Whoever wins the artificial intelligence race will rewrite the rules of civilization.

The only way to do so is with a rare and irreplaceable energy source and Keith Kohl's “#1 Nuclear Stock” for AI Supremacy is the key to achieving it.

The Teaser

Protests are already erupting over AI's onerous energy demands.

Keith Kohl is a longtime tech, biotech, and energy markets commentator, with nearly two decades of experience.

He is currently the editor of a few Angel Publishing newsletters, for which he has released teasers like The American Miner Breaking China's Metals Monopoly and “Next Nvidia” Company, that we have reviewed here.

This year marked a first.

The first time there have been street protests over AI and energy use.

It's happened on a few occasions, with the latest being a U.S. Senator's inaugural Energy and Innovation Summit in Pittsburgh.

If some experts and energy insiders are right, it could be a sign of things to come.

Power industry execs have stated that:

“The future likely sees old coal and nuclear plants restarting and more natural gas-fueled power stations built from scratch, to cope with rising demand.”

Coal and natural gas are consistent, but fail to align with the eco-conscious goals Big Tech has sworn to uphold.

While wind and solar are clean, but remain as unreliable as ever.

We can probably get away with maintaining AI in it's current state on the existing energy grid for a while, but there's no scaling up to artificial general intelligence or the ‘final frontier' of artificial superintelligence without a significant new energy source.

The only viable solution that currently exists is nuclear power and one small company is leading the charge with it's cutting-edge nuclear technology.

The Pitch

Keith reveals everything in a special report called “The #1 Nuclear Stock Fueling the AI Arms Race.”

It's ours with a subscription to The Energy Investor newsletter which costs $99 to join.

It promises at least one new energy investment opportunity per month and includes a six-month money-back guarantee.

The Pocket Technology Changing the World

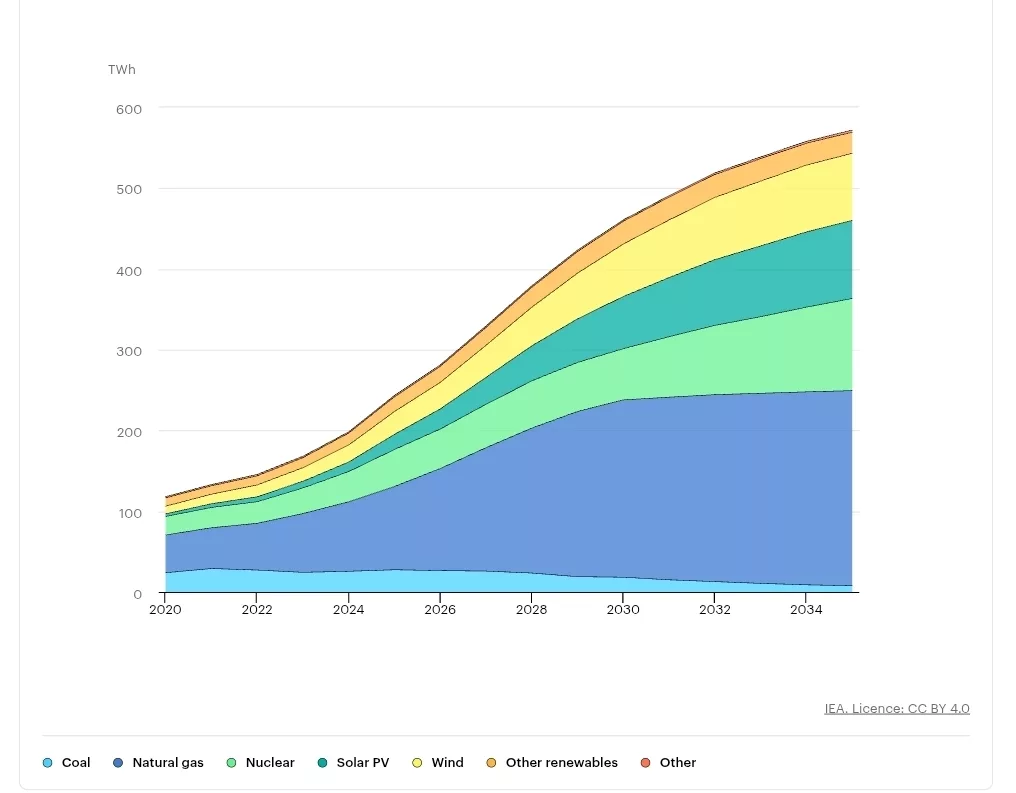

This is the current breakdown of global electricity supply, according to the International Energy Agency (IEA):

As our own earlier analysis showed, this mix is expected to stay pretty steady until 2030.

After 2030 is when a “pocket” technology by the name of Small Modular Reactors (SMRs) is supposed to enter the mix.

They have been talked up by other newsletter promoters as well for several reasons.

First, unlike their traditional big non-modular reactor brethren, SMRs are a lot more compact and thus, easier to build. So mass production is possible.

Second, SMRs are safer than traditional nuclear power plants, thanks to autonomous cooling systems that eliminate overheating risks.

Finally, SMRs are no longer a pipe dream. Approximately three SMRs are already operational in Russia, China, and Japan, respectively, with 51 SMR projects currently at the pre-licensing or licensing stage around the world.

Some of these are backed by AI hyperscalers such as Google, Microsoft, and Amazon, which we'll hear more about a little later.

Overall, the global SMR market is expected to grow at an annual rate of 30% between 2033-2043.

Combine this with the current presidential administration favoring fossil fuels and nuclear to renewables, and SMRs look poised to become essential infrastructure for AI's continued development.

A Nuclear Hybrid

The dream of cheap, energy-efficient SMRs in America is still that, a dream, rather than reality.

After the first SMR design approved by the Nuclear Regulatory Commission (NRC) was scrapped due to rising costs in late 2023, the new target for the first SMR on U.S. soil is now 2030.

However, Keith isn't telling us to lock up our cash and just wait it out.

Instead, his “#1 Nuclear Stock” operates good old-fashioned nuclear reactors that power homes and businesses, while developing it's next-gen SMR capabilities.

It's a nuclear hybrid providing current stability with significant upside if SMRs eventually live up to the hype. Let's find out what it is.

Revealing Keith Kohl's #1 Nuclear Stock

Keith's presentation was just the way we like it, short and straight to the point, while providing some telling clues about his pick.

- The company operates seven nuclear reactors across the U.S., which generate over 52.7 million megawatt-hours annually.

- The NRC recently extended the licenses for some of these reactors by 20 years.

- It is backed by Amazon to the tune of $500 million.

Amazon has invested in multiple nuclear energy projects, but the pick here is Dominion Energy Inc. (NYSE: D). This is why we are so sure:

- Dominion operates seven nuclear power reactors across three states, which generated more than 52.7 million megawatts in fiscal year 2021.

- Keith is referring to Dominion's V.C. Summer nuclear power plant, in Jenkinsville, S.C, whose license was renewed for 20 years in 2004, and again in August 2023, when Dominion applied for a subsequent 20-year license renewal.

- Late last year, Amazon entered into an agreement with Dominion to pay for the development of an SMR at its North Anna Power Station in Virginia.

An Explosive Profit Opportunity?

Normally, the term explosive and regulated utility aren't used in the same sentence unless something has gone terribly wrong and it's on the news.

To be fair, Keith is referring more to the potential of Dominion's SMR than to its current business.

In this spirit, we'll take a quick look at the company's existing operations and then focus our energy on the SMR angle.

Dominion's balance sheet isn't pretty, but this comes with the territory, as utilities are notoriously cost-intensive businesses.

Fortunately, it makes up for this with steady, reliable earnings and a low absolute valuation of less than 2x book value.

One of Dominion's other attractive features is its 4% annual dividend, which is safe for now, with a current payout ratio of around 82% of earnings.

Now for the SMR stuff…

Keith lamented about Dominion's “revolutionary SMR technology,” but what is the reality?

According to public statements, Dominion put out a call to SMR companies to submit ideas for adding generation units to its North Anna Power Station in Virginia.

This lets us know that things are still very early, only about two innings into the game, in baseball terms.

Based on the precedent set by the first and second SMR designs to be approved by the NRC, it will take around two years for the commission to complete a technical review, once all finalized designs are submitted.

Given this, we're probably looking at a 2029-2030 timeline for construction to begin on a Dominion SMR, if everything goes smoothly from here on out.

So, unlike the teaser title and image, this isn't some small, new energy technology company that can multiply our money this year or next.

We would be fortunate to get regular dividends and some capital appreciation over the short-term and a bigger bump over the long-term.

Not a bad pick in the grand scheme of things, but clickbait for sure.

Quick Recap & Conclusion

- Longtime tech and energy analyst Keith Kohl is teasing an irreplaceable energy source and a “#1 Nuclear Stock” as the key to achieving it.

- The irreplaceable energy source is Small Modular Nuclear Reactors (SMRs) and one company is leading the charge on them.

- It's name and ticker symbol are only revealed in a report called “The #1 Nuclear Stock Fueling the AI Arms Race.” To access it, we need a subscription to The Energy Investor newsletter, which costs $99 upfront to join.

- However, we're big on making things as easy as possible here at Greenbull, especially on the wallet, so we went ahead and revealed Keith's #1 Nuclear Stock for free as Dominion Energy Inc. (NYSE: D).

- Dominion is a regulated utility that trades at a decent valuation of less than 2x book value, with a 4% dividend yield. It's higher-growth SMR business is still at the initial design stage and won't be operational for another 4-5 years, at best.

When do you think the first U.S. SMR will be operational? Tell us in the comments.