I'm sure you're familiar with the term “hope for the best, but prepare for the worst.” Well, we may all be about to live it.

From tens of thousands of layoffs to bank failures, and a relentless surge in the cost of living, a “Breaking Point” is fast approaching according to former Goldman Sachs director Nomi Prins, but there are a few things we can do to not be caught off-guard in the weeks ahead.

The Teaser

You might think this sounds crazy, but a recession is the least of our worries. What is about to happen will be historic and unfortunately not in a good way.

To call Nomi Prins a bear would be like calling Peter Schiff pessimistic about the U.S. economy. It would be a massive understatement. We have taken an in-depth look at Nomi's growing reputation as a girl who cried wolf and a similar uber-bearish presentation called the “Dollar Endgame” from early July.

According to our esteemed presenter, understanding the details of the strange financial story currently unfolding could mean the difference between a worry-free retirement and years of pain and financial hardship. No pressure.

The mainstream media is stoking fears of a recession, but as usual, their message is dead wrong.

Instead, a major threat to our financial system is fast emerging and Nomi is calling it the “biggest risk to the U.S. banking system in American history.”

The Truth About America’s Next ‘Recession'

What is actually about to happen is a rare economic event called a ‘price shock’.

This is when the cost of some items will soar while others will crater, which may sound surprising, but it has happened before.

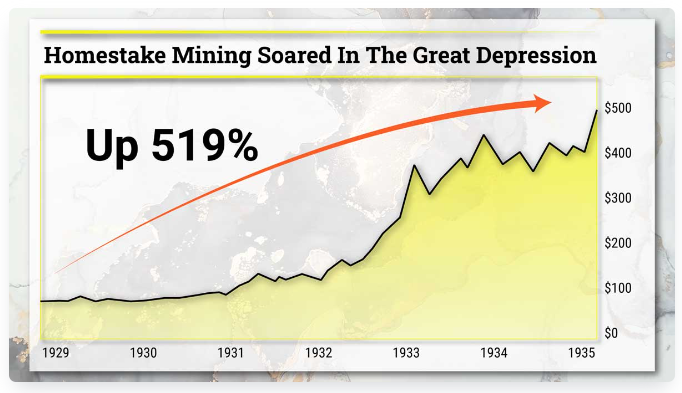

Take the Great Depression from 1929 to 1933 as an example. Banks across America fell like dominoes and millions lost their jobs and life savings.

But what is less documented is the price shocks over the ensuing few years.

A price shock struck the U.S. housing market, where prices fell by -67%. Meanwhile, oil soared 60% higher in the aftermath of the crisis. Americans who saw this coming had a chance to make a fortune.

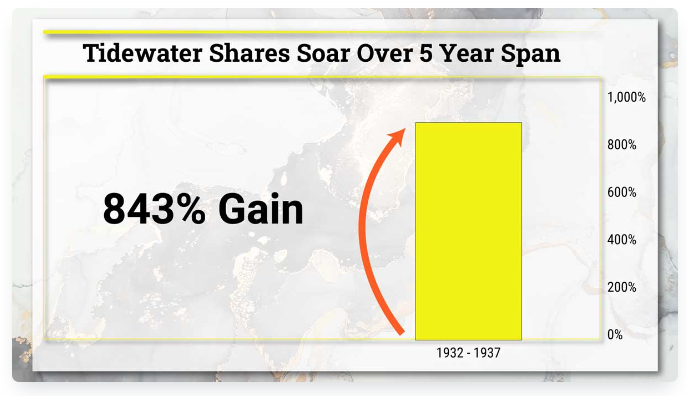

Some like oil baron J. Paul Getty did. He purchased shares of TideWater Associated Oil Company for $2.12 apiece in 1932 and five years later they were worth more than $20. A tidy 843% gain that anyone could have captured.

The same pattern has played out a few times over the last 100 years or so. Like during the Savings & Loan crisis of the 1980s and more recently, the Great Recession of 2008.

Now America is reaching its next breaking point, where trillions of dollars will rush out of some sectors and into others.

The Pitch

Nomi says she has found one single company primed to profit from all the chaos and she's put all the details on it inside a special report called The #1 Gold Stock for 2023 and Beyond.

The only way to get a copy is to sign up for a risk-free trial of Nomi's flagship research service, Distortion Report. A one-year subscription to Distortion Report is usually $199 but they have dropped this by 75% to only $49, in keeping with the theme of the presentation.

For this price, we would receive 12 monthly issues of the Distortion Report, two additional special reports, and a 60-day money-back guarantee.

America's Next Breaking Point

Practically each and every ‘breaking point’ has resulted in the same outcome – prices on some things soar, while others crash.

This is a solid beginning to not getting completely blindsided, but it's one thing to know a breaking point in the financial system is coming and another to know where to put your money.

Many More Banks Will Fail

If Nomi is right about more bank failures being imminent, based on a ‘restricted’ report circulated inside the Federal Reserve on February 14th that was eventually released to the public in April.

And the FDIC, which is supposed to protect depositors from such failures (up to $250,000 per account) is essentially insolvent, with ‘only' $128 billion in its account, while facing up to $1.7 trillion in prospective losses under such a scenario.

Then it follows that in the midst of such a wide-scale panic, money will rush into certain assets.

For starters, Nomi is convinced we could conservatively make at least three times our money or more if we just move a portion of our deposits from our bank accounts immediately.

The second thing is buying a safe haven asset, like gold.

To stem the bleeding and refill the Treasury's coffers amid The Great Depression, President Franklin Roosevelt ordered the confiscation of gold in 1933.

Under penalty of fines and prison, the government forced Americans to turn in all gold of more than $100, paying $20.67 for every single ounce turned in.

Then, with the stroke of a pen, Roosevelt hiked the price up to $35 per ounce, essentially causing a price shock that ended with Americans losing 69% of their hard-earned savings.

However, investors who shifted some of their nest eggs into Homestake Mining stock beforehand could have captured gains of 519% on the other side of the price shock, in just two years!

The world’s Central Banks are buying gold at a record pace for a reason and Nomi believes it’s virtually guaranteed the ‘barbarous relic' will set new records during the next ‘breaking point’ in the financial system.

This is why the top thing to do is move our money into a gold stock that is among the world’s top mining companies.

Revealing Nomi Prins' #1 Gold Stock…for 2023 and Beyond

Here is everything we know about the gold miner:

- It’s been around for decades. So it’s more efficient than nearly every other miner at getting gold out of the ground at the lowest cost.

- Over the last few years, this firm has set into motion a domino effect, structuring a cascade of deals that will put millions of ounces of gold into its vaults not only for the next few years but for decades to come.

- Insulated from the chaos by its remote mining locations, it will become one of the world’s top-performing businesses.

Very general info, but I'm willing to bet Nomi's pick is Barrick Gold Corp. (NYSE: GOLD).

- Barrick has been mining gold since 1983 and is among the lowest-cost gold miners in the world.

- The producer has been busy over the past few years, merging with Randgold Resources in a $6.5 billion dollar deal and forming a joint venture with Newmont Corp., among other projects.

- Some of Barrick's mine locations include Peru, Tanzania, and Mali, which are about as remote as it gets.

Profits Out of Chaos?

Let me start by saying that I agree with Nomi's premise that the next “breaking point” will be a bank/dollar crisis.

I have also put into practice her recommendation of keeping a tidy sum of money outside of my checking and savings account at the bank.

However, I am treading carefully on Barrick Gold stock. At least as a stand-alone investment.

Assuming it completely hits the fan, as an NYSE component and $28 billion dollar company, Barrick's shares would get battered along with all the other companies listed on the main exchanges.

But if one can stomach some volatility, Barrick Gold and its unmatched array of Tier One gold and copper assets would backstop a complete freefall and should do well as part of a larger portfolio of hard assets like real estate and resources over the long term.

Quick Recap & Conclusion

- Former Goldman Sachs director Nomi Prins is teasing a “Breaking Point” for the American economy that could end up being worse than the Great Depression.

- Before this happens, we should move a portion of our deposits from our bank accounts immediately and the second thing we ought to do is buy a safe haven asset, like gold.

- Nomi says she has found one gold mining company primed to profit from all the chaos and she's put all the details on it inside a special report called The #1 Gold Stock for 2023 and Beyond.

- All we got were some generic clues, but this was enough to reveal Nomi's pick as Barrick Gold Corp. (NYSE: GOLD).

- Barrick is one of the highest-quality gold producer stocks on the market and buying into it around the current price should pay off over the long term.

What are some other top-tier resource stocks? Let readers know in the comment section below.