For all the advances that have been made, it seems that health innovations have lagged behind.

According to Keith Kohl, this is all about to change thanks to an “AI Doctor” that produces new treatments at light speed.

The Teaser

Drug development is no longer in discovery.

Keith Kohl is a tech and energy man, writing about topics such as American Miners Breaking China's Metals Monopoly and Algo Meds, which we regularly review here.

In this teaser, he's talking biotech and more specifically breakthrough bio-engineering that is making rapid advancements possible not just in artificial intelligence and quantum computing, but medicine as well.

It's well-known that new drug discovery is expensive.

I'm not talking dinner for two at Nobu expensive, I'm talking family of four trip to Disneyland expensive.

The median cost of developing a new drug is estimated to be around $700 million, with some exceeding $2 billion!

That's a lot of Mickey ears.

This is where AI-enabled bioengineering comes in.

Fixing A Half Century Old Problem

Scientists have been wracking their brains since the cold war trying to map out human protein structures in an effort to find out what keeps us healthy and what does the opposite.

However, the number of possible protein combinations is more than the number of atoms in the universe, so it's been a tough task, to say the least.

Out of the 200 million proteins known to man, only about 170,000 have been manually mapped out to date.

But now, AI has mapped out all of the 200 million proteins known to man in days instead of decades.

It's not just protein structures either, with every aspect of our biochemistry now capable of being mapped out and simulated with AI.

The clinical implications and opportunities from an investment standpoint are profound, with Keith banking on a tiny AI drug developer to produce some of the biggest gains.

The Pitch

It's name and ticker are only shared in a brief, but straightforward investment guide called Bioengineering: Cashing in on AI Drug Development Before It’s Too Late.

The guide is complimentary, if we give Keith's biotech-focused newsletter Topline Trader a try.

Normally, a full year subscription goes for $4,995, but a discounted rate of $799.00 is being offered, along with a 90-day money-back guarantee.

The Quantum Quake

For decades the $1.7 trillion a year pharmaceutical industry has run on hope and chance.

A fungus growing in a petri dish, microbes in the soil, even some obscure plant in the Amazon which led to the discovery of one of the first anticancer drugs, Taxol.

All of these were discovered by sheer circumstance.

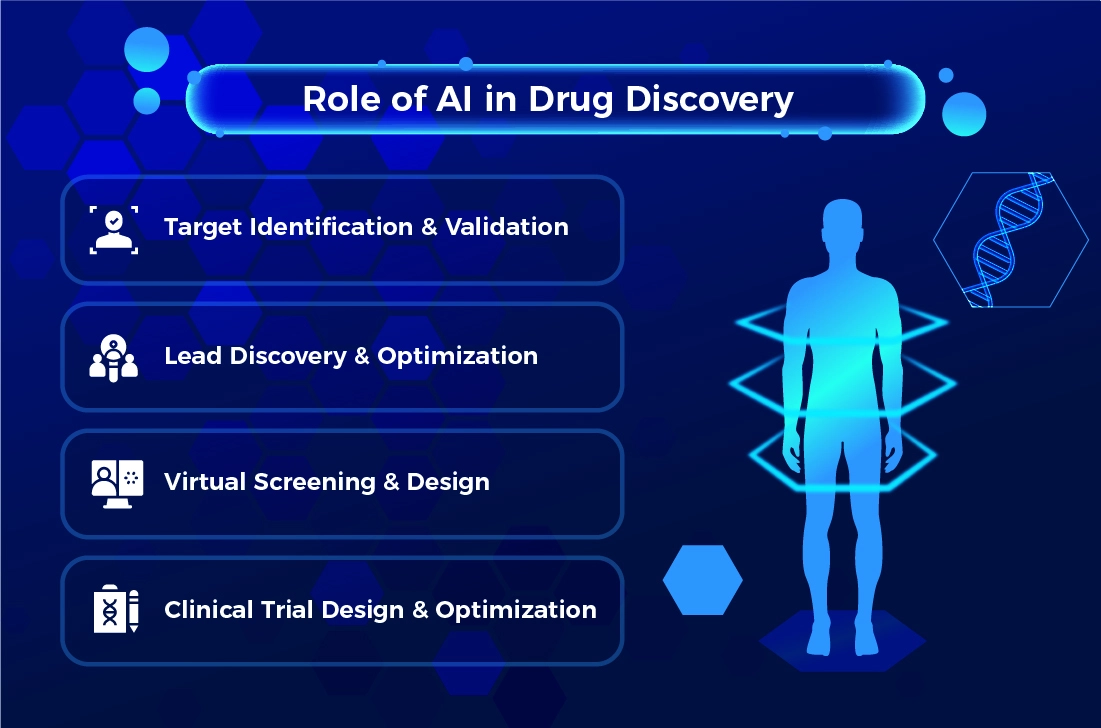

AI has changed this hit or miss approach.

That's because knowing the 3D structure of a protein allows scientists to design drugs that can fit into or block specific sites on said protein, leading to more effective and targeted cures.

So then why hasn't AI already cured every disease known to man?

In the highly regulated pharmaceutical industry, it's a process.

It's true that no AI-discovered drug has received FDA approval…yet. However, the groundbreaking tech has made the drug development process 60% faster, while reducing pre-clinical research and development costs by 25%-50%.

Moreover, around 70% of all pharmaceutical companies are now investing in or using AI in some capacity.

Based on these stats, there's a better than good chance that from this point forward most drug discovery will be bio-engineered.

A seismic shift or ‘quake' for sure.

Big names like prominent venture capital firm Andreessen Horowitz, the world's largest asset manager, BlackRock, as well as pharma giants such as AbbVie all investing in AI drug discovery confirm this premise.

Anything that reduces the usual harmful side effects you get with traditional drugs is ok in my book.

Keith believes there is “no single company advancing AI drug development faster“, than his “AI Doctor” firm.

Revealing Keith Kohl's AI Doctor Firm

The presentation is long-winded, with few specifics, but we did get enough to reveal the pick:

- This firm's first AI-discovered cancer treatment is already flying through clinical trials.

- It has partnerships in place with big players like Roche, Sanofi, Merck, and Bayer that have already earned the company $455 million, with the potential to receive another $20 billion more.

- The company still trades for a valuation of less than $3 billion or $5 per share.

This is Recursion Pharmaceuticals Inc. (Nasdaq: RXRX). Here is why we're so sure:

- Recursion received FDA approval to begin phase 1 trials for it's AI-discovered cancer treatment in late 2024.

- The company has partnerships in place with the likes of Roche, Bayer, and Merck.

- Recursion is currently valued at $2.2 billion and shares trade for under $5.

Biotech Pick of the Decade?

To say that Keith is high on Recursion's prospects would be an understatement.

In his estimation:

By the end of the decade, Recursion will be a bigger household name than Pfizer, Merck, or even Johnson & Johnson

A decade-old business unseating legacy names would be something, but it has happened before.

Tech, retail, and manufacturing have all had changing of the guard moments over the past few decades, could pharma be next?

I can see it going either way.

Artificial intelligence is expensive to set up and even more costly to run, as much as $25,000–$100,000 per use case.

For a large multinational this is how much they spend to keep the office kitchen stocked every month, but for a startup, it's only possible with millions in external funding.

This means that even if an upstart defies the long odds and develops a breakthrough drug that makes it to clinical trials, it will 9 times out of 10, be acquired by an incumbent to cash investors out.

As investors, there is opportunity in this, but it's not as large as it could be.

When it comes to Recursion, the biotech company is clinical stage, with most of it's AI-enabled drugs at phase 1/2, the second last phase in the trial process.

Per it's Q3 earnings release, it's $785 million cash pile is enough to take it through the end of 2027, without needing additional financing. A win in this capital-intensive, pre-revenue space.

The upside is clearly there.

Should one of these developmental drugs ever make it past clinical trials, shares will soar like eggnog sales the weekend before Christmas.

However, Recursion is still as speculative as a carnival game, and it is already in bed with big pharma via collaborations, so it will likely get taken out if it ever does make it to market, capping upside.

Quick Recap & Conclusion

- Keith Kohl says the face of medicine is about to change thanks to an “AI Doctor” that produces new treatments at light speed.

- Artificial intelligence-enabled drug discovery is what is being teased and one tiny biotech could be the first to get an AI-developed drug to market.

- It's name and ticker are only shared in an investment guide called Bioengineering: Cashing in on AI Drug Development Before It’s Too Late. The guide is complimentary, but to access it we need a subscription to Keith's biotech-focused newsletter Topline Trader, which costs $799 upfront for the first year.

- No need to add this to your shopping list though, because we were able to reveal Keith's “AI Doctor” firm for free, it's Recursion Pharmaceuticals Inc. (Nasdaq: RXRX).

- Recursion is a pre-revenue, clinical-stage biotech that is promising yet limited at the same time.

Will Recursion be the first to get an AI-discovered drug FDA approved? Give us your opinion in the comments.