All eyes and headlines are focused on Elon Musk’s plans to overhaul the federal government with President Trump.

However, no one is talking about his biggest goal…which is to create the most powerful AI on the planet! James Altucher has discovered the “Silent Partner” stock, which is the best way to play it.

The Teaser

“Artificial Intelligence for the American people.”

It's a matter of economic and national security!

This is a topic tailor-made for multipreneur James Altucher, who once designed his own AI software to identify patterns in the stock market that nobody else saw.

No word on how accurate this early AI software was, but we do know some stocks that James previously teased, including 3 Microcap Superstocks and an “X-9840” Stock.

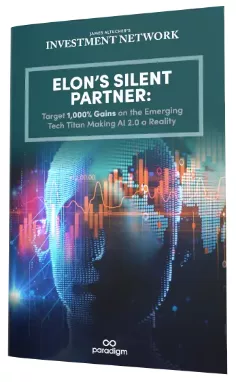

In this presentation, James is hinting at a in-direct way to invest in Musk's privately-held xAI, which owns the world's fastest supercomputer – Colossus.

Just as much as Trump's executive order promoting AI innovation instead of regulation and the Stargate Project's recently announced investment in AI data centers. Colossus is critical to the rise of AI 2.0.

Artificial Superintelligence

A sell-off to start the year may have temporarily gripped the market, but James is of the mind that “a more powerful wave of AI euphoria will soon spread across Wall Street.”

This is due to the realization that although AI 1.0 gave us all the world’s knowledge at our fingertips. AI 2.0 will give that knowledge to intelligent machines that will solve our problems for us.

See, Nvidia’s chips are the neurons or brain cells inside of AI.

It's what xAI has more of than every other company, but what it needs is a link that makes all of these chips work together, combining their power into one all-powerful, autonomous neural network.

This is Artificial Superintelligence and “Elon's Silent Partner” supplies the critical piece of technology that makes it possible.

The Pitch

All of the details on this company are revealed in a special briefing called Elon’s Silent Partner: Target 1,000% Gains on the Emerging Tech Titan Making AI 2.0 a Reality.

To get our hands on it, we will need a subscription to Altucher’s Investment Network, which costs $49 for a limited time (normally $299).

A sub comes with a 100% money-back guarantee (no timeframe specified), 12 monthly issues containing a “big investment megatrend” two bonus reports, urgent trade alerts, and more.

The Real AI Boom

James does not doubt that we’re about to see a second wave of AI wealth in the stock market.

But what will be the catalyst that kicks this off?

It's a combination of a few things that are already in motion.

Between tax cuts, looser federal regulation, and major investments, the U.S. is creating a breeding ground for AI and other industries to flourish.

Contrast this against the prior presidential administration that was restrictive on AI advancements and raised taxes, yet AI stocks still boomed over the past three years, and the makings of a boom are brewing.

Sure some valuations are stretched, but over the long term, growth will catch up.

Also, consider that the best returns won’t come from the companies that everyone is already talking about today.

The likes of Nvidia, Microsoft, and Alphabet might double over the next few years, but they won't be 10-baggers like the smaller firm developing the missing link for AI 2.0

A Massive Upgrade Cycle

As we have covered in previous AI-related teaser reviews, the existing energy infrastructure cannot support the computing power that is needed to scale up to AI 2.0.

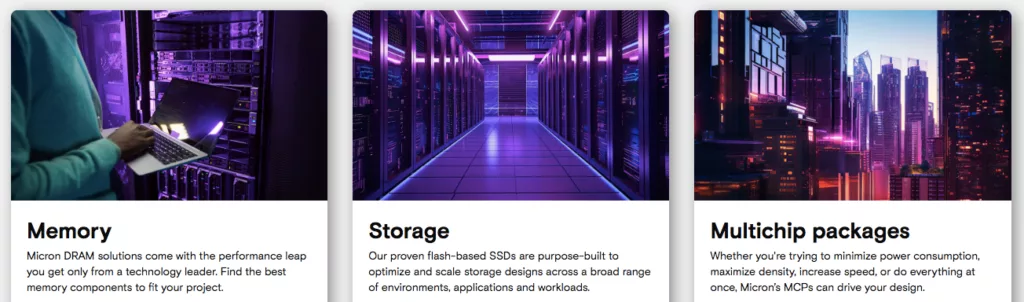

This is due to the huge amounts of memory, storage, and high-speed connections that AI Superintelligence requires.

Some studies have attempted to simulate the raw power required to replicate a single human brain. What they found is terrifying and enlightening…

It takes approximately 2.7 Gigawatts of energy, which is equivalent to about 5% of the UK's total power supply.

While we wait for the power grid to catch up, optimized solutions are the best we have, and the company James is pitching here has something to fulfill just about every need. Whether a company is “just starting to experiment with AI in the cloud or operating complex AI applications inside of large data centers and computing networks.”

Revealing James Altucher's AI 2.0 Stock

The clues provided were plentiful, but general in nature. Here is what we know:

- The company has developed a critical technology that links Nvidia chips and enables them to work together.

- Its technology is protected by over 50,000 patents.

- Besides supplying major tech firms, it is also a trusted partner of the U.S. government at the federal, state, and local levels.

All the clues point to the AI 2.0 Stock being Micron Technology Inc. (Nasdaq: MU).

- Micron is one of Nvidia's key High-Bandwith Memory (HBM) component suppliers.

- The company surpassed the 50,000 patents milestone in 2022.

- Micron's client roster includes Microsoft, IBM, Cisco, and the US government.

A $14 Quadrillion Opportunity?

This impossible figure comes from Stuart Russell, a professor of machine learning and computer science at the University of California Berkley.

He is predicting that AI could generate $14 quadrillion in wealth over the next 20 years, which equates to 14,000 trillion and 14 million billion.

Such staggering wealth will only be possible if artificial general intelligence scales to “Superintelligence.”

This is unlikely to happen anytime before 2030 due to energy and hardware constraints.

However, AI will continue progressing and pushing the limits of our existing infrastructure until then, with Micron's help.

The company's product range spans memory, storage, and multichip packages that optimize and scale data center infrastructure, making it an essential supplier.

A glance at its financials shows a business with some competitive advantages, trading for a good absolute price, and a great price compared to its peers.

Micron's 14x forward earnings is less than I expected for a bleeding edge tech company growing revenue by 80-90% year-over-year and operating cash flow by almost 40% quarter-over-quarter.

The latter figure along with its less accurate cousin, net income, have fluctuated greatly. But this should change soon as Micron's business has steadied and it forecasts record revenue, along with “significantly improved profitability in fiscal 2025“, per its CEO.

The only blemish on Micron's record is a $13 billion debt load, however, it's all relative, with the company keeping $7 billion in cash on hand as of the end of Q1 2025, which should accelerate alongside cash flow.

Micron's price is fair, its underlying economics are good, and growth is above average.

Quick Recap & Conclusion

- Elon Musk may have his hands full with DOGE, but his biggest goal is to create Artificial Superintelligence, and James Altucher has discovered the “Silent Partner” stock, which is the best way to play it.

- Elon's privately-held xAI may have more AI chips than any other company, but what it needs is a link that makes all of these chips work together, combining their power into one all-powerful, autonomous neural network.

- One company supplies this critical technology and it is revealed only in a special briefing called Elon’s Silent Partner: Target 1,000% Gains on the Emerging Tech Titan Making AI 2.0 a Reality. All we need is a subscription to Altucher’s Investment Network, which costs $49 for a limited time (normally $299).

- Fortunately, all you had to do was read the Greenbull to get the pick for free. It's Micron Technology Inc. (Nasdaq: MU).

- Micron is an AI infrastructure stock with a fair price and above-average growth. A quality pick.

When will we reach Artificial Superintelligence? Give us your best guess in the comments.