Host Lauren Sivan and “one of the greatest investors of our lifetime,” Louis Navellier, are teasing a new way to collect regular cash payouts from several “Trump/AI Convergence” Stocks they're calling the fastest wealth-creation tool ever.

It's all being unleashed by the convergence of President Trump’s aggressive pro-growth agenda and the AI Super Boom, but is this the real deal or just more newsletter hype?

The Teaser

It all dates back to World War II, when a tactical secret led to the development of the groundbreaking field of predictive analytics.

Louis Navellier takes a quantitative approach to investing that includes his own proprietary stock-picking system, which is being promoted throughout this teaser.

We have previously reviewed said stock-picking system and also revealed some of his more recent picks, including a handful of AI Proliferation Stocks.

Louis's renowned algorithm is a combination of fundamental principles mixed with highly selective quantitative analysis.

Built on the foundation of predictive analytics, that future outcomes can be predicted with reasonable accuracy by using historical data combined with statistical modeling and data mining techniques. It aims to zero in on stocks (no options or futures) about to hit their stride.

Those with “obscene earnings and sales growth,” as Louis puts it.

Louis has been successful at finding such stocks in the past. Buying into the likes of Microsoft, Cisco, and Dell in the late 80s and early 90s, respectively.

The list of his top 40 investments is ridiculous:

So, the credibility is there.

His “income strategy”, however, is an odd mixture, like chocolate-covered bacon.

Pulling Cash from the Market

Louis's strategy doesn't entail buying dividend-paying stocks, bonds, or using options to generate income.

Instead, unlike these traditional income strategies, it allows us to “pull cash from the market over and over again.”

Folks, Louis is talking about the ‘groundbreaking new strategy' of trading stocks on an intra-month basis.

The only difference is that he is using the momentum of the market and his proprietary algorithm, which has been let loose on the “Trump/AI Convergence” to pinpoint new opportunities.

The Pitch

Everything is outlined in a report called: 5 Trump/AI Convergence Growth Stocks to Buy Right This Second.

The only way to get it is to sign up for the Accelerated Profits newsletter for active traders.

A one-year membership typically costs $4,000, but for a limited time, we can get in ‘for just' $1,799.

To sweeten the offer, InvestorPlace is also offering a “$100k performance promise.” So if its model portfolio doesn't tally $100k in gains over the next year, they’re going to give you a second year for free.

An Unusual Shift

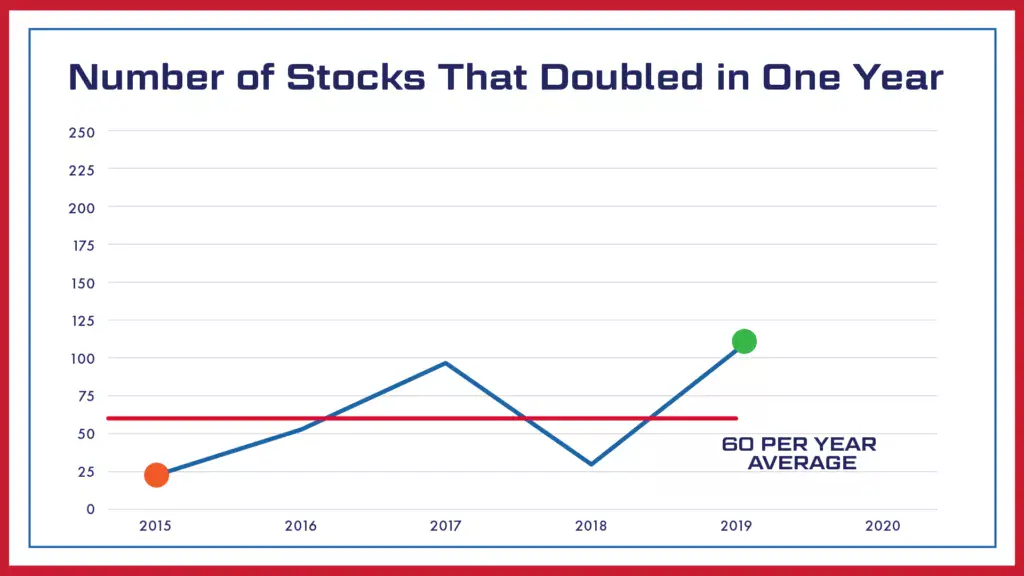

Between 2015-2019, an average of 60 companies per year saw their share price double.

However, in 2020, this number shot up to 234. A nearly 300% increase!

Ever since then, there has been no turning back.

In 2024, that number increased to 308, and this year could end up being even bigger.

So what happened?

Well, artificial intelligence happened.

After decades and years of advancing at relatively modest rates, AI began growing at mind-blowing exponential rates, starting with the release of OpenAI's GPT-3 in 2020.

This is also when Louis began to notice that more and more non-technology businesses began applying this new tech to their operations.

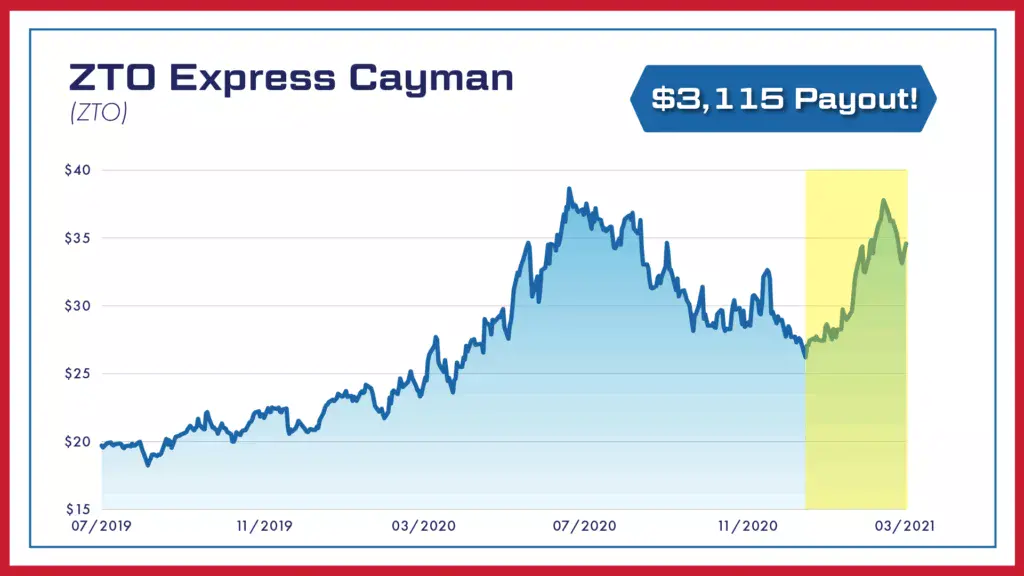

One example cited is ZTO Express, one of the largest courier services in China that uses GPS and self-driving delivery vehicles to deliver packages.

Louis traded its stock for a quick $3,115 payout when its shares jumped in January 2021.

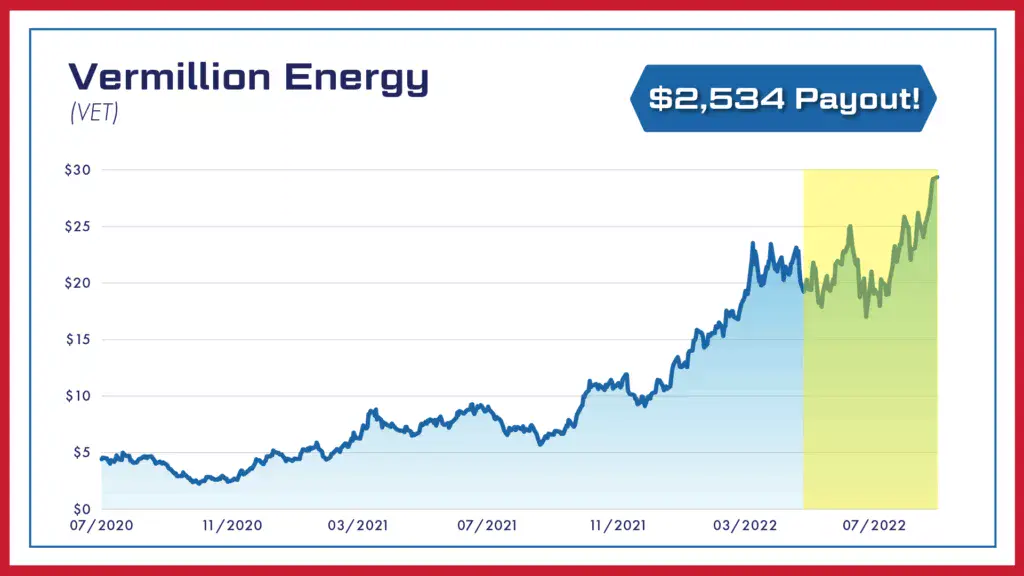

Vermillion Energy, a U.S. energy company that uses advanced algorithms to develop extended-reach wells that find unconventional reservoirs, is another example.

Louis made a nice little payday out of it, collecting $2,534.

You get the idea.

By focusing on smaller names that are applying AI to their business, we can repeatedly spot the fastest-moving stocks in the market and, most importantly, collect repeated cash payouts from them.

Trump’s return to office is simply throwing gasoline on this fire, given his pro-AI and business policies.

Combining this with the fastest-growing technology in history could equal a super boom, and Louis has five companies he believes will be the next iconic growth stocks to emerge from this next phase of exponential technological progress.

Louis Navellier's “Trump/AI Convergence” Stocks

A big game was talked, nice colorful charts were presented, but in the end, Louis didn't offer up a single clue about any of his picks.

However, after some amateur Internet detective work, we may have tracked down at least a few of them.

Based on the latest 13F filing by Louis's asset management firm, Navellier & Associates, its newest positions are:

- AppLovin Corp. (Nasdaq: APP)

- Doximity Inc. (NYSE: DOCS)

- Atmos Energy Corp. (NYSE: ATO)

- Kinross Gold Corp. (NYSE: KGC)

These aren't all of his new holdings, and there's no way to know if any are indeed his Trump/AI Convergence picks. But they are the ones that most closely align with the overall theme of this presentation.

The Next 1,000% Winners?

Waiting a few years for capital appreciation, while earning some income along the way, is the easiest way to make money in the market.

Jumping in and out of stocks every month is one of the quickest ways to lose money, behind only jumping in and out on a daily and weekly basis.

Most ten baggers, historically, have been microcaps. Louis's latest buys don't meet that criterion, but two of them are attractive nonetheless.

Energy distributors, such as Atmos, and producing gold and silver miners, like Kinross, are in a prime position to outperform.

This is because these industries make up the underlying infrastructure of AI, and most other modern technologies, like smartphones, without which they could not operate.

It's been said before, but it bears repeating because infrastructure businesses at this stage of AI's development are the growth plays to buy.

Picking up an Atmos or a Kinross today, at 15-20x current earnings, with a 1-2% dividend yield, will net us a multi-bagger over the next few years, or sooner, as energy demand accelerates.

Quick Recap & Conclusion

- “One of the greatest investors of our lifetime,” Louis Navellier is teasing a new way to collect regular cash payouts from several “Trump/AI Convergence” Stocks he's calling the fastest wealth-creation tool ever.

- Louis is simply using the momentum of the market and his proprietary algorithm, which has been focused on small and mid-cap stocks, applying AI to their businesses to find new trading and investing opportunities.

- He's found a few names he likes, and they are only revealed in a report called: 5 Trump/AI Convergence Growth Stocks to Buy Right This Second. The only way to get it is to sign up for the Accelerated Profits newsletter, which costs $1,799 to join for a limited time.

- In the end, Louis doesn't offer up a single clue about any of his picks. However, digging around the web and through his asset management firm's latest 13F filings, we were able to find a few possibilities.

- None of these are microcaps, which have historically produced the most ten-baggers, but buying into some well-priced energy and natural resource plays at this stage should provide above-average returns.

Have you loaded up on AI infrastructure stocks yet? Tell us in the comments.