Adam O'Dell claims that his “10X Switch” can multiply your money by 10 times in just five years. It sounds pretty darn good, but is this actually legit?

In this quick review I'll be going over what you should know, including how this investment strategy works, what's really going on here and more.

The teaser:

There might be multiple different teaser presentations floating around the internet, but here's what I came across, which reminded me a bit of 100X Summit and “The Secret to 10X Wealth” (past teasers we've reviewed here)…

As you know, the guy in the presentation shown above is Adam O'Dell. He is the chief investment strategist for Money & Markets, which is basically a research firm that provides investment advisory services. O'Dell mentions that around the office he's known as “the math guy”, and this is because he's actually a chartered market technician, meaning certified in technical trading and charting. O'Dell is a big fan of technical analysis, but also couples this with ol' fashion fundamental analysis when making recommendations. His background, besides being a certified chartered market technician, includes working at a spot Forex firm as a Prop trader as well as trading commodities, equities and futures later on.

This whole “10X Switch” presentation he puts on makes everything sound so simple. He literally compares this opportunity to the simple flip of a switch for making up to 10x profits in 5 years…

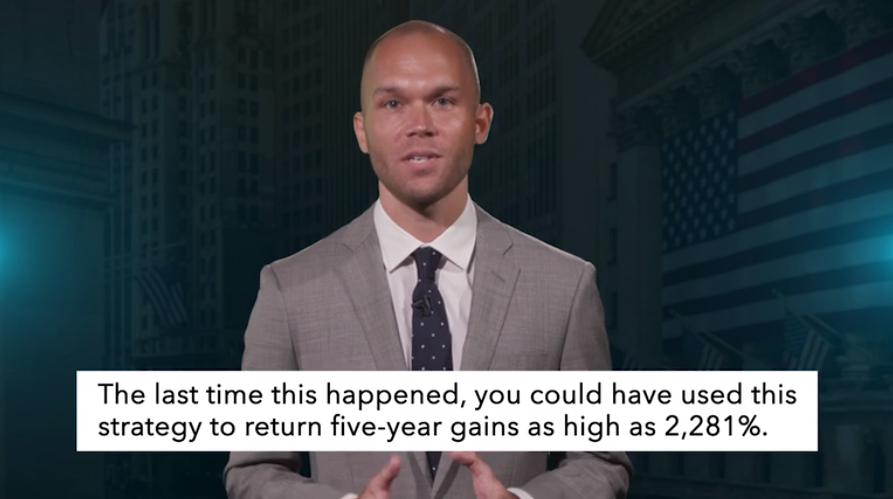

What we are told is that this strategy is perfect for the market volatility going on right now. It was created to take advantage of post-market crash volatility, and if you look at what happened after the 2008 crash you will see increased volatility for years. Adam expects the same to happen here… and claims you could have “gains as high as 2,281%” if it does…

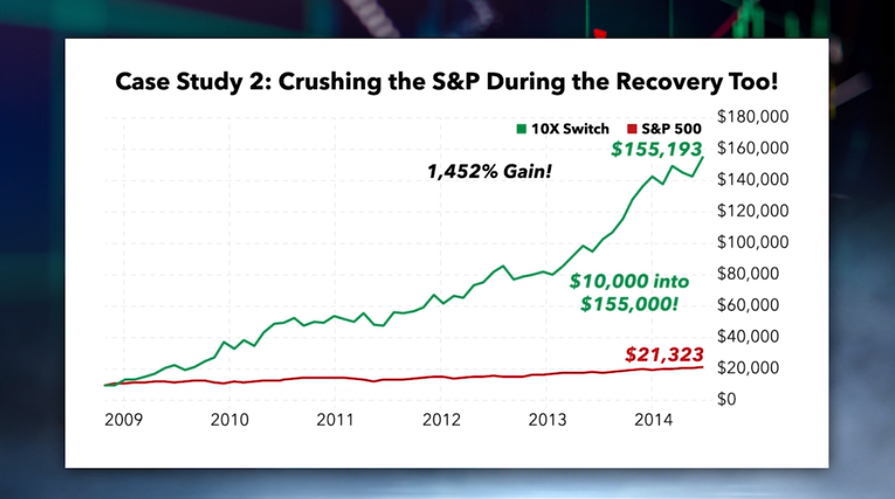

Throughout the presentation he shows a bunch of examples of this 10X Switch outperforming the S&P 500, and everything seems oh so amazing…

One thing I do know about Adam O'Dell is that he's a big fan of backtesting, backtesting, and backtesting some more. And with this “10X Switch” system he claims he's backtested it all the way back to 2006 and that it has beaten the S&P 500 by a ratio of 40 to 1, which is pretty crazy.

However, with investment opportunity teasers like this you can't always trust 100% of what you hear, and there were some things he said that I'm confused on… such as the conflicting statements where talked about how he hasn't provided this strategy/system to the public in over 5 years, but then later in the presentation went on to show trade alerts he supposedly sent out less than 5 years ago.

Anyways… let's talk about how this strategy actually works…

How The “10X Switch” Strategy Works

He acts like all you have to do is turn this switch one and off, but what's really going on here?

Well, there isn't actually a “switch” that you simply turn on and off like he leads one to believe. It's not like you're turning some sort of trading system on and off. What he's just referring to here is switching between two different trades. So there is a “switch”… just probably not what you'd think of after watching parts of the presentation and seeing the light-switch image he kept showing.

There Are Only 2 Trades Here

With this strategy there are only 2 trades that he switches between, both of which are ETF's, and both of which he trades the options of. Yes, this is options trading, not regular old stock trading, the reason being that options trading provides more ability to bring in fast and large profits.

The two ETF's that he switches between trading are VXX and QLD, which are available through any broker service.

The way it works is that he only holds one at a time, but is always holding one or the other. For example, if at the moment he's holding VXX and needs to make a switch, then he'll sell it and buy QLD.

These “switches” are mostly based on the volatility index (VIX), which is an indicator created by CBOE (Chicago Board Options Exchange) that measures market risk and investor sentiment. It's also called the “fear index”.

When the VIX is low this means that investors are confident, and at this time the “switch” turns to on, and vice verce… when VIX is high the “switch” turns to off.

So with that said, here's how he trades based on the VIX:

- Option 1: If the VIX is high then this “switch” is turned to “Risk Off” mode and investors profit from rising volatility and falling stock prices. Here Adam signals investors to buy VXX, an ETF for long volatility.

- Option 2: If the VIX is low then this “switch” is turned to “Risk On” mode and investors profit from falling volatility and rising stock prices. Here Adam signals investors to buy QLD, a leveraged, diversified stock ETF.

Overall, it's a very simple strategy.

Adam O'Dell's 10X Profits

If you made it through the whole presentation for this 10X Switch strategy then you know that it all ended in a sales pitch.

The service being promoted here is 10X Profits, which is a follow-along advisory service run by Adam O'Dell. This is the service which he provides his trade alerts through, meaning he tells subscribers exactly when to buy and sell, or make the “switch” of the two ETF's mentioned above.

These trade alerts will be sent out via email before the market opens when it's time to make a trade… and could come at any time.

Besides the trade alerts, subscribers also get:

- Weekly updates where Adam goes over the current state of the market and economies so that subscribers also know what's going on and what to possibly expect

- The 10x Profits Trading Manual, which goes over exactly how to trade these two options positions

- Members-only website access where subscribers are able to see all the current and past recommendations as well as an archive of updates and whatnot

There are also usually some bonus reports included too, but these can change frequently.

The cost?

Well, it certainly isn't cheap… for one year it is $1,795, and this is supposedly a big discount. And, there doesn't seem to be any refunds, or at least there aren't any mentioned. The only “guarantee” is that you can get a 2nd year of the service for free if “the signals from 10X Profits haven't created the opportunity to generate a profit”… which isn't saying much.

This is expensive and with no refund policy you may be questioning if it's even worth it. After all, the strategy seems pretty simple, right?

Well, of course the public isn't provided with all the details on how this works. We are told that this strategy is largely based on the movements of the VIX, but there is a lot more than that at play here. O'Dell does mention that he runs a computer system with proprietary software that tracks and monitors all sorts of data, much more than just looking at the VIX, but doesn't provide much info on this.

Performance

As mentioned, O'Dell has supposedly backtested this strategy all the way back to 2006, and claims it has outperformed the S&P 500 by 40 to 1.

Other than what we are told there isn't much else to say. I haven't been able to find any subscriber reviews as to the performance of this service so you'll have to just take him at his word if you do decide to buy in.

Pros v Cons

Pros

- It's options trading and has the potential for quick profits

- Simple strategy that only requires switching between two ETF's

- Follow-along service – doesn't require experience

- Adam O'Dell has a solid background and seems to know what he's doing

Cons

- Expensive service

- No refund policy

- Certainly not guaranteed to provide profits – and current market conditions aren't identical to those past

Quick Recap & Conclusion

- The “10X Switch” is what Adam O'Dell calls his strategy of trading based on the VIX

- This strategy consists of trading between only two ETF's, and it's options trading that's being done here

- O'Dell provides alerts on when to make trades through his 10X Profits subscription service, which costs $1,795 currently

- There don't appear to be any refunds

The decision of whether or not to buy into this ultimately falls upon you. Hopefully this review has helped make your decision easier and cleared the air on what's going on here. If options trading is something that interests you and you have a good chunk of cash you can invest into this service to test it out, it seems it could very well be worth it. I just wish I could find some reviews of its performance from subscribers.

Be sure to let us know what you think about this “10X Switch” in the comment section below. We like to hear back from our readers!