Artificial Intelligence is the hottest thing since the advent of the Internet. This has Marc Chaikin deeply concerned.

Although AI technology itself is here to stay, many of today's AI startups aren't, which is why Marc is sharing his #1 AI stock that is built to last.

The Teaser

The run-up in AI stocks is responsible for roughly half of the S&P 500's gains this year, which begs an important question…

Is AI in a bubble?

Marc Chaikin's career spans 50 years. That's longer than I've been alive and includes stints as a trader, stockbroker, and analyst. We have extensively reviewed Marc's Chaikin Analytics stock-rating system and the Power Gauge Report he promotes in this presentation.

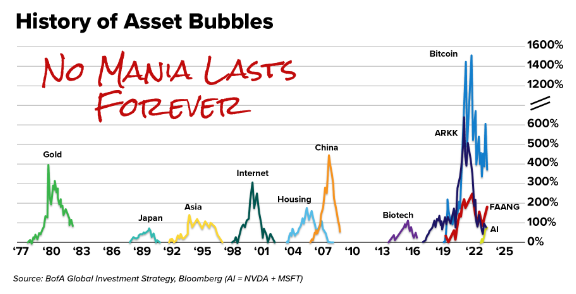

There always has been, and always will be, some “next big thing” that makes early investors a fortune and harms those who buy in too late.

This chart illustrates the most prominent examples of financial bubbles in our lifetimes:

But bubbles go back much further, like the Tulip Mania during the 17th Century Dutch Golden Age.

A wild time when the price of a Viceroy Tulip reached upwards of five times the cost of an average house at its peak.

While it's not a perfect one-to-one comparison, the price of a single high-end chip necessary for training and deploying AI software reached $40,000 on eBay earlier his year.

At the same time, we can't afford to ignore AI as an investment opportunity.

The top five stocks of the last thirty years have all been tech stocks and this trend is very likely to continue. However, Marc has a warning.

AI's Secret Dark Side

You're likely familiar with the expression: “A rising tide lifts all boats.”

This is AI right now, the rising tide lifting all boats in the sea.

The problem is, that most of the new boats seeing billions of dollars in investment are doomed!

Some estimates project that 85% of AI startups will go out of business in the next three years. This means that when the AI bubble bursts, as bubbles always do, we’ll see a devastating selloff.

Marc's Power Gauge has found a way to avoid this, by scanning the entire universe of AI stocks and pinpointing not just the ones with the highest profit potential, but also the least amount of risk.

The Pitch

Marc has compiled the names, tickers, and buying instructions for these stocks into a brand-new special report called Chaikin's AI Power Picks.

The only way to get it is by subscribing to the “world-renowned research service” known as the Power Gauge Report. A full year of the Power Gauge Report typically costs $199, but it's currently going for 75% off or $49. Consider it an early Christmas present…that you still have to pay for.

A few bonuses are included in a subscription, such as a shortlist of top stocks to avoid during the AI boom, access to a lite, easy-to-use version of his Power Gauge system, called Power Pulse, and a mystery gift that Marc says “could be transformative for our wealth in the weeks ahead“.

Marc's Real Intelligence System

Marc brags that his Power Gauge system can predict the future performance of thousands of stocks around the world.

All we have to do is merely type in a ticker and press enter. No artificial intelligence is used, just “real intelligence“.

What is the difference between the two exactly?

Marc breaks it down as such:

- Artificial Intelligence mimicks human thinking

- Real intelligence incorporates actual human thought

In short, the Power Gauge system integrates how some of Wall Street's most legendary investors like Paul Tudor Jones, Steven Cohen, and others analyze stocks across bull markets, bear markets, and everything in between.

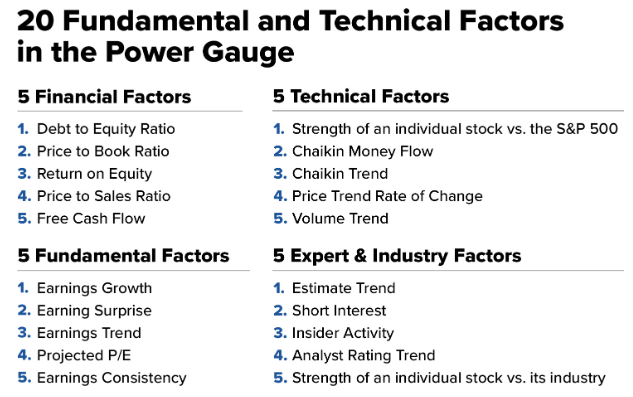

So instead of merely building a system that mimics successful investor's decisions using artificial intelligence, the Power Gauge system is based on real factors that dictate the decision-making of some of the most successful investors in history. Its a 20-factor model that looks like this:

As we can see, the model brings together the best of both worlds – data and experience, fundamental and technical. The human and the machine.

The Track Record

At the end of the day, only one thing matters in investing…results.

So how has the Power Gauge system fared to date?

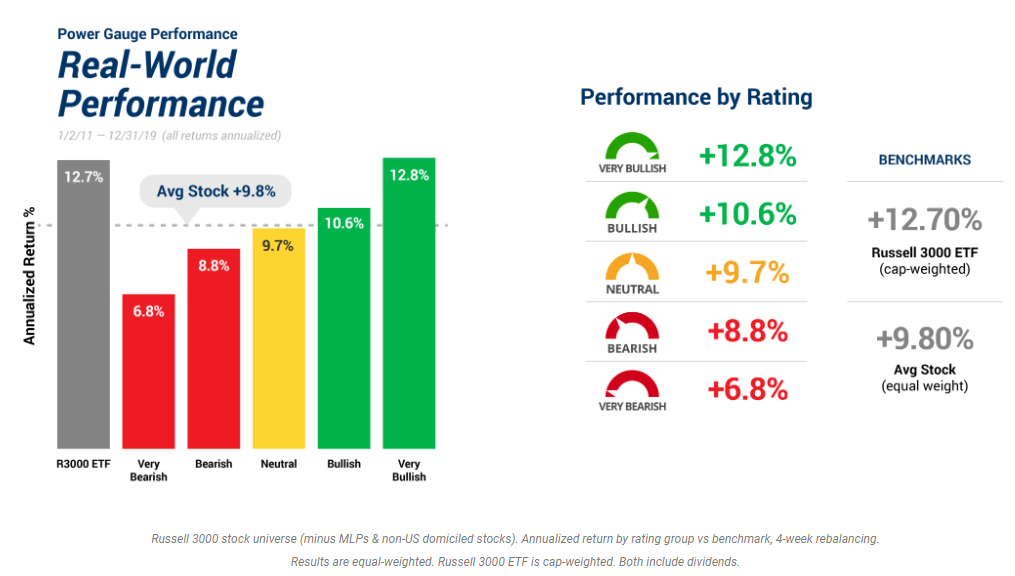

According to Marc's own website, which could use some updating, as real-world model performance is only displayed until the end of 2019. Power Gauge has fared ever-so slightly above-average.

It's not great, but its better than most hedge funds, if that counts for anything.

Would be interesting to see performance from 2020 onward, as that may determine whether its optimal to just buy a market index fund or try out Power Gauge for some additional alpha.

Marc's #1 AI pick and his power picks are all based on this Power Gauge system, which I will look at on an individual basis, like any old picks by a stock promoter.

Revealing Marc's AI Picks

Based on Marc's system, he predicts these will be among the top-performing stocks of the next 24 months.

Marc's #1 AI Pick

This is revealed to us as Pure Storage Inc. (NYSE: PSTG).

A “next-gen” data storage provider, Power Gauge likes the company for its earnings growth and positive expert and industry factors.

What about the power picks that can “double our money or more” very quickly?

No clues were provided, so we have a better chance of solving a decades old murder mystery than guessing the Power Gauge's “best” AI stocks on our own.

However, after some digging online past the first page of Google, I was able to find Marc's AI power picks or at least what a reader of his Power Gauge Report says are his AI power picks.

According to this anonymous person, they are as follows:

- Alphabet Inc. (Nasdaq: GOOG)

- IBM (NYSE: IBM)

- CrowdStrike Holdings Inc. (Nasdaq: CRWD)

- Box Inc. (NYSE: BOX)

- Adobe Inc. (Nasdaq: ADBE)

Without anything else to go on, there is no way I can verify these. So they should be taken with a grain of salt, but based on the Power Gauge system's previous picks, they do follow the same pattern of large-cap favoritism.

Double Our Money Or More?

A two-bagger is a pretty high threshold.

Especially when considering that besides data storage provider Pure Storage and cloud platform Box Inc. all of the Power Gauge system's picks are already large-caps on their way to being mega-cap stocks.

It takes a lot to move the needle at that size, like trying to steer a cruise ship instead of a dinghy boat.

That being said, all of the picks are well-positioned to capitalize on the AI boom and have plenty of juice and gains left to be squeezed from them. Some may even double or more, but this will take some time and won't happen over the short term.

Quick Recap & Conclusion

- Artificial Intelligence is the hottest thing around and Marc Chaikin promises to share the name and ticker of his #1 AI stock. But that's not the whole story.

- Current estimates project that 85% of AI startups will go out of business in the next three years. Marc's proprietary Power Gauge system has found a way to avoid these traps, and identify not just the ones with the highest profit potential, but also the least amount of risk.

- All of the names, tickers, and buying instructions have been compiled in a brand-new special report called Chaikin's AI Power Picks. The only way to get it is by subscribing to the “world-renowned research service” known as the Power Gauge Report, for a special discounted price of $49 for the first year.

- Marc reveals his #1 AI pick is Pure Storage Inc. (NYSE: PSTG) and his other AI power picks could be: Alphabet Inc. (Nasdaq: GOOG), IBM (NYSE: IBM), CrowdStrike Holdings Inc. (Nasdaq: CRWD), Box Inc. (NYSE: BOX), and Adobe Inc. (Nasdaq: ADBE).

- All of the AI picks, with two notable exceptions, are already large-cap stocks. This means we'll have to wait a while to double our money, but this is a distinct possibility given AI's explosive potential.

What is your favorite AI stock pick? Tell us in the comments.