“Institutional quality real estate powered by Bitcoin.”

This is the alluring headline on the homepage of Cardone Capital's website.

For those looking to move their money away from the volatile stock market and still generate a decent yield, it sounds like a promising proposition. But what's the catch?

We're looking at the man behind the offer, his company, how it works, and revealing the catch to it all.

What is Cardone Capital?

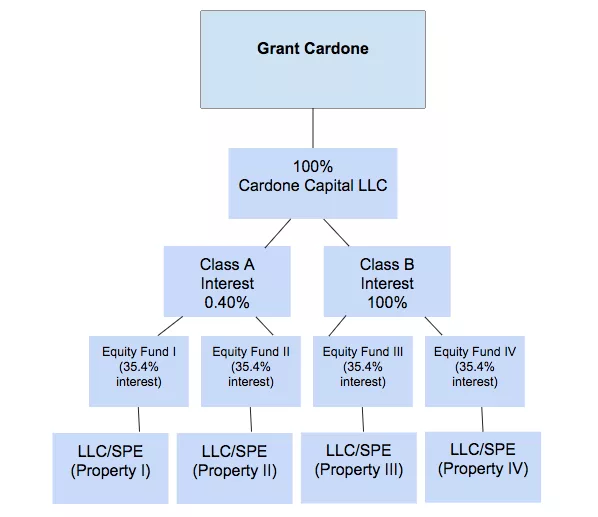

A limited liability company (LLC) organized in Delaware, Cardone Capital was established in 2016 for the purpose of acquiring multifamily properties throughout the U.S.

It does this through a dizzying gauntlet of funds, partnerships (other LLCs), and Single Purpose Entities (SPEs) that each own one or more properties.

This includes the 10X Space Coast Bitcoin Fund, which began taking investments at the end of last year and plans to simultaneously close on the acquisition of a 300-unit, Class A multifamily asset in Melbourne, Florida, and make an eight-figure Bitcoin purchase. No word on its progress yet.

As well as more traditional offerings such as:

- Cardone Delray Member, LLC (dba 10X Living at Delray). A 346-unit garden-style apartment complex located in Delray Beach, Florida.

- Cardone Stella Member, LLC (dba Stella at Riverstone). A 351-unit luxury garden-style apartment complex located in Sugar Land, Texas. A 456-unit garden-style apartment complex located in Naples, Florida.

- Cardone Laguna Member, LLC (dba 10X Living at Naples)

And 40 others across Florida, Texas, Alabama, Georgia, and Maryland.

Cardone Capital manages each LLC and SPE and receives compensation for its “services” through the Class B interest it owns in each partnership vehicle that entitles it to 35% of the profits.

The Class A interest in each partnership is where things get interesting, as that is what is being pitched to us.

Access to institutional-grade real estate deals normally reserved for large investors

This is Cardone Capital's elevator pitch, and so far, it's been successful.

Since its inception, it has raised over $1.6 billion across 27 funds from over 19,000 accredited and non-accredited investors.

$1.6 billion from minimum checks of $5,000-$10,000 is an incredible amount of money. That's what a recognizable name and some good salesmanship will get you.

So what have investors received in return?

A Class A Interest entitles holders to a 65% profit interest, meaning both rent and profit upon disposal, in the respective fund that owns the property.

Rent-based distributions are made every month or quarter, and the expected hold period for most funds is seven to ten years to maximize property appreciation.

Hard figures are not easy to find, but on one Cardone Capital landing page, I was able to find the elusive targeted returns, which are 12-15% annually.

This is an aggressive figure by any measure, as we will see, but the man behind it all believes that it is achievable.

Who is Grant Cardone?

Drug addict, purveyor of questionable advice, real estate investor, and Managing Member of Cardone Capital. Grant Cardone's life sounds like a motivational YouTube video.

The first time I heard Grant's name was in the 2010s while educating myself about the lost art of sales, and an ad for one of his sales seminars popped up.

Prices for his courses ranged from a few hundred dollars to $15,000 plus, so it's easy to see where he got the initial capital to start investing in real estate.

Property investing was a seed that was planted early in life for Grant, before his rambunctious teenage years, when he got hooked on hard drugs between the ages of 15-25, and his mom had to cut him off before he could do more harm to himself.

This is the human side of Grant that can get you to let your guard down, but that would be a mistake.

Grant's aggressive sales approach has hit his reputation harder than a one-two combo from boxer David Benavidez.

However, that was before, with the highly intangible service of sales consulting.

Now, we're dealing with hard assets and figures. So, how has Grant fared in the tangible world of real estate so far?

Track Record And Reviews

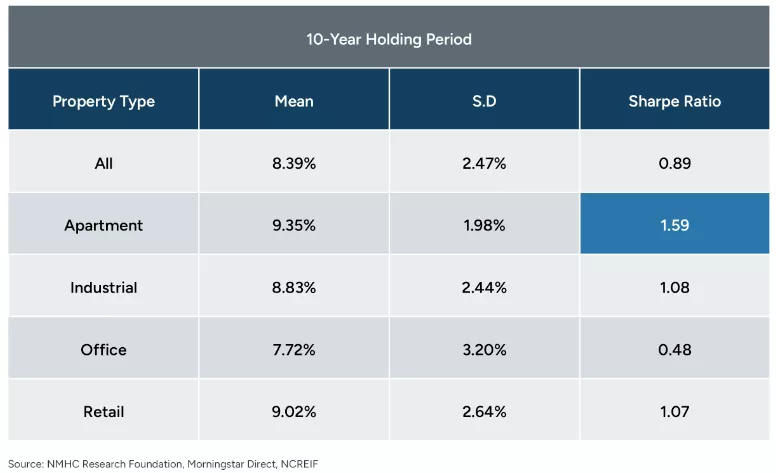

The measuring stick here is real estate returns over the long term.

Housing, meaning single-family homes, has historically returned 4%-8% per year. So, close to the S&P 500 return of 7-10% over the past 30 years.

However, if we drill down to apartments (multifamily) property, the average annual return is 9-10%. Add in less volatility and risk than other property classes, and multifamily's returns look even more attractive.

Earlier in this review, we noted that Cardone Capital's targeted returns are 12-15% annually. But what are its actual returns?

The company has been around for a little less than 10 years, so we'll take it easy on them, as they are still going through their first economic cycle.

However, based on Cardone Capital's own SEC filings and testimonials from actual investors, its funds have returned 2-4% annually on average, with no property disposals.

This is a subpar risk-adjusted return, no matter which way you slice it.

Is it likely to continue or improve?

Should You Invest in Cardone Capital?

Returns aside, to fairly gauge an investment in a private fund, we must first know its fee and organizational structure.

Despite claiming that we “won't find complex deals or confusing structures,” Cardone Capital's org chart isn't the simplest:

The fee breakdown is even less straightforward.

Cardone Capital is only compensated through returns on its Class B Interests, but Grant Cardone is also paid fees through Cardone Real Estate Acquisitions, LLC (CREA), which is responsible for the oversight of the third-party property managers who manage each owned property.

CREA is paid a set of fees directly by each LLC/SPE:

- 1% of the property’s fixed asset purchase price

- 1% of the property's disposition price received upon disposition

- 1% of the capital raised by the equity fund as an annual management fee

All told, Cardone Capital collects 38.4% in fees/profits from each owned property.

This 3/35 structure is steep and puts the typical fund manager's 2/20 model to shame.

When combined with the below-average returns to date and the illiquidity inherent in a private fund, the value proposition isn't attractive.

In terms of things possibly improving, Cardone Capital does have exposure to variable interest rates, which start at 3.25% to 4.5%, with 7-10 year terms. These have been rising, which has contributed to lower returns, but if the Fed lowers rates, this should boost returns by at least a few percentage points.

However, this wouldn't salvage the investment, and there are better private and public real estate investments that don't charge 3/35.

Quick Recap & Conclusion

- Cardone Capital was established in 2016 to invest in multifamily properties throughout the U.S.

- Since its inception, it has raised over $1.6 billion from over 19,000 accredited and non-accredited investors and purchased 43 multifamily properties in five states.

- Based on Cardone Capital's own SEC filings and testimonials from actual investors, its funds have returned 2-4% annually on average, with no property disposals to date.

- Not only has Cardone Capital fallen short of its targeted return of 12-15% annually, but its 3/35 fee and profit structure is higher than most private real estate funds.

- Cardone Capital is not an outright scam, as it does what it states with the capital it raises. However, its value proposition leaves a lot to be desired, and there are better private and public real estate investments.

Have you invested in any of Cardone Capital's funds? Tell us about your experience in the comments.