Former CIA, White House, and Pentagon advisor, Jim Rickards believes an event coming as early as April 11th will impact our finances for the next decade.

Jim's “AI Prediction” is that the next great disaster – an AI market crash, is coming.

The Teaser

“Before Trump's policies can Make America Great Again, we’ll have to suffer a crash that’s far from ordinary.”

Besides being a former government advisor, lawyer, and investment banker, Jim Rickards is also the author of 8 books, including “MoneyGPT” about something we are covering in this teaser review.

Artificial Intelligence is all the rage today and we have recently covered Alex Koyfman's Transceiver AI Data Center Stock and Louis Navellier’s AI Proliferation Stocks teasers, among many others.

However, this may be the most eye-opening of them all.

That's because through hard evidence Jim has collected, he now has undeniable proof linking “AI systems in the stock market to a completely new kind of market crash“.

A quick look at Jim's background gives him the credibility to make such a claim.

He's a former advisor to the CIA’s AI Prediction team, code-named ‘Project Prophesy‘, and has leveraged AI systems using Bayes Theorem to scan stock markets for unusual trades that might indicate a terrorist attack.

Suffice it to say, this will be nothing like the dot-com, housing, or the covid crash.

AI Doom Loop

It’s the first market crash that could erase 20% of the stock market’s value in just 2 hours…immediately followed by another 20% drop, as market circuit breakers fail.

Everything is on the table, 401(k)s, brokerage accounts, retirement plans, pensions, and even our checking and savings accounts are all at risk.

In intelligence circles, such a scenario is called an “AI Doom Loop.”

So, what exactly is this apocalyptic sci-fi plot, and what will kick it off?

Some studies suggest AI-powered algorithms now account for more than 80% of trades in US markets.

This is nothing new, as automated high-frequency trading (HFT) has dominated ‘the street' since the late 2000s.

However, as early as April 11th, JP Morgan is expected to launch a radically advanced, new AI trading bot called “Moneyball” shout out to Michael Lewis, that will be the beginning of the end.

The Pitch

Jim wants to give us access to a hidden chapter of his MoneyGPT book called “Thriving in Chaos”.

It reveals his exact plan to navigate the crash and it reveals his #1 investment to own ahead of any crash.

The only way to get it is with a subscription to the Strategic Intelligence research service, which costs $49 for a limited time.

This includes a 60-day money-back guarantee, monthly 12-16 page financial research reports, a few more “hidden chapters”, and a hard copy of the MoneyGPT: AI And The Threat To The Global Economy book (U.S. residents only).

The Hidden Danger of AI

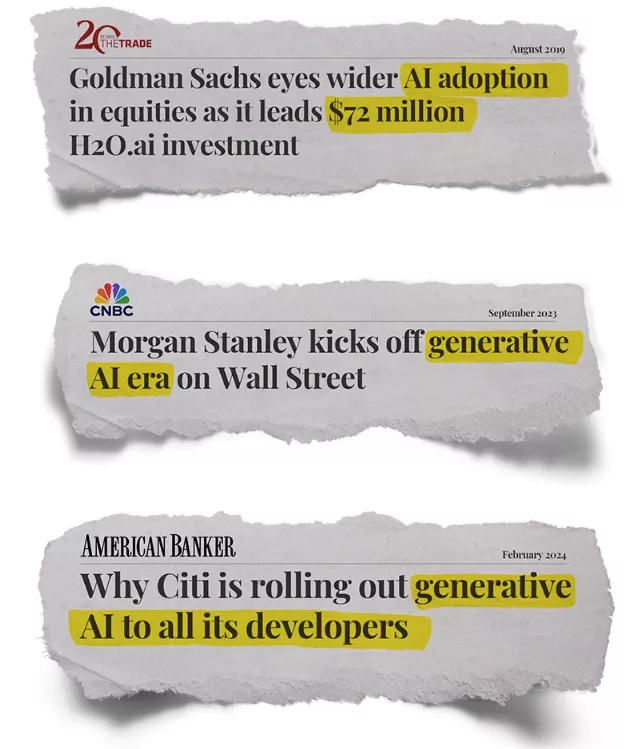

Artificial Intelligence on Wall Street was an inevitability.

Anything bringing lower costs and higher profits is bound to grow like food prices on The Street.

Indeed, major investment firms like Goldman Sachs, Morgan Stanley, and Citigroup have all begun implementing AI because they believe it will help them make more money.

However, as has been the case with every innovation Wall Street has adopted, from junk bonds in the 1980s to mortgage-backed securities in the 2000s. This too will have far-ranging consequences.

Jim explains that the more AI traders join the fray, the closer we get to an economic law called the “Curse of Scale.”

Advanced AI trading programs like JPM's “Moneyball” using layered neural networks, deep learning, and millions of pages of training materials offer an early edge.

But as more and more AI traders come online, mostly trained on the same datasets, and crowding into the same trades, the spread begins to disappear entirely.

Even worse, as AI traders become the entire market, the danger of a market collapse from a sudden automated rush for the exits becomes a reality.

This is how the “Curse of Scale” sets in.

Suddenly, within milliseconds of the first sell-off, the swarm of AI traders rush to copy each other, and because there are little to no offsetting buy orders from active managers, specialists, or speculators, the race to zero is on.

Essentially, the “AI Doom Loop” described earlier is a feedback loop on steroids and it could happen as early as April 11th.

There may be no way to stop this from happening, but what can we do to insulate ourselves and turn it into a once-in-a-lifetime opportunity?

Jim Rickards #1 Investment

Although this teaser is a truncated ad for MoneyGPT, Jim says the hidden chapter in which he reveals his #1 investment to own ahead of any crash is not included in the full release of the book.

The only tangible clue we get about it is that:

- We can activate this investment in any basic brokerage account and it’s not a stock, bond, or option.

By a process of elimination, what's left is commodities.

We already know Jim loves gold and silver from prior interviews and articles. In the teaser, he recommends that “every American family put 10% of their investable assets into gold and silver.”

The other possibility Jim is on record as liking and is a function of any basic brokerage account is cold hard cash. He recommends we hold as much as 30%, but this seems redundant.

There's no way to be sure exactly what Jim is teasing, but how likely is an “AI Doom Loop?”

Market Crash or Golden Age?

Jim believes before we can have the latter, we will get the former.

Unfortunately, he may be right.

Flash crashes from automated trading systems have happened in the past, with 2010 being the most notable example.

In less than an hour, the Dow Jones index lost almost 9% of its value and around $1 trillion was wiped out.

Ultimately, the subsequent investigation the SEC carried out looking into the underlying cause of the crash concluded that not only was the market susceptible to volatility given macro events like the Greek debt crisis at that time.

But that a single selling order of an “enormously large amount of E-Mini S&P contracts and subsequent aggressive selling orders executed by high-frequency algorithms triggered the massive decline in market prices“.

That was 15 years ago.

Given the higher proliferation of algorithmic trading today and the sophistication of AI, it stands to reason that a temporary 20-25% dip is entirely possible.

The timing is anyone's guess, but it will likely happen sometime in the next 2-3 years once more advanced AI bots become prevalent.

The best thing we can do to protect our downside is to hold hard assets like gold, silver, real estate, and Bitcoin that have valuation floors, and keep some cash handy (maybe not as much as 30%) to take advantage of any downturn.

Quick Recap & Conclusion

- Former CIA, White House, and Pentagon advisor, Jim Rickards has an “AI Prediction” that Artificial Intelligence will cause the next big stock market crash.

- This will be brought on by advanced AI trading programs creating an “AI Doom Loop” as they all simultaneously execute millions of sell orders and rush for the exits.

- Jim has a plan to navigate a crash like this and a #1 investment to own ahead of any crash. All is revealed in a hidden chapter of his MoneyGPT book called “Thriving in Chaos” and it can be ours with a subscription to the Strategic Intelligence research service for $49.

- Not enough clues were provided to find Jim's #1 investment with 100% certainty. But we do know he likes gold, silver, cash, and real estate. The usual suspects.

- A modern-day flash crash is inevitable sometime within the next few years as advanced AI bots proliferate. Owning hard assets and keeping some cash on hand is the best way to protect against this.

Will we see an “AI Doom Loop” this year? Drop a Yes or a No in the comments.

He says ai can write its own programs all in search of the same information indicating rising roi. So will all buy the same

stocks, no sellers. Does the mkt need mistakes made by humans buying wrong stocks to operate.Every buyer needs a seller.