Tech investor Jeff Brown has an artificial intelligence story that nobody else has told yet.

It has to do with a critical AI chokepoint, Nvidia’s next big breakthrough, and seven strategic partners Jeff is calling Nvidia’s “Magnificent Seven Stocks.”

The Teaser

AI bubble fears are growing, but one technological breakthrough is going to kick off it's final growth phase.

Jeff Brown may be just a little bit biased in this teaser.

He's been bullish on Nvidia since 2016, which has paid off big-time, and he's squeezing all the gains he can out of the stock. Previously, we have also covered his Quantum Computing Stocks and AI Superweapon Stock teasers, so he's definitely all in on the sector.

If AI is to reach it's full potential of robotic household helpers and superintelligent online agents capable of handling your ultraspecific Starbucks order, it will need to become a lot more powerful and energy-efficient.

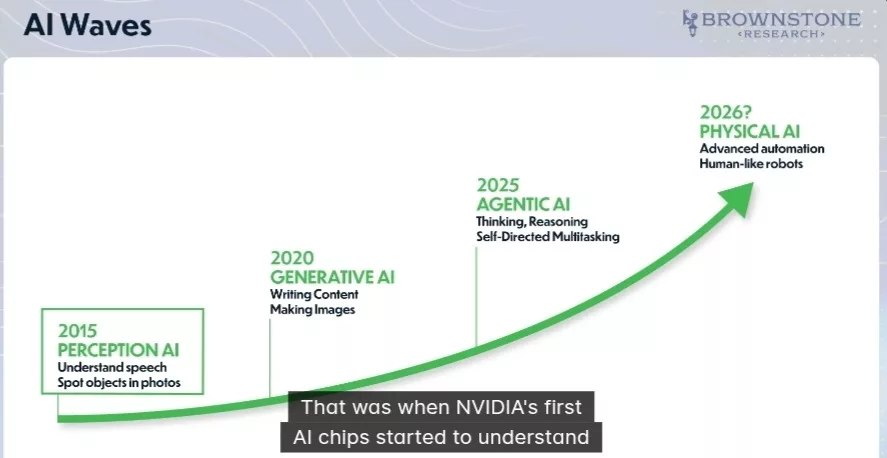

AI's Four Waves

Back in March, Nvidia CEO Jensen Huang gave a 2-hour keynote speech at Nvidia's annual GPU Technology Conference.

The most notable part of it was this graphic charting AI's development over the past decade and where it is likely to go next:

Each wave, from Siri speakers to full task automation, has required 100x more computing power.

Now, to arrive at what Forbes has called “humanity's last invention” or superintelligence, it will need to 100x again.

Just like it did with it's first significant leap into AI with the Tesla GPU (no relation to Elon Musk's trillion-dollar company), Nvidia has a solution that it believes will help make physical AI a reality.

Based on it's stellar track record to date, Jeff is confident Jensen & Co will be able to pull it off, which will cause a few select supplier stocks to surge.

The Pitch

Each contributes a crucial piece of technology to Nvidia’s breakthrough and their names have all been revealed in a new report called Nvidia’s Magnificent Seven: How to Pocket Generational Wealth in America’s FINAL AI Boom.

To get it, we'll need to take Jeff's Near Future Report newsletter for a test drive.

This would cost us $179 upfront for the first year (normally $499), with a 30-day money-back guarantee.

Nvidia's Next 100x Breakthrough

This is the closest thing we have to another 100x AI breakthrough:

It's the foundation for AI systems at scale – the AI factory.

Just as tycoons of yesteryear like Andrew Carnegie and John D. Rockefeller industrialized the production and refining of essential industries such as steel and crude oil, Jensen Huang is now attempting to systemize the production of AI.

To do it, Nvidia is picking up where traditional data centers fall short, building facilities that are specially equipped to handle AI's massive compute requirements.

So, what make it so special?

Each Nvidia ‘AI Factory' combines 50,000 of the company's next-gen Blackwell chips with high capacity storage, a software platform for simplifying AI development, and managed services without the large upfront costs.

To put it simply, it's the ultimate enterprise AI solution, combining hardware, software, and services.

The cost of each 1-gigawatt facility is estimated to be a whopping $20 billion to $30 billion, making it something that only a very few mega-corps could afford to even try to replicate.

As I write this, nearly 100 of these bad boys are currently under construction, with the first expected to be ready sometime in 2027.

The key, according to Jeff, is getting into Nvidia's “Next Magnificent Seven” supplier stocks before it announces that it's first AI factory is coming online.

We have some time, but the race for physical AI is on, with everyone from Alphabet to Microsoft spending billions to get there first.

Jeff is betting on Nvidia's AI Factories being the missing piece to the superintelligence puzzle and supplier stocks is how he's playing it.

Nvidia's Magnificent Seven Stocks

Halfway into Jeff's 1 hour and 16 minute-long video presentation, we get to the good stuff…clues about Nvidia's supplier stocks.

1st Magnificent Seven Stock

- The first company is the only one in the world that can assemble Nvidia's next-gen AI chips.

- It has a near monopoly for it's services.

Assembly, near monopoly, this is Taiwan Semiconductor Manufacturing Co. (NYSE: TSM).

- TSMC is the primary supplier of Nvidia chips.

- As of the latest print, TSMC still holds a dominant share (70%) of the semiconductor chip manufacturing market.

2nd Magnificent Seven Stock

- This is Jeff's “highest conviction play” because it supplies Nvidia's chips with high-bandwith memory.

- It recently announced a new technology that dramatically boosts AI memory storage.

A few companies supply Nvidia with memory modules, but the one that recently announced new AI-optimized memory chips is Micron Technology Inc. (Nasdaq: MU).

3rd Magnificent Seven Stock

- This company replaces silicon in Nvidia's AI chips.

- Unlike silicon, this material is able to withstand high voltage.

Jeff's third pick is Navitas Semiconductor Corp. (Nasdaq: NVTS).

- Earlier this year, Navitas was selected by Nvidia to supply it with silicon carbide-based semiconductors.

- Silicon carbide is known to improve power efficiency in electronics.

4th Magnificent Seven AI Stock

- The fourth pick provides liquid cooling systems for Nvidia's AI factories that prevent them from overheating.

- It's CEO has been quoted saying: “We are a key player in Nvidia's ecosystem.”

The most likely pick here is Super Micro Computer Inc. (Nasdaq: SMCI), which supplies rack-scale liquid-cooled platforms for Nvidia's Blackwell and upcoming AI factories.

5th Magnificent Seven Stock

- This well-established company recently pivoted to partner with Nvidia.

- It helped make the world's first “AI factory in a box.”

No way to be 100% certain, but this sounds like it could be Dell Technologies Inc. (NYSE: DELL).

- It's not a factory in a box, but Dell's partnership with Nvidia has been referred to as “AI Factory 2.0” because it supplies enterprise clients with everything needed to power the development of AI.

6th Magnificent Seven Stock

- The company supplies critical grid-to-chip power management.

- It's solutions ensure steady, safe waste-free electricity flow.

Much like Jeff's second pick, a few companies supply Nvidia with power management solutions. However, I'm thinking Flex Ltd. (Nasdaq: FLEX) is Jeff's pick.

- Not only does Flex collaborate with Nvidia, but it supplies rack power systems that help data center operators overcome power, heat, and scale challenges.

- Flex's solutions prioritize decreased water consumption and waste reduction.

7th Magnificent Seven Stock

- According to Jeff, this is the “rarest jewel in Nvidia's crown.”

- This company has a true monopoly on printing AI superchip circuits.

This can only be one company – ASML Holding N.V. (Nasdaq: ASML)*, which is the only business in the world designing and manufacturing photolithography machines that use light to print intricate circuit patterns onto silicon wafers.

Make 1,200% or more?

There's a lot riding on AI's robotic shoulders, like the entire global economy, by some accounts.

As I recently mentioned in another teaser review, I fully expect AI to deliver on it's promise over the long-term. However, things could get rocky over the short-term, given how stretched valuations are.

If you already own any of “Nvidia's Magnificent Seven” I wouldn't rush to sell them, as valuations are still reasonable. Especially in comparison to the original magnificent seven.

But are there any solid buys left among the group that provide both value and upside?

TSMC and ASML* are the most obvious plays, given their defensible market positions.

However, at only 17x earnings with a 1.6% annual dividend, Dell is an overlooked AI infrastructure play whose revenue still primarily comes from it's legacy computers and peripherals business.

Immediate expectations should be tempered, but businesses possessing solid underlying economics and defensible market positions will continue to outperform over the long run.

Quick Recap & Conclusion

- Tech investor Jeff Brown believes AI has reached a critical chokepoint, but Nvidia’s next big breakthrough, and it's seven strategic partners called Nvidia’s “Magnificent Seven Stocks” are the answer.

- This “Next 100x” breakthrough is Nvidia's AI Factories, which could be the final step to making physical AI a reality and a few, select supplier stocks will surge once this happens.

- Their names have all been revealed in a new report called Nvidia’s Magnificent Seven: How to Pocket Generational Wealth in America’s FINAL AI Boom. A subscription to Jeff's Near Future Report newsletter is required and it costs $179 upfront for the first year (normally $499).

- Fortunately, you got them all here for free – Taiwan Semiconductor Manufacturing Co. (NYSE: TSM), Micron Technology Inc. (Nasdaq: MU), Navitas Semiconductor Corp. (Nasdaq: NVTS), Super Micro Computer Inc. (Nasdaq: SMCI), Dell Technologies Inc. (NYSE: DELL), Flex Ltd. (Nasdaq: FLEX), and ASML Holding N.V. (Nasdaq: ASML)*.

- TSMC, ASML*, and Dell are the best businesses of the bunch, which are trading for high, but not totally unreasonable multiples.

Will Nvidia's AI Factories live up to the hype? Leave your thoughts in the comments.

*The writer owns shares in ASML Holding N.V. (Nasdaq: ASML).

Great job. Thanks for doing the heavy lifting!