The battlefield has changed.

Today, wars are fought with trade routes, critical minerals, and strategy, rather than bullets and bombs. One critical metal called Antimony is at the center of this and a small company is focused on developing domestic sources of it.

The Teaser

A lot of news headlines we're seeing today can be traced back to this one metal.

This teaser is another atypical paid advertisement we received via email from Kiyosaki Uncensored, Robert Kiyosaki's news website.

We recently reviewed Mode Mobile's sponsored pitch and other resource-related teasers such as Marc Lichtenfeld’s “Uranium Profit Package.”

You have probably heard President Trump mention Greenland and Canada in passing over the past month.

It has even been said that Greenland is “critical to American national security” but why?

The reason is that in the past, wars were fought for land. Today, wars are fought for resources.

Geography Rules the World

We may live in the digital era, but geography still rules the world.

The metal mentioned at the beginning of this review – Antimony, is the perfect example of this.

The grey metal's use dates back to ancient times, with ornamental bricks from the time of Nebuchadnezzar found in Babylon. It was also widely used in Medieval times.

Today, Antimony is used not only in alloys for batteries, but also in military applications such as night vision goggles, explosive formulations, nuclear weapons production, and infrared sensors, among other uses.

This is why the Department of Interior has identified Antimony as one of just 50 critical minerals.

However, there's a big problem with its supply.

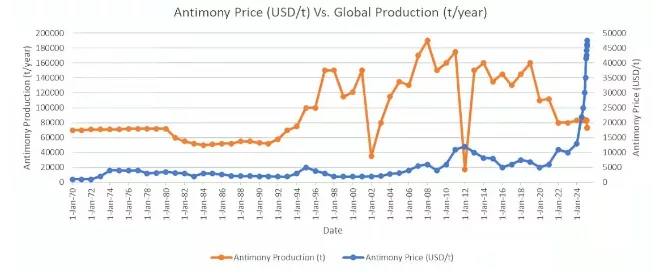

China is the world's largest producer of Antimony, making up nearly half the market, and it has outright banned the export of the critical mineral to the United States, leading to Antimony prices hitting all-time highs of nearly $50,000/ton in January.

The U.S. National Defense Stockpile has limited reserves of the metal, which suggests that a supply squeeze could be underway…unless something changes.

The Pitch

This is where Military Metals Corp. (OTC: MILIF) comes in and what is being pitched is its stock.

The link in the email we got directed us to an email signup on Military Metal's investor page, so it could be for a future private placement of shares or just to promote its stock and pump up its trading volume.

The War for Antimony

At the time this sponsored email first went out in mid-February, the U.S. military had just 17 days of antimony reserves left.

Given China's export ban and places like Tajikistan (the world's second-largest Antimony producer) being far-flung, and impractical to source from, alternative sources of the critical metal are a national security necessity.

Searching around the web, the stop-gap solution, for the time being, appears to be sourcing the metal from friendly producer countries like Australia.

However, this won't cut it long-term, so what is a practical solution?

Apart from taking over Greenland for its high-grade Antimony or annexing Canada for the same. Strategic ownership of mines and minerals, like what is now being sought from Ukraine, is the answer.

Military Metals is plugged as the knight in shining armor coming to the rescue, having secured historical antimony mines in Slovakia – a NATO-aligned nation, and strategic projects in North America.

An Antimony Goldmine?

Last October, when the Antimony situation wasn't so dire, before China's export ban, Military Metals signed a letter of intent to buy three brownfield projects in Slovakia.

This consisted of two Antimony projects and another focused on Tin.

The crown jewel of these is the Trojarova Antimony project located in Western Slovakia, which has historical resources dating back to the Soviet era.

During the 1980’s Slovakia was Europe’s largest antimony producer and Military Metal's Slovakian technical team is now in the process of completing the translation of Trojarova’s historical drill logs.

Based on a recent technical report filed by the miner, the historic mine could still hold as much as 2.4 million tonnes of Antimony.

There is still much work to be done before antimony-gold mineralization can officially be declared ‘current', but it does hold promise.

However, hopes aren't riding solely on this project alone, as Military Metals also owns two other past-producing properties, that it is in the process of bringing up to modern standards.

The question is, will it be enough to make a difference?

A Critical Player or A Pump and Dump?

There are a few things that stand out about this sponsored teaser.

The first is that Military Metals is actually a Canadian company based in Vancouver B.C. So the main plotline about the US using it to achieve Antimony independence is largely ruined.

Second, Vancouver is known for being the mining capital of the universe, with as many as 800 miners and juniors headquartered in the city at one point.

It is also notorious for being a penny stock promoter haven, with one writer even going so far as to call it the “Scam Capital of the World” in an old Forbes article.

I cannot make Military Metals guilty by association, but hiring investor relations (IR) firms to promote its stock and paying for sponsored posts/emails, like the one we are reviewing here, reveals a big emphasis being placed on the price of the stock, for better or worse.

Finally, Military Metals is a nano-cap, with a current market cap of only $28 million.

This isn't inherently a negative, it could even be a huge positive, its small size coupled with no institutional investor attention, could mean outsized gains.

However, for this to happen, there needs to be substance behind the shares.

Based on all the information and public filings I could find, Military Metals only shifted its focus to “the best-performing metal of 2024” – Antimony, in September of last year after a management shakeup.

Thus all current projects were only recently purchased within the past three months or sooner.

Considering that it takes a decade and a half, on average, to bring a mine from the discovery to the production stage, if it ever gets there. It could be years before Military Metals can make a positive contribution to the Antimony War.

I wouldn't call Military Metals a pump-and-dump scheme, but it does require a very long time horizon, making it a very speculative early-stage play in the cyclical resource space.

Quick Recap & Conclusion

- One small company is at the center of a global resource war for a critical mineral called Antimony, which the U.S. Department of Interior has designated as a matter of national security.

- The small company is Military Metals Corp. (OTC: MILIF) and it is hyped as having secured historical antimony mines in Slovakia, and strategic resource projects in North America.

- What is being pitched is Military Metals stock, no private placement of common stock, just good ol' wholesale promotion of publicly traded shares.

- Military Metals is a nano-cap at the mineral discovery stage, having only recently acquired its past-producing properties over the last few months. This means that it is going to take years before they become producing if they ever do. There are better, later stage, Antimony plays out there, such as Perpetua Resources Corp. (TSX: PPTA) and United States Antimony Corp. (NYSE: UAMY).

Will the U.S. ever secure a strategic supply of Antimony? Tell us how you think the story ends in the comments.