI model tailors itself to specific user activity and this past June Apple held talks with the company to leverage its AI model.

There are really only two possibilities here – Google's Gemini or Meta's Llama and based on Luke's final clue, it's Meta Platforms Inc. (Nasdaq: META).

- As per the WSJ, Apple and Meta have previously discussed integrating the Llama generative AI model into Apple's AI system for iPhones.

Bonus Pick

Luke gives away one more pick before ending his teaser.

It's a company that already produces Apple’s processor chips, so a pivot into AI by Apple means more chip orders.

The chip maker is Taiwan Semiconductor Company (Nasdaq: TSM).

Luke is confident TSM will continue to appreciate, as “it is at the forefront of semiconductor manufacturing, and semiconductors are the brains of AI“.

Will his other picks be big winners too?

10-Bagger Potential?

Like a fogged-up car window, the AI macro picture is slowly, but surely, becoming more clear by the day.

Generative AI providers and suppliers will remain important and some will inevitably be multi-baggers.

This is where Luke's silent supplier picks fit in. Here is the potential of each based on what we know today:

Enovix: A growing top line and the 3D cell technology it is developing for energy storage markets could be BIG. A solid multi-bagger if it begins generating cash flow.

Opera: The web browser has been proactive about integrating AI into its offering and at a price/earnings of only 10x, it is relatively cheap. The stock could turn into a multi-bagger by way of acquisition.

Meta: It's going all-in on AI just like it did with the Metaverse. The difference is this time it will pay off. Despite its large size, the stock can still 3x or 4x.

TSMC: A pillar AI infrastructure stock. The need for high-performance chips is only going to accelerate and given its headstart, it will continue to be one of the top suppliers. A definite multi-bagger.

Quick Recap & Conclusion

- Apple is making its “Next Trillion Dollar Bet,” but Luke Lango believes the real opportunity is in the smaller companies helping it make its move.

- The move is the rollout of Apple Intelligence to the mass market, which has already begun, and what could soar are three smaller stocks that Luke calls “Apple’s silent suppliers.”

- The names of these companies are revealed in a special report called The Silent Suppliers: 3 Companies Set to Support Apple’s AiPhone. We can get our hands on the report with a subscription to the Innovation Investor research service which costs $99 for the first year.

- However, before you go ahead and add another subscription to your list, we were able to reveal Luke's picks for free and they are: Enovix Corp. (Nasdaq: ENVX), Opera Ltd. (Nasdaq: OPRA), Meta Platforms Inc. (Nasdaq: META), and Luke's free pick Taiwan Semiconductor Company (Nasdaq: TSM).

- All of these stocks are favorites of Luke's that he's previously teased and that have performed well, so he's doubling down. A wise choice, as all still have multi-bagger potential.

Which “silent supplier” stock will be the best performing? Tell us in the comments.