According to The Motley Fool, the next major “AI Bottleneck” won't be in metals, chips or computing power, but in energy.

Insiders believe it could be just months away and one stock is positioned to solve it.

The Teaser

The global chip shortage wrought more havoc than an unsupervised toddler.

Since its notorious launch in the summer of 1993 promoting a fake sewage disposal company to teach a lesson about the dangers of penny stock investing. The Motley Fool has done very well for itself.

It's premium Stock Advisor service is up over 1,000% since inception in 2002 and we have reviewed some of it's picks, including Apple's AI Trojan Horse and “Frozen Gold” LNG Stock.

Getting back to the chip shortage, how bad was it really?

Well, 8 million fewer cars were made, iPhone production was also slashed, and all told, it cost the U.S. economy $240 billion.

However, some are now predicting that a far bigger crisis is now on its way.

These aren't just TV talking heads either, Meta CEO Mark Zuckerberg believes energy will be AI's biggest bottleneck.

Saying “before we hit compute limits, you're going to run into energy constraints.“

Amazon CEO Andy Jassy echoes this sentiment, telling the World Economic Forum that there's just not enough energy to go around.

Finally, the $1 trillion dollar man himself, Elon Musk, also predicted that AI will begin running into serious power issues by the middle of next year.

So, are the lights really about to go out for AI?

Most projections have AI using up around 12% of US electricity by 2030, but the exact magnitude of the coming demand is still largely uncertain.

However, most agree that the U.S. is facing a historic increase in electricity consumption.

Having traveled fairly widely and experienced some rolling blackouts firsthand, I can confirm that they aren't much fun, but at the same time, they can also be an investment opportunity.

The chip shortage saw companies like Nvidia go on a generational run and it will be no different for the top stock solving AI’s #1 bottleneck.

The Pitch

There's only one way to find out it's name and that's by becoming members of Stock Advisor Canada.

A full year of access costs $99 (normally $199) and comes with a 30-day fee-back guarantee.

The Solution to the AI Bottleneck

The energy industry is 11x bigger than the semiconductor chip market.

So, it stands to reason that a major energy shortage would have far greater consequences.

The most obvious solution, building more capacity, won't solve the near-term problem.

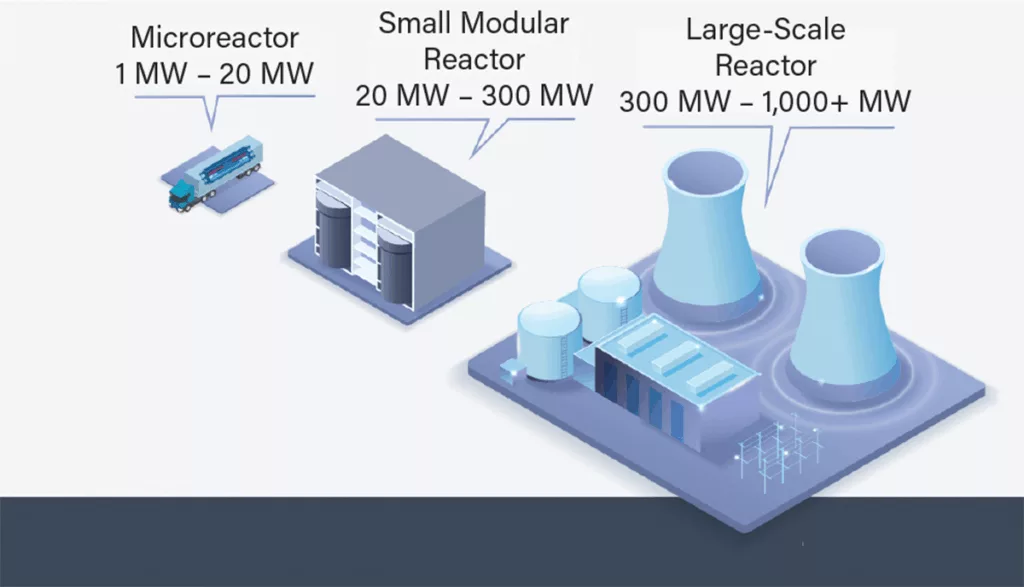

It takes years or potentially decades for clean power projects, like much-hyped nuclear power plants, to come online.

For example, between initial planning, permitting, and construction, it takes more than 10 years to complete a single nuclear power plant.

The timeline for pre-fabricated Advanced Small Modular Reactors (SMRs) is less, in theory, but despite an initial design approval in 2023, NuScale Power (NYSE: SMR) is still trying to get it's first SMR built.

This leaves only one solution…cutting power consumption.

Given an increasing population and accelerating demand from data centers, self-driving cars, robotics, etc. this is far easier said than done.

Heck, AI data centers alone are consuming energy at roughly four times the rate that more electricity is being added to grids.

However, one solution is gaining traction.

If you can't build more energy capacity, you have to make what you have more efficient.

This is where data storage efficiency comes in.

Flash memory technology reduces energy consumption in two primary ways:

- It utilizes solid-state drives (SSDs) that consume less power than traditional hard disk drives

- It takes up less physical space than other data storage solutions

One company claims it's technology can produce energy savings of as much as 85% and it's the Motley Fool's AI Bottleneck Stock.

Revealing The Motley Fool's AI Bottleneck Stock

The Motley Fool's promotional email doesn't offer much in the way of clues or info.

But we made the most out of what we did get:

- It is a mission-critical energy specialist, whose products can single-handedly cut power consumption at AI data centers by as much as 80%.

- This under-the-radar company is based out of Santa Clara, California.

- This relatively unknown company is 211x smaller than Nvidia.

The Fool's pick is Pure Storage Inc. (NYSE: PSTG). This is why we're so sure:

- On it's website, Pure Storage claims energy savings of up to 85% by using it's enterprise data storage solutions.

- Pure Storage is headquartered in Santa Clara, California.

- At a current market cap of just under $30 billion, Pure Storage is 150x smaller than Nvidia’s $4.5 trillion valuation.

Big Shortage Fueled Gains?

The Motley Fool's thesis rests on two things:

- A pronounced energy shortage over the short-term

- Pure Storage emerging as one of the top solutions

On the first claim, the U.S. Department of Energy (DOE) has warned that the risk of blackouts could dramatically increase if the U.S. continues to shutter reliable power sources and fails to add additional grid capacity.

Fortunately, it looks like the current Presidential administration is doing what it can avert such a scenario.

Trump's stated energy policy is all about unleashing natural resource exploration, which ultimately provides an affordable power supply.

Now, there's still a lot of work to be done on this front, but an inevitable energy grid collapse appears to have been averted, for now.

As far as Pure Storage being a top data storage solution, it definitely trades like it with a forward price/earnings multiple of 44x.

Does the business have the underlying economics to merit such a premium?

Pure Storage's operating margins, at under 1%, leave much to be desired. But it's Return on Equity (ROE) of 10% is decent and cash exceeds debt by nearly 7x, so it is building on a solid foundation.

In terms of growth, its high, at double digits on a quarterly basis.

This combination of profitable growth and financial flexibility is attractive, however, with no near-term energy blackout catalyst, I would look for a better entry point.

Big gains are still on the table, but they are unlikely to come over the short-term or be shortage-fueled.

Quick Recap & Conclusion

- The Motley Fool says the next major “AI Bottleneck” won't come from metals, chips, or computing power, but energy, and one stock is positioned to profit from it.

- The energy industry is 11x bigger than the semiconductor chip market and a major energy shortage would have far greater consequences. But it would also be an even greater investment opportunity.

- There's only one way to find out the Fool's #1 pick to solve the AI Bottleneck and that's by becoming members of Stock Advisor Canada. A full year of access costs $99 (normally $199).

- Despite the lack of info and clues found in the Fool's promotional email, we were able to reveal its pick for free…its Pure Storage Inc. (NYSE: PSTG).

- Pure Storage is a good business trading at a great business multiple. There's no imminent energy shortage catalyst, so waiting for a better entry point would be prudent.

Do you believe there will be a major energy shortage next year? Let us know in the comments.

Sounds too optimistic to me. 80 % power savings overall or just compared to hard disks? There is far more power in use in a data center than just for data storage. Also, do these disks have the same speed of access as HBW memory stacks? Speed is everything when you are trying to boost compute capability. How about heat generation which then mustbe cooled bya Vertiv system?