Best-selling author and Renaissance man James Altucher is predicting that a Starlink IPO is imminent.

In this teaser, James promises to reveal the name of a “Starlink IPO Stock” that can give us in-direct ownership BEFORE it's big upcoming public filing.

The Teaser

According to James, the single greatest wealth creation opportunity comes about by investing in a company early, before it goes public.

Investor, venture capitalist, podcaster, James is many things to many people, but to us here at Greenbull, we know him best as an investment newsletter hypeman.

We previously reviewed Altucher's AI 2.0 Stock and Microcap Superstocks, which turned out to be a nice change from the large and megacap names that are typically teased.

James himself has personally scored gains like making 60 times his money on one pre-IPO investment over just five years.

Truly impressive.

However, most individual investors are completely locked out of pre-IPOs, that is, unless you are an accredited investor and more connected than Jeffrey Epstein.

This is a travesty, as Inc. magazine reports, by the time a company goes public, 95% of all profits have already been made.

The figure seems high and I wasn't able to find a link to that article, but it's true that private, normally off-limits, early funding rounds in promising startups offer the lowest valuations and thereby, the best investment entry points.

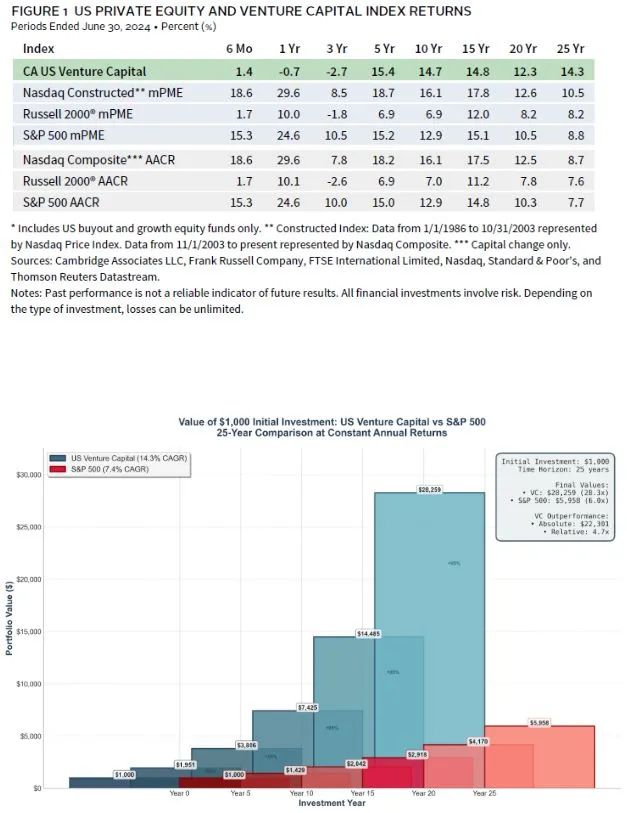

The numbers tell a similar story.

Venture Capital vs. the S&P 500

Backing businesses in the early stages is not for the faint of heart, but it is profitable.

Cambridge Associates did the heavy lifting for us by comparing the average annual compound return of venture capital to a buy-and-hold strategy in the S&P 500 over a 25-year time horizon.

What they found was that U.S. Venture Capital delivered a 14.3% compound annual return compared to 7.4% for the S&P 500, from June 30th, 1999 to June 30th, 2024.

Given the relative outperformance, having some exposure to early-stage businesses would be good for our wallet's health.

Fortunately, James says he has a way to get a pre-IPO stake in Starlink, which as we recently covered in another teaser review, could go on to be part of the single biggest IPO in history.

The Pitch

It's name and ticker are only revealed in a new report, Elon’s Big Buyout: The #1 Starlink IPO Stock To Buy Now.

All James asks is that we take a risk-free trial of his monthly research advisory called Altucher’s Investment Network.

This comes with a limited time offer of $49 upfront for the first six months (normally $299) and a full 90-day money-back guarantee.

The Starlink IPO Bombshell

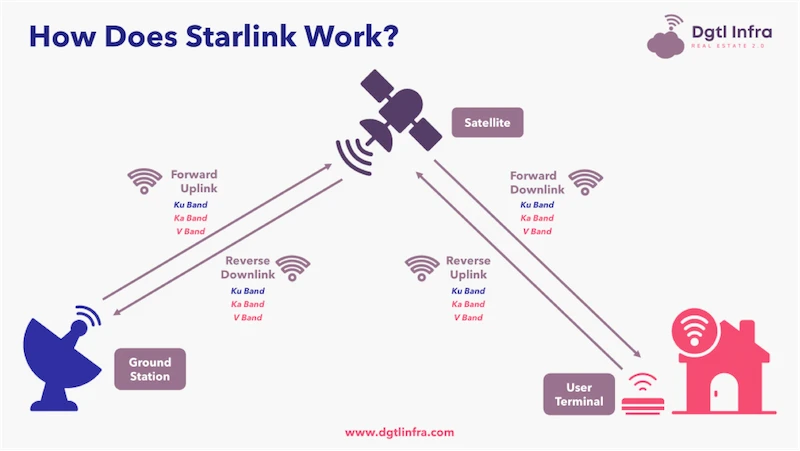

As you likely already know, Starlink is but one subsidiary of a larger parent company called SpaceX.

However, Starlink is the economic engine of the whole thing, accounting for nearly 70% of all of SpaceX's revenue.

At the moment, Starlink satellites in space beam internet service down to a Starlink terminal, and that terminal then transmits the lightning-fast speeds to your device.

There's just one catch…

The network requires proprietary hardware to function, meaning you can't connect to it without owning a terminal that looks like this:

Needless to say, carrying around a fun-size picnic table is less than convenient.

The company's future is in direct-to-device connections.

This is where James's “big buyout” opportunity comes into play.

One company has developed satellite technology which creates an entire cell tower in space, removing the need for a hardware terminal because their space cell tower beams internet directly to your device.

It's a small tech play that is patent protected, making them the only company in the world that has access to this space tower technology.

For Elon, there's only one choice: Buy this company out for tens of billions of dollars, in order to integrate its patented direct-to-device tech.

It's the missing piece and James's bombshell is that this buyout will be announced before a SpaceX/Starlink IPO takes place.

Let's try and find out which “small tech play” he's talking about.

Revealing James Altucher's Starlink IPO Stock

A potential Starlink acquisition isn't exactly what I had in mind for a backdoor play.

To give credit where it's due, James thought of this and recommends Destiny Tech100 Inc. (NYSE: DXYZ) to get direct pre-IPO exposure to Starlink/SpaceX stock and other early-stage companies.

That being said, he predicts the biggest gains will be made in the obscure tech play that Elon has little choice but to buy out.

We don't know anything about it except that:

- It owns Patent No. 9,973,266 for direct-to-device satellite internet.

- The company is a small-cap

Fortunately, this was all the info we needed. The buyout pick is AST SpaceMobile Inc. (Nasdaq: ASTS).

- AST owns Patent no. 9973266, which was granted in 2018 for technology related to space-based cellular broadband.

- At a market cap of $34 billion, AST is now a large cap.

A Change-Agent With a Catalyst

At this point, Elon Musk is the grim reaper meme personified.

Starlink appears poised to permanently disrupt the $2 trillion telecom industry.

It's about time the legacy internet service providers got some competition.

That's the good news, especially from a consumer point of view.

The bad news is the price we would be paying for this prospect.

Based on Forge data, SpaceX's current valuation stands at around $1.3 trillion. Slightly below the rumored $1.5 trillion it's upcoming IPO will be priced at.

So, we would be getting in at a slight discount, but not much.

A big hypothetical in all this is a potential spin-off IPO of Starlink, which James's research tells him could be announced as early as next month.

Next month is also the all-important space industry event known as SATShow.

James says:

If Elon were to attend this year’s SATShow, it’d be the perfect venue for him to announce to the world that he’s spinning off Starlink from SpaceX, which he’s now taking public

However, I don't think this will happen, as it would largely take the wind out of the sails of the already announced SpaceX IPO.

If it happens, it takes place sometime down the road after the SpaceX IPO.

Moving on to ATS Spacemobile, it's an interesting angle.

It's almost like speculating on an unannounced M&A arbitrage special situation, the riskiest kind.

The median public company takeover premium is around 35-40% based on figures from buyouts completed last year.

If we apply this to ATS stock and tack on another 10-20% for the competitive edge it would give Starlink, we would be looking at a 45-60% gain on today's price, with a time to completion of around 6-9 months.

The risk/reward in such a scenario is acceptable, but not great, especially considering the risk of betting on a yet-to-be-announced transaction.

Both Destiny and ATS stock provide us with unquestionable upside and getting exposure to private, early-stage companies would be a good idea, but on an opportunity cost basis, there are better deals out there.

Quick Recap & Conclusion

- James Altucher is teasing a “Starlink IPO Stock” that can give us in-direct ownership BEFORE it's upcoming public filing.

- What James is really teasing are two plays: One to get direct exposure to Starlink/SpaceX stock and the other, where the biggest gains will be made, is an obscure tech play that Elon has little choice but to buy out.

- The latter's name and ticker are only revealed in a new report, Elon’s Big Buyout: The #1 Starlink IPO Stock To Buy Now. It's ours with a subscription to James's monthly research advisory called Altucher’s Investment Network, which costs $49 for the first six months (normally $299).

- The way to get direct exposure to Starlink stock is by buying Destiny Tech100 Inc. (NYSE: DXYZ) and we were also able to reveal the buy-out candidate stock for free, it's AST SpaceMobile Inc. (Nasdaq: ASTS).

- Both Destiny and ATS stock provide us with upside potential and getting some exposure to early-stage companies would be a good idea, but from a valuation standpoint, there are better deals in the market.

Will Starlink buy out AST? Tell us what you think the odds are in the comments.

BPTRX Baron Partners Fund holdings include 28% of Space X. Far better investment that any of the hyped investments noted in this report.