Pest control is an unsexy, underappreciated $25 billion global growth market.

Privately-held Med-X is trying to disrupt it by introducing all-natural solutions to a dirty business, but is it a good investment?

What is Med-X?

For as long as humans have been growing food, there has been a need to keep crops free from pests, such as rodents, snakes, and other critters.

At first, analog solutions such as cats and ferrets were employed and it wasn't until much later that insecticides and herbicides were first introduced to combat mutations, like the potato beetle.

This is around the time that the conversation about chemical pesticides and their harmful side effects first began.

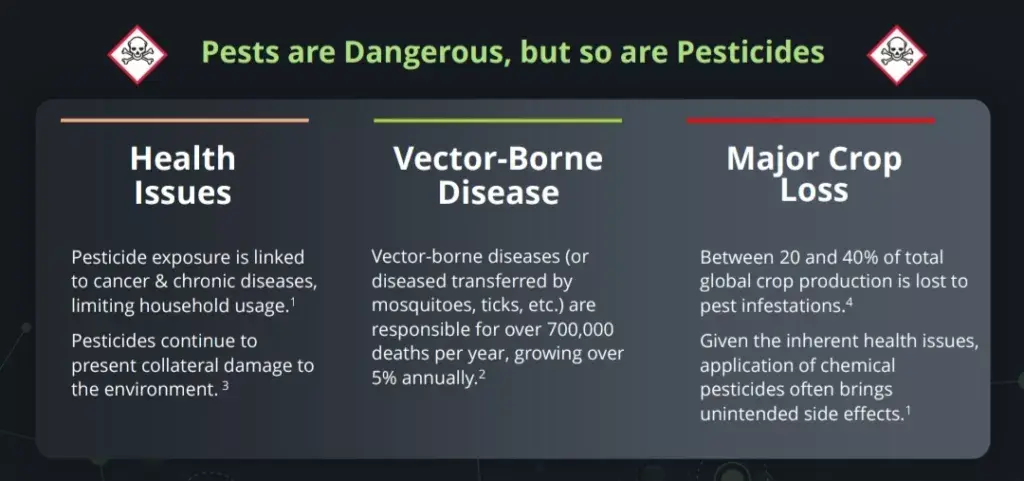

It turns out, our ancestors intuition was right and we now know that the negative side effects caused by widespread pesticide use can be even more dangerous than the pests themselves.

From pesticides being harmful to the environment to unintended side effects on crops. Producers and regulators alike have long been aware of the risks pesticides pose.

However, the tangible alternatives have been few…until now.

This is where Med-X comes in.

It's not our first rodeo reviewing a Reg-A or private offering of shares here at Greenbull. We previously looked at Pacasso and Elf Labs' equity offerings, among others.

Founded in 2014 by CEO Matthew A. Mills, a visionary according to the investor relations section on the company's website.

Med-X has developed a full line of safer, all-natural alternatives to conventional chemical-based pest control products.

Bringing it's products to market has been a journey that has included third-party laboratory testing and more than seven years of field testing on ranches in the Santa Monica Mountains.

Following positive results, the company patented it's proprietary formulations, brought them to market, and now it is looking to expand internationally.

Biopesticides vs. Pesticides

Like most things in life, the debate between naturally-derived biopesticides and pesticides containing chemical substances isn't black and white, it's gray.

At the end of the day, the less toxic, the better, which gives the nod to biopesticides.

However, when it comes to controlling numerous pests with one solution and maximizing crop yield, conventional pesticides still win the day.

This is part of the reason, biopesticides haven't been broadly adopted across the board.

Other reasons include the storage shelf-life of chemical pesticides being longer and rather importantly, they also tend to be more cost-effective.

For a product to achieve mass-market scale it has to be at least as good or better than the existing solution, more affordable, and just as easily available.

At the moment, biopesticides fall short of meeting this criteria, but two key macro catalysts could change this.

The first is shifting consumer sentiment.

According to a 1,000 person survey, 70% of respondents said they would choose a natural biopesticide, if it had the same effectiveness and cost up to 30% more.

It's a small sample size, but the first part about choosing a biopesticide, all things being equal, probably holds true for most.

The second catalyst is more concrete as it involves government directives.

Whether by design or oversight, the United States allows hundreds of pesticides that have been banned by the European Union, Canada, the UK, and other countries.

Even human rights champion China has banned the poisonous herbicide Paraquat, which is still widely used for weed and grass control stateside.

This may or may not be changing with a new nominee coming in to oversee the Environmental Protection Agency’s (EPA) chemicals and pesticides office.

The only thing certain is that chemical substance reviews will be made quickly and efficiently.

Regardless, pest control is a global market and the trend toward more natural solutions is clear.

Med-X's professional and consumer product lines are positioned to take advantage of these change catalysts.

It's consumer-focused Nature-Cide products are already available in all 50 states through Amazon and Walmart's online platforms, but is it ready to go global and turn innovation into dollars?

A Fertile Ground for Profits?

The first step Med-X is taking towards fulfilling it's global aspirations is a Reg-A share offering.

All told, it wants to raise $10 million by offering 2,500,000 shares of common stock at $4 a pop.

This tells us little, but the offering circular issued in June provides everything we need to know.

Before we get down to crunching the numbers to find out if Med-X can be a multibagger, the first notable thing uncovered in the circular is that it also owns the modern version of High Times Magazine.

Per the circular summary:

Med-X operates The Marijuana Times Network, an online media platform providing cannabis-related content and advertising opportunities.

Unfortunately, this segment doesn't produce significant revenue yet, but I like the potential pivot if the biopesticide biz doesn't work out.

Getting back to the task at hand, the second notable thing found in the circular is that Med-X's capital structure is fairly clean.

It only has one class of stock (common shares) and a limited amount of options and warrants outstanding.

As of the offering circular date, 21,706,015 shares are issued and outstanding, giving Med-X a valuation of nearly $87 million.

How closely does this number approximate the business' current reality?

It doesn't.

In fiscal year 2024, Med-X generated $1.7 million in revenue against $10 million in operating expenses for a net loss of $9.8 million.

This is a worse showing than fiscal 2023, when Med-X had more revenue, less expenses, and a net loss of only $6.4 million.

I now see why management opted to say “we generated over $6 million in product sales over the past four years” on the offering landing page instead of just listing last year's figures.

Turning to the balance sheet, things look even more dire.

Only $1.6 million of cash and intangible assets (patents) against $1.7 million in current liabilities, including $93k in credit card debt. Let's hope the rate is not below-prime.

Total book value: $2.8 million, if we're generous and include inventory and ‘other' current assets.

So even an elementary school kid learning multiplication for the first time can plainly see that paying $4 per share or more than 45x sales for Med-X makes as much sense as a pet shark.

It even puts Nvidia to shame, which ‘only' trades at 28x sales.

But what about the catalysts and future potential growth?

I believe this question largely comes down to management's ability to execute.

Thus, it's slightly concerning that neither the CEO, Matthew Mills, or the Chief Science Officer, who only works for the company on a part-time basis, possess any chemical or pest industry experience whatsoever.

Moreover, Nature-Cide, Med-X’s flagship product line of all-natural pest control solutions, is licensed to the company by Matthew Mills himself.

There's no royalty rate associated with the license agreement, but the potential for some double-dealing down the road is there.

Med-X's ground isn't fertile for profits, it's scorched earth.

Quick Recap & Conclusion

- Privately-held Med-X is trying to disrupt the multibillion-dollar pest control industry by introducing all-natural solutions to a dirty business.

- It aims to do so by expanding internationally into markets that favor biopesticides over chemical-based pesticides by decree.

- Med-X is looking to raise $10 million in growth capital at a valuation of $87 million by offering 2.5 million common shares at $4 per share.

- Unfortunately, Med-X's $1.7 million in fiscal 2024 revenue and $2.8 million book value fall well short of meriting such a valuation.

- Even if growth exceeds expectations, it could take decades, if ever, to live up to the lofty price being asked.

Is there a Reg-A offering you would like us to review? Drop it in the comments.