Can artificial intelligence outperform Warren Buffett when it comes to picking stocks?

This is what Whitney Tilson is trying to do and we're revealing if his “N.E.W. System” Stock Picker is any good.

The Teaser

Tilson's “N.E.W. System” isn't just an investment tool, it’s part of a massive economic shift that is already minting billionaires at unprecedented speed.

Whitney Tilson is like that friend who occasionally gives you unsolicited stock tips and some turn out to be money, while others are dog food.

In the same spirit, Whitney's teasers that we have reviewed, like his Top Stocks for the Nuclear Renaissance and DNA Titan Stocks, have been hit or miss.

If nothing else, this one is timely as it represents the next big thing in financial markets – AI trading.

Complex algorithms processing large data sets and identifying patterns to exploit them i.e. algorithmic trading has dominated for the better part of two decades.

It currently makes up about 60-75% of all intraday trading in the U.S., Europe, and major Asian markets.

Artificial intelligence (AI)-based trading is the natural progression, as it is smarter, faster, and more efficient than current-gen automated systems.

What used to take millions of dollars in salaries to build complex models run by dozens of staff who clocked 80-hour work weeks, now takes seconds thanks to AI.

All the usual suspects, from large asset managers like Bridgewater Associates to JP Morgan, which rolled out a proprietary genAI platform to its more than 200,000 employees, are implementing it.

Whitney takes things a step further, saying:

“One system, run on one laptop, by ONE person, can crush them all.”

He would know because his firm is putting this into practice itself.

Tilson's New Engine of Wealth System or, The N.E.W. System, has automated hundreds of roles into one system to help us find exactly where the most profitable part of the market is, at any time, in any given market, bull or bear.

And the backtested results are, quote, “incredible.”

The Pitch

Whitney is selling direct access to this “N.E.W. System“, which has never been offered to the public, until now.

A subscription to Stansberry's flagship research service, Investment Advisory, will get us in.

New subscribers pay $149 upfront for one year of access, with a full 30-day money-back guarantee.

The Same ‘Edge' as the Super Rich

Wall Street's competitive advantage used to be it's ability to hire the smartest brains, build the fastest computers, and buy the best datasets.

Now, thanks to AI, that advantage has vanished.

Think about it like this…

Worldwide, there are more than 58,000 listed companies and there are dozens of well-established ways of analyzing and valuing each one.

From quantitative factors like free cash flow, return on equity, and enterprise value to purely qualitative considerations, such as stock repurchases, management ownership, and more.

Up until now, it would take standing armies of analysts weeks and months to analyze some of these data points and come up with valuation figures and growth projections.

Now, AI can do work that used to take months, in just seconds.

Not only this, but AI can find the best combination of quantitative and qualitative factors for the highest potential gains.

This is what Tilson's N.E.W. System does in a nutshell.

It has figured out a way to analyze and understand trillions of data combinations, and crunch them down into a single number, from 0 to 100.

The higher the number, the more potential the stock has for growth and vice versa.

He cites a few backtest examples, such as Cadence Design (Nasdaq: CDNS), which was given a high score of 77.

Conversely, it also gave Jet.AI (Nasdaq: JTAI) a paltry score of just 17 before it proceeded to wipe investors out over the past year.

All told, Whitney claims the N.E.W. System cost $4 million and “a hell of a lot of coding and testing” to develop.

It apparently took a team of quantitative finance, computer science, and physics wizzes with advanced degrees, and a combined 76 years of coding and tech experience to get the job done.

So it's no ChatGPT or Grok wrapper vibe coded over a weekend by Whitney. That's assuring.

Besides analyzing and grading stocks, the system has also been trained up to simulate the future outcomes of thousands of different types of portfolios, using every combination of companies imaginable.

But is it really “the perfect AI-driven model investment portfolio” and what about those backtest results that are nothing short of amazing?

Is Tilson's N.E.W. System Any Good?

The claims about the AI-based system are numerous:

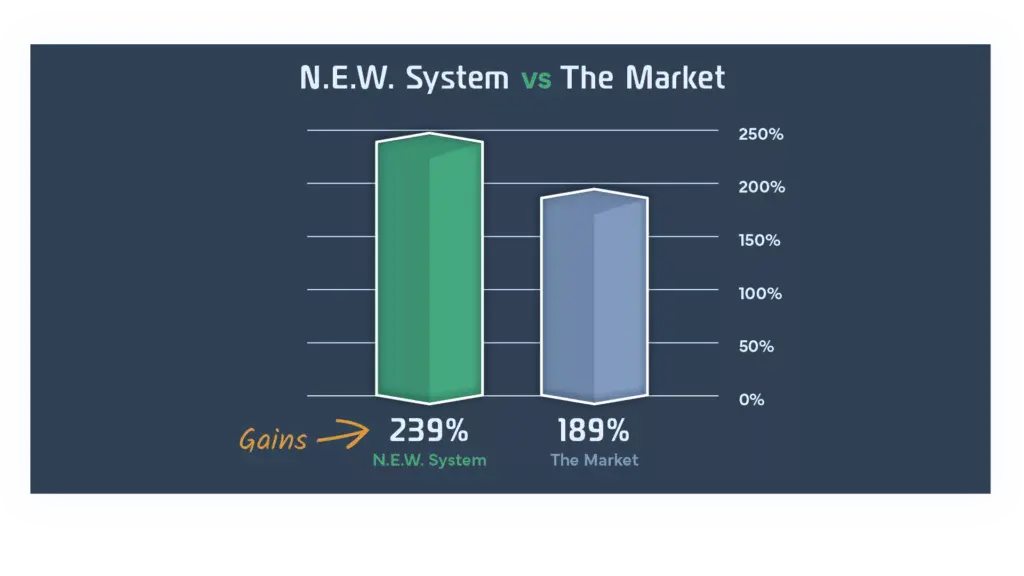

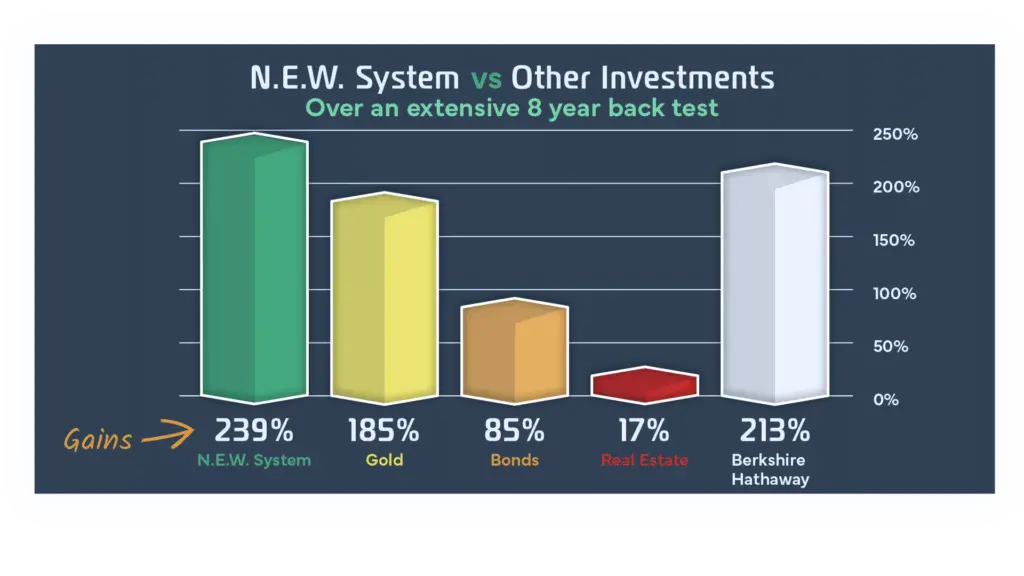

It would have made us more than the stock market, even through three major market crashes in 2020, 2022, and 2025.

Outperformed gold, bonds, real estate, and even Berkshire Hathaway.

Turned every $100,000 of our money into $339,000, with less risk than the stock market.

Based on what was disclosed in the presentation and everything we could dig up, the “New Engine of Wealth” AI stock picking system presents us with a model portfolio of stock recommendations four times a year.

What we want to buy into and what we don't is entirely discretionary.

The Stansberry team still vet each recommendation, along with a committee of experts (I'm assuming Whitney is one of them), and we get an update on model portfolio performance each month.

N.E.W. is purportedly the end product of more than a decade of R&D and it finally went live on September 9th with an announcement on the Stansberry site.

Thus, the outperformance claims are solely based on historical simulations, with the first quarter of live performance data due out in the new year.

As for the claim of less risk, it is simply based on the N.E.W. System's implied Sharpe Ratio versus other investments.

It's a widely used mathematical concept because it can be applied to all types of assets, but at the end of the day, risk is possibility of permanent loss of capital, not beta, or anything else.

The jury is still out on whether the N.E.W. System is any good until we've seen at least a few quarters of live performance results. At this point, it is too new, pun intended, to have received any initial public feedback either.

The price point of $149 for the first year to try out the AI system is decent, as there are other, far less sophisticated, AI stock screeners and alert systems on the web asking a lot more.

The 30-day money-back guarantee also makes the offer free from permanent loss of capital, if it turns out that the AI makes Jim Cramer-esque recommendations.

However, it is a good way to get more people subscribing to Stansberry's flagship Investment Advisory newsletter, which to be fair, has delivered an average annual return of 21% since 1999, outperforming the S&P 500's 17% average over the same period (based on audited track records).

Time will tell if Whitney and N.E.W. can follow in it's footsteps.

Quick Recap & Conclusion

- Whitney Tilson claims his “N.E.W. System” AI-based stock picker has outperformed the market and even Warren Buffett.

- N.E.W. is built to help us find exactly where the most profitable part of the market is, at any time, in any given market, and make individual stock recommendations based on its deep analysis.

- Whitney is selling direct access to his “N.E.W. System” and all of it's recommendations for $149 for the first year, with a 30-day money-back guarantee. All we have to do is subscribe to Stansberry's flagship research service, Investment Advisory.

- The outperformance claims are based solely on historical simulations, as the N.E.W. System just went live on September 9th and the first month's performance hasn't been reported yet. We will reserve judgment until we've seen at least a few quarters of live performance results.

Have you tried Whitney's N.E.W. System? Share your experience in the comments.