What happens when you combine iconic Disney characters with advanced artificial intelligence and virtual reality technology?

Privately-owned California-based Elf Labs hopes for next-level revenue and exit potential, but is this enough to make it a good investment?

What is Elf Labs?

The company describes itself as a “next-gen transmedia business.”

We'll get to what this means in a moment, but first, a short detour into its interesting past.

Elf was originally started by Billy Phillips, the current CEO, David Phillips, dad, in 2006. Back then, it was known as Toon Studio Inc. A marketing and licensing company for intellectual property (IP) in the children's entertainment space.

Billy remains the Chairman and Head of Creative for the company that he started on a whim after being approached by a copyright attorney selling classic fairy tale-themed IP.

Since then, he has worked like a madman to secure more and more IP, and today, Elf's copyright portfolio stands at 435 properties, including such beloved characters as Sleeping Beauty, Cinderella, and Rapunzel, among others.

Thus far, we have intangible assets that have real market value. So far, so good.

As for the transmedia business mentioned earlier, this is where things get intriguing.

Game-Changing Tech

Imagine being able to transform any space into a make-believe world.

Not only this, but picture interacting, playing games, and communicating with your favorite characters in immersive, high-fidelity environments. Like an old-school IMAX theater, only it's in your living room.

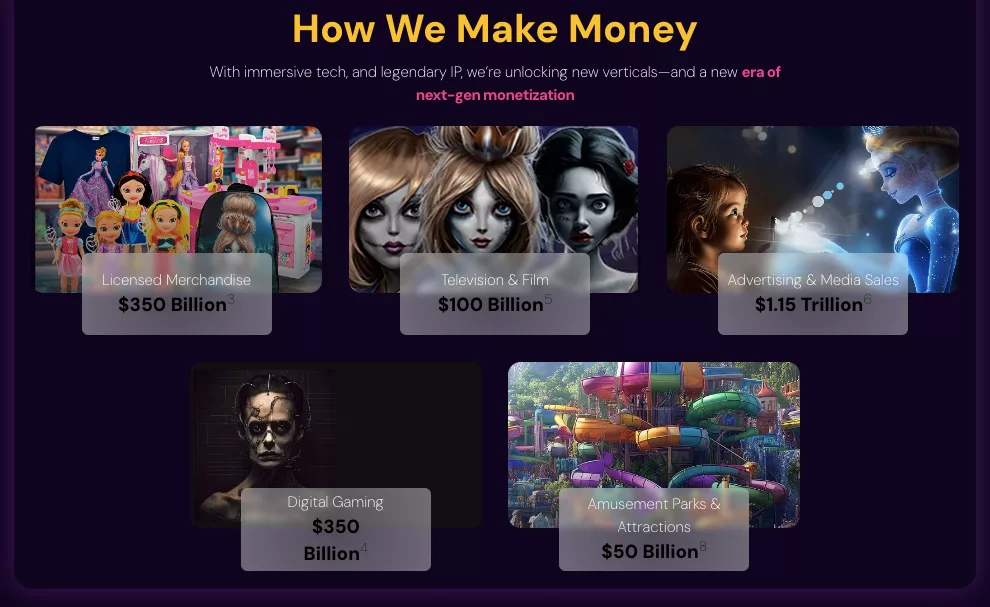

Elf has partnered with a pair of VR tech companies (Cosmic Wire & Compax Digital) to create “immersive transmedia experiences” around Elf's IP. This includes in-app purchases, so products can be seamlessly purchased as part of the experience.

It makes up one of the five ways that the company makes money.

Based on Elf's SEC filings, we find out that it has only four full-time employees and is virtual, opting not to rent out any expensive office space.

This means more of what it makes goes straight to the bottom line.

At first glance, Elf Labs looks like a lean business with a formidable IP portfolio ready to monetize its assets.

It's looking to make a big go-to-market push for its first three franchises, and is aggressively raising a private round of capital.

A Billion-dollar Business Model?

Sponsorship of AI newsletters in my inbox, frequent YouTube ads, and advertorials on well-known sites. Elf Labs is pulling out all the stops to raise money.

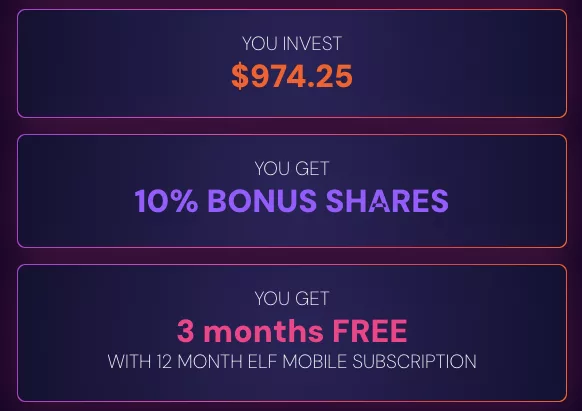

The terms of its raise break down like this:

A standard offering, and it comes with some perks:

The most important part, though, besides the enticing Elf Mobile subscription, of course, is the valuation.

As per the Offering Circular (OC), Elf determined its value by

conducting an internal analysis of its prior funding, technology growth, partnerships, development, and team, as well as historical revenue and revenue forecast when determining the valuation of this offering.

This word salad simply means that it is projecting, but are Elf's projections grounded in reality?

The company, like most others whose private offerings we have covered, including RAD Intel and Mode Mobile, goes to great lengths to conceal how many shares it is offering.

Doing so would allow potential investors to quickly calculate what value they are receiving for the price they are paying, and you can't have that.

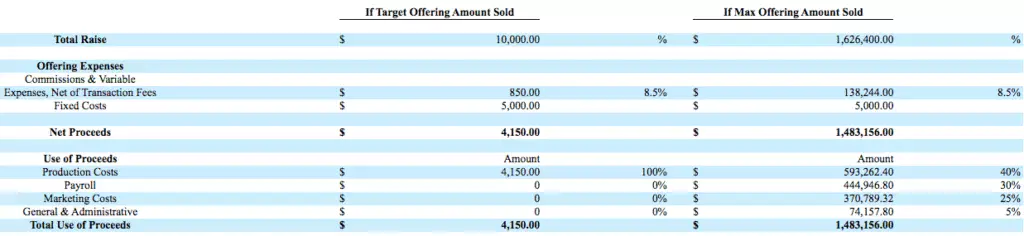

Even the OC only mentions the maximum amount the offering will raise, if fully subscribed, the associated costs, and the use of the proceeds:

Based on the offering price of $2.25 per share and the $1.62 million max offering amount, some basic math tells us that Elf Labs is selling just under 725,000 Class B shares.

Knowing this, we can deduce exactly what is being pitched.

A 3% stake in Elf Labs at a valuation of $116.5 million.

Is this good, bad, or awful?

On its face, Elf has intangible IP, which has generated over $14 million to date, large addressable markets, and a low-cost, high-margin business model.

However, its financials paint a starkly different picture.

Should You Invest in Elf Labs?

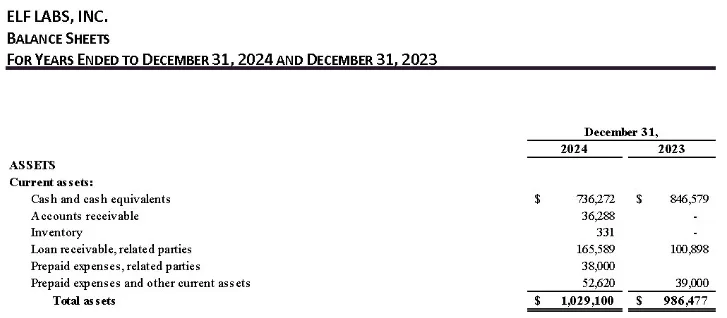

Curiously, something is missing from the balance sheet of Elf Labs.

It doesn't list its most valuable asset, its IP, anywhere.

Normally, IP should show up as an intangible asset, recorded at cost, and be amortized over its useful life.

Elf Labs' management says this is precisely the reason it doesn't include IP on its books:

The balance sheet only looks at costs (i.e., what was paid for the asset), and does not consider whether the asset has increased in value over time. In addition, some intangible assets, such as patents, trademarks or trade names, are very valuable but are not usually represented at their market value on the balance sheet.

This throws a bit of a monkey wrench in our ability to properly value Elf Labs, but there is still a way by turning to the company's revenue.

Elf Labs' SEC filings reveal that it had 2024 and 2023 revenue of $264,751 and $386,206, respectively. Both years produced net losses of $1.67 million and $468K.

So, what we will do in this instance is use the most aggressive method of valuing IP there is…the income method. Except we will use a multiple of Elf's revenue, in place of its income.

Fixing a 20x multiple on Elf's 2024 revenue, which was generated entirely from licensing its IP, would value the company at $5.3 million.

There is some precedent here.

The publicly-traded IP royalty company, Royalty Management Holding Corp. (Nasdaq: RMCO), has a market value of $17.3 million, on $800K in annual revenue. Another example, the largest of them all, is Walt Disney Co.

Even though it is an entertainment conglomerate that generates income from much more than just its IP, the market values it at 22x current earnings.

These are both larger, publicly-traded businesses, so a very good case can be made that Elf should be valued at a lower multiple.

However, Elf management disagrees.

Based on its total number of outstanding Class B shares, 1,793,344, and Class A shares, 50,000,000, which are owned exclusively by David and Billy Phillips, Elf Labs is raising capital at a multiple of 440x sales!

When I initially multiplied the share offering price of $2.25 by Elf's 51,793,344 outstanding Class A and Class B shares to arrive at this figure, I had to double-check the numbers because I couldn't believe it.

This is a valuation that would make Nvidia blush.

Maybe if only 1,793,344 Class B shares were outstanding, Elf would have a somewhat reasonable valuation of $4.03 million. Still, a price/sales of 13.4x would be ultra-aggressive for a privately-owned business that's been around for nearly two decades, and lacks explosive growth.

Overall, the biggest fairytale here is Elf Labs' valuation, and you should not invest at anything close to its current offering price.

Quick Recap & Conclusion

- Privately-held Elf Labs is combining iconic Disney characters with advanced artificial intelligence and virtual reality technology, but does this make it a good investment?

- Elf has amassed a formidable copyright portfolio of over 400 properties, mainly consisting of Rand McNally's Junior Elf Book characters (Cinderella, Sleeping Beauty, Rapunzel), and more. Now, it is going to market with its first three franchises and aggressively raising a round of capital to do so.

- The terms of Elf's offering are 3% of the company at a valuation of $116.5 million.

- Unfortunately, it is trying to spin a fairytale when the reality is a nightmare. Elf's IP generated less than $300K in revenue last year, its advanced AI and VR tech comes by way of partnerships with other companies, and despite its lean business model of IP licensing, it is still losing money. Do not invest in Elf Labs at its current offering price.

What are some good publicly-traded IP stocks? Drop them in the comments.

Very thoughtful commentary!

Thank you for what seems to be a thoroughly researched response!