Are we on the edge of the biggest tech meltdown in history?

“Market expert” Adam O'Dell believes that popular tech stocks like Nvidia, Apple, and Amazon will plunge by half, overnight, as soon as May 21st.

This provides an opportunity for a new generation of “Tech Titan” Stocks to rise from the ashes, which have 10x, 50x, and 100x growth potential.

The Teaser

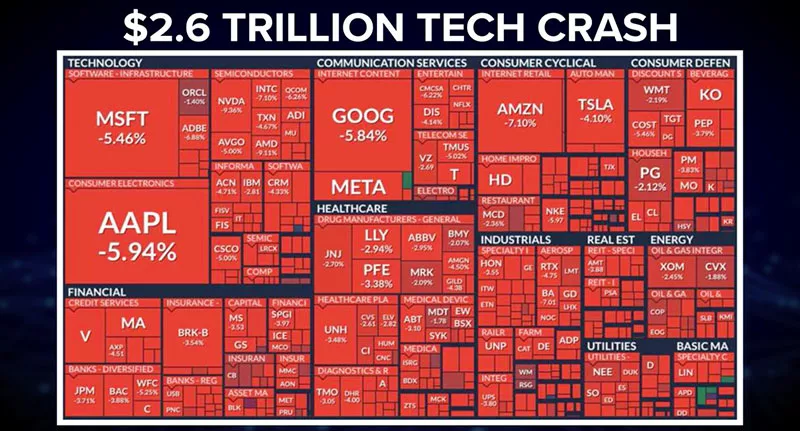

If Adam's prediction comes true, the market will look like this in just a matter of weeks:

We are very familiar with Adam O'Dell and his clickbaity claims. A self-described numbers geek and financial guru whose personal website is adamodellguru.com. Last year, we exposed his “Tiny Company Fueling the $200 Trillion AI Revolution” and covered his $5 Stock Summit teaser.

In his latest effort, Adam offers some bad news, followed by some good news.

As is tradition, first the bad news…America's favorite tech stocks “will lose 50%, 70%, even 90%, or more.” Just like we saw during the Dot Com Crash of 2000.

The catalyst to such market carnage is a combination of factors.

From insider selling, with Jeff Bezos and Amazon execs offloading shares, to Nancy Pelosi, who outperformed every hedge fund last year, being a net seller.

Another factor is that just 5 tech stocks (Microsoft, Nvidia, Google, Amazon, and Meta) accounted for 60% of the S&P 500's total return last year. Such extreme concentration in any asset class has typically ended in disaster.

Finally, Adam's own predictive stock-market system – the Green Zone Power Rating, which we talked about at greater length in the past, is flashing red.

In his eyes, this is creating a perfect storm for a big selloff.

However, this is where the good news begins, because while one corner of the market craters, another will become the new “Wall Street Darling.”

All of Adam's selections are in this corner, and they are on the verge of the biggest breakout in a quarter century.

The Pitch

Adam reveals his picks in a pair of special reports called “The Perfect Stock”: The Next Big Tech Titan and The Three 10X Tech Titans.

Both of these bad boys can be ours with a subscription to the Green Zone Fortunes newsletter, which costs $49 quarterly (regular price: $199 a quarter).

The offer includes a 30-day money-back guarantee, a third special report, and access to the notorious Green Zone Power Ratings System.

The Big Rotation

Despite the bad news doled out at the beginning of the presentation, Adam insists this is “one of the biggest opportunities of the last quarter century.”

He points to a rotation out of big tech and other large-cap stocks into small-caps.

The last time this happened in a major way was in 2001, and small-caps exploded:

Others, such as Morningstar, have also hinted at a stock market rotation.

However, this sounds a lot like trying to time the market, which seldom works out.

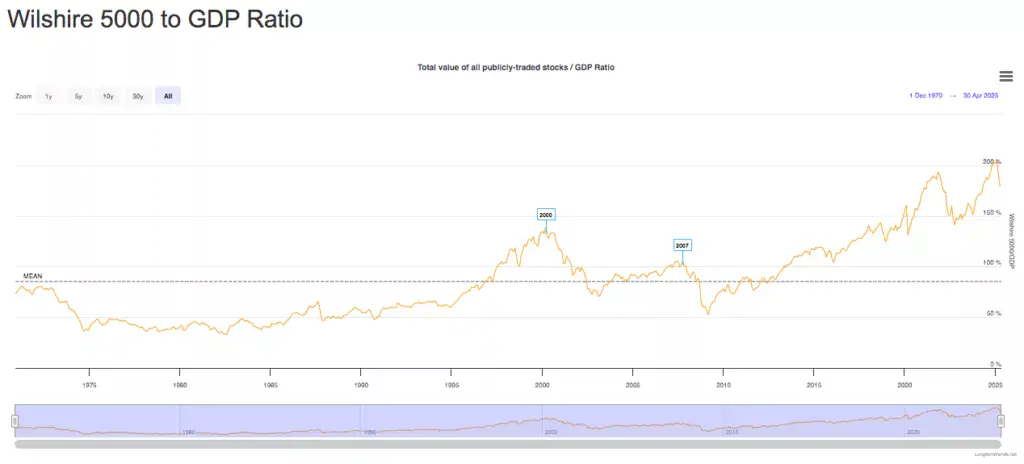

A far more reliable measure is valuation, and it's true, these are a bit stretched.

The trusty total market value/GDP ratio has come off its all-time high made in February, but it remains well-above the mean.

But there's another more ominous indicator…

It's one that was seen right before the crashes of 1929, 1987, 2000, 2008, and 2020! A more impressive streak than the Boston Celtics' seven straight championships in the 1960s.

Over the past century and a half, the top 10 stocks in the S&P 500 have made up about one-quarter of the index. Today, they make up closer to 38%!

This is uncharted territory, so where we go from here is anyone's guess.

Some market strategists are calling it a “valuation time bomb“, and it could blow up as soon as May 21st.

That's the date of Nvidia's next quarterly earnings call, where CEO Jensen Huang will have to answer for his execs selling millions of their own shares and justify the company's hefty valuation.

Any negative or neutral news could burst the dam.

If a market spiral does follow, as Adam and others suggest, it also equals opportunity, and some overlooked stocks will be ripe for the picking.

Revealing Adam O'Dell's “Tech Titan” Stocks

It takes Adam a while to get to it, but he eventually drops several hints about his first pick, “The Perfect Stock.”

- It's a small company that is a silent powerhouse with ownership of over 30,000 patents, which are behind many of the modern-day apps and features critical to smartphones.

- This company is rapidly becoming the go-to partnership in the new world of Artificial Intelligence.

- It recently announced a patent license agreement with Apple.

The last clue gave it away: it's InterDigital Inc. (Nasdaq: IDCC).

- At a market cap of just over $5 billion, InterDigital isn't that small, but it does have more than 30,000 granted and pending patent applications.

- As a provider of wireless and video technologies for mobile devices and networks, the company is essential for our wireless infrastructure.

- InterDigital's worldwide, royalty-bearing licensing agreement with Apple was announced at the end of last year.

As for his three “10x Tech Titans,” the only thing Adam mentions is that they are future powerhouses in three different industries – Biotech, Energy, and Transportation. Not enough info to do anything here.

However, he does throw us a bone and reveals his “#1 stock to profit” at the end of the teaser. It's Himax Technologies Inc. (Nasdaq: HIMX). A Taiwanese fabless semiconductor manufacturer.

Are these stocks the future, and do their valuations make them a buy?

Make 100x in as little as 6.5 years?

Before we get down to the steak and potatoes of underlying economics and valuations, let's see how likely a 50% or greater market decline is.

It would be truly unprecedented.

The largest single-day drop was Black Monday 1987, when the S&P 500 fell by 20.5% and the Dow took a 22.6% hit.

The worst year on record, 1931, amid the Great Depression, with a 47% drop.

Market speculation may be rampant today, and debt is widespread. However, that is where the similarities end. Banks' commercial real estate day of reckoning is still a year or two away, and insiders aren't all dumping their shares, as Adam suggests. The overall market buy/sell ratio confirms this.

Now, are InterDigital and Himax true moonshots?

InterDigital has been on my watchlist for a while. It is a leader in its niche (wireless technology) with the underlying economics to match (50% net profit margin), and it is now trading for a very fair 17x current earnings.

It has also held up very well during this year's market rollercoaster, up a modest 3%.

Himax differs in that it has no competitive advantage in the semiconductor space. A 9% net profit margin and return on equity bear this out.

It is a true small-cap, at a market value of $1.2 billion, but I don't see it growing into a $100 billion company anytime soon, given the entrenched competition in the fabless semiconductor market from Nvidia, AMD, Marvell, and others.

The better pick is InterDigital, and it should continue to serve up above-average growth, as it has done over the past few years.

Quick Recap & Conclusion

- Market expert Adam O'Dell is teasing a new generation of “Tech Titan” Stocks that will rise from the ashes of the biggest market meltdown in history.

- Adam believes a market downturn is inevitable and will take the form of a rotation out of big tech and other large-cap stocks into small-caps.

- His new “Tech Titan” small-cap picks are revealed in a pair of special reports called “The Perfect Stock”: The Next Big Tech Titan and The Three 10X Tech Titans. Both are ours with a subscription to the Green Zone Fortunes newsletter, which costs $49 quarterly (regular price: $199 a quarter).

- We were able to reveal Adam's “Perfect Stock” for free. It's InterDigital Inc. (Nasdaq: IDCC), and another “#1 stock to profit,” which Adam gives away at the end as Himax Technologies Inc. (Nasdaq: HIMX). However, no clues were forthcoming about “The Three 10X Tech Titans.”

- Of the two stocks, InterDigital is the superior pick. It is a leader in its niche, has solid underlying economics, and is selling for 17x current earnings. Cheap for a business with such characteristics.

Do you believe there will be a big market selloff soon? Leave your prediction in the comments.