Remember vacation timeshares?

Well, they're back with a modern twist. Privately-owned Pacaso offers co-ownership in luxury vacation homes all across the world, but is an investment in the company as nice as it's real estate?

What is Pacaso?

Some may associate the word ‘timeshare' with late night infomercials, telemarketers, or being locked inside a dimly light conference room to listen to a never-ending sales pitch while you're supposed to be on vacation.

Pacaso isn't that.

In fact, it's not a timeshare company at all.

Unlike the dubious long-term leasing models of traditional timeshare sellers such as Wyndham Resorts, Hyatt, Marriott, and their brokers, like Capital Vacations, with Pacaso you co-own a home.

Monetizing Vacancy

The way co-founder and CEO Austin Allison describes it, Pacaso is “monetizing vacancy” by bringing together available vacation properties and buyers.

A proverbial light bulb went off for Austin while he was working at Zillow, which bought his previous startup, when he learned that most second homes are only used about 10% of the time.

This was the springboard for Pacaso, which Austin co-founded in 2020 alongside Zillow co-founder, Spencer Rascoff, who brought added credibility to the startup.

It's aim is to democratize access to vacation home ownership by enabling buyers to purchase as little as 1/8 to as much as half of a luxury home rather than 100%, reducing both buy-in and long-term costs, while simplifying upkeep and maintenance needs.

Simply go to the Pacaso website, browse it's available vacation home listings in more than 40 markets around the world, register your interest in a property, and it streamlines the purchasing, financing, co-owning, and reselling processes.

It's a combination of Zillow and RedWeek, the world's largest timeshare marketplace, with a co-ownership component.

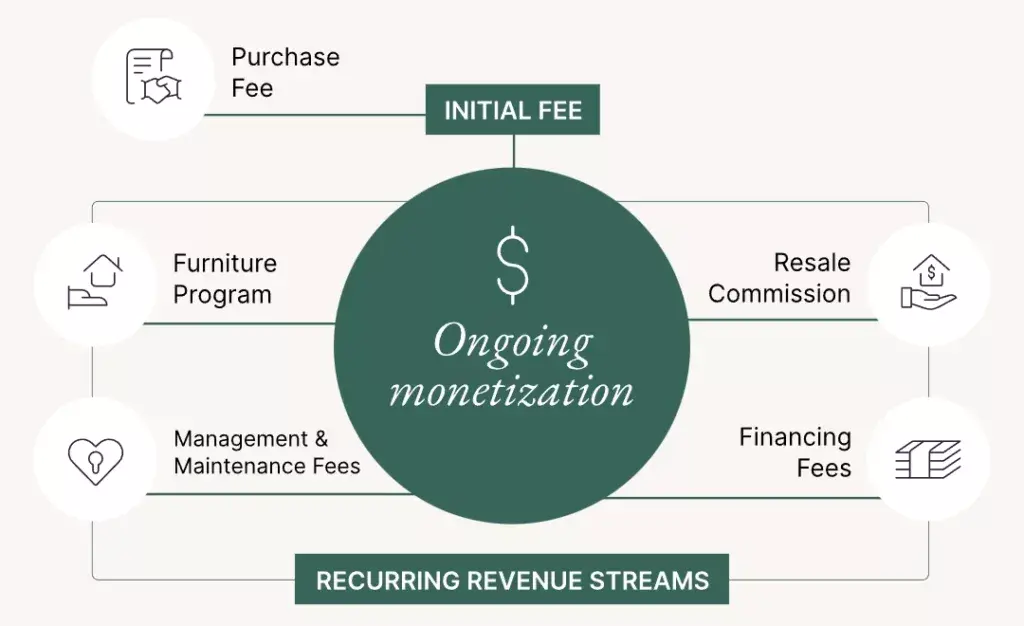

Over the past five years, Austin, Spencer, and the team have worked to prove the business model, which makes money from one-time transactions costs when buyers purchase into a property, and a mix of recurring service fees.

So far, it appears to be working.

More than 2,000 people have purchased co-ownership in vacation homes through Pacaso.

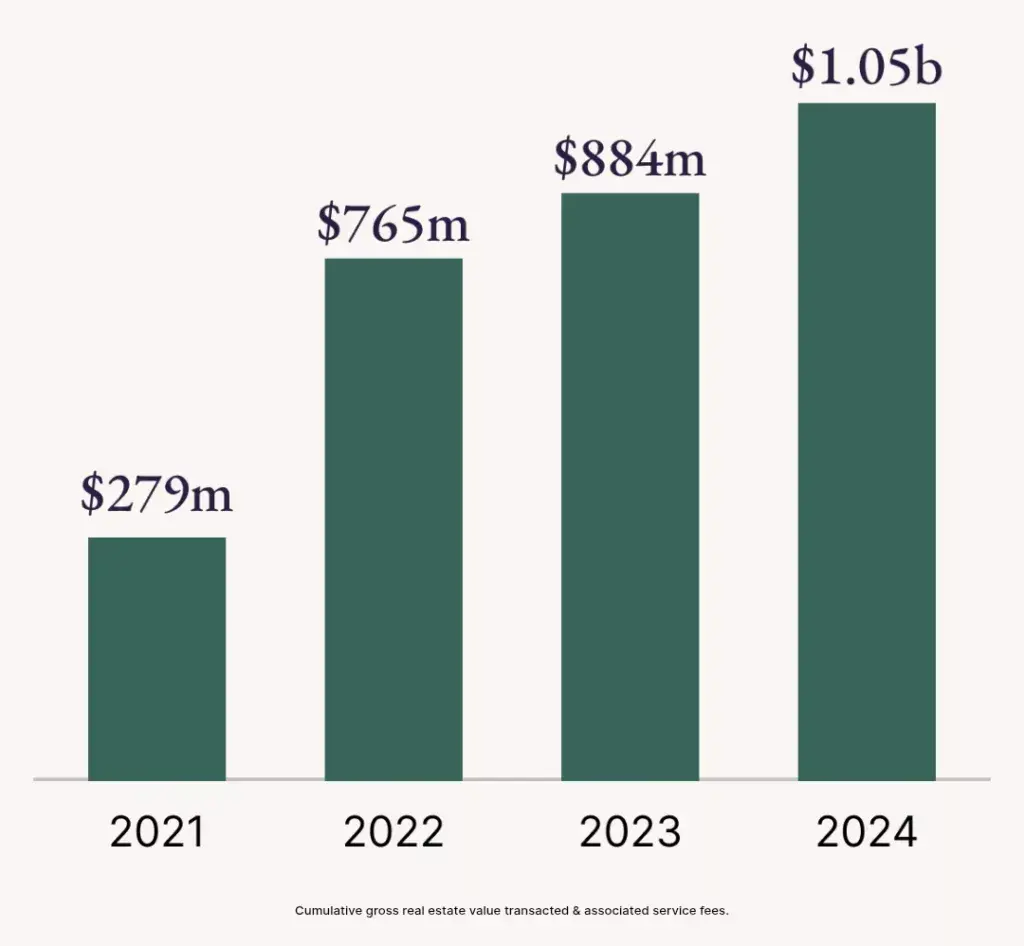

On average, it's properties are occupied 90% of the year and in 2024, the marketplace facilitated more than $1 billion in gross real estate transactions and service fees.

Now that the model has been proven and the company is making money, its time to expand it's footprint, margins, and profitability.

This is where it's current Regulation A offering of shares and the investment opportunity comes in.

Investing in a Unicorn

A unicorn is any privately-owned startup with a valuation of $1 billion or more.

Based on it's last funding round, which included notable investors like SoftBank Vision Fund 2, and venture capital firms Greycroft, and Maveron, Pacaso is a certified unicorn, with a $1.5 billion valuation.

It's an exclusive club, with only about 1,200 businesses around the world as members and getting a look at the underlying economics of one, as we are now, is just as rare.

Based on the disclosures in it's Information Circular, Pacaso's cap table breakdown is such:

- 150,000,000 shares of Class A Common Stock

- 120,000,000 shares Class B Common Stock

- 31,508,762 shares of Class C Common Stock

- 28,957,528 shares of Class D Common Stock

- and 99,395,105 shares of Preferred Stock

Each class of shares come with accompanying voting rights, 10 votes for each Class A common stock holder, one vote for each share of Class C common stock, and each share of Class B and Class D common stock is non-voting and not entitled to vote on any Company matter.

Guess which share class the company is offering us?

If you said the non-voting kind, you would be right.

Pacaso is offering up to $72,375,000 in shares of its non-voting Class D common stock, at a price of $2.90 per share.

Not treating all shareholders equally is already a strike against it.

The minimum investment amount is $1k, with the company already having raised about $25 million to date.

It's important to note that most unicorns receive the label primarily due to their hypergrowth prospects, not their current financials. Is Pacaso any different?

Should you invest in Pacaso?

Pacaso's latest annual report reveals the numbers we need to make an informed decision.

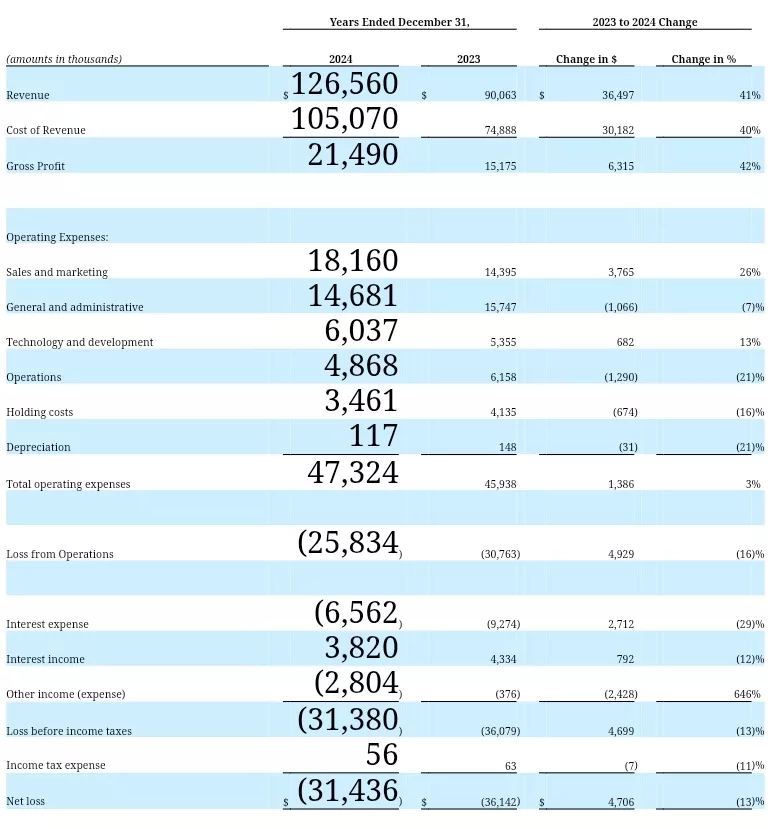

The good news is, the company is growing by 40% annually.

Last year it sold 145 co-ownership shares compared to 122 in 2023, for an increase of nearly 20%, with the remainder of the growth coming from a corresponding uptick in service fees.

The bad news is, it's operating expenses are also increasing by about 40% per year. Mainly due to marketing expenses for capital raises like the current one.

As a result, Pacaso lost $31.4 million last year and $36 million in 2023.

It's still early days for the company, but the biggest problem I see is with it's operating model.

As per the 1-K filing with the SEC:

Pacaso purchases homes and then membership interests are sold to buyers

Rather than curating MLS listings based on vacation home buyer preferences and going out and purchasing a property once sufficient demand has been generated for it on it's website, a more obvious model, to me at least, would have been to simply serve as a marketplace where vacation property owners can sell co-ownership stakes in their properties and buyers can list their own criteria and make offers.

The latter would be a more lean, efficient, and profitable model, whereas the current one requires a lot of capital, carrying, and interest costs, which are a drag on margins.

It also opens the door for regulatory matters, like the kind it is now litigating with the city of Newport Beach, California, which wants to regulate Pacaso’s model.

Based on what we now know, what would be a fair price to pay for a business like Pacaso, with $126 million in annual revenue, above-average growth, but no profitability, and a flawed operating model?

The median price/sales (P/S) multiple for a core middle market tech business ($100-$250 million in annual revenue) was around 4-5x in the first half of this year.

Based on Pacaso's valuation for this round of $914 million, it is asking for a P/S of 7.25, and it's not even a unicorn anymore.

The valuation is above average, but its not as egregious as some other Regulation A offerings we have reviewed here.

Still, given the capital intensive nature of the business, which is only going to increase with scale, the lack of profitability, and the illiquidity of the shares, such a premium is not warranted.

The founders do have a track record of successfully exiting businesses they start and the prospects of doing so again are decent, but would it be at a big enough premium to the premium we would already be paying? I'm not so sure.

At a valuation closer to the median, Pacaso may be a buy, even with it's flawed model for the exit potential. But at the current premium, it's not.

Quick Recap & Conclusion

- Privately-owned luxury vacation co-ownership platform Pacaso, is selling shares to investors via a Regulation A offering, but is an investment in the company as nice as it's real estate?

- Part Zillow, part RedWeek, with a co-ownership component, more than 2,000 people have purchased 1/8 to as much as half of a luxury home through Pacaso's platform to date, and it's properties are occupied 90% of the year on average.

- Based on the figures in it's regulatory filings, Pacaso is offering 16,262,032 Class D non-voting common shares at $2.90, after already raising $25 million.

- The valuation of $914 million, when accounting for all of the company's outstanding shares, comes out to a price/sales (P/S) premium of 7.25x on it's $126.5 million in annual revenue, with a $31.4 million net loss in fiscal year 2024.

- This is above the median 4-5x P/S premium for private core middle-market tech businesses, and not warranted given Pacaso's capital intensive business model of buying and carrying properties, non-profitability, and the illiquidity of it's shares.

Would you consider co-ownership of a vacation property? Let us know in the comments.