Investing legend Jim Woods says “all hell has broken loose in the silver market.”

A collision of economic forces have triggered a “Silver Storm” and it could mean gains of as much as 886%.

The Teaser

Something is definitely up, as sterling has had it's best year since 2020, hitting an all-time high in the process.

In his 30-plus years in the market, Jim has just about seen it all, from tech booms to financial crises.

His previous teasers have typically centered around macro events, like his China Shock Stocks and America Forward Stocks, both of which we covered here.

Over the last 20 years, owning physical silver outright would have delivered an average annual return of around 10%.

But Jim isn't talking about making 5% or 10% here.

Instead, he teases:

A type of trade that supercharges any move in the price of silver to bring home triple-digit gains.

It sounds like futures or options trading to me, but let's delve deeper…

We're told that the ‘something' behind supercharged trades is a historical move in the silver market.

The Ultimate Catalyst

Now, you don't need to be a metallurgist or a numbers whiz to understand what moves commodities. It basically comes down to two basic things:

The less there is of something, the more it’s worth and the more demand there is for something, the higher the price it sells for.

However, what if the supply of silver falls at the same time demand increases?

Well, that’s exactly what’s happening in the silver market now.

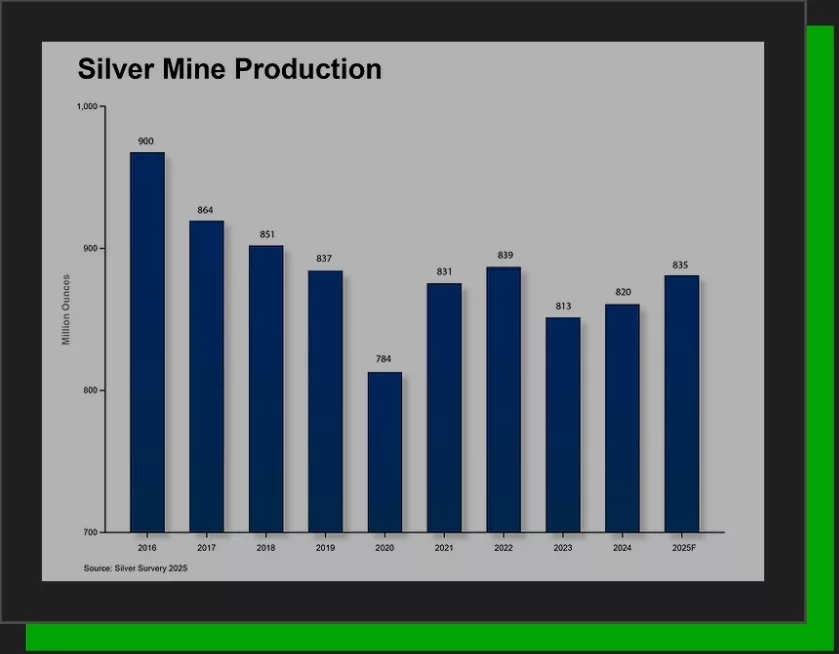

Silver production has declined by 7% since 2016.

It may not sound like much, but the overall shortfall in supply compared to demand since 2021 adds up to some 800 million ounces!

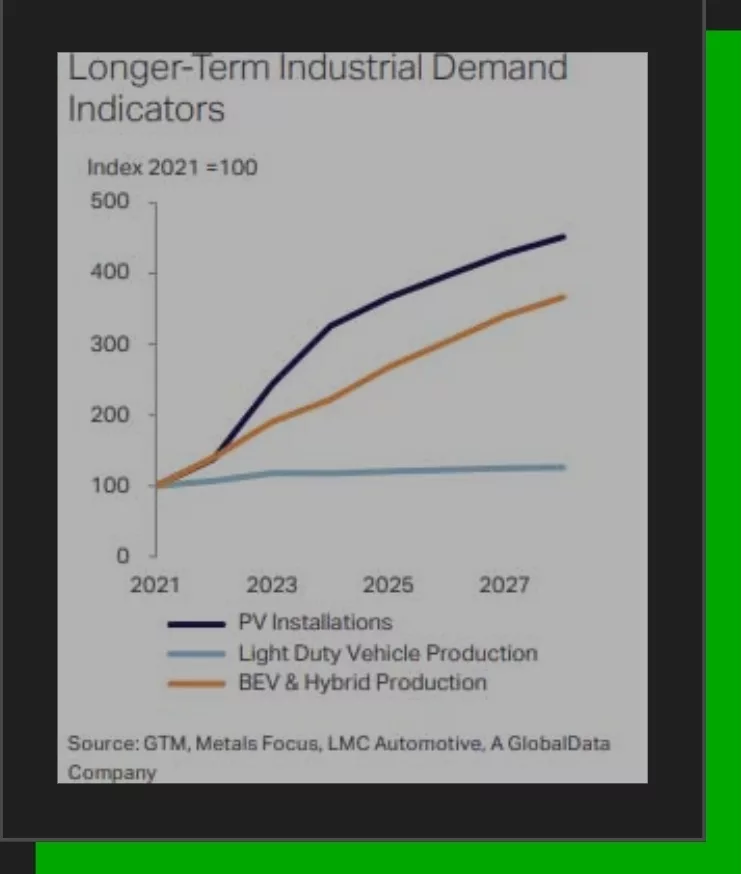

At the same time, silver demand is going through the roof because it has the highest electrical conductivity of any metal.

It's so effective that industrial demand incredibly accounted for 83% of the silver produced last year and with increased investment going into computing infrastructure, there's no signs of it letting up anytime soon.

Historically, such supply/demand shortfalls have meant huge silver price gains.

This is the “silver storm” that is now upon us, and Jim has a silver trading strategy, as well as a couple of silver stocks that he believes every investor should own.

The Pitch

All the details are inside a pair of reports called “Silver Storm: The Secret To Riding the Coming Boom for Historic Gains“ and “AI’s Hidden Gem: The Top Silver Play for the Tech Metal Boom.”

To get it, we have to try out Jim's research advisory, Crypto & Commodities Trader, for 30 days.

Inside Jim singles out the best commodities investing ideas and charges us $995 (usually $1,995) upfront for the first year.

A Bull Run for the Ages?

The stars are aligning behind silver like they once did behind FedEx founder Fred Smith at the blackjack table.

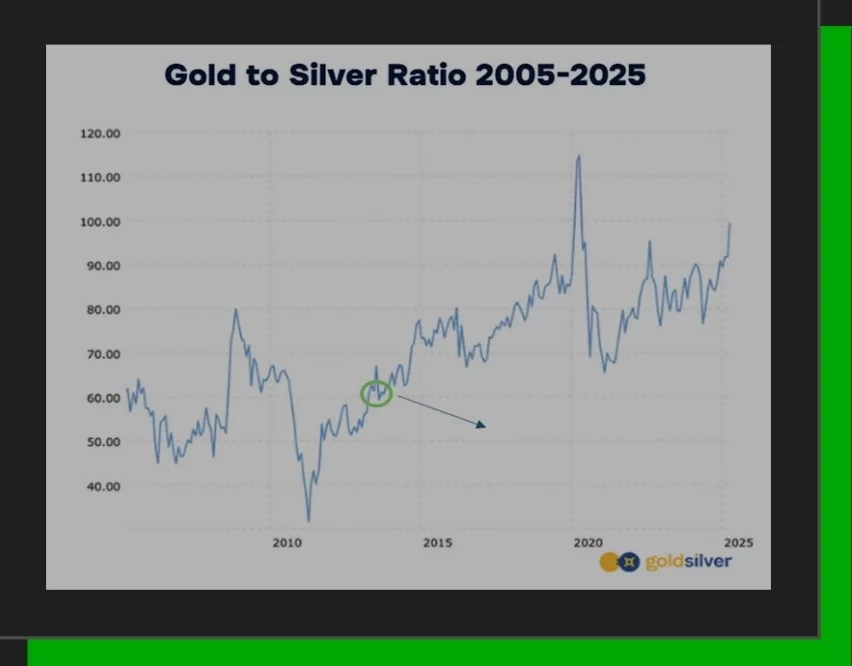

Every single factor affecting it's price, from supply and demand to perhaps the oldest investment indicator ever – the gold/silver ratio, is bullish.

According to this ratio, gold was worth around 15 times more than silver for centuries.

Currently, it's more like a 100:1 ratio

Assuming the price of gold remains above $4,000, silver would need to get up to $133 just to get back to a 30:1 ratio.

A 160% appreciation from the currently prevailing price would be a bull run for the ages, and entirely feasible given the factors at play.

So, what is Jim's secret to amplifying this already tidy hypothetical return?

We guessed right when we said that it might have something to do with options.

Jim has a handpicked $2 options trade that he first made back in late April.

The way he explains it, silver was trading for $33.57 an ounce and six weeks later, when the trade was cashed out, it was trading for $35.66.

A 6% gain in a little over a month isn't bad, but that's not the gain Jim says he walked away with when the dust settled.

Rather, he made out with a 147% gain in only 46 days.

That's leverage in action.

Unfortunately, Jim doesn't go any further other than to add that his options trades are “predictable, easy to understand, and most importantly, profitable.”

However, he does have a bit more to say about his stock picks.

Revealing Jim Woods' “Silver Storm” Stocks

Jim's main pick is based on silver's dual role as a precious metal and industrial metal.

Like others, Jim is high on the demand that artificial intelligence infrastructure is driving for silver and believes the metal will boom in tandem with next-gen tech.

All we know about the top play for the tech metal boom is that:

- It owns and operates one of the largest silver mines in North America

- Jim expects it to become North America’s largest producer and refiner of silver

There are only a few options here.

Hecla Mining Co. (NYSE: HL) is the current incumbent, but two others are gaining on it.

Coeur Mining Inc. (NYSE: CDE) is already the second-largest silver producer in the country thanks to it's Rochester gold and silver mine in Nevada.

Another distinct possibility is Americas Gold and Silver Corp. (NYSE: USAS), which recently helped its case for becoming a top North American producer by acquiring the Galena Complex in Idaho.

Jim also wants us to consider picking up shares of his free pick, iShares Silver Trust (NYSE: SLV), which is an ETF that tracks the price of silver.

Turn $5,000 into $50,000?

Silver has had it's best year since the Hunt brothers tried to corner the market in 1980.

It's up 63% so far, with some miner's performing even better. But at this point, are we chasing gains or is this just the beginning of a generational bull market in metals?

Based on everything we know, it's the former.

We are in the fifth consecutive year of supply/demand imbalances, which are more likely to widen before they narrow.

Despite this and big increases in valuations, stocks like Coeur Mining remain relatively and absolutely affordable like a Costco hot dog at 21x current earnings.

Americas Gold and Silver's total proven and probable reserves are some 18 million ounces of silver, so it is fairly valued at a $1 billion market cap. Although measured and indicated base metals could take fair value higher.

If production increases and profits return, as investors seem to think, shares will go higher.

Finally, I prefer the real thing, physical bullion bars and coins to iShares Silver Trust shares.

Quick Recap & Conclusion

- Investing legend Jim Woods says a collision of economic forces have triggered a “Silver Storm” and it could mean gains as high as 886%.

- Jim is referring to silver metal demand outstripping supply, causing a “Silver Storm” that we can profit from with an options trading strategy and a couple of stock picks.

- All is disclosed in a pair of reports, but to get them, we have to try out Jim's research advisory, Crypto & Commodities Trader, which costs $995 upfront for the first year (usually $1,995).

- The “Silver Storm” trading strategy is kept under tight wraps, but Jim does reveal a free stock pick – iShares Silver Trust (NYSE: SLV) and we think his other, undisclosed pick could be Coeur Mining Inc. (NYSE: CDE) or Americas Gold and Silver Corp. (NYSE: USAS).

- Silver supply/demand imbalances are likely to widen before they narrow, so owning physical silver and some quality producers is likely to net market-beating returns.

Will silver return to its historical ratio with gold? Leave your thoughts in the comments.