Every stock exchange has a story.

In the former Kingdom of Poland, its primary stock exchange has experienced everything from medieval merchants to periodic occupations, and video games.

Now, it is one of the best-performing markets in the world, but is this enough to make it a good investment?

A Tale of Three Exchanges

We will get into exactly how and why the Warsaw Stock Exchange (WSE) is up 27% so far this year.

But first, a word on how we got here.

Like most early exchanges, Poland's first stock exchange, the Towarzystwo Kupieckie (merchant's society), was established by a decree from the Prince Viceroy of the Kingdom of Poland in 1817.

Back in those early days, trading sessions lasted only a single hour from 12:00 to 1:00 PM, and it was mostly just foreign currency bills and bonds changing hands.

For the first half century or so, the exchange steadily grew, and all was good. That is, until 1863 happened.

That is when Poles staged a bloody rebellion against Russian rule, which went back to the Napoleonic War period.

As a result of the armed uprising and the subsequent death of thousands, emergency rule was declared, and with it came the permanent shuttering of the Merchant's Society.

The First Warsaw Stock Exchange

Poland wouldn't have another proper exchange until 1908, when a group of local business owners and bankers founded the first Warsaw Stock Exchange.

Their timing wasn't the greatest, as both World War I and the Communist Bolshevik Revolution were just around the corner, which were bigger watershed events than the Russian conflict.

The exchange would recover following the First World War, with more than 130 issuers, and an annual trading turnover of more than $1 billion in local currency.

However, it couldn't shake the spread of Communism, as Poland would again be occupied in 1939 by German, then Soviet forces, and the exchange would be permanently closed.

Crushing poverty, repression of the Polish people, and even a massacre followed.

These humanitarian and dark ages would last for nearly 50 years! Until reason finally prevailed and freedom of movement was restored in 1989.

The Second Warsaw Stock Exchange

Ironically, the second iteration of the Warsaw Stock Exchange (WSE) was opened in 1991 in the former building of the Central Committee of the Polish United Workers’ Party.

However, it was a shadow of its former self.

First, trading only happened once per week, which is highly irregular. Not only this, but all trade orders were taken on loose-leaf paper by employees, and calculations were made manually on calculators.

So it shouldn't come as a surprise that on the first day of trading on April 16th, it had a total of five listed companies and a trading volume of 1.8 million zlotys.

This was a humble start, if there ever was one for a country's primary stock exchange.

So, how exactly did it go from a garage startup operation to the largest stock market in Central and Eastern Europe?

Warsaw Rising

The bar was low, but the WSE has made a few moves that have made it not only competitive but stand out when it comes to attracting capital.

For starters, you'll be glad to know that the WSE no longer writes down orders on loose-leaf paper.

It now has a modern computer-based trading system that anyone can access with a basic international brokerage account, like Charles Schwab or Interactive Brokers.

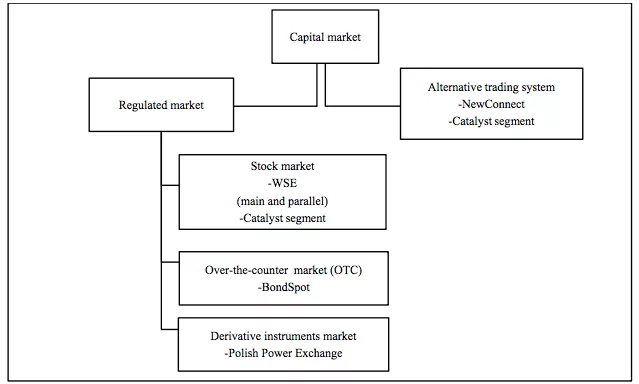

The exchange has streamlined listing regulations and supports everything from futures trading to corporate bonds, options, warrants, and even provides access to an alternative trading system called NewConnect.

This is the WSE's “young companies with huge growth potential” market, which is similar to the U.S. OTC, if the NYSE or Nasdaq owned it.

Unlike the OTC, there are only about 360 companies currently listed on NewConnect with a combined market cap of 11 billion zlotys. Interestingly, most of them are video game developers, but there are listing requirements, so quality over quantity.

There is also one other thing that stands out about the WSE today.

Despite being ranked only in the top 40 exchanges in terms of total market cap, the WSE ranks in the top tier in terms of annualized performance over the past decade.

The London, Frankfurt, and Paris exchanges may get all the attention from foreign investors, but Warsaw is rising.

How likely is this to continue, and are there any undervalued stocks worth a buy?

Make 40% Per Year?

An Eastern European stock exchange with a turbulent past and price quotes in a little-used foreign currency.

It's easy to dismiss the WSE and label it as not worth the time and effort.

However, the only way an individual investor can get any kind of an edge is by looking where the big boys can't or won't due to their size and regulatory restrictions.

The WSE meets this criterion, and if you already have a brokerage account with access to international markets, there are no extra steps that you would need to take. The reporting standards are on par with other major exchanges, and the payoff could be well worth it.

CCC S.A.'s stock is a perfect example.

It is one of the largest omnichannel footwear and apparel retailers in Europe, with stores in 28 countries and four e-commerce sites. Having traveled extensively throughout Europe over the past five, six years, I can confirm that its ads and stores are fixtures.

CCC is a simple, easy-to-understand business that has been listed on the WSE since 2004. It is now a component of the main WIG20 index, and sports some above-average economics.

The apparel group does nearly 2.7 billion in annual turnover (zloty), with a net profit margin of 17%, and a normalized return on equity (ROE) of 25-50%, excluding the extraordinary years of 2020 and 2021.

Both net profit and ROE figures are well above the WSE's consumer discretionary index of 10% and 5%, respectively. Yet the stock trades for only 15x current earnings.

CCC S.A. is up 200% over the past five years and 50% over the past year.

There are other examples as well, such as Tarczynski S.A. (WSE: TAR). The dominant meat distributor in the region, with annual revenue of 500 million, a market cap of 1.3 billion, and a current earnings multiple of only 11x, with a 2% dividend. Its stock is up more than 700% over the past five years.

Finally, there's Atrem S.A. (WSE: ATR), an engineering firm with a focus on automation.

A recent addition to the WSE main board, it is an ultra-rare, profitable small-cap with a small 1.5% dividend to boot. The stock is up nearly 150% over the past year.

As you can tell, we're underestimating the return potential at 40%. Oftentimes, the most value is found in the unlikeliest places.

Quick Recap & Conclusion

- Poland's stock exchange has a long, turbulent history that includes uprisings, occupations, and periodic closures.

- The Warsaw Stock Exchange (WSE) is the third stock exchange in the country's history, and it finally looks to have gotten things right.

- The WSE is the largest stock exchange in Central and Eastern Europe, and over the past year, it has outperformed the U.S., Canadian, and UK markets.

- Upon further research, most of its best-performing listed companies, such as CCC S.A. (WSE: CCC), Tarczynski S.A. (WSE: TAR), and Atrem S.A. (WSE: ATR), are growing, profitable, and available for half the multiples of their American counterparts. This makes it a credible place to go bargain hunting.

Have you ever purchased shares in a company on a foreign exchange? Share your experience in the comments.