Artificial Intelligence is now being applied to everything from flipping burgers to drafting legal documents, and crafting the perfect marketing message with zero guesswork.

RAD Intel is using advanced language models to understand our interests and behaviors on a deeper level, but is this enough to make it worth investing in?

What is RAD Intel?

RAD Intel (Remove All Doubt) was founded in Los Angeles in 2018 by marketing and technology bro Jeremy Barnett after he exited his previous company, a men's apparel subscription service with some dubious reviews, called Trendy Butler.

Searching online, it looks like the company raised a $1.15 million seed round of funding from institutional investors, but I wasn't able to find anything on a sale or exit.

In any case, Jeremy moved on and acquired a marketing tech company by the name of Atomic Reach, which developed the AI technology that the renamed RAD Intel now calls its own.

Atomic was originally focused on using its tech to improve the SEO of client websites and cold email open rates. However, Jeremy had a much grander vision for the technology.

A Marketing Agency on Steroids

In the past, meaning as recently as last year, it would take brands months, or even up to a year, to launch new ad campaigns.

Now, thanks to artificial intelligence, market research is collected in minutes, analyzed in days, and campaigns are being launched in just a matter of weeks.

It's a fundamental reshaping of the industry. More efficient, personalized, and data-driven than ever before.

In a Forbes article from last year, the guest author stated, “By embracing these (AI) technologies, marketers can unlock deeper insights into consumer behavior.”

This is what RAD specializes in.

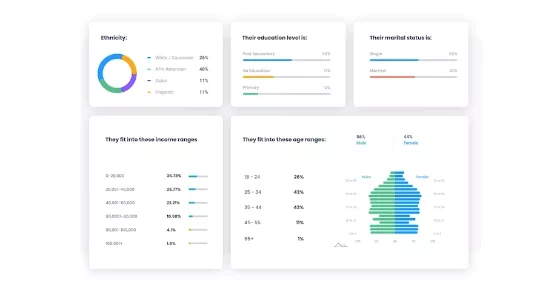

The AI-powered platform's secret sauce is its proprietary language models, which produce near-real-time interest-based audience insights at scale.

Similar to any large language model (LLM), RAD's model feeds on public conversations happening on platforms like Reddit, TikTok, and X, as well as private information shared by clients.

In as little as 24 hours, it then generates an extensive list of insights that it claims are proven to motivate your target audience.

Faster, more effective, and less expensive. This is RAD's promise.

So far, its pitch is working.

Over the past few years, RAD has grown and signed up blue-chip clients such as Hasbro, Omnicom, and MGM Entertainment, among others.

Now, RAD is looking to scale and acquire legacy marketing agencies into which it can integrate its cutting-edge tech. For this, it needs capital-lots of it-and that's where we come in.

A Transformative Opportunity?

“The vision of RAD is to be the blue check mark next to any creative campaign that they used Rad intelligence to decide what they were going to do, why they were going to do it, and what channels they were launching on.”

I respect Jeremy's ambition, but let's see what kind of deal he's offering potential shareholders.

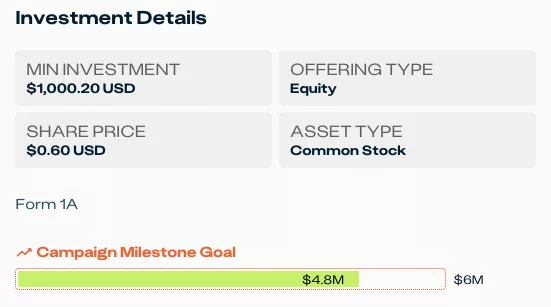

This is a basic overview of the equity offering from RAD's investor portal:

The good stuff, however, is the disclosures found in the Offering Circular made with the Securities and Exchange Commission (SEC).

This is where we learn that the offering is for Class B Common Stock, and shares of Class B Common Stock have no voting rights of any kind, except as required by law.

The voting rights are reserved for Class A Common Stockholders, who are Jeremy and other RAD execs and directors.

Dual share classes, self-dealing, like loans made to the company by insiders or vice versa, outstanding options, and warrants, are all unattractive, like an uninteresting first date.

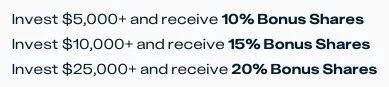

Something else that is unattractive is the 20% Bonus Share scheme.

Receiving more shares than the ones you pay for sounds generous, but it also means immediate dilution, which is like buying a 2-for-1 sale that becomes 0.75 for 1.

But lots of early-stage companies dilute their initial investors. What about the growth???

On this point, the company appears to be picking up steam from a low starting base.

In fiscal year 2023, RAD had revenue of $506,686. This represents a 24.5% increase compared to fiscal year 2022, when the Company had revenue of $406,824.

For the six months ended June 30, 2024, the latest provided in the Offering Circular, RAD generated net revenue of $385,225. A 204% increase from the prior six months ended June 30, 2023. This is more like it.

Sure, the net loss for this same six-month period from continuing operations was $4.4 million, and in fiscal year 2023, the realized net loss was $5.4 million. But it's still early days.

However, the growth of the operating losses, paired with limited revenue, and a capital raising of only $6 million, makes one question the viability of the company as a going concern.

Particularly concerning is that general and administrative expenses, which consist largely of payroll and business services, are the single largest expense item.

Supporting six part-time and fifteen full-time employees on less than $1 million in annual revenue will do this. Not to mention, the $530K combined annual salary of Jeremy Barnett and RAD President, Bradley Silver.

But maybe I'm missing something, maybe management is offering a real sweetheart deal for equity at a bargain basement valuation?

Should You Invest in RAD Intel?

Tellingly, nowhere on the investor portal or in the offering circular does it state RAD's valuation.

However, we have the offering price ($0.60) and the total number of shares currently outstanding (141,436,413), so some quick back-of-the-envelope math says that the company values itself at a whopping $84.8 million.

For a seven-year-old service business doing less than $800K in annual revenue based on the latest financials provided, and running seven figures in losses per year. The valuation is an abomination.

Perhaps the proprietary AI model RAD developed is worth $80 million? I wouldn't bet on it.

First, the company admits that its technology is not yet fully developed.

It even discloses that while “the analysis of data is performed using proprietary AI models. The response is then sent to an AI service like ChatGPT or Google's Gemini for labelling of the information so that it can respond to the client in user-friendly language.”

Also, RAD's operations team currently runs the insights analysis for each client manually, as it is not automated yet, which explains the need for so many employees.

Any interested, objective third party would not pay $80 million for half-baked AI tech that is still partially manually operated.

Bottom line: You should not invest in RAD Intel. There are far cheaper, more profitable, automated marketing tools and agencies for sale on Flippa that offer more value.

Quick Recap & Conclusion

- Privately-held RAD Intel, which stands for Remove All Doubt, claims to be revolutionizing decision-making around creative direction and content creation.

- It aims to do so with a proprietary AI model that produces near-real-time interest-based audience insights at scale.

- RAD is looking to expand and acquire legacy marketing agencies into which it can integrate its cutting-edge tech. For this, it needs capital, which is where we come in.

- The company is offering up to 21,818,181 shares of Class B Common Stock for $0.60 per share or 15% of the company. Based on the total number of shares outstanding (141,436,413), this gives RAD a market value of $84.8 million.

- Unfortunately, for a seven-year-old service business doing less than $800K in annual revenue, running seven figures in losses per year. The valuation is not just bad, it's an abomination, and you should not invest in RAD Intel.

Have you used RAD's AI insights tool? Share your experience in the comments.

This article was posted 5/8/25 and since then they ar offering a new round of stock at $.85.

I was thinking about an investment, but after reading this article I’ve reevaluated my intentions and am wondering what your thoughts on the company are now? Is it still sketchy?