Investment newsletter legend Jeff Brown is in the middle of an American ghost town with just 30 people, where he's found the key to unlocking $100 trillion in new wealth.

It's a strange “AI Metal” and one company has a virtual monopoly on it.

The Teaser

More than 300 materials and components go into building an artificial intelligence chip.

Jeff believes this particular “AI Metal” is one of the most critical ones.

In 2020, Jeff founded the investment research boutique he would unceremoniously leave in 2023, before subsequently returning a year later.

Since coming back, he has put out such teasers as AI Superweapon Stocks and a “Manifested AI” Stock for 25,000% Growth, which we have reviewed.

The Semiconductor Industry Association backs up Jeff's claim about the “AI Metal“, saying:

In many instances, there are no known alternatives to these materials that satisfy our functional needs.

Once upon a time, in the 1980s, America used be a leading producer of this “AI Metal,” but after the government did what it does best…hamper functioning markets with red tape, the U.S. lost it's lead to China.

This is a big problem.

It's not just AI that relies on this metal, but so do energy suppliers, computers, mobile phones, automobiles, and more.

Despite all of his recent shortcomings, Trump recognizes this, which is why he signed an executive order to immediately begin facilitating domestic mineral production to the maximum extent possible.

In layman's terms, this means projects are getting fast-tracked.

So far, 30 exploration sites and counting have been granted “Covered Projects” status under Title 4, including silver, uranium, palladium, and others.

Jeff is of the mind that his “AI Metal” project is next in line to get granted this special status, causing shares of the company behind it to soar.

The Pitch

The name, ticker symbol, and a full analysis on this company is in a report called “The Company Behind the $100 Trillion AI Metal.”

It's ours, but only with a subscription to Jeff's Near Future Report newsletter.

A membership usually costs $499 per year, but Jeff has lowered the price for a limited time to $199, with a 60-day “ironclad” money-back guarantee.

An Accidental Discovery

After World War II, the nuclear arms race was on.

The world's two major superpowers at the time, the United States and the Soviet Union, were pulling out all the stops to outdo one another in the development and stockpiling of nuclear weapons.

All of this military one-upsmanship caused the demand for uranium to skyrocket.

This is great, but you may be wondering, what does it have to do with the teaser?

Well, in 1949 three prospectors went looking for uranium in the ghost town Jeff was in at the beginning of the presentation.

However, instead of uranium, they found a strange ore called Bastnaesite.

It is a rare earth mineral that contains magnetic elements used to produce speakers, microphones, vibration motors in mobile phones, and other technology applications, like AI.

Powering Next-Gen AI

The magnetic properties inside bastnaesite increase heat resistance, keeping chips running smoothly even under heavy workloads.

It is also used inside data center hard drives and energy-storing batteries.

As readers know, there have been more than a few teasers of late talking about next-gen AI, which is artificial general intelligence (AGI), and how it will need far more computing power than we currently have available.

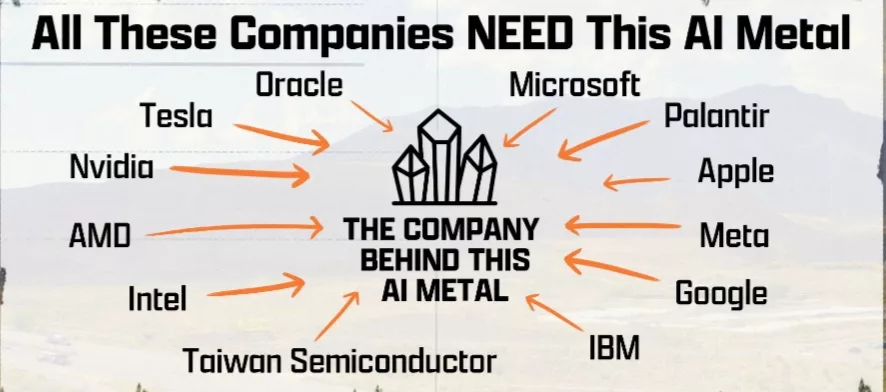

Whether it's for running large language models, humanoid robots, or self-driving cars, all of these companies depend on bastnaesite's magnetic properties, in one form or another:

It makes bastnaesite more important than ever.

This is where the “AI Metal” opportunity comes in.

There's only one company producing a d refining it in the U.S. and it will likely remain this way for some time, as it takes years for new mines to come online, and become productive.

The lethal combination of low supply coupled with rising demand equates to higher prices. It's economic law, like 2+2 equals 4.

We've witnessed this play out numerous times in the past with the oil embargo in the 1970s and with uranium in the early to mid-2000s, when a $5k investment into Forsys Metals turned into $1.7 million.

Now, its happening again with rare earth minerals, but the difference is, this time we'll know exactly what company to buy.

Revealing Jeff Brown's “AI Metal” Company

The company Jeff has been raving about is the only one capable of helping the U.S. close the rare earth mineral supply gap.

We don't know much about it, except that:

- It's operations are based entirely in the U.S.

- It is taking steps to become vertically integrated, mining and refining rare earths in the U.S.

- The Trump administration could grant it “Covered Project” status, as it has done with others.

This isn't much to go on, but given the rarity (no pun intended) of this miner's operations, we were able to narrow it down pretty quickly.

For starters, we know that there are only two domestic rare earth mining locations in the U.S., California and Georgia.

Of these, only one has a rare earth mine and processing facility. The Mountain Pass Rare Earth Mine and processing facility in California, which are owned by MP Materials Corp. (NYSE: MP).

It checks every one of Jeff's boxes in terms of a domestic, vertically integrated mineral producer, and it just did a multibillion-dollar deal with the U.S. government to boost output of rare earth magnets.

Turn $5k into $1.7 Million?

Shares of MP Materials are up 350% since the start of the year.

Does it have more room to run or have we arrived to the party too late and the bartender has already stopped serving drinks?

The proverbial cat is out of the bag about the necessity of rare earth minerals to AI, so the rest will depend on how constrained, or not, supply becomes.

If purchasing from China-based producers is ruled out, then supply will become more cramped than a clown car at a circus.

Since the U.S. government is now MP's single largest shareholder following their multibillion-dollar deal, a lot of traditional metrics, like a current ratio above 1, indicating financial stability, and a steady, sustainable growth rate, go out the window.

Given it's “national strategic asset” status and the essential commodity it produces, MP is now “too important to fail.”

The rare earth producer will grow into its current valuation, once it expands its Mountain Pass facilities and opens up its second domestic magnet manufacturing facility in Texas by 2028, which will produce an estimated 10,000 metric tons of rare earths.

Buying MP stock now chasing short term gains may not work out as a lot of growth is already baked into the price. But, as a monopoly that produces an essential commodity, MP will be a multibagger over the long term.

Quick Recap & Conclusion

- Investment newsletter legend Jeff Brown is teasing a strange “AI Metal” that one company has a virtual monopoly on.

- During Jeff's hour-long video presentation, we learn that the “AI Metal” is Bastnaesite, a rare earth mineral, and the company is the only domestic U.S. producer and refiner of it.

- It's name and ticker symbol are only revealed in a report called The Company Behind the “$100 Trillion AI Metal.” The report is ours with a subscription to Jeff's Near Future Report newsletter, which costs $199 upfront for the first year.

- Despite the decided lack of any real clues, we were able to track down and reveal Jeff's “AI Metal” Company for free. It's MP Materials Corp. (NYSE: MP).

- MP Materials is a government-controlled monopoly on an essential commodity, with 100% of it's future output guaranteed. Shareholders will receive a hefty premium if it is taken private, and perhaps some dividends along the way.

Will the United States ever achieve rare earth mineral independence? Leave your thoughts in the comments.