Personal finance guru Robert Kiyosaki is teasing a way to profit from gold, without having to go out and buy physical gold.

It's “Trump's Income Secret” and it could bank us as much 80x our money.

The Teaser

When Trump first ran for the highest office in the land in 2014, he was forced to disclose a powerful wealth building strategy.

“Rich Dad” Robert Kiyosaki has long been a precious metals bug. His sites have written about them at length and we have also exposed plenty of metals-related teasers as of late, including Jim Woods' “Silver Storm” Trade and Dr. David Eifrig's “Mar-a-Lago Accord.”

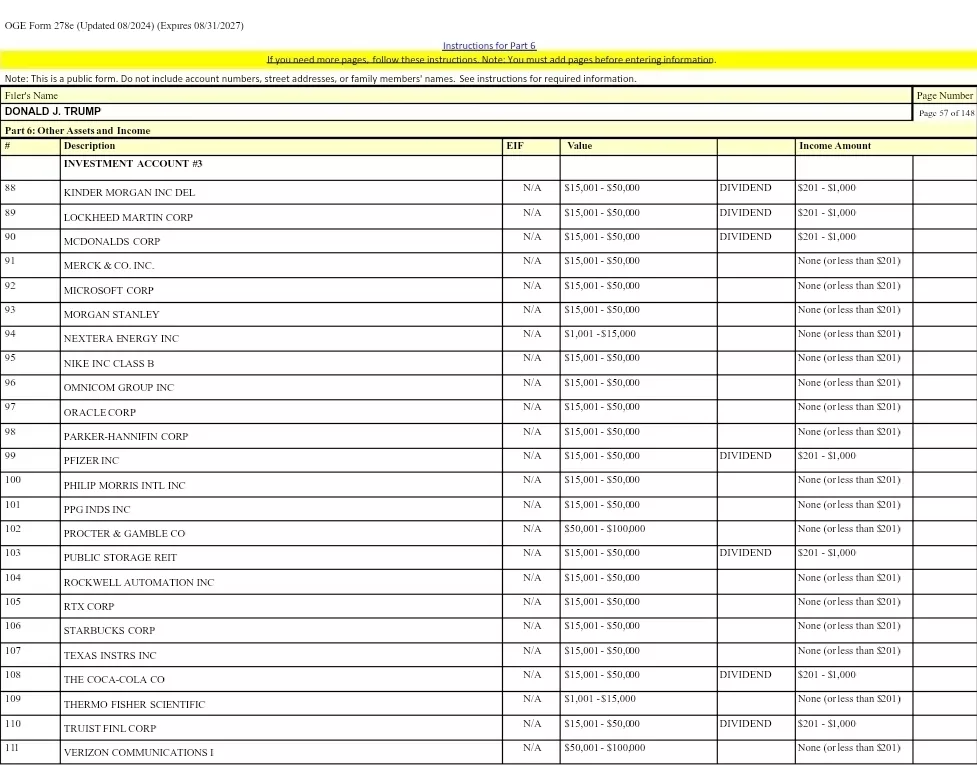

The disclosure can be found inside a U.S. Office of Ethics form numbered OGE Form 278e.

This 234-page doc is now a matter of public record and the strategy Kiyosaki hints at is revealed on page 57.

A quick look reveals various holdings in one of President Trump's personal investment accounts.

But which one is Kiyosaki talking about?

He mentions that its:

An automatic income stream from gold

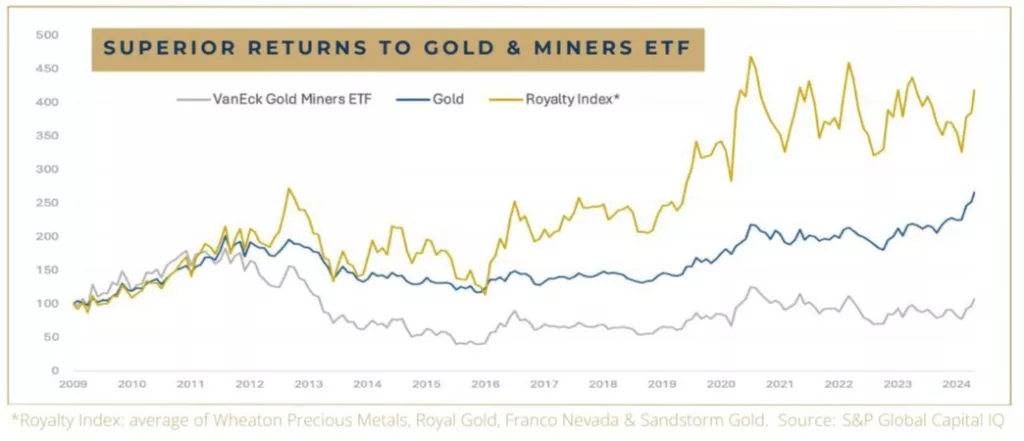

Some more hints are dropped, with Robert saying this “gold income secret” has outperformed physical gold by 8x over the past three years.

We can also buy it for less than $100.

What Kiyosaki is really teasing here is shares in gold royalty companies.

Historically, gold royalties have outperformed gold mining stocks and the physical metal itself, so Kiyosaki's point is valid.

This has been especially true during hard times, which he believes are coming.

However, continued outperformance isn't being left to chance, as an upcoming December 10th event is supposed to serve as a catalyst, sending gold skyrocketing past $5,000, and taking a few gold royalty shares along with it.

The Pitch

The names of these are only disclosed in a report titled Trump's Golden Income Secret: How to Generate Income From Gold's Boom

As per usual, the only way to get it is by subscribing to Robert's Kiyosaki Letter investment newsletter.

It usually goes for $890 per year, but a $49 three-month trial is being offered for a limited time along with a 30-day money-back guarantee.

The Makings of A Super Gold Market

There are generally two schools of thought when it comes to gold:

- The first thinks the price of gold, despite it's run up, is still being suppressed.

- The other, that it is overvalued due to it's limited industrial uses.

Both schools are entrenched and we're probably not going to change any hearts and minds either way, but one thing is undeniable…

The Federal Reserve Board's final meeting of the year is all set for December 10th.

An interest rate cut isn't set in stone, but it is more than 80% likely according to FedWatch, and this would mean a weaker USD.

In turn, a weaker dollar would translate to more gold buying, and a higher gold price.

However, an uptick in retail purchases won't move the needle much. But central bank buying does.

These have been trending up for the past several years and through the first three quarters of this year as well.

Some think this will push the price of gold to $5,000 by the end of next year, with further gains likely if institutional buying continues.

Robert Kiyosaki is slightly more aggressive, saying gold will hit $5k by the end of this year and $25,000 by the end of Trump’s term.

This would be a 22% and 500% gain, respectively. Not too shabby.

But if gold royalty trusts continue their 8x relative outperformance to the physical thing, we could be looking at 176% and 4,000% appreciation over the coming years.

What's more, Kiyosaki says one of his gold royalty picks could soar by 8,000% in the long-term scenario.

Let's see if we can find out what it is.

Robert Kiyosaki's Gold Income Secret Picks

There are a number of gold royalty companies listed on American and Canadian exchanges.

Knowing which ones to buy takes boots on the ground research in Kiyosaki's opinion.

Him and his research team have done the heavy lifting and found the “best of the best royalty companies“.

I listened to Robert's entire 57 minute and 21 second video presentation and the clues we got were extremely limited, but they were all we needed.

First Gold Income Pick

- This company works with a massive mine in Panama that was shut down by protests.

- Recent Panamanian election results were favorable to the mine reopening.

- The mine is estimated to contain 8.1 million ounces of gold.

Robert's pick here is Franco-Nevada Corp. (NYSE: FNV).

- The infamous Cobre Panamá is the shut mine, which is the largest open pit copper project in Central America.

- Prior to it's abrupt closure, Franco-Nevada had a gold-copper steaming agreement with the mine’s owner and operator, First Quantum Minerals (TSX: FM).

- I wasn't able to confirm gold reserve figures, but Panama's new president is looking into reopening the mine.

Second Gold Income Pick

- Kiyosaki's second pick receives blanket royalties on the production of all of a miner's producing properties, including the 11.5 billion pounds of copper it is about to mine.

Not much to go on, but Royal Gold Inc. (Nasdaq: RGLD) is the blanket royalty-receiver.

- Earlier this year, RGLD entered into a gold purchase agreement for all metals produced by the Warintza Project in southeastern Ecuador, until 11.5 billion pounds of recovered copper has been produced.

Third Gold Income Pick

- 13F filings show that institutional investors, such as the Gabelli Gold Fund and Midas Fund, have loaded into this gold royalty company.

Based on this sole clue, the pick is OR Royalties Inc. (NYSE: OR).

- After some double-checking, no other gold royalty company overlaps in both funds' present portfolios.

Turn $1,000 into $80,000?

A few MAJOR assumptions have to come true for the kind of outsized returns Robert Kiyosaki is projecting to be realized.

It starts with a persistently weak U.S. dollar and continues with lower interest rates, and institutional gold buying in response.

The latter two are almost a given, but the wild card is the U.S. dollar, as tariffs will strengthen it over the short/mid-term.

If tariff revenue is also used to start chipping away at the Everest-like debt load, as has been stated, Kiyosaki's thesis could unravel.

However, until that happens, owning physical gold along with a compliment of gold royalty and mining stocks, is the responsible play.

Looking at Robert's picks, there is a lot to be desired income-wise, considering this started as a “buy gold royalties instead of physical because you get income” teaser.

Royal Gold has the highest yield at a pidling 1% and it's also the most attractive of the bunch from a valuation standpoint at a P/E of 26.

If I peer into the dollar store crystal ball, I see gold continuing it's steady upward ascent, but I don't forsee any big, violent moves up unless something breaks.

So, making 80x your money with gold royalties isn't likely in the cards, but beating inflation and the market is.

Quick Recap & Conclusion

- Personal finance guru Robert Kiyosaki is teasing a way to profit from gold, without having to go out and buy physical gold, and he's calling it “Trump's Income Secret.“

- Trump's Income Secret is revealed inside an old Presidential financial disclosure form which showed that one of Trump's many investment holdings is gold royalty companies.

- Kiyosaki has three gold royalty company picks and their names are only disclosed in a report titled Trump's Golden Income Secret: How to Generate Income From Gold's Boom.

- The clues were more limited than quality turkey stuffing on the store shelf the day before Thanksgiving, but we were able to reveal all three of Kiyosaki's gold royalty picks for free: Franco-Nevada Corp. (NYSE: FNV), Royal Gold Inc. (Nasdaq: RGLD), and OR Royalties Inc. (NYSE: OR).

- None of the picks offer a dividend yield greater than 1%, but all should continue to outperform inflation and the market, as hard assets strengthen against fiat.

Do you have a favorite metals royalty stock? Tell us in the comments

awesome assessment as usual Thanks

Favourite metal stock, perpetual, ppta.to from Idaho. Where rgld end OR make hardly 100% annual, ppta makes 345%, this year sofar

Dr. David Eifrig Stansberry Research keeps talking about Trumps Mar a Lago Accord to devalue the u.s. dollar by 40%

and transferring the value to gold.Has plans to swop short term debt for long term.