Tech sector specialist Luke Lango says the U.S. federal government is doing something it has never done before.

It is picking the next stock market winners and he is here to share “The U.S. Government's AI Shortlist.”

The Teaser

We're officially in uncharted territory, with some of the biggest market gains of the past year being entirely due to the White House.

When he's not publishing teasers about Apple's Silent Supplier Stocks and AI Software Firms, Luke Lango is the Chief Technology Analyst at InvestorPlace. One of the largest investment newsletter publishers in the nation.

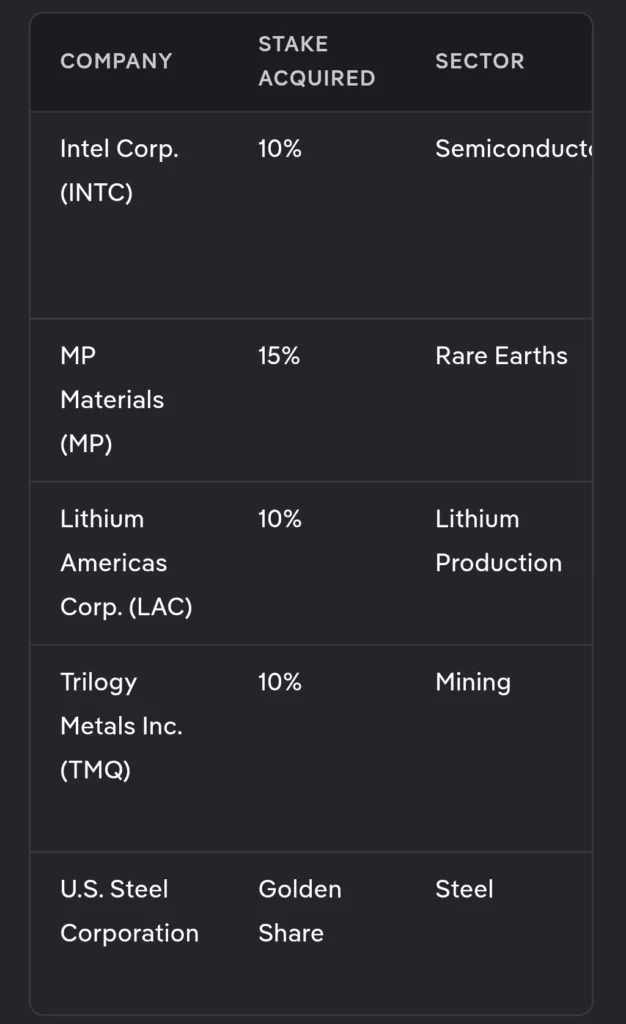

Over the past odd year, the Trump administration has cited national security to stake claims and golden shares, in several major public companies.

It marks the first time that Big Brother has intervened in public markets since the 2008 financial crisis.

That was under slightly different circumstances to say the least, but the end results could be the same. Billions in profits for The Man and soon, investors too, if the speculated IPO comes to fruition.

If we go back even further, an argument can be made that some of the most profitable businesses throughout history, have been government-backed enterprises.

The Dutch East India Company, John Law's Mississippi Company, and Saudi Aramco, which reported more than $100 billion in profits for fiscal 2024, all come to mind.

Luke recognizes this pattern too and says:

If we want to make very large gains, in a very short period of time, “The President's Portfolio” is arguably the single best opportunity in the markets today

Just like overseas trade in the past, artificial intelligence (AI) is our generation's “gold rush”, and whoever controls it, controls the future.

Almost every major world power is going all in on it, including the United States, and Luke thinks he's found the AI companies that the government is investing in next.

The Pitch

The names can be found inside a detailed new report called: The U.S. Goverment's AI Shortlist.

We can get it with a subscription to Luke's “high-end research service” Early Stage Investor, which costs $1,799 upfront for the first year (normally $4,000).

America's AI Action Plan

This story boils down to two things:

#1 America's need to win the AI race.

#2 The unprecedented steps that the U.S. government is taking to boost the domestic tech and mineral companies that are mission critical to the first thing.

However, the most interesting thing of all may be the creation of The Office of Strategic Capital (OSC).

This sounds like a proper name for a piggybank, but it is actually a Department of War office established by the Trump administration with a clear mission: To attract and deploy capital into critical technologies that support U.S. national security.

Some call the OSC the most consequential government agency since the creation of DARPA in 1958, which developed the precursor to the Internet.

Now, the internet has given us cat memes and social media, so the OSC has it's work cut out for it.

Earlier this year, it started it's journey by releasing a report outlining over 30 critical areas of investment.

No surprise, AI topped the list.

If we dig deeper into the report, the entire AI supply chain is well represented, rare earths, nuclear power, software and hardware, semiconductors, and more.

This is the document and themes Luke is using to try and find the companies that are next on the Government's AI Shortlist. Let's see what he's got for us.

Revealing Luke Lango's Stocks for the U.S. Government's AI Shortlist

All told, Luke has identified seven companies that he sees making the government's AI shortlist.

Each is in an industry deemed critical by the White House, starting with rare earths and magnets.

The first picks and shovels plays is revealed in the presentation as MP Materials (NYSE: MP)*.

The next one is…

A Critical AI Play

- It's a way to claim a stake in OpenAI, via a publicly traded investment fund.

- We can still buy into it for about $10 per share.

This wasn't hard, all we had to do was consult our previous teaser review on OpenAI's Pre-IPO Shares. It's SuRo Capital Corp. (Nasdaq: SSSS).

- SuRo in-directly owns OpenAI shares via it's stake in Cathy Woods' ARK Type One Deep Ventures Fund LLC

- Shares of the high-growth investment fund currently go for around $9.

Luke's third pick is a semiconductor company like Nvidia, that could very well become America's next top supplier of AI chips.

This is GlobalFoundries Inc. (Nasdaq: GFS).

The fourth…unfortunately there is no further info provided on the fourth, fifth, sixth, or the seventh pick. Just a call to pick up the Early Stage Investor newsletter.

Disappointing to be sure, but we've seen the kind of returns previous government-backed monopolies and companies have produced. This could be another such opportunity.

The Best Way to Make 500% or 1,000%?

Luke's teaser does one thing better than any other.

It fully embraces the crony capitalist system we find ourselves in and proposes a way to profit from it.

Front-running government investments is how Congress and Senate members get rich, so why not us?

Well, this isn't quite as lucrative as being a Washington D.C. swamp creature, since Luke admits that “it's impossible to know how many of his picks will be tapped by the U.S. government in the weeks and months to come.”

But he is extremely confident that we'll see a string of huge winners from the government's AI shortlist.

It's a plausible thesis and the first pick, MP Materials*, has already made good, appreciating by more than 200% after the Department of War became it's largest shareholder this summer.

The second pick, our backdoor OpenAI play, SuRo Capital, has also fared above-average. It's returned over 50%, pays a 5% dividend, and still sells for slightly below net asset value (NAV).

A good pick up, although I have my doubts about how much higher OpenAI's valuation can go.

As for the last pick that we know anything about, GlobalFoundries, it's the biggest question mark.

No direct U.S. government equity investment, just milestone-based funding.

Despite more than $5 billion going into the chip foundry to date, revenue and profits have been a rollercoaster ride, with both on a downward trajectory since 2022.

However, shares remain reasonably priced at 18x forward earnings.

Given the billions that have already been pumped into the chipmaker and the Trump admin's propensity for equity investments, I can see at least a portion of the funding getting converted into shares at some point, and the stock jumping on the news.

I don't know about this being the best way to score a five or ten-baggar, but it's definitely not the worst way.

Quick Recap & Conclusion

- Tech sector specialist Luke Lango says the U.S. federal government is picking the next stock market winners and he's sharing “The U.S. Government's AI Shortlist.”

- The teaser is based on The Office of Strategic Capital (OSC) and it's publicly released report outlining over 30 critical areas of investment.

- Luke uses the themes in this report to try and identify the AI companies that the government is investing in next. The names can be found inside a detailed new report called: The U.S. Goverment's AI Shortlist. But it's not free and it costs $1,799 to get our hands on it.

- What is free is two of Luke's picks, which he reveals as MP Materials (NYSE: MP)* and GlobalFoundries Inc. (Nasdaq: GFS), as well as his backdoor OpenAI play, which we were able to reveal as SuRo Capital Corp. (Nasdaq: SSSS).

- Overall, a solid investment thesis and the picks still have lots of room to run over the long-term.

How do you feel about the government investing directly in essential industries? Let it all out in the comments.

*Disclosure: The writer owns shares of MP Materials (NYSE: MP).

Think Biden did the same.

Your knowledge and comments are always awesome. Hoping others will reply with more input.