Deep in the heart of Appalachia an energy transformation is underway.

Larry Benedict believes it presents one of the greatest investment opportunities of the next 100 years and the real money will be made in his “#1 Retirement Play in U.S. Energy.”

The Teaser

Appalachia has long been known as coal country, but soon, it is about to be known for something else.

A former Wall Street trader and money manager, Larry Benedict has been in the investment newsletter racket since 2018.

Since then, he has teased a “Bitcoin Skimming” Strategy and Trump “Trigger Stocks”, which we have reviewed here.

This teaser is all about one thing – energy, which has fueled every industrial revolution.

Coal powered the steam engines of the late 18th century and oil was largely responsible for the second industrial revolution of the early 20th century.

Now, another type of fuel is about to dominate the next industrial revolution.

Larry believes U.S. produced natural gas will predominantly power the artificial intelligence (AI) revolution.

The overwhelming consensus is that natural gas will indeed play a major role in powering AI for decades to come.

We have gone over the numbers of how much energy AI consumes in previous teaser reviews, it's about 1.5-2% of all the electricity in the world, and growing rapidly.

Based on this, we have two choices:

- Optimize AI applications to consume less energy

- Produce more natural resources that generate more energy

Both need to happen, but the latter is far more expedious than the former.

Natural gas is the underappreciated play that is revitalizing old coal towns and powering millions of AI-generated memes like this one:

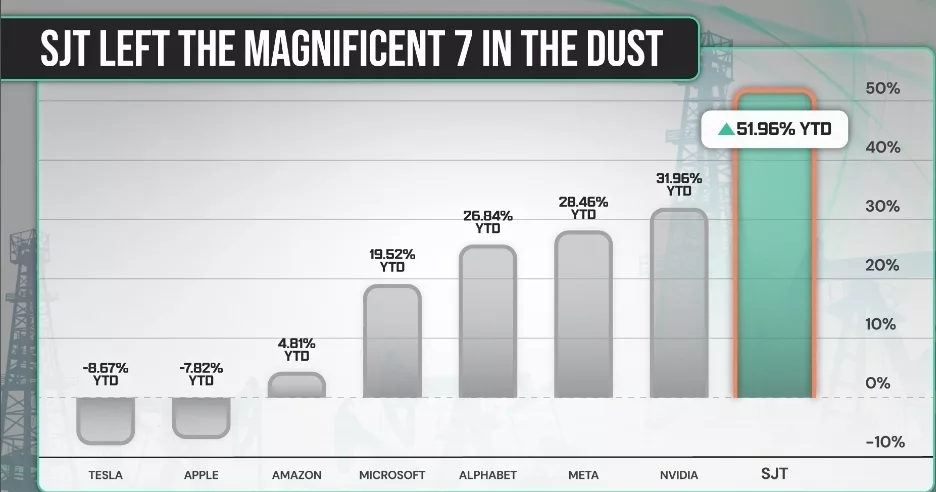

Based on the returns of some nat gas trusts like the San Juan Basin, it is already booming:

However, Larry says he has a way to 12x SJT's return, with far less risk.

The Pitch

One report titled The #1 Retirement Play in U.S. Energy explains everything.

We can get it with a subscription to Larry's flagship service One Ticker Trader.

One year normally goes for $499, but for a limited time, we can get in for $79 upfront, with a standard 30-day money-back guarantee.

The Natural Gas Catalyst No One Knows About

There's a massive source of demand for U.S. natural gas that has nothing to do with AI.

It's no secret that Western Europe isn't exactly a bastion of energy production.

This combined with over zealous clean energy policies and the breakout of conflict, which has severed ties with its largest energy provider, has left a massive sinkhole between its energy supply and demand.

To fill it, the continent logically turned to it's old BFF, the United States.

In 2021, the European Union (EU) pledged to buy about $250 billion worth of Liquefied Natural Gas (LNG) from the U.S.

Since that faithful pledge, nearly half of their liquefied natural gas (LNG) supply has come from the U.S.

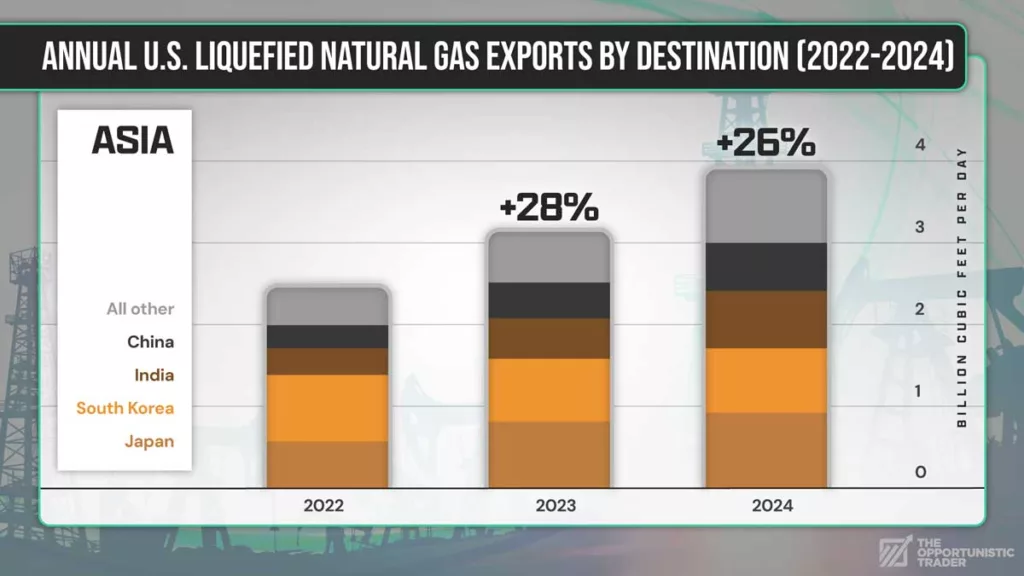

However, Europe is far from the only importer of U.S. natural gas.

Demand from Asia is also soaring, up 61% since 2022.

Between good ol' fashioned market demand, foreign buying pledges, and AI, there are more forces competing for U.S. natural gas than ever before.

While true, this only tells one side of the LNG story.

The Supply Side

At the same time that demand is increasing, so too is supply.

As President Trump vowed during his campaign, U.S. energy production is being unleashed.

According to some analysts, America's LNG capacity will rise to 130 million tons next year. Up from 110 million tons this year.

Other LNG-producing nations, such as Qatar and Canada, are also set to bring more production online starting next year.

So, if the price of natural gas is due to dip, why is Larry recommending an LNG play?

It's because he's teasing options that make money on the way up as well as on the descent, in a company that is finalizing an agreement to supply natural gas directly to a major Appalachia data center project.

Revealing Larry Benedict's #1 Retirement Play in U.S. Energy

We got a few crucial details about Larry's top pick half way into the nearly hour-long presentation:

- It is the owner of the Mountain Valley Pipeline, connecting the Marcellus Shale to the Southeast.

- The company is the largest, fully integrated natural gas provider in the country.

- Vanguard owns a $4 billion stake in the business.

This was enough to reveal the #1 Retirement Play as EQT Corp. (NYSE: EQT).

- EQT acquired Equitrans Midstream Corp. in early 2024, giving it control of the highly coveted Mountain Valley Pipeline.

- The transaction created the largest, vertically integrated natural gas business in the U.S.

- Vanguard is EQT's largest institutional shareholder, with a 12.7% stake worth $4.8 billion.

The Best Pure Profit Play in the Market?

Over the short-term, natural gas demand and prices will continue to go up.

According to the latest from the U.S. Energy Industry Association (EIA), they could even remain elevated for longer than some expect.

This is on account of 2025 production coming in lower than initially forecast.

Meanwhile, on-site gas-powered data center construction is just heating up.

The converted Homer City power plant in Pennsylvania is expected to become the largest natural gas-powered data center campus in the country when it comes online in 2027.

Others, like a 600MW natural gas-powered data center campus have also been proposed for land outside the city of Hubbard, Texas.

Based on this, nat gas demand is not falling off a cliff anytime soon.

However, putting the macro aside, is buying into EQT a good move?

At first glance, we would be getting value for our money.

EQT is an industry leader with a 23% profit margin and a 4% Return on Assets that trades for less than 2x book.

In the scenario that natural gas prices fall, EQT is a low-cost producer, with long-term customer supply contracts in place that will continue to generate free cash flow.

In the event they don't or even continue to trend up, the natural gas producer has a pipeline (pun intended) of low-risk, high-return projects in the works that give it plenty of upside.

I don't know if I would call it the best play in the market at the moment, but EQT is a solid pick up at it's current price, even without any options hedges.

Quick Recap & Conclusion

- Former Wall Street trader Larry Benedict is teasing an energy transformation and the real money will be made in his “#1 Retirement Play in U.S. Energy.”

- Larry is of the mind that U.S. produced natural gas will not only play a large part in, but predominantly power the artificial intelligence (AI) revolution.

- One report titled The #1 Retirement Play in U.S. Energy breaks down everything and reveals his top pick. We can get it with a subscription to Larry's flagship service One Ticker Trader for $79 upfront for the first year (normally $499).

- Greenbull readers can skip this step, as we revealed Larry's #1 Retirement Play for free as EQT Corp. (NYSE: EQT).

- At less than 2x book value, EQT is a bargain no matter what natural gas does going forward.

Will natural gas largely power AI as Larry predicts? Leave your thoughts in the comments.

I got killed on Larry Benedict advice. Stay away.

If 2X is referring to PE, I think your a magnitude off.

I would be for sure, but it’s referring to book value.

Thank you for your efforts!

RPM