The stock market is at a record high and so is Berkshire Hathaway's cash hoard. This means one thing…

A market crash could be imminent and Keith Kohl has identified the five stocks that Warren Buffett will buy next.

The Teaser

The bulk of Warren Buffett's $146 billion fortune was built during three distinct and relatively brief windows of opportunity.

Keith Kohl isn't your average Buffett groupie, he's more of an oil and gas guy (spoiler), whose teasers, like the American Miner Breaking China's Metals Monopoly and Horseshoe Well Company, we have previously covered.

Most have seen the often-cited stat that 99% of Buffett's net worth was made after he turned 50.

However, most don't know that the bulk of it came in the aftermath of market crashes.

Buffett ran the same play before the dot-com crash of 2000, the Great Recession of 2008, and the 2020 COVID crash, like he was the Philadelphia Eagles running the Tush Push.

Each time, he strategically amassed record cash positions before market crashes, and then strategically deployed that cash into attractively priced stocks immediately after.

Just like the Tush Push, it was effective each time.

Now, he's doing it again.

According to Berkshire's latest financial reports, the company has $344 billion in cash and equivalents laying around, the largest in its storied history, and is preparing for the worst.

Why now and what is “the Oracle of Omaha” seeing that the rest of the market is missing?

The Buffett Indicator

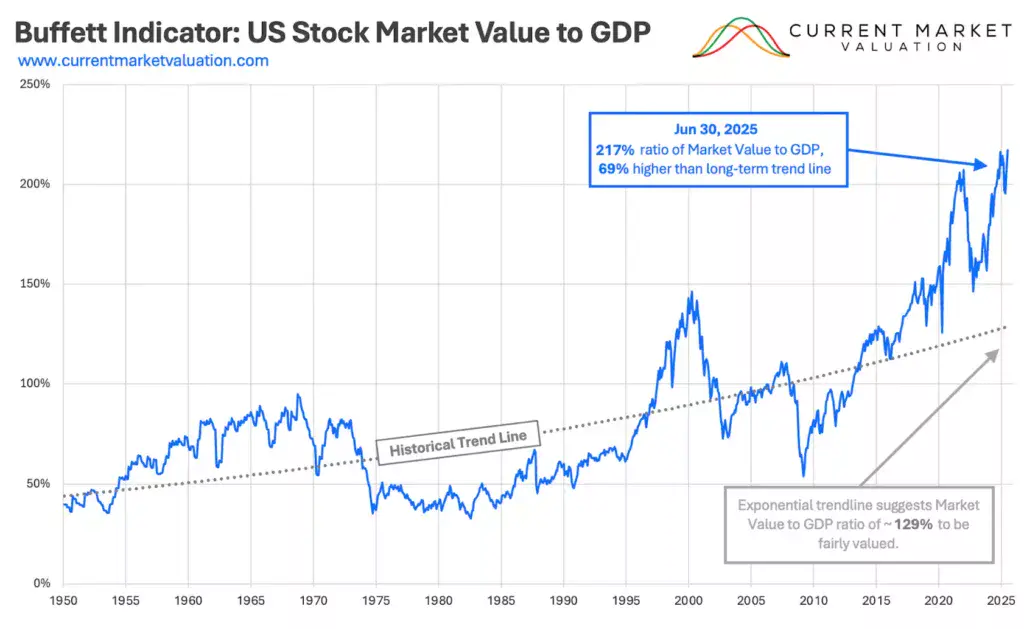

In a 2001 interview with Fortune, Warren Buffett called one indicator

probably the best single measure of where valuations stand at any given moment

He was talking about the total market/GDP figure.

As of the latest print, the total value of the market (as represented by the Wilshire 5000 index) stands at $66 trillion.

This is nearly 218% above the last reported GDP figure of $30.5 trillion

It means that the market is, by and large, expected to underperform going forward.

Buffett will be the first to admit that this indicator has certain limitations. It doesn't take into account new innovations (AI, Blockchain, etc.) that justifies higher highs in the market or the fact that the economy is increasingly digital and international, which isn't captured in GDP calculations.

No matter what ends up happening from here, a historical precedent is evident, and Keith has noted it, along with where and what Buffett is likely to buy next.

The Pitch

In a new report called “Buffett’s Escape Plan: 4 Canadian Oil Stocks Ready to Skyrocket” Keith reveals the names and ticker symbols of four stocks that aren't just on Buffett's radar, but also trading at substantial discounts.

The report is ‘free' for subscribers to Keith's energy investment research service Energy Investor.

Normally, a one-year subscription costs $499 upfront, but a $99 limited time offer is currently being promoted.

Buffett's Next Big Money Maker

If there's one thing Buffett loves to buy after market downturns it's oil.

It was his first trade when he was 13, so it may have been his first love.

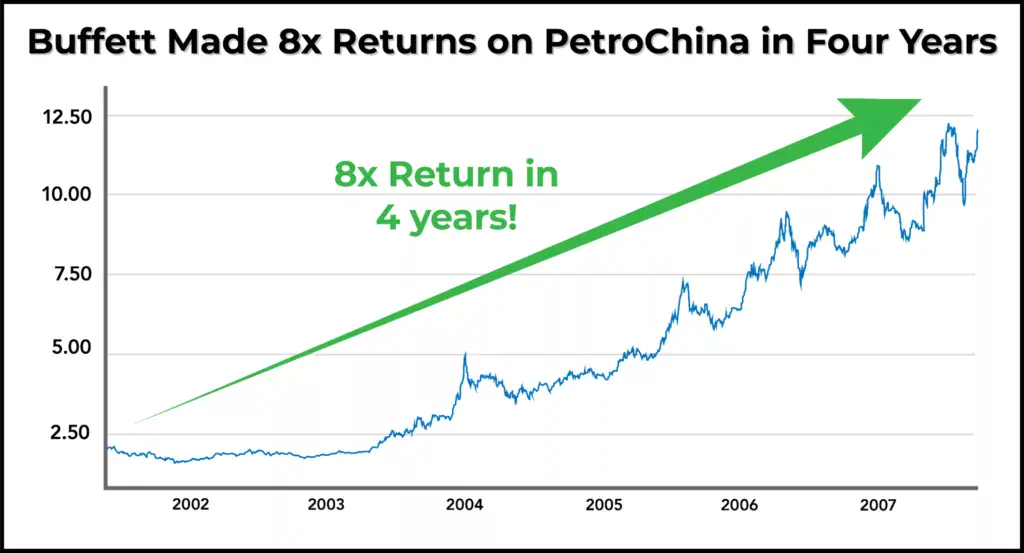

He bought it after the dot-com bubble burst, purchasing nearly $500 million of PetroChina stock in 2022.

This earned him an 8x return in only four years.

He went back to the (oil) well again after the stock market sold off by more than 50% in 2008.

The following year, Buffett took a majority ownership stake in the BNSF railroad, investing $26.3 billion, which at the time was the biggest bet of his career.

It was an ingenious move, as BNSF’s railroad tracks sit on top of North Dakota’s Bakken oil formation, where pipeline capacity was limited, so oil companies turned to BNSF to ship their oil to refineries.

The dividends earned from BNSF eventually exceeded the price originally paid for the business.

Finally, when the stock market took a massive 55% hit in 2020, Buffett used the opportunity to invest $13 billion into Occidental Petroleum.

OXY stock proceeded to go from $10 to $69.

Now, he's turning his attention North to the world’s third-largest oil exporting country.

It comes at a pivotal moment for Canada.

The country's Trans Mountain Oil Pipeline is expanding, increasing capacity from 300,000 barrels per day to 890,000 barrels per day, effectively tripling the amount of oil available for overseas export.

Pair this with the growing international demand for energy and Canadian oil companies trading at attractive valuations, and the investment opportunity becomes a potential bonanza.

Revealing Keith Kohl's Canadian Oil Stocks

Five companies stand to benefit immensely from the Trans Mountain pipeline expansion.

Keith drops the name of the first one in the teaser, its Cenovus Energy (NYSE: CVE).

Cenovus isn't just the largest producer in Canada's oil sands, but its committed to returning up to 100% of its free cash flow to shareholders via dividends and share buybacks.

However, Cenovus isn't Keith's top pick.

2nd Canadian Oil Stock

- At a market cap of just $7 billion, this company is too small for Berkshire to target.

- The company’s production is currently averaging 100,500 barrels of oil per day, a 17% increase compared to last year, and it pays a 10 cents per share dividend.

This could be MEG Energy Corp. (OTC: MEGEF).

- MEG's current market cap sits just above $7 billion.

- In fiscal year 2024, daily production averaged 102,000 barrels per day.

3rd Canadian Oil Stock

- This next company is on track to become Canada’s leading energy provider.

- One of their crude oil tankers was among the first to load oil from the expanded Trans Mountain pipeline, exporting approximately 550,000 barrels of crude oil to China.

- It is an international concern, with offices in Calgary, Houston, and London.

Suncor Energy (NYSE: SU) is Keith's pick here.

- Suncor sold 550,000 barrels of heavy crude to Sinochem, which was the newly expanded Trans Mountain pipeline's first load.

- The Canadian oil major is headquartered in Calgary, with marketing offices in Houston and in the UK.

4th Canadian Oil Stock

- Just one day after the Trans Mountain Pipeline opened, this company announced plans to boost output at its oil sands mine by 195,000 barrels per day.

- It has seen major upgrades at its oil sands mining facilities and a new facility in Alberta is scheduled for completion by the end of this year, adding another 5,600 barrels per day to its production capacity.

Based on the first clue, Canadian Natural Resources (NYSE: CNQ) is the pick.

- Last year, the company stated that it plans to boost output at its Horizon oil sands mine by exactly 195,000 barrels per day, making the announcement one day after the Trans Mountain Pipeline opened.

- CNQ finished major upgrades at its oil sands mining facilities last year, which lead to a production bump.

5th Canadian Oil Stock

- The last company is one of Canada’s largest oil producers.

- What sets it apart is its pioneering use of a fully autonomous fleet of heavy haul trucks for oil production, which transport extracted oil sands from the pit to the processing facilities.

- Production at it's flagship oil sands mine hit a record 270,000 barrels per day.

Keith's last pick is Imperial Oil (NYSE: IMO).

- Based on revenue, Imperial is the third largest Canadian oil producer.

- The integrated company now has 81 fully autonomous haul trucks in service, helping the company save $1-per-barrel in costs.

- Last year, production at Imperial's flagship Kearl Mine hit 299,000 bbl/day.

Big Growth, Little Premium?

Near the end of his presentation, Keith said “this is the kind of opportunity where early investors could see a lifetime of returns generated in a very short period of time.”

Is he right and are his picks Buffett-worthy?

Cenovus: A current price/earnings of under 20x for a category leader is a great price and it is also bidding to takeover the next pick.

MEG Energy: Shareholders are due to vote on a takeover offer by Cenovus at a special meeting on Oct. 9. The stock isn't trading at a discount to the takeover bid.

Suncor: Over the past five years, Suncor has tripled the return of the S&P/TSX Composite and it is still a good value buy.

Canadian Natural Resources: A good risk/reward at only 11x current earnings for the 5% annual dividend.

Imperial Oil: Majority owned by ExxonMobil with a 70% stake, would make more sense to buy the latter and get the former thrown in.

I have no major objections to any of Keith's Canadian oil stocks. All present quality bets on growing energy demand at good prices.

Quick Recap & Conclusion

- Berkshire Hathaway's cash hoard is at a record high, which means one thing…a stock market crash could be imminent and Keith Kohl has identified the next five stocks that Warren Buffett will buy next.

- Going back to the dot-com crash in 2000, Buffett has strategically amassed record cash positions before market crashes, and then strategically deployed the cash into attractively priced stocks immediately after.

- Now, Buffett could be doing it again, and Keith has included the names and ticker symbols of four stocks he could buy in the event of a downturn in a new report called “Buffett’s Escape Plan: 4 Canadian Oil Stocks Ready to Skyrocket.” We need a subscription to the Energy Investor investment research service to access it, which costs $99 upfront for a limited time.

- Greenbull readers don't need to pony up anything though, as we revealed all of Keith's Canadian Oil Stocks for free, starting with his first pick Cenovus Energy (NYSE: CVE) and continuing with MEG Energy Corp. (OTC: MEGEF), Suncor Energy (NYSE: SU), Canadian Natural Resources (NYSE: CNQ), and Imperial Oil (NYSE: IMO).

Keith's Canadian oil stocks are solid bets given the growing global demand for energy and we get value for the price paid.

Is a market downturn near or has the next leg of the bull market just started? Tell us what you think in the comments.