‘Trading champion' Alpesh Patel confirms what we already knew, that the Defining Megatrend of 2023 is Artificial Intelligence.

However, the biggest winners in AI will not be the companies developing the technology itself, but rather companies that make AI possible, and Alpesh has found one such company that is breaking away from all the others.

The Teaser

Businesses from nearly every industry on Earth have realized that AI can add game-changing money to their bottom lines. They have also quickly realized that without the world's highest-powered computer microchips, AI is a mere pipe dream.

Alpesh Patel is a name we aren't familiar with here at Green Bull, but what we do know is that he started trading at the age of 12 with money borrowed from his aunt, parlayed his trading skills into a hedge fund, and the Queen thought so highly of him that as she made him an Officer of the Order of the British Empire.

This is my first time looking at one of Alpesh's presentations, but we have covered plenty of AI-related teasers lately, including Keith Kohl's “Algo Meds” Company and Wealthpin's “Apple of AI” Stock.

What has ensued as a result of businesses actively seeking to implement AI is a boom for chipmakers, processors, and semiconductor developers alike.

It's something that hasn't been seen since the early days of the Internet when stocks like Intel, IBM, and Cisco surged. Today, its chipmakers such as Nvidia and Taiwan Semiconductor that are up big.

Right Place, Right Time

Because of this rising AI tide that is lifting everything even remotely related, one technology is on pace to deliver gains that will blow many of those previous examples out of the water.

The company Alpesh is teasing makes something known as a microcontroller, which is a critical component for any AI system.

It's used in refrigerators, microwaves, insulin pumps, and even NASA satellites.

Up until now, AI has been primarily relegated to the cloud, which is really just a huge server farm of connected computers.

In order for your device to “learn” how to solve a new problem, it needed to communicate with this data farm, find a solution, receive the new information, and take action.

All of these steps created significant lag time, which is not safe, to put it mildly, when it comes to something like braking in autonomous vehicles for example.

Alpesh's AI stock has found a workable solution that essentially takes the artificial intelligence from data farms and puts it inside the chips it designs.

This real-time processing means devices can respond without network delay in just a few milliseconds, compared to the full second or more it takes cloud-based AI systems.

It's a vital improvement and one company leads the microcontroller market globally.

The Pitch

Alpesh and his team have put together a special report about this company, including its name and ticker symbol called “CODE RED: Discover the Secret Stock Powering AI’s Global Takeover.”

In order to get our hands on a copy we have to take a risk-free trial of the Manward Letter. As you can probably guess, there is a charge to try out the service, but in this case, it's only $49 for a one-year trial. The offer includes monthly top stock picks, weekly updates on open positions, access to the letter's model portfolio, and more.

The Microcontroller Revolution

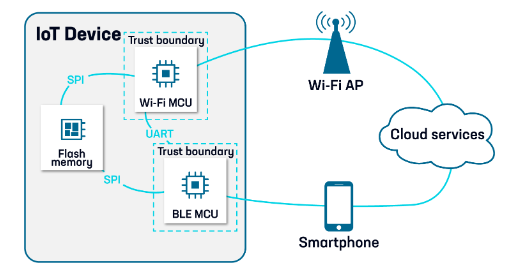

One of the biggest trends in AI is moving machine learning to “the edge”, where the sensor data is generated.

In order to do this, microcontrollers are needed.

In 2021, 31.2 billion of these microcontroller units were shipped globally.

No official number has been released yet for last year, but it is expected that shipments grew by around 10%. So the trend is picking up steam.

As AI continues to proliferate, this figure will increase along with the fortunes of microcontroller makers.

Artificial Intelligence of Things

You have likely heard of the term Internet of Things (IoT).

It describes objects like smart watches, vehicles, and appliances with embedded sensors that can seamlessly collect and transfer data among themselves.

Well, AI and more specifically microcontrollers are helping make it a reality.

The tech is finally tiny and powerful enough to pull it off, and initial products using machine learning in microcontrollers should hit the market in two to three years' time.

Besides the lag factor highlighted earlier, microcontrollers offer one other important advantage – privacy. Processing and storing data at the endpoint is obviously much safer than doing so in the cloud.

The AI company Alpesh teases is the world’s single largest supplier of microcontrollers and its watershed moment could be just around the corner.

Revealing Alpesh Patel's Megatrend AI Company

Some telling clues were dropped throughout the presentation for us to piece together like a Sherlock Holmes of stocks.

- This company's shares trade for around $10.

- It ships more than 3.5 billion microcontroller units each year

- It has a blue-chip roster of clients, including Sony, Verizon, and Toyota among many others.

The first few search results led me straight to NXP Semiconductors N.V. As it is the world's largest microcontroller supplier by market cap. But Renesas Electronics Corp. (OTC: RNECY) is Alpesh's pick. Here is why:

- Renesas shares trade just under $8 today. They were up around $10 back in July.

- Per its own account, the company ships more than 3.5 billion MCUs per year.

- Verizon and Toyota are both Renesas' clients.

The AI Play Destined to Win Big?

Admittedly, I was not at all familiar with Renesas Electronics before revealing it here.

I will get to the economics of the business next, but let me say that I do agree with the core of Alpesh's thesis.

The biggest winners of the AI era will be the infrastructure providers, like chipmakers and large language model (LLM) providers. Just as computer chip makers like Intel and operating system providers such as Microsoft emerged from the dot-com era as the winners.

Back to Renesas, is the business any good?

A quick look at its return on equity and return on invested capital shows a 20% ROE and 12% ROIC, respectively. Both of these key metrics are above the median and show that management is efficient with capital.

The company is also a global 100 innovator in terms of the number of patents it holds and it already has a large, diversified client base.

Finally, Renesas has a near-perfect current ratio of 1 and shares trade at a low 12x premium to trailing earnings for a business with its growth potential. This is most likely due to its shares trading on the OTC market, which gets no love from large institutional investors, but is a certified goldmine for us individual investors.

Of course, none of this guarantees that the stock will be a big winner. But not overpaying for future growth, and buying into a business with good underlying economics always increases our chances.

Quick Recap & Conclusion

- Alpesh Patel says Artificial Intelligence is the defining megatrend of 2023 and he's found one company that is powering a huge growth market within it.

- The company Alpesh is teasing makes something known as a microcontroller, which is a critical component in every AI system.

- Alpesh and his team have put together a special report about this company, including its name and ticker symbol called “CODE RED: Discover the Secret Stock Powering AI’s Global Takeover.” It is available only to subscribers of the Manward Letter, which costs $49 to try out for the first year.

- Fortunately, you can put your credit card away and skip the hassle of filling out a long online form, as we were able to reveal Alpesh's pick right here for free as Renesas Electronics Corp. (OTC: RNECY).

- The Japanese manufacturer of microcontrollers and microprocessors is already a global leader in this market and boosts some good underlying economics, not to mention growth prospects.

What type of businesses do you believe will be the biggest winners of the AI era? Tell us in the comments below.