Since November Bitcoin has been on an absolute tear, gaining about 40%.

However, “Bitcoin expert” Nick Giambruno believes we still have one last chance to make transformative Bitcoin profits through a small group of stocks piggybacking the crypto megatrend, including a “#1 Bitcoin Stock“.

The Teaser

Nick originally released this teaser in the first half of last year, but a whole lot has happened since then.

Nick Giambruno is founder of The Financial Underground economic research site and Editor-in-Chief of its ‘Speculator' newsletter.

We have reviewed several Bitcoin-focused teasers in the past, such as Robert Ross’ “Next Gen Cryptos” And Brian Hicks’ “Bitcoin Loophole” Recommendation.

Nick's teaser is one of the more interesting ones.

This is because he is claiming to have found the key to enormous and fast gains from the Bitcoin megatrend.

- It's not ETFs

- Bitcoin futures contracts

- Or any other cryptocurrency

He's recommending we avoid all of these.

Instead, the real secret to making “transformational profits from the Bitcoin megatrend is a select number of tiny stocks” that anyone can access from an ordinary brokerage account.

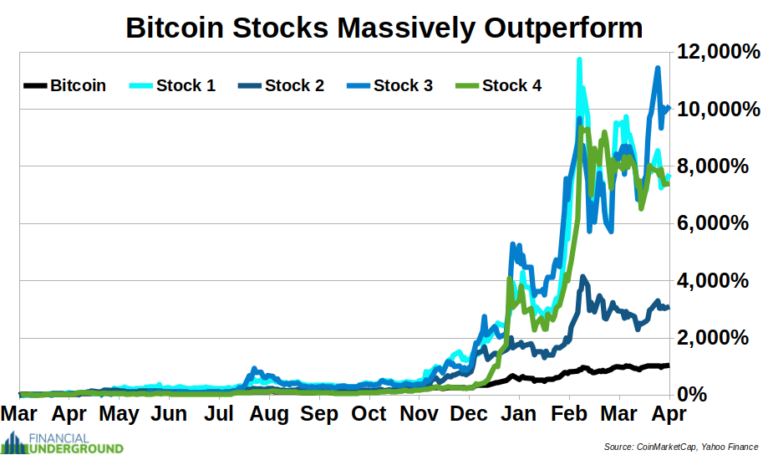

These have a history of massively outperforming Bitcoin and delivering enormous gains quickly, as this chart shows:

Perhaps most telling is that all of these publicly traded companies belong to a single industry…

The Bitcoin mining industry.

As of 2024, Bitcoin mining is still a growth market and it plays a crucial role in the Bitcoin ecosystem.

Mining is what keeps the blockchain behind the world's largest cryptocurrency going by constantly verifying that new transactions are legit and following the Bitcoin protocol.

For this critical yet tedious task, miners earn transaction fees and are awarded new Bitcoins.

Think of it as the digital equivalent of junior mining stocks which offer leveraged exposure to gold and silver. Only in this case, the exposure is to Bitcoin and the potential profits are even greater.

But what Bitcoin mining stocks should we be tapping into?

The Pitch

Like many others, Nick believes Bitcoin still has plenty of upside left.

This means a select few Bitcoin mining stocks could be set to go parabolic and their names, including Nick's top pick, are in a special report called The #1 Stock To Multiply Your Profits From Bitcoin's Next Upside Explosion.

The report along with a flurry of other bonus reports and additional perks are ours, if we subscribe to The Financial Underground's SPECULATOR newsletter for $1,799.

The Three Stages of Scarcity

Scarcity, hardness, rareness, whatever you want to call it. This is the primary reason Bitcoin and in turn, Bitcoin miners, are so lucrative.

See, there are three stages of scarcity, and the higher an asset is on the scale, the more valuable it becomes.

Artificial Scarcity

If we quantify scarcity by supply growth rate, the new supply produced in a year divided by the existing stockpiles. Then fiat currency is the least scarce asset.

It is artificially scarce.

Money's most essential function is to act as a store of value. However, an asset with a high supply growth rate cannot accomplish this.

By being able to arbitrarily inflate the supply, central banks and politicians have relegated fiat currencies to the status of a depreciating asset.

The same applies to most cryptocurrencies, as they have key players, insiders, and development teams that can inflate the supply or change the rules when they choose to.

Genuine Scarcity

Unlike paper money and most digital tokens, genuinely scarce assets are ‘hard' assets.

Gold and silver fall into this category.

Historically, gold has been mankind’s hardest asset with the lowest supply growth rate, which is why it has always been the best money.

Nobody can arbitrarily inflate the supply and there's no counterparty risk.

This is why gold has been money for over 5,000 years. But now, something many refer to as “digital gold” is taking its place.

Absolute Scarcity

Unlike every other commodity, increasing Bitcoin's supply in response to increased demand is not an option.

Bitcoin completely takes humans out of the equation.

Neither Central banks, governments, or even Satoshi Nakamoto (whatever he or it is) can alter the supply of Bitcoin.

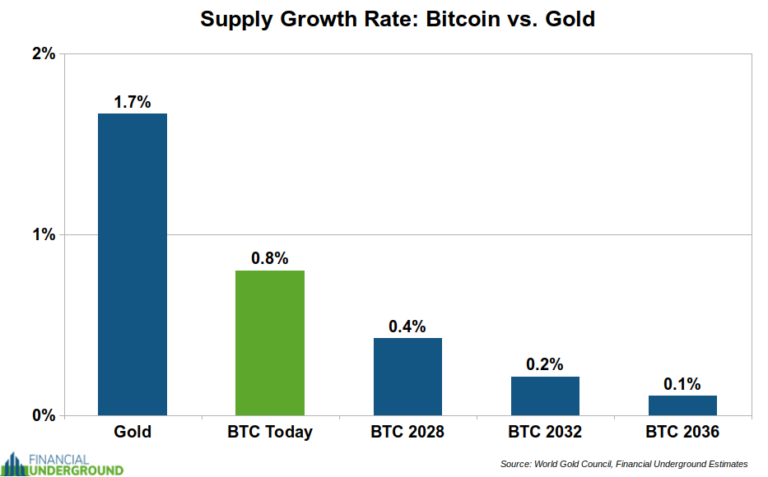

Today, Bitcoin’s supply growth rate is about 0.8%, half of gold’s (1.7%).

Not only this but Bitcoin's supply is automatically halved every four years.

This makes Bitcoin absolutely scarce, which means Bitcoin miners are producing the most valuable asset in the world.

Let's find out which miner Nick has singled out as having the most profit potential.

Revealing Nick Giambruno's #1 Bitcoin Stock

Nick believes this stock is the best way to position ourselves for Bitcoin's next upside explosion. Here is what we know about it:

- This Bitcoin miner is tapping into ultra-cheap renewable energy to mine Bitcoin with some of the lowest electricity costs in the world.

- It mines Bitcoin with 100% renewable energy.

Not much to go on, but it was enough to reveal the pick as Gryphon Digital Mining Inc. (Nasdaq: GRYP).

- Gryphon was established in 2020 as a pure-play Bitcoin miner with a zero carbon footprint.

- As of this past summer, Gryphon's mining operation was independently certified as 100% carbon-neutral.

As for other Bitcoin miner picks, no clues were forthcoming. But is Gryphon what we should be putting our hard-earned money into now?

A Return of 32x, 75x, or Higher?

The last time we checked in on Gryphon, it was underwater, with fewer assets than liabilities, and its stock was down more than 90% for the year in 2024.

Has anything changed?

In Q3 2024, Gryphon converted approximately $13 million of its $19 million debt into equity at a 100% premium to its stock price at the time.

This has had the effect of improving the company's balance sheet, but not completely repairing it. It remains underwater, albeit to a lesser extent.

As for the stock, it is up a modest 4% year-to-date. However, it may be too little, too late.

Gryphon was hit with a delisting notice by the Nasdaq for failing to meet its minimum Market Value of Listed Securities requirement.

This was back in September and Gryphon now has until March 4th to maintain a closing bid price of at least $1.00 for ten consecutive days. As I write this, it currently sits at just over $0.40.

At this stage, there are better Bitcoin mining plays that are on much firmer financial footing, such as Stronghold Digital Mining (lowest power cost) and Marathon Digital Holdings (best hash rate).

Gryphon may be salvageable as a company. But you are much more likely to lose your investment at this point then make 75x your money.

Quick Recap & Conclusion

- “Bitcoin expert” Nick Giambruno believes we still have one last chance to make transformative Bitcoin profits through a small group of stocks piggybacking the crypto megatrend, including a “#1 Bitcoin Stock”.

- Bitcoin is the most scarce asset in the world, with a supply growth rate that is about half of gold’s. This makes Bitcoin miners producers of the most valuable asset in the world.

- The name of Nick's top Bitcoin mining pick is in a special report called The #1 Stock To Multiply Your Profits From Bitcoin's Next Upside Explosion. The only way to get is by subscribing to The Financial Underground's SPECULATOR newsletter for $1,799.

- Not many clues were given, but what we got was enough to reveal Nick's top pick for free as Gryphon Digital Mining Inc. (Nasdaq: GRYP).

- Gryphon is barely keeping its head above water and may be delisted from the Nasdaq if its stock doesn't outperform over the next two months. There are better Bitcoin miners available, including Stronghold Digital Mining and Marathon Digital Holdings.

What is your Bitcoin price prediction for 2025? Tell us in the comments.