Financial analyst Alex Koyfman is teasing the rare earth element uranium, which AI cannot survive without.

Hardly anyone connects this element with AI, which is why it has flown under the radar, just like one “Oppenheimer Uranium Stock” set to surge.

The Teaser

According to Alex, everyone is missing the most crucial part of the AI story…

But first, what kind of a financial analyst is Alex Koyfman?

His LinkedIn profile's About section reads “wealth creation, venture capitalism, world travel.”

Some further digging reveals that for the past 10 years, he's been a senior editor for Angel Publishing focused on sub $100 million market cap, early-stage companies in the tech, biotech, resource, and materials sectors. We have previously reviewed his “Lithium Volcano” Mining Company teaser and his “E-Axle” Company.

Alright, so back to the teaser. Artificial intelligence is supposed to change the world and unlock as much as $15.7 Trillion in new wealth.

However, the promise of AI changing civilization will never come to fruition without one important element – uranium.

AI's Energy Problem

Think about this:

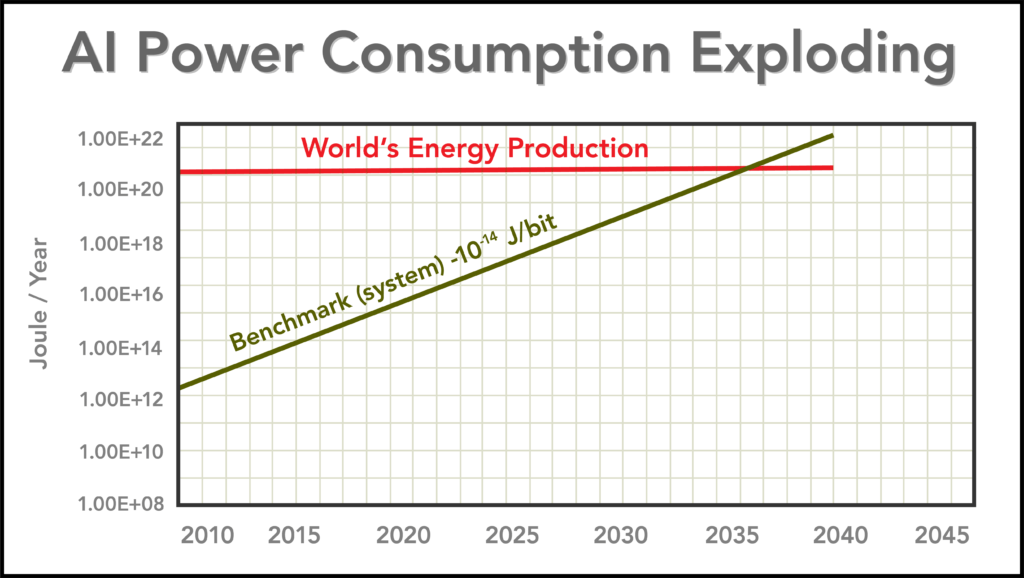

Running ChatGPT for one day costs 1 gigawatt-hour. That’s as much energy as 33,000 homes consume!

But this is just one generative AI app. Multiple this by hundreds or thousands and electricity consumption is about to go through the roof.

A research paper suggests that by 2027, AI servers could consume as much as 134 terawatt hours annually.

That’s the same amount of energy that countries like the Netherlands, Argentina, and Sweden require.

Elon Musk predicts that there will be electricity shortages in about two years.

The bottom line is that AI will need more electricity than the world’s entire energy resources can generate at the moment.

Alex believes one solution to AI’s energy problem is quietly being deployed across America as we speak and one Midwestern firm is at the center of this effort.

The Pitch

We can find all the details on this company in Alex's new research report “The Oppenheimer Stock: Profit From Uranium 2.0.”

All we have to do is sign up for a risk-free trial of The Crow's Nest weekly investment advisory.

The standard membership fee is $249, but there's a 60% discount being offered taking the price down to $99. This includes a six-month 100% money-back guarantee, two additional research reports, one of which, “Lithium Volcano: Tapping the World’s Biggest Lithium Reserve” we have already reviewed, weekly issues, and more.

Taking Uranium To A Whole New Level

One uranium pellet, roughly the size of the tip of a pinky finger, produces as much energy as one ton of coal, 560 liters of oil, or 480 cubic meters of natural gas.

This is why uranium is the only element that can meet the insatiable electricity demands of AI.

However, before rushing out to buy all the uranium mining stocks you can get your hands on, the one industry set to supply the uranium to the tech sector is a new kind of nuclear power.

Its small modular reactors (SMRs), which we have talked about here in previous reviews.

These reactors require a special kind of high-concentration uranium. Think of it like premium, high-octane fuel used in race cars compared with regular gasoline.

According to Alex, there is only one little-known firm in the U.S. that can make high-grade fuel of this quality, and its origins date back to the infamous Manhattan Project.

Development of Substitute Materials

This was the original codename given to the research and development program that produced the world's first nuclear weapons during World War II.

As the hit movie Oppenheimer about the project's lead nuclear physicist J. Robert Oppenheimer documented, the weapons were created using a special type of enriched uranium called uranium-235.

See, the concentration of ordinary reactor fuel is only about 5%.

But the company Alex is teasing, its fuel “has concentration levels of up to 20%, four times higher than regular fuel.”

It takes the uranium to a whole new level.

Better still, it's the only one with the license to produce this kind of fuel, effectively making it a legal monopoly.

Like many commodities, the uranium sector is known for volatile jumps that can turn a modest investment into a six or even a seven-figure bonanza, and with AI supercharging demand, Alex says “the profit potential is off the charts.”

Revealing Alex Koyfman's Oppenheimer Uranium Stock

Alex confides that “we could just buy a uranium ETF to play this opportunity“, as uranium ETF assets have grown 20-fold over the past three years.

But if we want a chance to rake in outsized gains, we should buy at least a small stake in the only American company that can produce high-grade uranium.

Here is what we know about this company so far:

- It is based in the Midwest and its market cap is only around $700 million.

- The company already has a $1 billion order book.

- Bill Gates and Sam Altman are investors, as are large institutions such as Blackrock, Vanguard, and Morgan Stanley.

Given the enriched clues, this one was pretty easy to track down. Alex Koyfman's Oppenheimer Uranium Stock is Centrus Energy Corp. (NYSE: LEU).

- Centrus Energy is based in Maryland and has a market cap of $650 million.

- The company reported in its full-year 2023 results that it originated $189 million of new sales contracts while maintaining its $1 billion long-term order book.

- Bill Gates-backed SMR developer TerraPower signed a supply agreement with Centrus Energy, as has Sam Altman's nuclear energy company, Oklo.

Turn $1,000 Into Six or Seven Figures?

This may seem like a sensationalist headline, but it's not so far-fetched. Hear me out.

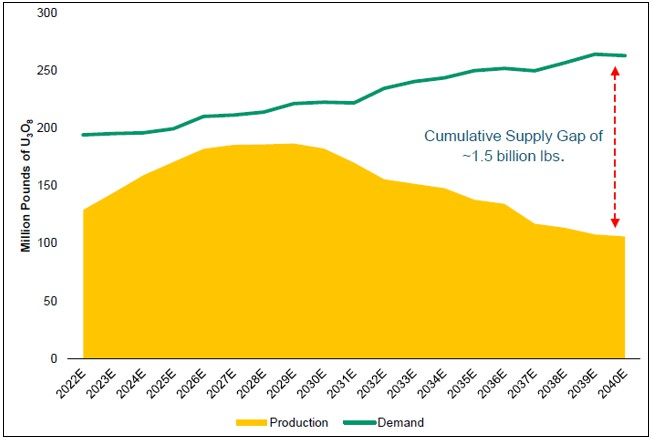

Alex's teaser feeds nicely into the commodities supercycle that is now underway and could last the better part of a decade or more, given all the factors that are at play.

Basically, the production of many essential materials hasn't yet caught up to post-2020 demand and when you throw in all the additional demand coming from energy vampire industries like AI, the disparity will get worse before it gets better.

So, all looks good on the macro front.

But what about the microeconomics of Centrus Energy itself?

Given its monopoly position on the production and supply of High-Assay-Low-Enriched-Uranium to utilities and other businesses, these are pretty good as well.

For starters, the company had $227 million cash on hand as of the end of its 2023 fiscal year, compared to total debt of only $172 million.

Operating margins are also healthy at 20%, with an above-average 7% Return on Assets (ROA).

Lastly, Centrus' valuation of 13x forward earnings is well below the market median of nearly 25x, making for a nice combination of a good commodity business available for a great price.

As for growth, triple-digit annual revenue growth is on the table if SMR and AI demand materialize as expected over the coming years, meaning Centrus stock is currently undervalued with lots of potential upside.

Quick Recap & Conclusion

- Financial analyst Alex Koyfman is teasing the rare earth element uranium, which AI cannot survive without and one “Oppenheimer Uranium Stock” is set to surge as a result.

- The Oppenheimer name comes from the infamous Manhattan Project's chief nuclear physicist J. Robert Oppenheimer, who developed enriched Uranium-235, which this company has U.S. Nuclear Regulatory Commission approval to produce.

- We can find all the details on this company in Alex's new research report “The Oppenheimer Stock: Profit From Uranium 2.0.” It is available with a trial subscription to The Crow's Nest weekly investment advisory for $99.

- However, if you follow Green Bull, you don't have to pay anything, as we revealed the stock pick for free as Centrus Energy Corp. (NYSE: LEU).

- Centrus may be Alex's best stock pick to date, as it is a well-funded, profitable business available for a below-average price, with above-average growth potential.

Is Uranium one of the best ways to play Artificial Intelligence? Tell us what you think in the comments.