Artificial intelligence became part of popular culture over two years ago.

But veteran tech analyst Luke Lango believes a singular event – AI ‘Day One', will kick off its next phase and the best way to profit is with some “AI Applier” stocks.

The Teaser

This event will alter the trajectory of history, but it won't be the first time.

We are familiar with Luke's work here at Greenbull, having previously revealed his x.AI Supplier Company and “A.I. 2.0” Stocks.

This is how we were able to know that the beginning of this teaser is trademark Lango – an event promising to alter or transform civilization as we know it, followed by some aggressive profit projections.

It's like the boy who cried wolf one too many times.

However, there is historical precedent to a ‘Day One' event.

The first website went live in 1991, but the web's ‘Day One' came five years later, when Amazon made its first online sale, vaulting the new technology into the worldwide consciousness.

Similarly, Blackberry released the first smartphone in 1999.

But the market's true ‘Day One' was eight years later, when Steve Jobs announced the first iPhone, marking the beginning of a new era.

Now in 2025, Luke says a ‘Day One' event will make the version of ChatGPT that launched in 2022 “look as relevant as a VHS tape“.

Nothing will be the same after AI Day One, so what exactly will this disruptive event be?

Gradually, then Suddenly

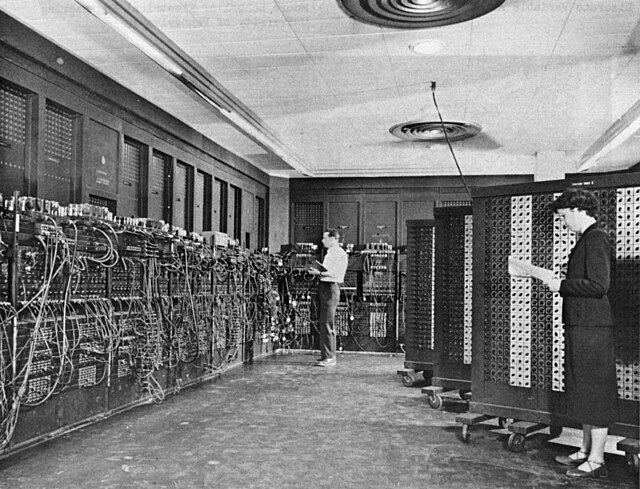

When it comes to new technology, the changes each new iteration brings don’t happen overnight.

For example, no one who saw the first computer 70 years ago, which was the size of a living room, could have imagined where they are today.

But after years of advancing at relatively modest rates, computing power is now advancing at mind-blowing exponential rates.

Gradually, then suddenly.

At the current pace of progress, with computing power doubling every 18 months, this year is when a computer with the processing power of the human brain arrives.

Luke thinks it is basically already here in the form of a new AI technology called “o1” and he's found the best stocks to own during this next phase of the AI revolution.

The Pitch

The names and ticker symbols of these stocks are found only in a special report called The AI Day One Portfolio: 7 Stocks That Could Go Parabolic in 2025.

There's only one way to get it and that's with a subscription to the new special situation research project called AI Revolution Portfolio.

Normally, the AI Revolution Portfolio retails for $5,000. But it is now 70% off, at $1,495 for the first year. This includes a 90-day money-back guarantee, two more special reports, instant portfolio alerts, and more.

The Next Phase of AI

There are a lot of AI models out right now.

However, these are mostly just chatbots capable of conversational language and not much else.

In other words, responses are based on pre-programmed scripts and/or simple, rapid pattern matching. No thinking or reasoning is happening.

But late last year there was a huge breakthrough.

OpenAI (the maker of ChatGPT), announced a landmark new AI model named “o1” that is capable of “doing more time thinking before it responds” and complex reasoning.

This is the next phase of AI.

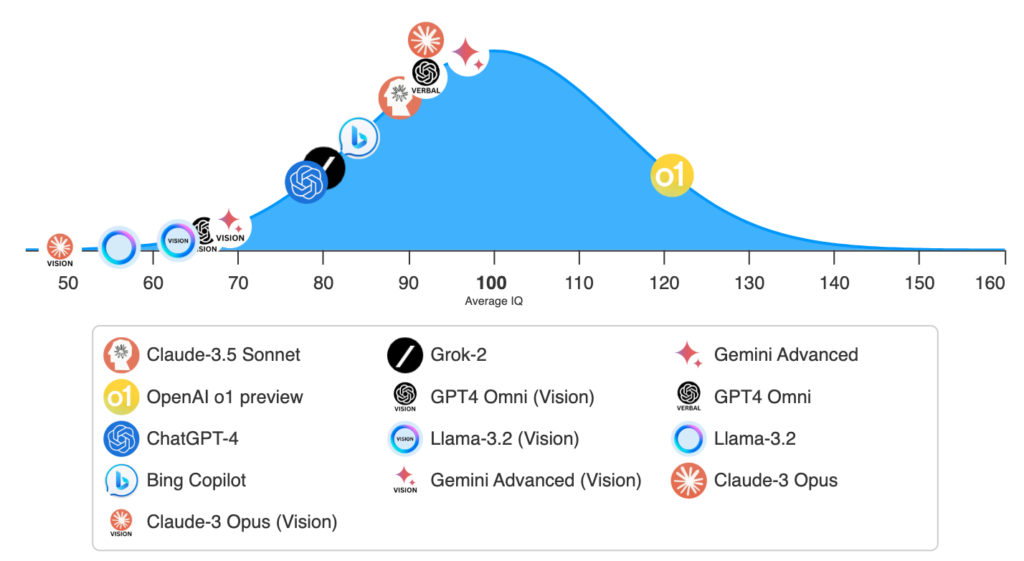

Consider this, something called the TrackingAI project quizzes a variety of AI models every week to test their IQ.

Most current models, such as ChatGPT 4, Llama, Claude, Grok, and Bing Copilot, score around 80 to 90 on these IQ tests.

The average human IQ is around 100. So current AI models are slightly less ‘intelligent’ than the average human.

But not OpenAI's o1.

It scored just below the commonly accepted threshold for a genius, an IQ above 130.

Deliberate reasoning is a true quantum leap forward in AI development.

Now that o1 is live as of last month, Luke expects things to accelerate quickly and he has some second-generation AI companies that he's investing in.

Luke Lango's AI ‘Day One' Stocks

Luke calls ChatGPT a foundational model.

It must be applied and used innovatively to extract value from it.

So-called “AI Appliers” will be the big winners of the next phase of AI and earlier in the pitch Luke teased seven applier stocks.

In the end, we got no clues, and only one pick was revealed.

That pick is big pharma blue chip Eli Lilly And Co. (NYSE: LLY), which is applying AI to develop new therapies.

Even though we didn't get any other names, what are some other possible “AI Applier” stocks, and is Eli Lilly worth considering?

3, 5, even 10X gains?

Before we get to the good stuff, let's first address the teaser's biggest claim that “AI will create more wealth than any other previous technology in human history.”

By comparison, the digital economy created by the Internet currently makes up more than 12% of the United States' annual GDP.

Although it's still early in the game, AI's contribution is expected to surpass this figure by 2030.

Some adamantly dispute this and say that AI will provide just a 1% boost to GDP over the next decade.

If we land somewhere in the middle and assume that AI will contribute 4-5% to the economy over the next 10 years and extrapolate this figure out by two or three decades. It's feasible that AI's impact will be greater than the internet by 2050.

In such a scenario, getting into the right plays now could easily net us a five-bagger, ten-bagger, or more.

Is Eli Lilly one of these plays?

On its face, this is a confusing pick.

Near the end of his pitch, Luke stated that “if we want to make serious money over the next year or two, the likes of Nvidia or Microsoft are not what he’d recommend.”

They will be powerhouses for years to come, but they’ve already experienced their hypergrowth phase and can’t get too much bigger.

Well, Eli Lilly fits this description.

Its hypergrowth phase is behind it and at a market cap of nearly $750 billion, it won't get too much bigger.

Some “AI Applier” picks that could end up being multi-baggers just based on their relatively small size and conservative valuations include:

- Trimble Inc. (Nasdaq: TRMB) = AI applied to logistics

- Teradyne Inc. (Nasdaq: TER) = AI applied to manufacturing.

- Real Brokerage Inc. (Nasdaq: REAX) = AI applied to real estate brokerage

In any case, the small-cap/mid-cap space is where to look for the next big AI winners.

Quick Recap & Conclusion

- Veteran tech analyst Luke Lango believes a singular event – AI ‘Day One', will kick off the biggest, fastest societal changes in human history and the best way to get rich from it is with some “AI Applier” stock.

- This next phase of artificial intelligence kicked off just before the new year and it's all about advanced models capable of complex reasoning.

- The names and ticker symbols of Luke's AI ‘Day One' picks are only found in a special report called The AI Day One Portfolio: 7 Stocks That Could Go Parabolic in 2025. There's only one way to get it and that's with a subscription to the new special situation research project called AI Revolution Portfolio, which costs $1,495 for the first year.

- No clues were provided on any of these picks and only one was revealed – Eli Lilly And Co. (NYSE: LLY).

- There are much better examples of companies applying AI to specific industries, that are smaller and more conservatively valued, including Trimble Inc. (Nasdaq: TRMB), Teradyne Inc. (Nasdaq: TER), and Real Brokerage Inc. (Nasdaq: REAX), among others.

What is your favorite example of a company applying AI to its business? Let readers know in the comments.